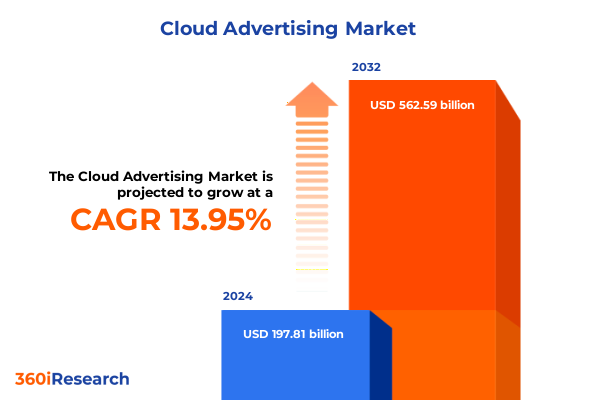

The Cloud Advertising Market size was estimated at USD 225.22 billion in 2025 and expected to reach USD 256.43 billion in 2026, at a CAGR of 13.97% to reach USD 562.59 billion by 2032.

Navigating the Dynamic Cloud Advertising Environment Shaped by AI Innovation, Programmatic Evolution, Data Privacy Imperatives, and Scalable Infrastructure Synergies

As digital media continues to flourish, advertisers are migrating from traditional on-premises ad stacks to cloud-native platforms that deliver unprecedented scalability, real-time bidding efficiency, and seamless integration of advanced analytics. This shift is propelled by the need to handle massive volumes of data, enabling brands to optimize targeting across mobile, display, social and video channels without the latency and rigidity of legacy systems. Cloud infrastructures now underpin omnichannel campaigns, centralizing management of creative assets, audience segments and performance metrics to ensure consistent brand experiences across web, mobile and emerging CTV environments.

Moreover, the rapid integration of artificial intelligence and predictive analytics within cloud advertising platforms empowers marketers to anticipate consumer behaviors and dynamically adjust campaigns in near real time. Machine learning algorithms sift through vast datasets to detect trends, optimize bid strategies and identify fraudulent activity, mitigating invalid impressions and bot-driven clicks before they erode budgets. These capabilities have become table stakes for competitive differentiation, with leading platforms offering embedded fraud detection, audience modeling and automated creative adaptation, all accessible via web-based dashboards and APIs that streamline campaign orchestration across global markets.

Unveiling Critical Transformative Inflection Points in Cloud Advertising Encompassing AI Integration, Edge Computing, and Sustainable Privacy-Centric Innovations

The cloud advertising ecosystem is undergoing a series of transformative shifts that are redefining how brands plan, buy and measure digital campaigns. First, artificial intelligence has moved beyond niche applications to become the core engine of ad operations. Advanced AI-driven bidding engines now autonomously allocate budget across channels and forecast optimal bid amounts per impression, reducing manual intervention and driving efficiency gains in programmatic buying. Concurrently, serverless architectures and edge computing are emerging as critical enablers for low-latency targeting and ad delivery, processing key operations closer to end users and minimizing delays in high-stakes, real-time auctions.

In parallel, the industry’s transition to a cookieless landscape has accelerated the adoption of first-party data strategies and contextual targeting frameworks. Marketers are leveraging consent-based data collection and secure clean-room environments to enrich audience insights without relying on third-party identifiers, bolstered by AI-powered natural language processing that analyzes page content for precise ad placements. Sustainability and resilience have also risen to prominence, as brands and cloud providers prioritize greener data centers powered by renewable energy, while hybrid and multi-cloud deployments mitigate vendor lock-in, enhance regulatory compliance and ensure business continuity in the face of evolving trade policies and infrastructure challenges.

Assessing the Comprehensive Effects of 2025 US Reciprocal Tariffs on Cloud Advertising Infrastructure Costs Operational Strategies and Innovation

The imposition of reciprocal U.S. tariffs in 2025 under Section 301 provisions has introduced steep duties on imported cloud infrastructure components, significantly elevating costs for hyperscalers and downstream advertisers alike. Tariffs ranging from 25% on Chinese-manufactured servers to 34% on high-end networking equipment have disrupted procurement cycles, compelling major cloud service providers to absorb short-term cost increases while evaluating longer-term pricing strategies. For enterprises reliant on public cloud services, the ripple effects manifest as potential price adjustments, delays in new data center deployments and recalibrated expectations for innovation rollouts as providers manage hardware supply constraints.

Smaller cloud operators and regional platforms face amplified pressure due to their limited negotiating leverage and thinner financial buffers. Lacking the economies of scale of their global counterparts, these providers have been forced to explore alternative manufacturing hubs in Vietnam, Taiwan and Mexico to offset duty impacts, a process that introduces additional logistics complexity and regulatory compliance costs. Over time, the evolving trade landscape is expected to catalyze more resilient, diversified supply chains. However, in the near term, both cloud vendors and advertisers must navigate a delicate balance between cost management and sustaining rapid deployment of AI-driven advertising solutions.

Uncovering Deep-Dive Cloud Advertising Market Segmentation Insights Spanning Ad Formats Service Models Deployment Modes Enterprise Scales and Industry Verticals

Deep analysis of the cloud advertising market segmentation reveals a multifaceted landscape where ad types, cloud services, deployment modes, enterprise sizes and industry verticals each play a pivotal role in shaping service offerings and go-to-market strategies. Mobile, search, display, social and video advertising formats demand distinct targeting capabilities and infrastructure resilience, with programmatic display and AI-powered search solutions enabling hyper-personalization at scale. Within social media, platforms such as Facebook, LinkedIn and Twitter are differentiated by audience profiles and engagement models, prompting tailored integration of creative engines, attribution tools and spend optimization algorithms.

On the service spectrum, consulting, integration, deployment and support services underpin the adoption of ad exchanges, demand-side platforms and supply-side platforms, ensuring seamless orchestration of media buys and data flows. Hybrid, private and public cloud models further diversify deployment choices, enabling brands to align performance, security and cost objectives. Large enterprises leverage dedicated private clouds or hybrid architectures for maximum control and compliance, while SMEs gravitate toward public cloud solutions that offer turnkey access to programmatic ad stacks and analytics dashboards. Industry-specific demands-from regulatory scrutiny in BFSI and government to rapid innovation in IT and telecom-drive verticalized cloud advertising suites, with banking, insurance, healthcare, manufacturing and retail each requiring customized data governance, creative workflows and measurement frameworks.

This comprehensive research report categorizes the Cloud Advertising market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ad Type

- Cloud Service

- Enterprise Size

- Deployment Mode

- Industry Vertical

Highlighting Distinct Regional Cloud Advertising Dynamics Reflecting Digital Maturity Regulatory Environments and Consumer Behavior Across Key Geographies

Regional dynamics in cloud advertising are shaped by diverse market maturities, regulatory climates and consumer behaviors across the Americas, Europe, Middle East & Africa, and Asia-Pacific. North America leads global adoption, fueled by early embrace of programmatic technologies, mature data privacy frameworks and hyperscale cloud availability that collectively support large-scale campaign experimentation and performance testing. European markets, guided by stringent data protection regulations, have catalyzed a new generation of privacy-first advertising platforms and strong partnerships with local cloud providers to ensure compliance with GDPR while maintaining high campaign agility.

Asia-Pacific presents a vibrant frontier characterized by rapid digital transformation, mobile-first consumption and expanding cloud infrastructure investments. Governments and enterprises across the region are driving public cloud deployments to support advanced advertising use cases-ranging from real-time bidding in high-volume markets like China and India to creative-rich video campaigns in Southeast Asia. Despite regulatory fragmentation, the proliferation of 5G networks and growing collaboration between global hyperscalers and regional telcos are accelerating the next wave of cloud-native advertising solutions. Across all regions, the convergence of local regulations, consumer expectations and infrastructure readiness continues to shape differentiated go-to-market strategies for cloud advertising vendors.

This comprehensive research report examines key regions that drive the evolution of the Cloud Advertising market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Leading Cloud Advertising Contenders Capitalizing on Infrastructure Prowess AI Capabilities and Programmatic Innovation to Drive Market Leadership

In the competitive arena of cloud advertising, Google Cloud, Amazon Web Services and Microsoft Azure have each leveraged unique strengths to capture advertiser spend and platform integrations. Alphabet’s Google Cloud has bolstered its adtech credentials through partnerships with leading AI firms, underscored by a near 32% surge in cloud sales that outpaced Wall Street expectations, prompting a $10 billion capex increase for 2025 to support enhanced TPU chip deployments and AI Overviews. Meanwhile, Amazon Web Services continues to assert its dominance through infrastructure breadth and global reach, exemplified by a $4 billion investment in new cloud regions in Chile and ongoing renewable energy commitments that reinforce its leadership in sustainable data center operations.

Microsoft Azure has emerged as a formidable rival, leveraging its deep integration with OpenAI’s agentic models and introducing specialized AI tools that enable enterprises to deploy conversational agents and automated workflows directly within their existing Microsoft 365 ecosystems. Beyond the hyperscalers, adtech specialists such as The Trade Desk have been accelerating innovation in programmatic buying with AI-driven platforms like Kokai and Deal Desk, which provide transparent one-to-one deal management and real-time campaign optimization across connected TV, audio and premium internet channels. These leading firms exemplify a landscape in which infrastructure prowess, AI capabilities and specialized adtech solutions converge to meet the evolving demands of modern marketers.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Advertising market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Alphabet Inc.

- Amazon.com, Inc.

- Criteo S.A.

- International Business Machines Corporation

- Magnite, Inc.

- Meta Platforms, Inc.

- Microsoft Corporation

- Oracle Corporation

- PubMatic, Inc.

- Salesforce, Inc.

- Taboola.com Ltd.

- The Trade Desk, Inc.

Implementing Robust Multi-Cloud Strategies AI-Driven Data Governance and Sustainable Practices to Enhance Cloud Advertising Agility and Resilience

Industry leaders seeking to capitalize on the evolving cloud advertising landscape should first prioritize building resilient, multi-tiered infrastructure footprints that blend public, private and edge deployments. By diversifying supplier relationships and exploring alternative manufacturing hubs, organizations can insulate themselves from tariff-induced supply disruptions while maintaining cost efficiencies in hardware procurement. Simultaneously, investment in AI-driven fraud detection, dynamic bidding engines and predictive audience modeling will be essential to optimize performance and safeguard budgets in a competitive, cookieless era.

Equally critical is the development of a robust first-party data strategy, reinforced by consent-driven data collection, secure clean-room partnerships and real-time analytics platforms. Brands should leverage contextual targeting powered by natural language processing to complement identity-based approaches, ensuring privacy compliance without compromising on relevance or personalization. Finally, embedding sustainability into technology road maps-through commitments to renewable energy use, carbon-intelligent computing and green cloud certifications-will not only satisfy ESG mandates but also resonate with increasingly eco-conscious consumers, enhancing brand reputation and long-term value.

Combining Secondary Analysis Primary Expert Interviews and Data Triangulation to Deliver Rigorous Cloud Advertising Market Research Insights

Our research methodology combined rigorous secondary research, extensive primary interviews and systematic data triangulation to ensure comprehensive and objective insights. Initially, we conducted a thorough review of industry whitepapers, regulatory filings and leading news sources to map market dynamics, identify tariff impacts and catalog emerging cloud advertising technologies. We then engaged with a network of cloud architects, ad operations executives and data privacy specialists through structured interviews to validate secondary findings and capture nuanced perspectives on deployment challenges and innovation priorities.

To enhance methodological rigor, we employed a triangulation approach, correlating qualitative inputs with publicly available performance indicators and vendor announcements to refine our segmentation framework. The service and deployment dimensions were validated through cross-referencing platform usage data, while vertical-specific demands were corroborated via use case analyses provided by technology partners. This multi-method approach ensured that our insights reflect both the strategic intentions of leading stakeholders and the operational realities of executing cloud advertising campaigns under evolving trade and privacy regulations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Advertising market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Advertising Market, by Ad Type

- Cloud Advertising Market, by Cloud Service

- Cloud Advertising Market, by Enterprise Size

- Cloud Advertising Market, by Deployment Mode

- Cloud Advertising Market, by Industry Vertical

- Cloud Advertising Market, by Region

- Cloud Advertising Market, by Group

- Cloud Advertising Market, by Country

- United States Cloud Advertising Market

- China Cloud Advertising Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Summarizing the Convergence of AI-Powered Programmatic Innovation Privacy Compliance and Resilient Infrastructure as Imperatives for Future Cloud Advertising Success

The cloud advertising sector stands at a pivotal juncture, with AI-driven programmatic capabilities, privacy-first frameworks and resilient infrastructure strategies redefining the rules of engagement. Leading hyperscalers and specialized adtech vendors are racing to integrate advanced analytics, contextual targeting and sustainable operations into their platforms, while market entrants navigate a complex terrain of regional regulations and tariff-driven supply constraints. The cumulative impact of these forces is fostering a more dynamic, responsive ecosystem in which agility and data-driven precision are paramount.

Organizations that embrace hybrid cloud models, invest in robust first-party data governance and prioritize green computing will be best positioned to harness the full potential of cloud advertising. As the industry continues to evolve, the winners will be those who balance innovation with strategic resilience, leveraging technology partnerships and diversified supply chains to deliver measurable ROI in an increasingly competitive environment.

Unlock Strategic Value with a Comprehensive Cloud Advertising Market Research Report by Connecting with Our Associate Director for Exclusive Insights

To acquire the full in-depth market research report on cloud advertising and gain strategic insights tailored to your business needs, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He will guide you through the report’s comprehensive findings, including detailed analyses of transformative market forces, regulatory impacts, segmentation and regional dynamics, and leading company profiles. Reach out to schedule a personalized consultation to explore how these insights can drive your advertising strategies forward and unlock competitive advantage.

- How big is the Cloud Advertising Market?

- What is the Cloud Advertising Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?