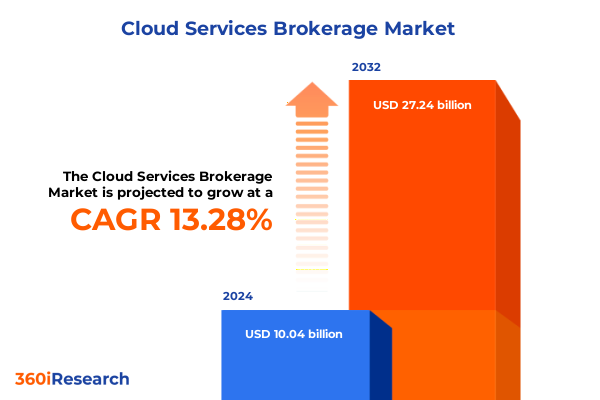

The Cloud Services Brokerage Market size was estimated at USD 11.21 billion in 2025 and expected to reach USD 12.53 billion in 2026, at a CAGR of 13.51% to reach USD 27.24 billion by 2032.

Embracing Cloud Services Brokerage as the Strategic Nexus Redefining Enterprise Cloud Adoption while Amplifying Operational Agility and Cost Efficiency

In today’s rapidly evolving digital landscape, enterprises confront an array of complex challenges as they pursue scalable, agile, and cost-effective cloud deployments. Against this backdrop, cloud services brokerage emerges as a pivotal capability that streamlines service selection, management, and optimization across multiple providers, enabling organizations to offload administrative burdens while accelerating innovation. By aggregating diverse cloud offerings under a unified management layer and delivering tailored governance frameworks, brokerages empower IT teams to focus on high-value initiatives rather than routine provisioning tasks.

Transitioning to a brokerage model demands a sophisticated understanding of service portfolios, dynamic pricing structures, and interoperability considerations. As cloud consumption patterns shift from monolithic on-premises infrastructures to distributed, service-oriented architectures, brokerage platforms provide the requisite abstraction and automation. They bridge the gap between internal stakeholders and external vendors, ensuring compliance with organizational policies, optimizing cost and performance, and fostering collaboration across DevOps, finance, and security functions. Ultimately, cloud services brokerage transforms chaotic cloud sprawl into a coherent, manageable ecosystem aligned with strategic business objectives.

Navigating Disruptive Transformations Shaping the Evolution and Strategic Imperatives of Cloud Services Brokerage Ecosystems Worldwide

Over the last decade, the cloud services brokerage landscape has undergone profound shifts driven by advancements in containerization, serverless computing, and AI-powered orchestration. Early brokerages focused primarily on aggregating public cloud offerings, but modern platforms now integrate private, hybrid, and on-premises environments, delivering true multi-cloud governance. This evolution has been catalyzed by the rapid adoption of microservices architectures and Infrastructure as Code, which demand seamless interoperability across compute, networking, and storage layers.

Simultaneously, digital transformation initiatives have spurred demand for automated deployment pipelines, advanced security policy enforcement, and self-service portals that grant developers direct access to mandated resources. Brokerages have responded by embedding DevOps automation and policy-as-code frameworks, enabling continuous compliance checks and real-time cost optimization. As container orchestration platforms like Kubernetes mature, brokerages are integrating deeper workload observability and workload mobility features, ensuring that applications can fluidly shift between hyperscale public clouds, managed public clouds, and hosted private clouds without risk or vendor lock-in.

Looking ahead, the convergence of edge computing, 5G connectivity, and IoT will further reshape brokerage services. Stakeholders must embrace platforms that not only unify service management but also support decentralized execution models, guaranteeing consistent policy enforcement across global edge footprints.

Decoding the Strategic Ripples of New US Tariffs on Cloud Infrastructure Costs and Sourcing Tactics for Brokerage Providers in 2025

The imposition of revised tariff measures by the United States in early 2025 has generated material repercussions for global supply chains and technology service costs. Cloud services brokerage providers that rely on hardware imports for data center components, including specialized networking switches and storage arrays, are experiencing input cost pressures as duties affect imported equipment from strategic manufacturing hubs. These incremental expenses have necessitated adjustments in service pricing models and have prompted brokerages to revisit their hardware sourcing strategies to maintain margin targets.

In response, several leading brokerage firms have accelerated the transition toward software-defined infrastructure and containerized environments, reducing dependency on proprietary hardware. By leveraging open-source virtualization platforms and commodity servers procured through domestic channels, brokerages can sidestep tariff-induced cost escalation while preserving performance SLAs. Concurrently, the reshuffling of hardware supply chains has underscored the importance of multi-vendor agility, compelling brokerages to cultivate robust distribution partnerships across Americas, Europe, and Asia-Pacific to mitigate single-source risks.

These dynamics also influence cloud licensing negotiations, since tariff-induced cost fluctuations can ripple into public and private cloud service fees. Forward-looking brokerages are proactively embedding cost-containment strategies into their SLAs and accelerating capabilities for real-time billing adjustments, thereby insulating end customers from sudden rate hikes and reinforcing trust in the brokerage model.

Illuminating How Diverse Service, Deployment, Vertical, Organizational, and Application Dimensions Shape Brokerage Offerings for Targeted Customer Value

Examining the market through the lens of service type reveals that Infrastructure as a Service dominance is propelled by compute, networking, and storage needs, whereas the ascendancy of Platform as a Service is driven by demand for streamlined application development and middleware integration. Concurrently, Function as a Service delivers event-driven scalability for microservices, and Software as a Service continues to capture enterprise collaboration, CRM, and ERP workloads. These nuanced distinctions guide brokerages toward tailored portfolio architectures.

Deployment model segmentation shows that hybrid cloud environments, characterized by container orchestration and multi-cloud integration capabilities, are preferred by organizations balancing flexibility and control. Private cloud remains a stronghold for regulated industries through hosted and on-premises offerings, while hyperscale and managed public cloud services provide elastic capacity for digital natives and SMBs. Understanding these deployment nuances is critical for packaging brokerage services that align with customer risk profiles.

Vertical markets such as banking, government, healthcare, IT, manufacturing, and retail each demand specific compliance frameworks and workload optimizations, informing how brokerages structure service catalogs. Likewise, large enterprises, including Fortune 500 corporations and midsize organizations, require sovereign cloud provisions, whereas micro and small enterprises prioritize managed offerings for minimal administrative overhead. Across applications-ranging from cloud strategy consulting and data analytics to CI/CD pipelines, API management, and identity management-brokerages must orchestrate end-to-end workflows to drive business outcomes.

This comprehensive research report categorizes the Cloud Services Brokerage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Service Type

- Platform Type

- Deployment Model

- Industry Vertical

- Enterprise Size

Unveiling Regional Disparities Driving Cloud Services Brokerage Growth through Innovation, Compliance Mandates, and Strategic Partnerships Globally

Regional dynamics continue to redefine the competitive landscape for cloud services brokerage. In the Americas, brokerages benefit from mature public cloud ecosystems led by hyperscalers, robust professional services demand, and proactive regulatory frameworks that enable secure cross-border data flows. Brokerages in this region are capitalizing on advanced analytics and AI modules to deliver predictive cost management and performance tuning services.

Across Europe, the Middle East, and Africa, stringent data sovereignty regulations and emerging digital transformation mandates have fueled rapid growth in managed and hosted private cloud segments. Brokerages here are differentiating through localized data center presence, compliance advisory functions, and partnerships with regional telecommunications providers to support multi-access edge computing. Demand for ERP and CRM SaaS brokerage services is particularly strong in nations modernizing public sector and financial infrastructures.

Asia-Pacific reflects a heterogeneous mix of advanced economies prioritizing innovation hubs and developing markets focused on scalable digital inclusion. Brokerages in this region are leveraging container-driven hybrid cloud solutions to address latency-sensitive applications, while forging alliances with local ISVs to embed regionalized APIs and integration frameworks. Emerging use cases around IoT platforms and 5G-enabled edge deployments further underscore the need for adaptive brokerage architectures.

This comprehensive research report examines key regions that drive the evolution of the Cloud Services Brokerage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Positioning and Competitive Differentiators of Premier Cloud Services Brokerage Providers Shaping Market Leadership

Leading global consultancies and technology conglomerates continue to shape the cloud services brokerage market by integrating deep industry expertise with expansive cloud partnerships. Firms with entrenched advisory practices have invested heavily in proprietary orchestration layers and turnkey policy-as-code frameworks, enabling them to guide clients through complex multi-cloud migrations seamlessly. At the same time, specialist software vendors have carved out niches by offering modular brokerage components-ranging from security monitoring to API management-that integrate into larger ecosystems.

Strategic investment patterns reveal that organizations with end-to-end service portfolios, from strategy consulting through managed operations and continuous optimization, are securing larger, multi-year engagements. Meanwhile, nimble regional players differentiate by offering hyper-localized compliance services and vertical-specific accelerators, appealing to customers seeking tailored solutions. Competitive convergence is evident as leading brokerages pursue alliances with hyperscalers, telcos, and systems integrators to co-develop integrated offerings, intensifying the race to deliver frictionless cloud consumption models.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Services Brokerage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Accrets

- ActivePlatform

- AppDirect, Inc

- Arrow Electronics, Inc.

- Atos SE

- BMC Software, Inc.

- BT GmbH & Co. oHG

- Capgemini SE

- CloudBlue

- CloudFX

- Cloudmore

- Cognizant Technology Solutions Corporation

- Fujitsu Ltd.

- IBM Corporation

- InContinuum Software

- Infosys Limited

- Jamcracker, Inc.

- Jenne Inc.

- NEC Corporation

- NTT Data Inc.

- Tata Consultancy Services

- VMware, Inc.

- Wipro Limited

Driving Sustainable Competitive Advantage through Tailored Automation Frameworks Strategic Alliances and Outcome-Based Engagement Models

To capitalize on the momentum in cloud services brokerage, industry leaders should adopt a portfolio optimization mindset that prioritizes reusable automation assets, policy-driven governance, and continuous delivery pipelines. Building differentiated offerings requires investment in domain-specific accelerators-such as regulatory compliance toolkits for finance or validation frameworks for life sciences-while maintaining a robust marketplace of third-party integrations.

Collaboration with hyperscalers and independent software vendors can unlock co-innovation opportunities, enabling brokerages to embed unique value propositions for performance monitoring, cost analytics, and security posture management. Furthermore, expanding managed service capabilities through centers of excellence focused on DevOps best practices and container security will reinforce customer trust and foster long-term partnerships.

Finally, leaders must cultivate talent ecosystems by upskilling cloud architects, security specialists, and data engineers to orchestrate end-to-end engagements. Embedding outcome-based commercial models that tie fees to cost savings, performance SLAs, or innovation milestones can further align incentives and differentiate brokerage services in an increasingly crowded market.

Ensuring Robust and Objective Insights through a Comprehensive Multi-Method Research Framework Integrating Expert Feedback and Industry Data

The findings presented in this report are underpinned by a rigorous multi-methodology research design combining quantitative and qualitative data sources. Primary research involved in-depth interviews with C-level executives, cloud architects, and procurement leads across key verticals to validate market drivers and buyer requirements. These dialogues were augmented by a structured survey capturing deployment preferences, pricing sensitivity, and satisfaction metrics.

Secondary research encompassed analysis of industry whitepapers, regulatory publications, and vendor documentation to contextualize technological advancements and policy developments. Publicly available financial statements, investor presentations, and partnership announcements were examined to triangulate competitive strategies and investment trends. Data synthesis was conducted through thematic analysis, identifying recurring patterns related to service adoption, architectural best practices, and emerging use cases.

Data integrity was ensured through cross-validation with third-party industry analysts and subject matter experts. Where discrepancies arose, follow-up inquiries and data audits were performed to reconcile insights. This methodology ensures a comprehensive and reliable portrayal of the cloud services brokerage landscape, empowering readers with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Services Brokerage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Services Brokerage Market, by Offering

- Cloud Services Brokerage Market, by Service Type

- Cloud Services Brokerage Market, by Platform Type

- Cloud Services Brokerage Market, by Deployment Model

- Cloud Services Brokerage Market, by Industry Vertical

- Cloud Services Brokerage Market, by Enterprise Size

- Cloud Services Brokerage Market, by Region

- Cloud Services Brokerage Market, by Group

- Cloud Services Brokerage Market, by Country

- United States Cloud Services Brokerage Market

- China Cloud Services Brokerage Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Elevating Enterprise Cloud Journeys through Adaptive Brokerage Models Focused on Governance Automation and Strategic Collaboration

In summary, cloud services brokerage has evolved from a tactical service aggregation function into a strategic enabler of enterprise transformation. By unifying multi-cloud environments under consistent governance, brokerages deliver critical capabilities in cost optimization, compliance assurance, and operational agility. As digital initiatives proliferate and technology ecosystems fragment further, the brokerage model will remain indispensable for organizations seeking to harness the full potential of cloud innovation.

The interplay of tariff-driven cost pressures, regional compliance dynamics, and evolving service consumption patterns underscores the necessity for brokerages to adopt adaptable architectures and invest in domain-specific expertise. Market leaders who excel in automation, cultivate strategic alliances, and embed outcome-based engagement models will secure the most significant growth opportunities. Ultimately, the future of cloud services brokerage hinges on its ability to deliver seamless, secure, and cost-effective cloud experiences that align with organizational ambitions and regulatory requirements.

Unlock Actionable Intelligence on Cloud Services Brokerage Market Dynamics by Connecting with Our Sales Leadership Today

For decision-makers seeking to harness the power of cloud services brokerage to optimize their multi-cloud strategies and deliver unprecedented value, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report and gain the competitive edge your organization deserves

- How big is the Cloud Services Brokerage Market?

- What is the Cloud Services Brokerage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?