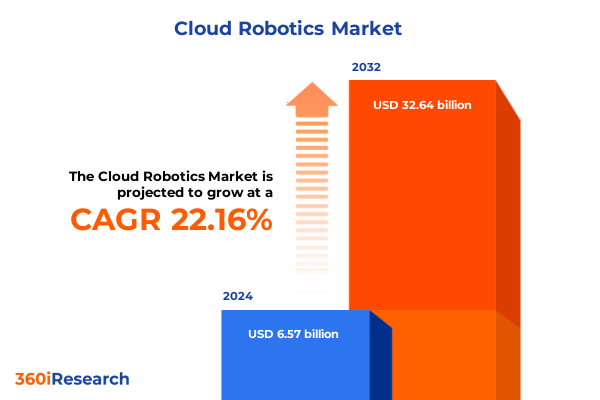

The Cloud Robotics Market size was estimated at USD 7.95 billion in 2025 and expected to reach USD 9.61 billion in 2026, at a CAGR of 22.34% to reach USD 32.64 billion by 2032.

Navigating the Frontier of Cloud-Enabled Robotics: An Overview of Technological Progress and Strategic Imperatives Defining the Next Era of Automation

Cloud robotics represents the convergence of advanced robotics and cloud computing, ushering in a new era of intelligent automation. By offloading computational tasks traditionally handled on-board to scalable cloud infrastructures, robotics systems can leverage elastic resources for data processing, deep learning model training, and real-time analytics. This paradigm shift not only reduces the hardware constraints and energy consumption of individual robots but also enables continuous improvement via centralized software updates and collective learning across distributed fleets.

As enterprises across manufacturing, logistics, healthcare, and agriculture seek to enhance productivity and agility, cloud-enabled robots are increasingly pivotal in addressing labor shortages, ensuring operational resilience, and accelerating innovation cycles. The ability to manage sprawling device networks through unified dashboards and to harness shared AI models means organizations can deploy new capabilities faster, respond to market fluctuations with greater flexibility, and unlock novel business models around-as-a-service offerings.

Despite promising advancements, stakeholders face challenges in designing secure communication channels, ensuring latency-optimized performance, and navigating evolving regulatory landscapes related to data sovereignty. This report explores these dynamics in depth, offering decision-makers a holistic view of the technological foundations, industry shifts, policy impacts, and segmentation insights essential for capitalizing on the transformative potential of cloud robotics.

Examining the Dramatic Transformations Redefining Cloud Robotics Through Connectivity, AI Integration, and Edge-Computing Innovations

The landscape of cloud robotics is being reshaped by a series of transformative shifts that are redefining how robots interact, learn, and perform complex tasks. Foremost among these is the proliferation of high-bandwidth, low-latency networks such as 5G, which bridge the gap between decentralized endpoints and centralized processing hubs. This connectivity leap enables real-time collaboration among robots, allowing them to share sensory inputs and AI-derived insights instantaneously, thus achieving levels of coordination previously unattainable.

Parallel advancements in edge computing have been equally influential. By distributing micro data centers closer to operational sites, organizations can balance the computational demands between local devices and cloud platforms. This hybrid approach mitigates latency concerns for mission-critical operations-such as surgery-assisting robots in healthcare or autonomous vehicles in logistics-while retaining the scalability benefits of centralized AI training.

Artificial intelligence itself has undergone a renaissance with the maturation of deep learning frameworks optimized for robotic workloads. Digital twins, virtual replicas of physical robotic systems, are now extensively used to simulate scenarios, accelerate model validation, and forecast system behaviors under varied conditions. These simulations feed back into continuous learning loops, equipping next-generation robots with enhanced perception, adaptive control, and predictive maintenance capabilities. Collectively, these shifts forge a dynamic environment where the pace of innovation is limited only by the imagination of system architects and the agility of regulatory frameworks.

Analyzing the Cumulative Impact of 2025 Tariff Adjustments on US Cloud Robotics Supply Chains and Global Competitive Dynamics

In 2025, the United States implemented a series of tariff adjustments targeting key components and materials integral to cloud robotics platforms. These levies have reverberated throughout global supply chains, resulting in elevated procurement costs for sensors, actuation systems, and specialized semiconductors. Robotics OEMs and system integrators have had to reassess sourcing strategies, shifting production to tariff-exempt regions or renegotiating supplier contracts to absorb cost increases.

The immediate effect has been a selective deceleration in hardware roll-outs, particularly in sectors with thin margins such as consumer retail and small-scale manufacturing. Some vendors have opted to redesign their architectures to rely more heavily on domestically produced edge devices, even at the expense of cutting-edge performance, in order to maintain predictable cost structures. Conversely, larger industrial players with extensive capital reserves have leveraged vertical integration, acquiring upstream component suppliers to internalize tariff risks and secure preferential access to critical inputs.

Looking ahead, the tariff climate has catalyzed a broader reassessment of resilience strategies. Companies are expanding dual-source agreements, investing in in-house prototyping capabilities, and exploring tariff engineering approaches-modifying product assemblies or classification codes to qualify for lower duty rates. As the landscape continues to evolve, decision-makers must weigh the trade-offs between cost efficiency, performance benchmarks, and geopolitical exposure to sustain competitive advantage in the cloud robotics market.

Unveiling Key Segmentation Insights Highlighting Diverse Applications, Offerings, Deployment Models, and Component Architectures in Cloud Robotics

A nuanced understanding of market segmentation reveals the diverse application scenarios driving cloud robotics adoption. Across the application spectrum, robotic systems are revolutionizing Agriculture with automated crop monitoring, empowering Automotive manufacturers with collaborative assembly lines, enhancing Defense operations through unmanned reconnaissance, and elevating Healthcare via patient-centric solutions such as patient care, assisted surgery, and remote telepresence. Simultaneously, Logistics & Warehousing is being transformed by AI-driven order fulfillment, optimized factory storage workflows, and seamless port and terminal automation. In Manufacturing environments, discrete and process manufacturing facilities alike are benefitting from adaptive production lines, while Retail innovators deploy robotic assistants for inventory management and customer service.

From an offering perspective, the cloud robotics ecosystem comprises hardware platforms, professional services, and sophisticated software stacks. Hardware enhancements now span high-precision communication modules, ruggedized edge computing devices, and next-generation sensors and actuators. Complementary services include strategic consulting, system integration and deployment oversight, as well as comprehensive maintenance and support frameworks. On the software side, providers deliver robust AI and analytics engines, middleware and platform services that unify device orchestration, modular operating systems, and industry-grade security solutions designed to safeguard data and operational continuity.

Deployment modalities further segment the market into hybrid cloud architectures that blend on-premises compute with public cloud scalability, fully private cloud instances for organizations prioritizing data sovereignty, and public cloud models offering rapid elasticity. Underpinning these segments are core platform components that include foundational infrastructure such as compute clusters, networking fabric, and scalable storage, management services for continuous monitoring, analytics, and compliance enforcement, and developer-centric platforms equipped with comprehensive APIs and toolchains to accelerate custom application development.

This comprehensive research report categorizes the Cloud Robotics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Deployment

- Application

Deriving Strategic Regional Perspectives on Cloud Robotics Adoption Trends Across Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping cloud robotics trajectories. In the Americas, robust investments in digital infrastructure and public-private partnerships are accelerating pilot deployments across manufacturing hubs and smart agriculture initiatives. Government incentives and technology grants are fueling experimentation, while leading universities collaborate on advanced robotic research, creating a fertile ecosystem for commercialization.

Across Europe, the Middle East, and Africa, regulatory frameworks are coalescing around harmonized safety standards and data protection regulations. European Union directives on AI ethics and cross-border data flows are guiding system architects toward privacy-by-design deployments. The Middle East is witnessing rapid modernization efforts, with port authorities and logistics operators integrating cloud robotics to enhance throughput, and African markets leveraging low-power robotic platforms to address labor shortages in agriculture and mining sectors.

Asia-Pacific continues to lead in scale and ambition, propelled by strong government mandates in nations such as China, Japan, and South Korea. National initiatives are channeling significant funding into smart factories, autonomous warehousing, and service robots for healthcare. Meanwhile, regional trade agreements are streamlining cross-border partnerships, enabling collaboration between local integrators and global technology providers to deliver solutions tailored to dense urban landscapes and expansive industrial precincts.

This comprehensive research report examines key regions that drive the evolution of the Cloud Robotics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Cloud Robotics Innovators and Market Players Driving Technological Advancements and Strategic Collaborations

The cloud robotics arena is characterized by a blend of established technology leaders and agile disruptors. Legacy industrial automation companies have bolstered their portfolios through partnerships with leading cloud providers, integrating edge-optimized controllers with advanced AI toolsets to offer turnkey solutions. Concurrently, hyperscale cloud platforms are deepening their foothold by developing specialized robotic development kits, pre-trained machine learning models, and orchestration services designed to reduce time-to-market for developers.

Emerging startups are carving niches by focusing on vertical-specific applications, such as precision agriculture drones or autonomous material-handling vehicles for e-commerce warehouses. These players often leverage open-source frameworks and community-contributed algorithms to iterate rapidly and secure early pilot successes. Venture capital inflows into these segments underscore the market’s growth potential and the premium placed on differentiated solutions that can seamlessly integrate with existing enterprise IT landscapes.

Strategic alliances between system integrators, component vendors, and AI analytics firms are also shaping competitive dynamics. By co-developing reference architectures and joint go-to-market programs, these collaborations are accelerating solution adoption, providing end-users with end-to-end services that encompass device provisioning, network configuration, AI model customization, and ongoing performance optimization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Robotics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Amazon Web Services, Inc.

- Boston Dynamics, Inc.

- FANUC Corporation

- Google LLC

- Hit Robot Group Co., Ltd.

- International Business Machines Corporation

- inVia Robotics, Inc.

- Kawasaki Heavy Industries, Ltd.

- KUKA Aktiengesellschaft

- Microsoft Corporation

- NVIDIA Corporation

- Rapyuta Robotics Co., Ltd.

- Siemens Aktiengesellschaft

- SoftBank Robotics Group

- Teradyne, Inc.

- Universal Robots A/S

- Yaskawa Electric Corporation

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities in Cloud Robotics Ecosystem

To capitalize on the momentum in cloud robotics, industry leaders should prioritize partnership frameworks that span the entire technology stack. Engaging with hyperscale cloud providers early can secure access to specialized credits, technical support, and co-innovation opportunities that accelerate proof-of-concept cycles. At the same time, forming alliances with established robotics OEMs and specialized integrators ensures alignment with field-proven hardware platforms and domain expertise.

Investment in cybersecurity architectures is non-negotiable. Organizations must implement zero-trust models, encrypt data in transit and at rest, and routinely conduct penetration testing to safeguard IP and operational continuity. Embedding security considerations at the design stage prevents costly retrofits and fosters stakeholder confidence, from executive leadership to on-floor operators.

Finally, cultivating internal talent through targeted training initiatives and cross-functional teams will be a differentiator. Upskilling engineering, IT, and operations personnel in cloud-native development, AI model lifecycle management, and robotics safety standards mitigates reliance on external consultants and embeds innovation capabilities within the organization. These combined actions will position leaders to launch scalable, resilient cloud robotics deployments that drive long-term value.

Detailed Research Methodology Outlining Robust Data Collection, Multivariate Analysis Techniques, and Qualitative Validation Procedures

This research employs a comprehensive mixed-methods approach to ensure validity and depth of insights. Primary data collection consisted of in-depth interviews with over 40 senior executives spanning robotics manufacturers, cloud platform operators, and system integrators. These conversations provided qualitative perspectives on technology adoption barriers, partnership models, and future investment priorities.

Secondary research involved rigorous analysis of publicly available sources, including patent filings, regulatory filings, industry white papers, and financial disclosures from both private and public companies. Market participants’ press releases and conference presentations served as supplemental inputs, offering visibility into roadmap announcements and pilot program outcomes.

Quantitative data was triangulated using proprietary databases on global trade flows, tariff schedules, and investment trends. Advanced multivariate techniques, such as cluster analysis and regression modeling, were applied to identify correlation patterns between regional regulatory changes and adoption rates. Finally, findings were validated through an expert panel workshop, where triangulated results were stress-tested against emerging scenarios, ensuring the robustness of strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Robotics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Robotics Market, by Offering

- Cloud Robotics Market, by Deployment

- Cloud Robotics Market, by Application

- Cloud Robotics Market, by Region

- Cloud Robotics Market, by Group

- Cloud Robotics Market, by Country

- United States Cloud Robotics Market

- China Cloud Robotics Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Conclusive Perspectives on the Evolutionary Trajectory of Cloud Robotics and Their Strategic Implications for Industry Stakeholders

Cloud robotics stands at the nexus of rapid technological innovation and evolving market realities, offering a potent avenue for enterprises to amplify productivity, drive cost efficiencies, and unlock new business models. As network infrastructures mature and AI algorithms become more sophisticated, the seamless orchestration of distributed robotic systems will redefine operational norms across key industries.

The interplay of regulatory dynamics, especially in the context of tariffs and data sovereignty, underscores the importance of agile strategies that marry technical excellence with geopolitical awareness. Organizations that can navigate this complexity through diversified sourcing, strategic alliances, and built-in resilience protocols will emerge as market leaders in the next wave of automation.

Ultimately, success in cloud robotics hinges on a holistic approach that integrates robust infrastructure, secure communication channels, advanced analytics, and human capital development. By aligning technology roadmaps with organizational capabilities and regional market nuances, stakeholders can harness the full potential of cloud-enabled robotics to drive sustainable growth and competitive differentiation.

Partner with Ketan Rohom to Access Comprehensive Cloud Robotics Market Intelligence and Propel Strategic Growth Initiatives

Embarking on your cloud robotics journey with authoritative insights and a strategic roadmap is only a conversation away. By connecting with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch), you gain exclusive access to the full market research report, which delves deeper into emerging trends, competitive benchmarks, and actionable strategies tailored to your organizational priorities. Ketan’s expertise will ensure you receive a customized demonstration of how this intelligence can drive your innovation pipeline and optimize decision-making.

Whether you are exploring entry into new industry verticals, seeking to refine your deployment architecture, or aiming to strengthen supplier negotiations in light of evolving tariff environments, this comprehensive resource is designed to align with your strategic objectives. Reach out today to schedule a one-on-one briefing and discover how leveraging these insights can accelerate your competitive positioning in the rapidly transforming cloud robotics ecosystem. Your next breakthrough begins with informed action.

- How big is the Cloud Robotics Market?

- What is the Cloud Robotics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?