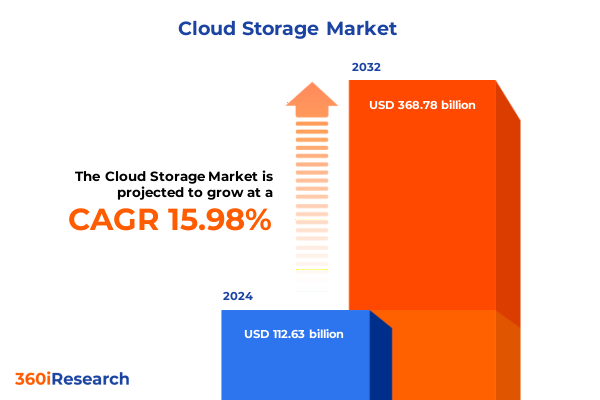

The Cloud Storage Market size was estimated at USD 130.23 billion in 2025 and expected to reach USD 150.58 billion in 2026, at a CAGR of 16.03% to reach USD 368.78 billion by 2032.

Discover how rapid digital transformation and evolving data demands are reshaping the global cloud storage ecosystem and stakeholder strategies

The relentless acceleration of data creation across enterprises and individual users has established cloud storage as an indispensable element of modern digital infrastructure. From soaring multimedia content demands to the proliferation of IoT devices generating continuous telemetry, organizations confront unprecedented volumes of information that traditional on-premises solutions struggle to manage efficiently. As a result, cloud storage emerges as the preferred paradigm, offering scalable capacity that adapts to dynamic business requirements.

Amid this transformation, diverse drivers converge to shape the market landscape. Remote and hybrid work models have elevated the importance of reliable, anywhere-access storage, while advanced analytics, artificial intelligence, and edge computing place new performance expectations on data repositories. Concurrently, concerns around data sovereignty, security, and regulatory compliance compel organizations to reevaluate deployment strategies, driving innovation in encryption, access controls, and regional hosting policies.

This executive summary delves into the key forces molding the global cloud storage ecosystem. It explores the transformative technology shifts, assesses the cumulative impact of recent United States tariffs, unpacks critical segmentation and regional nuances, and highlights leading companies’ strategies. Additionally, it offers actionable recommendations for industry leaders and outlines the research methodology underpinning these insights.

Examine the groundbreaking technological advancements and market dynamics driving a new era of cloud storage innovation and competitive differentiation

In recent years, the cloud storage landscape has undergone a profound metamorphosis driven by breakthroughs in software-defined architectures and the convergence of emerging technologies. Organizations now deploy microservices and containers at scale, demanding storage solutions that deliver low-latency access and seamless integration with orchestration platforms. Software-defined storage layers have emerged to abstract underlying hardware, enabling dynamic provisioning that aligns capacity with real-time application needs.

At the same time, edge computing has gained momentum, shifting data processing closer to end-points to reduce latency and conserve bandwidth. This evolution has given rise to distributed storage models that synchronize edge nodes with central repositories, ensuring data consistency without compromising performance. As edge deployments expand across smart cities, manufacturing floors, and retail environments, cloud storage providers are adapting by extending their services to edge-optimized footprints.

Moreover, the integration of artificial intelligence into storage management is revolutionizing capacity planning and cost optimization. Machine learning algorithms now predict usage patterns, automate tiering between high-performance NVMe drives and cost-efficient hard disk arrays, and identify anomalies to bolster security. Together, these technological advances herald a new era of cloud storage characterized by agility, resilience, and intelligence.

Analyze how recent United States import tariffs and trade policies have cumulatively influenced hardware supply chains, cost structures, and strategic planning in cloud storage

The introduction of new United States tariffs in 2025 has exerted a cumulative influence across hardware supply chains, compelling cloud storage providers to revisit cost structures and long-term purchasing strategies. With duties ranging from ten to thirty-four percent on imported servers, solid-state drives, and networking components sourced from key manufacturing regions, providers have faced immediate financial pressures that rippled through pricing negotiations and capital investment plans.

Initially, leading hyperscale operators absorbed the increased costs to preserve competitive service rates, drawing upon deep economies of scale and established supplier relationships. However, sustained tariff burdens have spurred a strategic pivot toward diversifying manufacturing footprints. Suppliers and providers alike have accelerated efforts to qualify assembly facilities in Taiwan, Vietnam, and Mexico while evaluating opportunities to onshore critical component production within the United States. These shifts, while mitigating risk, introduce transitional complexities, including extended qualification timelines and incremental logistics expenses.

Looking ahead, tariff uncertainty remains a strategic variable in infrastructure road-mapping. Providers are layering flexible contract terms with hardware vendors, revising procurement frameworks to incorporate tariff-indemnity clauses, and deepening collaboration with domestic manufacturers. By proactively aligning procurement and financial planning with evolving trade policies, industry players aim to stabilize deployment costs and sustain innovation investments over the long term.

Uncover segmentation insights demonstrating the impact of deployment models, organization sizes, storage media, service types, and end-user applications

A nuanced view of market segmentation reveals divergent requirements and adoption patterns across deployment models, organization sizes, storage media types, service offerings, and application use cases. Hybrid cloud environments, which blend on-premises control with public cloud elasticity, appeal to organizations balancing sensitive workloads and cost efficiency. In contrast, private cloud deployments serve enterprises demanding strict data governance, particularly within highly regulated sectors, while public cloud remains the go-to choice for dynamic scaling and rapid provisioning.

Organization size further dictates adoption pathways, with large enterprises leveraging comprehensive storage portfolios to align with global IT strategies and drive digital transformation initiatives. Meanwhile, small and medium enterprises prioritize cost-effective, turnkey solutions that minimize administrative overhead, and individual users gravitate toward simplified backup and personal data repositories offered by consumer-oriented providers. Storage media type plays a pivotal role as well, with high-performance NVMe SSDs and traditional SATA SSDs supporting latency-sensitive applications, while SAS and SATA HDD arrays deliver cost-optimized capacity for archiving and bulk storage.

Service type segmentation adds another layer of insight. Object storage excels at managing unstructured data for content distribution and archive workloads, block storage caters to transactional databases and virtual machines, and file storage addresses shared file systems in enterprise collaboration. Application-level distinctions underscore the varied use cases driving demand, from long-term archiving and robust backup and recovery solutions to content management systems and streaming media platforms. Collectively, these segmentation dimensions illuminate the tailored requirements shaping cloud storage adoption across diverse industry landscapes.

This comprehensive research report categorizes the Cloud Storage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Model

- Organization Size

- Storage Media Type

- Service Type

- Application

- End User

Explore regional insights highlighting growth drivers, regulatory considerations, adoption trends across the Americas, EMEA and Asia-Pacific cloud storage markets

Regional analysis highlights the heterogeneous evolution of cloud storage across major geographies. In the Americas, early hyperscaler expansion and a mature enterprise base have fostered sophisticated multi-region architectures. Robust digital initiatives in North and South America, bolstered by investments in sustainability and data privacy regulations such as CCPA, continue to drive demand for encrypted, cross-border storage solutions that adhere to evolving compliance frameworks.

Transitioning to Europe, the Middle East and Africa, regulatory imperatives such as GDPR exert a powerful influence on deployment strategies. Data sovereignty concerns have catalyzed the emergence of local cloud providers and consortium models to address jurisdictional constraints. Additionally, infrastructure rollout in emerging markets within EMEA is gaining momentum, supported by government-backed digital transformation programs and cross-border connectivity investments that reduce latency and enhance resiliency.

Meanwhile, the Asia-Pacific region stands out for its rapid uptake of cloud storage underpinned by booming digital economies and a surge in mobile-first application development. Local cloud champions in markets like China and India complement the footprints of global providers, creating a competitive arena where price, performance, and service localization decide the leaders. Government mandates around data localization further shape regional strategies, prompting both international and domestic players to expand localized data center capacity.

This comprehensive research report examines key regions that drive the evolution of the Cloud Storage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delve into company insights on how leading cloud storage providers and infrastructure vendors innovate and compete to secure market leadership

Industry leaders and niche innovators alike are vying for prominence in the cloud storage arena through differentiated service portfolios, strategic alliances, and targeted acquisitions. Amazon Web Services continues to extend its lead by layering advanced machine learning features atop its S3 object storage, while Microsoft Azure differentiates through deep enterprise integration with its Microsoft 365 and Dynamics ecosystems. Google Cloud Platform emphasizes its data analytics and AI-driven storage optimizations, appealing to organizations focused on deriving insights from large datasets.

On the enterprise hardware front, traditional vendors have adapted by offering converged infrastructure appliances optimized for hybrid cloud environments. Dell Technologies and Hewlett Packard Enterprise have refreshed their midrange and high-end arrays to support multi-protocol access and non-volatile memory express performance tiers. NetApp and Pure Storage maintain strong partnerships with cloud providers to deliver seamless data mobility tools, enabling customers to migrate workloads and orchestrate backup strategies across on-premises, private cloud, and public cloud realms.

A parallel set of emerging players is carving out specialized niches. Companies offering cold and archive-tier storage with ultra-low retrieval costs have gained traction among long-term data retention use cases, while next-generation startups leverage erasure coding and geo-distributed object stores to compete with established hyperscalers. Through continuous innovation and ecosystem development, these key players are shaping the competitive contours of the global cloud storage market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cloud Storage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- Dell Technologies Inc.

- Google LLC

- Huawei Technologies Co., Ltd.

- IDrive

- International Business Machines Corporation

- Microsoft Corporation

- NetApp, Inc.

- Oracle Corporation

- pCloud

- Tencent Holdings Limited

- Wasabi Technologies

Empower industry leaders with actionable strategies to optimize supply chains, diversify sourcing, and foster innovation in cloud storage solutions

To navigate the evolving cloud storage landscape, industry leaders must prioritize supply chain resilience and strategic sourcing. By establishing partnerships with alternative manufacturing hubs and incorporating tariff-indemnity terms into procurement contracts, organizations can mitigate cost volatility and maintain project timelines. Concurrently, investing in software-defined storage and automation tools will enable enterprises to optimize resource utilization and reduce operational overhead.

Furthermore, leaders should accelerate the development of differentiated service offerings that align with specific segmentation needs. Tailoring solutions for hybrid cloud scenarios, performance-sensitive workloads, and regulated industry requirements will strengthen customer value propositions. Incorporating advanced analytics, policy-driven data governance, and tiered storage architectures will address the particular priorities of enterprise, SME, and individual users alike.

Finally, a regionalized go-to-market approach is essential. Building localized data center footprints or partnering with trusted regional providers can alleviate compliance concerns and reduce latency for end users. By combining these strategic actions-fortified supply chains, targeted innovation, and regional alignment-industry leaders can secure sustainable competitive advantage and drive continued market growth.

Detail the research methodology combining primary interviews, secondary data analysis, and rigorous triangulation to validate cloud storage market insights

Our research methodology integrates both primary and secondary data sources to deliver robust cloud storage market insights. Initially, we conducted in-depth interviews with CIOs, IT managers, and technology architects representing diverse industries and organizational sizes. These conversations provided nuanced perspectives on deployment preferences, performance expectations, and procurement strategies under changing trade policies.

Complementing primary inputs, our secondary analysis encompassed a comprehensive review of industry literature, regulatory filings, and corporate disclosures. We examined publicly available documentation on tariff legislation, hardware component classifications, and data sovereignty regulations to contextualize current market dynamics. This desk research ensured that our understanding of supply chain shifts and regional adoption trends was anchored in verifiable facts.

Critical to our approach was the triangulation of data points across both qualitative and quantitative streams. We cross-validated interview themes with reported infrastructure investments, patent filings, and partnerships announced by key cloud and hardware vendors. Through this rigorous methodology, we have distilled accurate, actionable insights that reflect the real-world complexities of the evolving cloud storage ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cloud Storage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cloud Storage Market, by Deployment Model

- Cloud Storage Market, by Organization Size

- Cloud Storage Market, by Storage Media Type

- Cloud Storage Market, by Service Type

- Cloud Storage Market, by Application

- Cloud Storage Market, by End User

- Cloud Storage Market, by Region

- Cloud Storage Market, by Group

- Cloud Storage Market, by Country

- United States Cloud Storage Market

- China Cloud Storage Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesize the pivotal findings and emphasize the strategic imperatives shaping the future of cloud storage in an increasingly interconnected global economy

The confluence of rapid data growth, advanced technology integration, and shifting trade policies underscores the pivotal moment facing the cloud storage industry. As organizations accelerate digital transformation initiatives, they demand storage solutions that balance performance, cost, and compliance. The recent tariff adjustments have introduced new variables into infrastructure planning, prompting a reconfiguration of supply chains and sourcing strategies.

Segmentation analysis reveals that tailored approaches-whether through hybrid deployments for enterprises, cost-efficient archiving for smaller organizations, or performance-optimized SSD tiers for latency-sensitive applications-are critical to meeting diverse customer requirements. Regional insights further illustrate that compliance frameworks and local market conditions shape adoption pathways, necessitating flexible, localized offerings.

Ultimately, companies that combine strategic procurement, differentiated service innovation, and regional alignment will lead the market. By embedding agility into both operations and product road maps, stakeholders can capitalize on emerging opportunities while navigating uncertainties. The insights presented here provide a foundation for informed decision-making as the global cloud storage ecosystem continues to evolve.

Engage with Ketan Rohom Associate Director of Sales & Marketing to obtain the market research report and unlock strategic cloud storage insights

Engage with Ketan Rohom, Associate Director of Sales & Marketing, to access the market research report and unlock strategic cloud storage insights

- How big is the Cloud Storage Market?

- What is the Cloud Storage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?