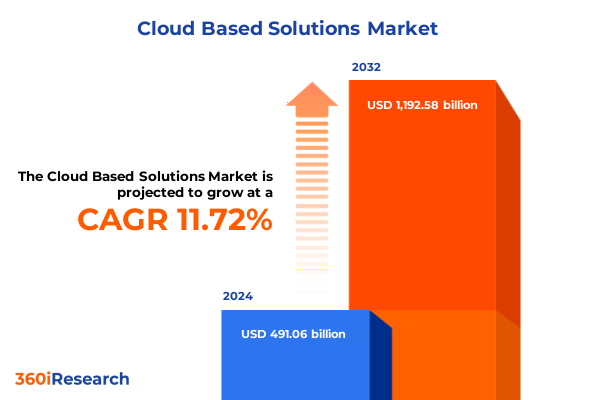

The Cloud Based Solutions Market size was estimated at USD 543.68 billion in 2025 and expected to reach USD 601.95 billion in 2026, at a CAGR of 11.87% to reach USD 1,192.58 billion by 2032.

Understanding the Critical Role of Cloud-Based Solutions in Driving Digital Transformation and Operational Agility Across Modern Enterprises Globally

Cloud-based solutions have become the cornerstone of modern digital transformation, enabling organizations to rapidly scale infrastructure, optimize costs, and drive innovation. As enterprises confront disruptions-from shifting consumer behaviors to evolving regulatory requirements-the ability to harness the agility and elasticity of cloud platforms has emerged as a strategic imperative. This report delves into the critical role that cloud technologies play in empowering businesses to remain adaptive in a constantly evolving environment.

Building on a thorough exploration of service models, deployment options, and application types, this introduction sets the stage for a comprehensive executive summary. It underscores how the convergence of virtualization, automation, and orchestration is reshaping IT operations and business processes. Against this backdrop, decision makers are increasingly prioritizing cloud as the primary locus for data management, development pipelines, and customer engagement platforms.

Ultimately, this opening section contextualizes the transformative potential of cloud solutions against the broader backdrop of digital acceleration. By highlighting the foundational concepts and strategic drivers, it prepares stakeholders to engage with the ensuing analysis, which examines shifts in technology paradigms, the impact of external factors, and the key insights that will shape cloud strategies in the coming years.

Examining the Converging Technological and Business Transformations Redefining the Cloud Services Landscape and Accelerating Innovation Across Industries

The cloud landscape is undergoing transformative shifts driven by technological innovation and evolving business priorities. As organizations transition from traditional on-premises infrastructures, they are embracing a spectrum of service models that range from foundational compute, network, and storage capabilities to advanced application development toolsets and fully managed business applications. Container orchestration and database services are blurring the lines between infrastructure and platform, while SaaS offerings are delivering domain-specific functionality in collaboration, customer relationship management, and enterprise resource planning.

Parallel to service model evolution, deployment strategies are maturing. Hybrid environments that integrate disjointed and tightly coupled public-private architectures are gaining traction, balancing flexibility with control. Meanwhile, multi-tenant public clouds coexist with single-tenant configurations to meet diverse security and compliance requirements. Across sectors, large, medium, and small enterprises are customizing their off-premises footprints to align with financial constraints and growth objectives.

These dynamics are underpinned by an escalating demand for real-time analytics, artificial intelligence, and enhanced security frameworks. As generative AI and edge computing embed deeper into operations, cloud providers are racing to offer seamless integration and unified management surfaces. This section explores how converging technologies and strategic expectations are coalescing to redefine what cloud solutions can achieve for enterprises today.

Assessing the Far-Reaching Economic and Operational Consequences of 2025 United States Tariffs on Cloud Infrastructure and Service Provision Models

The imposition of new tariffs on cloud infrastructure components in 2025 by the United States has introduced both cost pressures and strategic recalibrations across the ecosystem. Hardware providers have experienced increased import expenses, a change that cascades through supply chains and influences the pricing of compute-optimized instances and storage arrays. As a result, infrastructure-as-a-service offerings are facing margin compression, leading providers to reexamine capacity provisioning and hardware refresh cycles.

These tariffs have also prompted shifts in platform strategy. Platform-as-a-service offerings that depend on container management, database services, and development frameworks have seen altered licensing and support costs, which are in turn reflected in subscription-level pricing tiers. The increased cost base has encouraged enterprises to optimize workloads for efficiency, adopting serverless patterns and rightsizing virtual resources to mitigate financial impact.

On the SaaS front, broader enterprise applications-spanning collaboration, customer relationship management, and resource planning-face indirect repercussions. Vendors are streamlining feature roadmaps and consolidating service tiers to preserve value propositions amid tightening budgets. Throughout the value chain, customers and providers alike are engaging in proactive scenario planning, leveraging cost analysis and benchmarking exercises to absorb or pass through the effects of tariffs while safeguarding cloud adoption momentum.

Deriving In-Depth Insights from Service Model Deployment Model Organization Size Industry Vertical and Application Type Segmentation Dynamics

Segmentation analysis reveals the nuanced ways in which cloud adoption varies by service model, deployment approach, organizational scale, industry vertical, and application type. Within the compute, network, and storage layer of infrastructure-as-a-service, performance and customization requirements diverge significantly among enterprises prioritizing high throughput workloads versus those focusing on cost-efficient archival. Moving up the stack, platform-as-a-service environments demand a delicate balance between integrated development pipelines, container orchestration services, and managed database solutions that can support both transactional and analytical workloads at scale. At the SaaS layer, collaboration platforms, CRM suites, and enterprise resource planning systems each present unique adoption curves influenced by industry-specific workflows and integration complexity.

Deployment models further distinguish use cases, as hybrid architectures incorporate a mix of public and private environments that range from hosted private clouds to on-premises configurations. Integrated hybrid implementations facilitate workload mobility and unified management, while multi-tenant public clouds leverage scale for elastic provisioning. Organizational size also dictates cloud strategy; large enterprises often deploy multi-faceted portfolios to address global operations, whereas medium and small enterprises tend to focus on turnkey solutions that deliver rapid time to value.

Industry vertical segmentation highlights the distinct demands of banking, public-sector mandates, healthcare compliance, telecommunication throughput, manufacturing automation, and retail omnichannel experiences. This variation extends to application types, where big data analytics services like Hadoop and Spark as a Service uphold data-driven initiatives, and backup and recovery solutions-whether cloud backup, disaster recovery, or disk backup-ensure resilience. Each of these dimensions informs a tailored approach to solution architecture and vendor selection.

This comprehensive research report categorizes the Cloud Based Solutions market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Model

- Deployment Model

- Organization Size

- Industry Vertical

- Application Type

Uncovering Critical Regional Variations and Growth Drivers Across the Americas Europe Middle East and Africa and Asia Pacific Cloud Markets

Geographic analysis underscores the contrast in cloud maturity and growth drivers across the Americas, EMEA, and Asia-Pacific regions. In the Americas, enterprises continue to lead with advanced adoption of AI-driven services and edge-enabled deployments, benefitting from robust digital infrastructure and supportive regulatory environments. North American markets exhibit strong uptake of container platforms and serverless frameworks, reflecting a prioritization of developer productivity and rapid innovation cycles.

Across Europe, the Middle East, and Africa, compliance and data sovereignty concerns shape deployment preferences, steering many organizations toward private and hybrid clouds. The EMEA landscape is marked by strategic investments in blockchain for secure transactions and a growing emphasis on sustainability metrics in infrastructure decisions. Connectivity challenges in certain markets drive selective adoption of regional public cloud zones to balance performance and cost.

Asia-Pacific demonstrates the highest year-on-year growth trajectory, fueled by digital transformation initiatives within government bodies, financial institutions, and manufacturing hubs. Emerging markets in Southeast Asia and South Asia are leapfrogging legacy infrastructures, opting for multi-tenant public clouds to accelerate service rollouts. Meanwhile, established economies in East Asia are scaling hyperscale data centers to support AI workloads and real-time analytics, underscoring the region’s pivotal role in the global cloud ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Cloud Based Solutions market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Portfolio Differentiation among Leading Cloud Solution Providers Shaping the Market Landscape

Leading cloud solution providers are leveraging differentiated portfolios and strategic partnerships to strengthen their competitive positions. Providers with expansive compute and storage infrastructures are bundling advanced networking capabilities and security frameworks to address enterprise concerns around latency and data protection. Meanwhile, platform-focused vendors are building ecosystems of pre-integrated developer tools, managed container services, and AI accelerators to capture the rising demand for custom application development and machine learning workloads.

Competitive intensity is further heightened by aggressive acquisitions and alliances. Companies active in high-growth verticals-such as finance, healthcare, and retail-are aligning with specialized software vendors to embed domain-specific functionality directly within their cloud stacks. This strategy deepens customer relationships by offering turnkey, industry-aligned solutions that reduce integration complexity and shorten deployment cycles.

A third cohort of challengers is carving out niche segments through innovative pricing models and usage-based billing, enabling small and medium enterprises to access enterprise-grade capabilities without heavy upfront commitments. Collectively, these competitive moves are accelerating feature roadmaps and driving continual enhancements to service reliability, developer experience, and ecosystem interoperability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Based Solutions market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Cloud Computing Ltd.

- Amazon Web Services, Inc.

- Google LLC

- HCL Technologies Limited

- Huawei Technologies Co., Ltd.

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Salesforce, Inc.

- SAP SE

- ServiceNow, Inc.

- Tencent Cloud Computing (Beijing) Co., Ltd.

- Veritis Group Inc.

Formulating Pragmatic and Forward Looking Strategies to Empower Industry Leaders in Optimizing Cloud Adoption and Ensuring Sustainable Growth

To capitalize on emerging opportunities, industry leaders should embrace a multi-pronged approach that aligns technology investments with strategic objectives. First, organizations must refine workload placement strategies by articulating clear criteria for performance, cost, and compliance, thereby ensuring that each application resides in the optimal service or deployment environment. This foundation empowers teams to implement governance frameworks that maintain visibility and control across heterogeneous cloud landscapes.

Second, decision makers should advance their cloud-native maturity by institutionalizing infrastructure as code practices and embedding security controls into continuous integration and delivery pipelines. By automating provisioning, policy enforcement, and monitoring, enterprises can accelerate time to market, reduce manual errors, and strengthen resilience against cyber threats.

Finally, leaders must cultivate collaborative partnerships with providers that demonstrate a roadmap for future innovation, particularly around artificial intelligence, edge computing, and sustainability. By engaging in co-innovation initiatives and pilot programs, organizations can gain early access to cutting-edge capabilities, influence feature development, and realize competitive advantage through differentiated service offerings.

Detailing the Rigorous Research Methodology and Analytical Framework Employed to Ensure Comprehensive and Unbiased Cloud Market Insights

This analysis is grounded in a comprehensive methodology that blends primary research, secondary literature review, and expert stakeholder interviews. The primary component comprised in-depth discussions with CIOs, CTOs, and cloud architects across varied industries, capturing firsthand perspectives on strategic priorities, implementation challenges, and success metrics. These insights were supplemented by secondary sources such as technology white papers, regulatory filings, and vendor documentation.

Quantitative data was synthesized through systematic aggregation of publicly available usage statistics, vendor performance benchmarks, and cloud service provider disclosures. Qualitative analysis involved thematic coding of interview transcripts to identify recurring patterns in technology adoption, pricing strategies, and integration best practices. Rigorous validation rounds were conducted with industry experts to ensure consistency and to reconcile any divergences in reported findings.

The resulting framework offers a balanced view of current market dynamics, combining numeric indicators of service utilization with narrative accounts of enterprise transformation journeys. This approach ensures a robust foundation for the executive-level insights and recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Based Solutions market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Based Solutions Market, by Service Model

- Cloud Based Solutions Market, by Deployment Model

- Cloud Based Solutions Market, by Organization Size

- Cloud Based Solutions Market, by Industry Vertical

- Cloud Based Solutions Market, by Application Type

- Cloud Based Solutions Market, by Region

- Cloud Based Solutions Market, by Group

- Cloud Based Solutions Market, by Country

- United States Cloud Based Solutions Market

- China Cloud Based Solutions Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Reinforcing the Strategic Importance of Cloud Innovation and Summarizing Key Findings to Inform Executive Decision Making and Future Planning

The cloud paradigm is more than a technological shift; it represents a fundamental reimagining of how enterprises create, deliver, and capture value. Throughout this summary, we have highlighted the pivotal role of service model innovation, adaptive deployment strategies, and responsive segmentation approaches in driving cloud success. The analysis of U.S. tariff impacts underscores the need for agility and cost optimization, while the regional breakdown reveals divergent paths to adoption based on regulatory, economic, and infrastructural contexts.

By dissecting competitive strategies and portfolio differentiators, we see that market leadership is increasingly defined by the ability to deliver seamless integration, industry-specific capabilities, and forward-looking roadmaps. The actionable recommendations equip decision makers with practical steps to refine workload placement, automate governance, and engage in co-innovation, all while maintaining rigorous security and compliance standards.

In conclusion, the insights contained within this executive summary provide a strategic compass for organizations seeking to harness cloud technologies as a catalyst for growth. By translating these findings into targeted initiatives, leaders can accelerate digital transformation efforts, optimize resource utilization, and establish a resilient foundation for future innovation.

Seize the Opportunity to Gain Unparalleled Market Intelligence by Connecting with Ketan Rohom Associate Director Sales Marketing for Report Acquisition

To unlock comprehensive insights that will inform your strategic decision making, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings deep expertise in cloud market dynamics and can guide you through the nuances of the latest report. By partnering with him, you’ll gain access to proprietary intelligence, tailored guidance, and the confidence to accelerate your organization’s cloud initiatives. Don’t miss the chance to secure a definitive resource that will position you ahead of the competition-connect with Ketan Rohom today to purchase your copy of the complete analysis and ensure your leadership in the evolving cloud solutions landscape.

- How big is the Cloud Based Solutions Market?

- What is the Cloud Based Solutions Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?