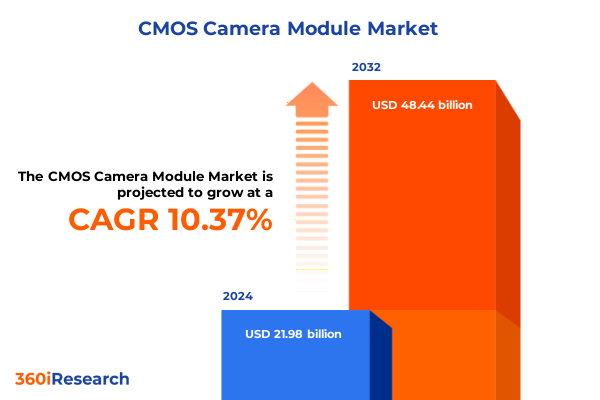

The CMOS Camera Module Market size was estimated at USD 24.21 billion in 2025 and expected to reach USD 26.69 billion in 2026, at a CAGR of 10.41% to reach USD 48.44 billion by 2032.

How Evolving CMOS Camera Module Technologies Are Reshaping Imaging Capabilities Across Automotive, Consumer, Medical, Industrial, and Mobile Phone Applications

The rapid evolution of CMOS camera module technology is reshaping the very foundation of modern imaging solutions within automotive safety systems consumer electronics wearables and healthcare diagnostics. Advances in sensor architecture pixel scaling and back-illuminated designs have significantly boosted low-light performance dynamic range and power efficiency. In parallel the integration of on-chip image signal processors and deep learning accelerators is enabling real-time computational imaging algorithms that deliver unprecedented accuracy in facial recognition object tracking and environmental mapping. As global industries pivot toward autonomous vehicles smart factory automation and immersive augmented reality experiences demand for sophisticated imaging capabilities is driving innovation at an accelerated pace.

Across diverse markets engineers and decision makers are navigating a complex landscape where cost performance and differentiation must coexist. Automotive manufacturers now require high-resolution modules capable of advanced driver assistance system functions cabin monitoring and rear-view imaging under stringent reliability standards. Consumer electronics brands are integrating AR/VR modules into headsets drones and wearables to support interactive applications demanding high frame rates and compact form factors. Within the medical sector CMOS camera modules are transforming diagnostic imaging endoscopic procedures and telemedicine by offering lightweight high-definition cameras that adapt seamlessly to stringent sterilization protocols. Furthermore mobile phone OEMs continue to push the boundaries of miniaturization combining multi-lens arrays across feature phones and flagship smartphones to meet the insatiable appetite for high-quality photography and video. Against this backdrop the CMOS camera module industry stands at the intersection of technological possibility and market opportunity where innovation must be balanced with reliable supply chain and cost control strategies.

Emerging Trends and Disruptive Innovations That Are Driving Transformative Shifts in the Global CMOS Camera Module Landscape and Redefining Imaging Standards

In recent years the CMOS camera module sector has witnessed transformative shifts driven by disruptive innovations across sensor fabrication and system integration. Stacked sensor architectures leveraging advanced 3D wafer bonding techniques are enabling designers to separate the photodiode array from the signal processing layer thereby optimizing each for peak performance. This approach along with the widespread adoption of backside-illuminated sensors has drastically improved quantum efficiency and reduced noise levels in low-light conditions. Meanwhile the proliferation of on-sensor phase-detect autofocus pixels and in-pixel neural network engines is accelerating autofocus speed frame-by-frame noise reduction and real-time scene recognition without offloading data to external processors.

Simultaneously event-based vision sensors that capture changes in luminance rather than fixed frames are emerging as a game-changer for high-speed machine vision and robotics applications. By only transmitting pixel data when illumination changes these modules can achieve microsecond response times and produce data rates orders of magnitude lower than traditional frame-based sensors. Furthermore complementary developments in high dynamic range stitching algorithms and global shutter designs are expanding the applicability of CMOS modules in harsh lighting environments and high-velocity scenarios such as automated inspection lines and autonomous navigation. In parallel the integration of heterogeneous computing elements combining CPU GPU and FPGA blocks on a single chip is permitting truly intelligent camera modules that execute complex analytics on the edge minimizing latency and bandwidth constraints.

Collectively these advancements are not only elevating raw imaging performance but also redefining how camera modules fit within broader systems. From smart vehicles capable of semantic scene understanding to drones that react instantaneously to environmental changes and medical devices offering AI-driven diagnostic assistance each shift underscores a fundamental trend: imaging is becoming more computationally intensive more adaptive and more deeply embedded into the automated workflows that define Industry 4.0.

Analyzing the Multifaceted Consequences of United States Tariffs Implemented in 2025 on the Supply Chain Profitability and Competitiveness of CMOS Camera Module

The introduction of new United States tariffs on camera sensors and related components in early 2025 has introduced significant challenges for manufacturers and OEMs across the CMOS camera module value chain. Suppliers subject to duties have experienced immediate cost increases for key wafers and optical filters prompting many to reassess their procurement strategies. In response several tier-one module producers have shifted a portion of their high-volume production to facilities in Southeast Asia where local content rules help mitigate tariff exposure. Nevertheless the reshuffling has led to longer lead times and elevated logistics expenses.

For companies unable to relocate production the consequence has been a direct pass-through of additional costs to end-users creating upward pressure on module prices. Automotive OEMs reliant on advanced driver assistance system sensors have reported tightened margins and deferred rollouts of new sensor-based features. Conversely major smartphone manufacturers with vertically integrated supply chains have managed to absorb a portion of the duty impact by renegotiating long-term contracts and financing tariff relief mechanisms. Despite these tactics most stakeholders agree that the cumulative burden of the 2025 tariff regime will persist throughout the year driving further consolidation among smaller suppliers.

Looking forward the ongoing trade tensions underscore the importance of strategic diversification within the supply chain. Manufacturers are exploring dual-sourcing agreements for critical image sensors and optical components while investing in alternative imaging technologies that fall outside the current tariff scope. As a result industry participants that proactively manage these obstacles stand to gain a competitive edge by ensuring uninterrupted access to components at a controlled cost base.

Uncovering Critical Market Segmentation Insights That Illuminate Application Needs Product Type Preferences End User Categories Interface Selections Resolution

An in-depth examination of market segmentation reveals that application diversity remains a critical driver for CMOS camera module adoption and innovation. Within the automotive sector modules tailored for advanced driver assistance systems prioritize high dynamic range and global shutter performance cabin monitoring applications emphasize compact form factors and infrared functionality and rear-view systems demand panoramic coverage and robustness under extreme temperatures. Shifting focus to consumer electronics highlights distinct requirements for augmented and virtual reality headsets where sub-millisecond latency and high pixel density are paramount alongside drone imaging that balances lightweight design with stabilized optics and wearable cameras that integrate power-efficient sensors in ultra-compact housings. Transitioning to industrial applications the machine vision segment values deterministic timing and precise color reproduction whereas robotics leverages flexible integration with motion systems and on-board analytics for real-time decision making. In parallel the medical domain sees diagnostics modules equipped for high-contrast microscopy and endoscopy systems demanding sterilizable housings and uniform illumination. Finally mobile phone cameras bifurcate between feature phone solutions focused on cost-effective fixed-focus lenses and smartphone arrays that combine auto-focus modules with computational photography enhancements across multiple megapixel tiers.

Beyond applications product type insights indicate that auto-focus modules are increasingly preferred in high-end segments where speed and accuracy can be monetized whereas fixed-focus modules sustain strong demand in cost-sensitive deployments. End user patterns show a split between aftermarket channels where flexibility and rapid availability are crucial and OEM supply chains that prioritize long-term quality certifications and supported lifecycles. Interface choices follow a similar duality: LVDS and parallel links persist in legacy platforms seeking proven reliability while MIPI and USB connectivity dominate in high-bandwidth mobile and PC-based imaging scenarios. Resolution segmentation further shapes design considerations with sub-one-megapixel sensors enduring in simple detection tasks one-to-five-megapixel modules serving mainstream consumer products five-to-ten-megapixel solutions advancing mid-tier smartphones and greater-than-ten-megapixel offerings emerging in premium automotive and specialized imaging systems.

This comprehensive research report categorizes the CMOS Camera Module market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Component

- Resolution

- Sensor Architecture

- Shutter Type

- Spectral Type

- Configuration

- Application

- End User

Exploring Key Regional Market Dynamics That Highlight Growth Drivers and Adoption Patterns Across Americas Europe Middle East Africa and Asia Pacific Regions

Regional characteristics exert a significant influence on both demand patterns and technology adoption rates within the global CMOS camera module market. In the Americas robust growth in automotive ADAS and consumer electronics segments is driven by substantial R&D investments from local OEMs and integrators, while a dynamic aftermarket landscape is supported by aftermarket distributors and retrofit suppliers seeking quick turnaround. Europe, Middle East and Africa present a more fragmented opportunity set as stringent regulatory requirements for vehicle safety and emissions shape the automotive sector whereas diverse levels of industrial automation across the region create differentiated demand for machine vision and robotics solutions. Additionally mobile device proliferation in certain EMEA countries fuels ongoing interest in smartphone-grade imaging devices and niche medical applications.

In the Asia-Pacific region the density of consumer electronics manufacturing hubs, coupled with government incentives for advanced driver assistance research and smart factory initiatives, positions this region as the epicenter of volume production and early adoption. Tier-one module producers frequently base their largest assembly campuses here to leverage integrated component ecosystems and favorable labor conditions. Simultaneously emerging markets within APAC are closing the technology gap by adopting cost-effective fixed-focus cameras in entry-level devices and deploying USB-based modules for telemedicine to improve healthcare access. Across all regions supply chain resilience, driven by recent geopolitical developments and tariff uncertainties, remains a top priority influencing facility siting decisions and strategic partnerships.

This comprehensive research report examines key regions that drive the evolution of the CMOS Camera Module market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Moves Partnerships and Innovation Portfolios of Leading CMOS Camera Module Providers to Illuminate Competitive Landscapes Strategies

Leading companies in the CMOS camera module space are differentiating themselves through strategic partnerships targeted acquisitions and sustained investment in next-generation sensor architectures. A number of tier-one semiconductor manufacturers have enhanced their portfolios by integrating vertically with optics suppliers while expanding their wafer fabrication capabilities to support backside-illuminated and stacked die technologies. In parallel specialized module assemblers are forming alliances with AI software providers to embed bespoke image processing pipelines directly within the module’s firmware.

Mergers and acquisitions continue to reshape competitive dynamics with established players absorbing niche innovators focused on event-based vision and global shutter integration. These moves accelerate time to market for novel solutions while consolidating expertise in areas such as low-light enhancement and spectral imaging. At the same time a cohort of emerging companies is capturing attention by offering highly customized modules for robotics and industrial automation where precision timing and deterministic data flows are demanded.

Furthermore global suppliers are reinforcing their market presence through multi-tiered customer engagement programs that include joint development agreements pilot line access and regional technical support centers. This customer-centric approach not only strengthens long-term relationships with OEMs and system Integrators but also ensures faster feedback loops for iterative product enhancements. Ultimately companies that can marry advanced sensor design with scalable assembly processes and responsive customer frameworks are best positioned to lead the CMOS camera module market into its next phase of growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the CMOS Camera Module market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ams-OSRAM AG

- BAE Systems PLC

- Canon Inc.

- Chicony Electronics Co., Ltd.

- Hamamatsu Photonics K.K.

- Himax Technologies, Inc.

- Huiber Vision Technology Co., Ltd.

- hynix Semiconductor Inc.

- LG Innotek Co., Ltd.

- Nippon Chemi-Con Corporation

- NXP Semiconductors N.V.

- OmniVision Technologies, Inc.

- ON Semiconductor

- Oxford Instruments PLC

- PixelPlus Co., Ltd.

- Samsung Electronics Co., Ltd

- Sharp Corporation

- SiliconFile Technologies, Inc.

- Sony corporation

- STMicroelectronics NV

- Thorlabs, Inc.

- Toshiba Corporation

- Universe Kogaku (America) Inc.

- XIMEA GmbH

Driving Transformation with Actionable Recommendations for CMOS Camera Module Industry Leaders to Optimize Innovation Supply Chains and Market Positioning

Industry leaders looking to capitalize on evolving opportunities within the CMOS camera module market should prioritize a balanced approach that addresses both technological innovation and supply chain resilience. Investing in research and development to refine stacked sensor designs and in-pixel computational engines will position organizations to meet the increasing demand for intelligent edge imaging. At the same time establishing diversified sourcing agreements across multiple geographic locations will mitigate risks associated with tariff fluctuations and geopolitical disruptions while ensuring continuity of critical component supply.

Moreover companies should explore strategic collaborations with software developers to deliver turnkey solutions that seamlessly integrate hardware modules with analytics platforms. By providing end-to-end offerings that include calibration tools and cloud-based management services module vendors can unlock new revenue streams and foster deeper customer engagement. In parallel sales and marketing teams must tailor value propositions to distinct segments such as automotive consumer electronics industrial and medical, highlighting relevant performance metrics and reliability credentials.

Finally thought leadership initiatives such as co-authored whitepapers participation in standards bodies and early involvement in pilot projects will amplify a company’s credibility in emerging fields like event-based vision smart cities and telehealth diagnostics. By adopting an agile go-to-market strategy that aligns technological roadmaps with end user requirements and regional market nuances industry leaders can secure sustainable advantage amid intensifying competition.

Detailing the Rigorous Multi Stage Research Methodology Employed to Ensure Data Integrity Analytical Precision and Comprehensive Industry Coverage

The research underpinning this analysis combined multiple data gathering techniques to ensure comprehensive coverage and analytical rigor. Initially a series of primary interviews were conducted with senior engineers product managers and procurement executives across key OEMs system integrators and component suppliers. These discussions provided qualitative insights into current pain points strategic priorities and technology roadmaps. In parallel a thorough review of publicly available patent filings technical whitepapers and product datasheets was performed to map the evolving sensor and module architectures influencing market trajectories.

Secondary research involved analyzing corporate financial disclosures industry conference proceedings and government trade data to quantify trade flows and tariff impacts. To validate emerging trends and micro-level shifts a third layer of expert consultations was conducted with independent academics technology consultants and venture capitalists specializing in imaging technologies. Triangulation of these information streams was supported by a structured framework that assessed technology readiness levels competitive intensity and supply chain stability.

Finally segmentation analyses were executed by categorizing applications according to automotive advanced driver assistance cabin monitoring and rear-view scenarios consumer electronics AR/VR drones and wearables industrial machine vision and robotics medical diagnostics and endoscopy and mobile phones feature phones and smartphones. Further segmentation frameworks considered product type auto focus and fixed focus end user aftermarket and OEM interface type LVDS MIPI parallel and USB and resolution classes of under one megapixel one to five megapixels five to ten megapixels and over ten megapixels. This multi-dimensional approach ensured that insights accurately reflect the nuanced demands driving each segment’s evolution.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our CMOS Camera Module market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- CMOS Camera Module Market, by Product Type

- CMOS Camera Module Market, by Component

- CMOS Camera Module Market, by Resolution

- CMOS Camera Module Market, by Sensor Architecture

- CMOS Camera Module Market, by Shutter Type

- CMOS Camera Module Market, by Spectral Type

- CMOS Camera Module Market, by Configuration

- CMOS Camera Module Market, by Application

- CMOS Camera Module Market, by End User

- CMOS Camera Module Market, by Region

- CMOS Camera Module Market, by Group

- CMOS Camera Module Market, by Country

- United States CMOS Camera Module Market

- China CMOS Camera Module Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2226 ]

Summarizing Key Findings and Strategic Takeaways That Empower Stakeholders to Navigate the Complexities of the CMOS Camera Module Ecosystem

Drawing together the most significant observations from the preceding sections yields a cohesive narrative that empowers stakeholders to make informed strategic decisions. Technological innovations including stacked sensor designs event-based vision and integrated AI engines are redefining performance benchmarks across automotive consumer medical industrial and mobile markets. At the same time the imposition of United States tariffs has underscored the importance of supply chain diversification and proactive cost management to preserve profitability and maintain market agility.

Segmentation analysis highlights that differentiated requirements across applications product types end users interfaces and resolution tiers necessitate targeted product roadmaps and tailored go-to-market strategies. Regional insights confirm that the Americas Europe Middle East Africa and Asia Pacific each present unique growth drivers and adoption challenges shaping vendor priorities around capacity deployment and customer engagement. Competitive dynamics are evolving rapidly as leading companies forge partnerships acquire niche innovators and expand vertically to secure advanced capabilities in a landscape where time to market and technical differentiation are critical.

Ultimately organizations that align their innovation pipelines with end-user demands embrace supply chain flexibility and cultivate deep domain expertise will navigate the complex CMOS camera module ecosystem with confidence. These foundational elements establish a robust platform for sustained growth and lasting competitive advantage in an industry defined by rapid change and high strategic stakes.

Connect with Ketan Rohom Associate Director of Sales and Marketing to Secure Immediate Access to the Comprehensive CMOS Camera Module Market Research Report

For customized insights and to secure immediate access to the full market research report on CMOS camera modules, industry professionals are invited to connect directly with Ketan Rohom Associate Director of Sales and Marketing. Ketan’s expertise in translating complex technical analyses into actionable intelligence will ensure your organization gains timely competitive advantages through comprehensive data on technology trends, supply chain developments, and regional dynamics. Engage today to discuss tailored research packages, volume discounts, and strategic briefings that align precisely with your business objectives. Harness the depth of market knowledge and step confidently into the future of imaging innovation with a specialized report designed to inform every critical decision.

- How big is the CMOS Camera Module Market?

- What is the CMOS Camera Module Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?