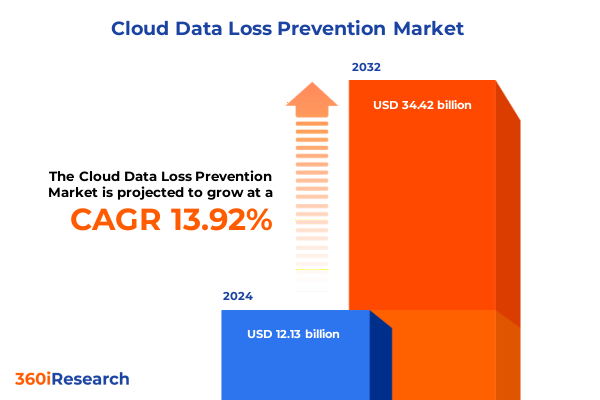

The Cloud Data Loss Prevention Market size was estimated at USD 13.77 billion in 2025 and expected to reach USD 15.64 billion in 2026, at a CAGR of 13.97% to reach USD 34.42 billion by 2032.

Understanding the Strategic Imperatives Driving Demand for Cloud Data Loss Prevention Solutions in a Rapidly Evolving Cybersecurity Environment

In today’s digital-first world, protecting sensitive information in cloud environments has become an organizational imperative. As enterprises increasingly migrate workloads, applications, and storage to public, private, or hybrid cloud infrastructures, the attack surface for data exfiltration and accidental exposure grows exponentially. Stakeholders from boardrooms to IT operations teams are challenged to reconcile the agility and cost benefits of cloud adoption with the stringent requirements of data privacy regulations and evolving threat landscapes.

Furthermore, high-profile breaches and compliance violations have underscored the reputational and financial risks of insufficient data loss prevention. Organizations must implement robust cloud-native and integrated DLP frameworks that span email, endpoints, network channels, SaaS applications, and data-at-rest storage. This executive summary introduces the strategic context for Cloud Data Loss Prevention, highlighting the convergence of regulatory mandates, stakeholder expectations, and technology advancements that drive investments in comprehensive DLP solutions.

By laying this foundational perspective, we establish the critical role of Cloud DLP in modern cybersecurity architectures. As you progress through the sections ahead, you will gain insights into market dynamics, segmentation drivers, regional nuances, vendor strategies, and actionable recommendations to inform your organization’s DLP roadmap and strengthen its data protection posture.

Highlighting Major Technological and Operational Shifts Reshaping the Cloud Data Loss Prevention Landscape Amid Rising Cyber Threats and Digital Transformation

The Cloud Data Loss Prevention arena is experiencing sweeping changes driven by broader digital transformation efforts and heightened security priorities. As organizations recalibrate their infrastructure strategies toward cloud-first and hybrid models, they are embedding DLP capabilities directly into their cloud-native architectures and orchestration platforms. This shift away from traditional on-premises appliances toward dynamic, API-driven prevention frameworks has enabled more granular visibility and automated policy enforcement across distributed environments.

Simultaneously, the surge in remote work and collaboration tools has accelerated the need for endpoint and SaaS application DLP, ensuring sensitive documents and intellectual property remain protected outside the corporate network perimeter. Artificial intelligence and machine learning enhancements are also playing a transformative role, empowering solutions to detect anomalous behavior and contextually adapt controls without unduly impacting user productivity. These innovations, complemented by Zero Trust principles, are redefining how cloud data protection integrates with identity, access management, and network segmentation.

In addition, regulatory developments such as enhanced privacy laws and industry-specific compliance requirements are prompting organizations to adopt more unified and scalable DLP platforms. These platforms leverage advanced analytics and reporting to streamline audit processes and demonstrate due diligence. Collectively, these technological and operational shifts are reshaping the DLP landscape, requiring enterprises to reassess legacy deployments and embrace modern, integrated solutions that align with evolving business imperatives.

Assessing the Compound Effects of 2025 United States Trade Tariffs on Cloud Data Loss Prevention Supply Chains and Service Delivery Economics

The introduction of new United States trade tariffs in 2025 has had a significant ripple effect on the Cloud Data Loss Prevention ecosystem, particularly across hardware and software supply chains. Components sourced from affected regions have experienced cost increases, prompting vendors to reevaluate procurement strategies and explore alternative manufacturing partnerships. This has, in turn, influenced pricing structures for security appliances and dedicated DLP gateways, leading some service providers to adjust subscription or licensing fees to offset elevated import expenses.

At the same time, the tariffs have accelerated investment in cloud-native DLP solutions that minimize reliance on physical appliances. By shifting toward SaaS delivery models and leveraging global cloud infrastructure, organizations can mitigate tariff-induced cost volatility while benefiting from continuous updates and built-in scalability. Service providers have responded by enhancing their multi-tenant architectures and optimizing data processing pipelines to deliver enterprise-grade prevention capabilities without imposing additional capital expenditures.

Moreover, these trade measures have underscored the importance of supply chain resilience, driving a surge in strategic partnerships between DLP vendors and regional cloud providers. Stakeholders are prioritizing diverse sourcing options and developing contingency plans to ensure uninterrupted service delivery. Ultimately, while the 2025 tariff adjustments introduced new operational challenges, they also catalyzed the adoption of more agile, cloud-centric DLP deployments that enhance overall cost predictability and business continuity.

Unveiling Critical Insights Across Component, Deployment Model, Organization Size, and Industry Vertical Segments Driving Strategic DLP Decisions

Analyzing the market through a component lens reveals that service offerings encompassing consulting, support, and maintenance continue to drive early-stage adoption, as organizations seek expert guidance to navigate complex deployment scenarios. In parallel, solution segments such as cloud-native DLP and email DLP have gained prominence for their ability to address major threat vectors, while endpoint, network, SaaS application, and storage-based prevention tools form complementary layers within a comprehensive security fabric.

From a deployment model perspective, hybrid cloud environments often require unified policy orchestration across on-premises systems and public cloud services, whereas private cloud implementations demand tailored integration with internal IT governance frameworks. Public cloud customers, meanwhile, favor scalable, pay-as-you-go DLP platforms that align with variable workloads and user patterns. These diverse deployment preferences underscore the necessity of flexible architectures that support both centralized policy management and distributed enforcement points.

Organizational size further influences DLP strategies: large enterprises typically invest in cross-platform solutions with advanced analytics and dedicated security teams, while small and medium enterprises prioritize ease of deployment, minimal maintenance overhead, and bundled services that offer rapid time to value. Beyond these dimensions, industry vertical dynamics shape specific requirements-financial services demand rigorous regulatory compliance and real-time transaction monitoring, healthcare and life sciences prioritize patient data confidentiality, and sectors such as government, IT and telecom, manufacturing, retail, and e-commerce have unique data flow profiles that necessitate bespoke prevention policies. By synthesizing these varied segmentation perspectives, decision makers can tailor DLP roadmaps to align with organizational context and risk appetite.

This comprehensive research report categorizes the Cloud Data Loss Prevention market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Model

- Industry Vertical

Exploring Regional Dynamics Across Americas, Europe Middle East Africa, and Asia Pacific to Inform Tailored Cloud Data Loss Prevention Strategies

Regional dynamics exert a profound influence on Cloud Data Loss Prevention adoption and evolution. In the Americas, robust investment in cloud services and stringent privacy regulations at both federal and state levels have motivated extensive DLP deployments, particularly within financial services and technology sectors. The proximity of leading hyperscale cloud providers has further catalyzed the integration of advanced prevention capabilities into enterprise architectures, driving focus on data sovereignty and cross-border compliance.

Across Europe, the Middle East, and Africa, diverse regulatory landscapes-from the General Data Protection Regulation to evolving national privacy acts-have compelled organizations to adopt unified DLP frameworks that support localized policy controls. Increased digital transformation spending in the region’s public sector and telecommunications industries has also accelerated demand for comprehensive solutions capable of managing sensitive data across on-premises, private, and public cloud environments. In addition, infrastructure modernization initiatives aimed at boosting economic growth have further fueled DLP modernization.

The Asia-Pacific landscape reflects a similar interplay of regulatory, economic, and technological factors. Rapid cloud adoption in markets such as Australia, Japan, India, and Southeast Asia is accompanied by heightened cybersecurity awareness and investment. Organizations in the region are embracing cloud-native prevention services to reduce capital expenditure pressure and improve scalability. At the same time, regional data protection acts and cross-border data flow requirements continue to shape vendor offerings and deployment strategies. These regional nuances highlight the need for adaptable DLP solutions that balance global standards with local sensitivities.

This comprehensive research report examines key regions that drive the evolution of the Cloud Data Loss Prevention market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Vendor Strategies and Innovations Shaping the Competitive Cloud Data Loss Prevention Landscape for Enterprise Risk Mitigation

Leading vendors in the Cloud Data Loss Prevention domain are advancing their offerings through strategic acquisitions, partnerships, and continuous innovation. Established security software providers are integrating DLP modules into broader cloud security platforms, consolidating data protection, identity management, and threat detection within unified consoles. This convergence enables customers to streamline operations and reduce complexity by adopting holistic security ecosystems rather than point solutions.

At the same time, pure-play DLP specialists are differentiating through targeted enhancements such as automated policy recommendation engines, contextual risk scoring powered by machine learning, and prebuilt connectors for popular SaaS applications. Collaborative partnerships with major cloud service providers have also emerged, allowing vendors to offer natively embedded prevention services that align with cloud platform APIs and governance frameworks. These alliances not only enhance solution performance but also simplify procurement and support processes for end users.

In addition, forward-looking vendors are investing in developer communities and open APIs to foster extensible ecosystems, enabling organizations to build custom integrations and automate workflows. This focus on extensibility and integration is critical for enterprises that require agile response capabilities and deep visibility into data movement across hybrid infrastructures. As the market becomes increasingly competitive, vendor strategies centered on innovation, interoperability, and customer-centric partnerships are shaping the future of cloud data protection.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Data Loss Prevention market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services, Inc.

- Broadcom Inc.

- Check Point Software Technologies Ltd.

- CrowdStrike

- Digital Guardian, Inc.

- Forcepoint LLC

- Google LLC

- Microsoft Corporation

- Palo Alto Networks, Inc.

- Proofprint

- Trellix Holdings, Inc.

- Trend Micro Incorporated

- Zscaler

Offering Practical Guidance and Strategic Priorities for Executives to Strengthen Cloud Data Loss Prevention Posture and Optimize Security Investments

To maximize the effectiveness of Cloud Data Loss Prevention initiatives, industry leaders should adopt a phased, risk-based approach that aligns with organizational priorities and resource constraints. Initially, establishing comprehensive data discovery and classification processes is essential for identifying high-value assets and sensitive information flows within cloud environments. This foundational step ensures that subsequent prevention policies are targeted and proportionate to the actual risk profile.

Next, integrating DLP controls with identity and access management systems and applying adaptive policies based on user context will strengthen enforcement while minimizing workflow disruption. Organizations should also leverage automation to manage policy lifecycles, remediate incidents, and generate actionable insights from analytics dashboards. In parallel, developing cross-functional governance frameworks that engage legal, compliance, and business stakeholders fosters a culture of accountability and shared ownership for data protection.

Furthermore, investing in ongoing training programs and tabletop exercises will ensure that security teams and business units are prepared to respond effectively to potential data loss incidents. Engaging with trusted technology partners and managed service providers can enhance operational resilience by supplementing internal capabilities and accelerating time to value. By prioritizing these strategic actions-grounded in a clear understanding of organizational risk appetite-executives can drive sustainable improvements to their Cloud DLP posture and realize stronger, more predictable security outcomes.

Detailing Comprehensive Research Framework and Analytical Methods Employed to Ensure Credibility and Depth in Cloud Data Loss Prevention Market Insights

This research report is underpinned by a robust, multi-stage methodology designed to ensure accuracy, depth, and practical relevance. The process begins with an extensive review of publicly available information, including vendor white papers, regulatory filings, and industry publications, to establish baseline market trends and technology capabilities. These secondary sources are complemented by a series of in-depth interviews with cybersecurity experts, vendor executives, and enterprise practitioners, providing qualitative insights into adoption drivers and deployment challenges.

Quantitative validation follows through rigorous data triangulation methods, where vendor performance metrics and adoption rates are cross-checked against advisory firm reports, financial disclosures, and third-party research. Segmentation analysis is applied to contextualize findings across component categories, deployment models, organization sizes, and industry verticals. Regional dynamics are similarly examined by mapping regulatory frameworks and cloud infrastructure maturity to observed market behaviors.

Lastly, all findings undergo a peer review process involving subject matter specialists to verify technical accuracy and strategic relevance. This iterative validation ensures that conclusions and recommendations reflect real-world conditions and emerging developments. By employing this layered research framework, the report delivers a credible, comprehensive, and actionable view of the Cloud Data Loss Prevention landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Data Loss Prevention market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Data Loss Prevention Market, by Component

- Cloud Data Loss Prevention Market, by Deployment Model

- Cloud Data Loss Prevention Market, by Industry Vertical

- Cloud Data Loss Prevention Market, by Region

- Cloud Data Loss Prevention Market, by Group

- Cloud Data Loss Prevention Market, by Country

- United States Cloud Data Loss Prevention Market

- China Cloud Data Loss Prevention Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Summarizing Key Findings and Strategic Considerations to Empower Decision Makers in Mitigating Data Loss Risks Within Cloud Environments

As organizations continue to accelerate cloud adoption, the imperative to protect sensitive data against loss, theft, and misuse has never been stronger. Key findings underscore the importance of migrating from fragmented, appliance-based DLP tools to integrated, cloud-native platforms that offer continuous visibility, contextual policy enforcement, and automated threat remediation. Leading vendors are differentiating through AI-driven analytics, extensible APIs, and deep partnerships with hyperscale cloud providers, enabling enterprises to evolve their security architectures in step with modern workloads.

Segmentation analysis highlights that service offerings for consulting and maintenance remain critical for successful deployments, particularly among complex, hybrid environments. Deployment preferences vary broadly by organization size and industry needs, making flexibility and orchestration capabilities essential design considerations. Regional insights reveal that regulatory pressures in the Americas, EMEA, and Asia-Pacific are harmonizing around data sovereignty and privacy, driving consistent demand for unified DLP solutions that support localized controls.

Ultimately, enterprises that embrace a holistic approach-combining data discovery, user-centric policies, robust governance, and continuous improvement-will be best positioned to reduce risk exposure and maximize return on security investments. The strategic considerations and recommendations presented in this report serve as a blueprint for decision makers seeking to strengthen their Cloud DLP posture and build enduring data resilience.

Connect with Our Associate Director to Secure the Comprehensive Cloud DLP Market Research Report and Accelerate Your Data Protection Strategy

The path to safeguarding your organization’s critical data within cloud environments starts with proactive engagement. To secure the full breadth of market intelligence packed into this comprehensive Cloud Data Loss Prevention report, connect with Ketan Rohom, Associate Director, Sales & Marketing. His deep expertise in translating complex research insights into actionable strategies means you’ll receive a tailored briefing that aligns with your unique security objectives and operational priorities.

By partnering with Ketan, you gain not only access to detailed analysis but also personalized guidance on navigating vendor landscapes, emerging threat vectors, and regulatory considerations. Whether you are seeking to validate an existing DLP roadmap or explore new investments in cutting-edge prevention technologies, he will help you unlock the most relevant findings and recommend the best next steps.

Act now to ensure your organization remains resilient against data loss incidents. Reach out to Ketan Rohom today to purchase the full Cloud Data Loss Prevention market research report and equip your team with the insights needed to drive stronger governance, smarter technology adoption, and enduring business growth.

- How big is the Cloud Data Loss Prevention Market?

- What is the Cloud Data Loss Prevention Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?