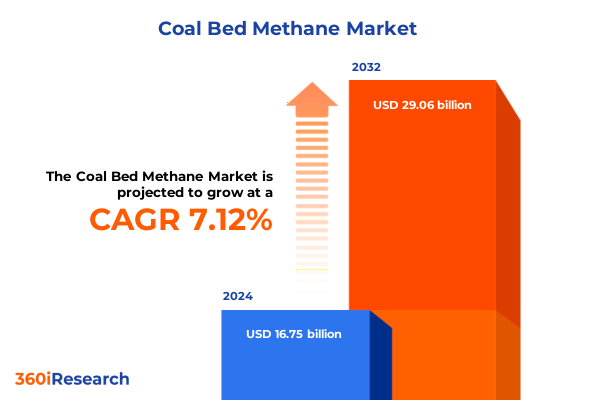

The Coal Bed Methane Market size was estimated at USD 17.96 billion in 2025 and expected to reach USD 19.26 billion in 2026, at a CAGR of 7.11% to reach USD 29.06 billion by 2032.

Introducing Coal Bed Methane’s Vital Role in the Global Energy Transition and Its Emerging Significance Amid Industry Decarbonization Initiatives

Coal bed methane represents a critical component of the global energy mix, emerging as an unconventional gas resource with significant potential to bridge traditional hydrocarbons and renewable alternatives. Extracted from coal seams through specialized drilling and fracturing techniques, this form of natural gas has gained traction for its abundance in key regions and its relatively lower carbon footprint compared to coal combustion. Against a backdrop of escalating energy demand and stringent environmental targets, coal bed methane offers stakeholders a pathway to diversify energy portfolios while advancing decarbonization mandates.

As industry leaders and investors navigate shifting policy landscapes and intensifying market pressures, understanding the strategic imperatives of coal bed methane is paramount. This executive summary distills the essential factors shaping the sector, from technological innovations and tariff repercussions to segmentation insights and regional dynamics. By framing the discussion around transformative shifts and actionable recommendations, the analysis equips decision makers with the clarity needed to harness growth opportunities. Ultimately, this introduction lays the groundwork for a holistic exploration of market forces, competitive landscapes, and strategic options that define coal bed methane’s trajectory.

Examining the Technological, Regulatory, and Market Forces Driving a Fundamental Transformation Within the Coal Bed Methane Sector

Over the past decade, the coal bed methane landscape has undergone profound transformation, driven by rapid advancements in drilling and completion technologies. Horizontal drilling combined with optimized fracturing techniques has unlocked reserves previously deemed uneconomical, extending the productive life of mature coal seams. Concurrently, digital innovations such as real‐time data analytics and remote monitoring have enhanced operational efficiency, reduced downtime, and improved safety standards across field operations.

Equally impactful are evolving regulatory frameworks aimed at balancing energy security with environmental stewardship. Policies incentivizing methane capture and limiting fugitive emissions have compelled operators to adopt stringent leak detection and repair protocols. Meanwhile, increasing scrutiny on water management and land reclamation has spurred investment in closed‐loop systems and sustainable disposal practices.

Market dynamics have also shifted, as natural gas demand in industrial and power generation sectors gains momentum in response to global decarbonization goals. Strategic alliances between technology providers and service companies are fostering integrated solutions that streamline project execution. Furthermore, collaborations with research institutions are yielding novel approaches to enhanced gas recovery and carbon sequestration, signaling a more resilient and adaptive coal bed methane sector.

Assessing the Comprehensive Effects of Newly Enforced United States Tariffs in 2025 on Coal Bed Methane Production Equipment and Supply Chains

In 2025, newly enforced United States tariffs on imported drilling equipment, compressor units, and specialized fracturing components are reshaping cost structures across the coal bed methane value chain. Manufacturers of horizontal drilling machinery and high‐pressure pumps face increased duties of up to 15 percent, prompting operators to reassess procurement strategies. As a result, supply chain optimization has become a focal point, with companies exploring domestic sourcing and long‐term procurement contracts to mitigate tariff‐induced price volatility.

The tariff regime has also catalyzed innovation among equipment providers. Domestic fabricators are investing in advanced manufacturing capabilities, seeking to bridge the cost gap created by import duties. This shift supports localized supply ecosystems, reducing lead times and enhancing operational flexibility. However, smaller service firms may experience margin pressures if they lack the scale to absorb incremental costs or negotiate favorable terms with equipment vendors.

Moreover, tariff‐driven cost increases are influencing project economics for new developments. Operators are integrating scenario analyses that factor in duty rates and currency fluctuations, enabling more robust decision making. In certain cases, delayed project approvals and cost renegotiations have emerged as operators balance capital expenditure commitments against evolving regulatory costs. Ultimately, the 2025 tariff landscape underscores the importance of agile supply chain management and collaborative vendor partnerships.

Unveiling Essential Segmentation Insights to Illuminate End Uses, Well Types, Distribution Channels, Drilling Stages, and Technology Dynamics

A nuanced understanding of coal bed methane segmentation reveals diverse market dynamics across multiple dimensions. In terms of end use, commercial applications showcase steady uptake as businesses seek reliable onsite energy, while electricity generation segments benefit from the dispatchability of natural gas to balance intermittent renewables. Industrial operators leverage gas for heating and feedstock, and residential consumers increasingly adopt piped solutions for heating and cooking needs, each segment exhibiting distinct demand drivers and regulatory contexts.

Examining well configurations, horizontal wells command premium yields by intersecting more extensive fracture networks, whereas vertical wells continue to serve legacy fields where simpler completion approaches prevail. Distribution channels similarly diverge; high‐pressure pipeline transmission underpins wholesale supply to major hubs, low‐pressure networks cater to local distribution, trucking of compressed gas provides flexibility in remote operations, and liquefied gas trucking addresses large‐volume deliveries where pipeline infrastructure is absent.

Drilling stage analysis further stratifies the market. Completed wells, whether producing or suspended, represent existing asset bases with predictable output profiles. In contrast, uncompleted wells in fracturing or logging stages embody future production potential, albeit with uncertainty around well performance. Technological trajectories amplify these distinctions. Advances in carbon storage leverage deep saline aquifers and geological formations, while enhanced gas recovery via CO₂ or nitrogen injection seeks to maximize recovery factors and extend field life.

This comprehensive research report categorizes the Coal Bed Methane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Well Type

- Drilling Stage

- Technology

- End Use

- Distribution Channel

Deriving Strategic Regional Perspectives to Highlight the Coal Bed Methane Market’s Trajectories Across the Americas, EMEA, and Asia-Pacific Territories

Regional trends in the coal bed methane sector underscore diverse growth patterns and strategic imperatives. In the Americas, abundant onshore reserves and mature infrastructure underpin continued investment, with North America leading in advanced drilling techniques and commercial-scale enhanced gas recovery pilots. Latin American markets are gradually expanding capacity as governments pursue domestic energy security and foreign investment in field development.

Across Europe, the Middle East, and Africa, regulatory frameworks emphasizing emissions reduction and energy diversification are reshaping market opportunities. European nations prioritize methane capture projects and integrate coal bed methane into broader hydrogen and renewables strategies. Middle Eastern producers explore CBM as a complementary resource to conventional gas, while African nations with underdeveloped gas networks view coal bed methane as a catalyst for rural electrification and industrial growth.

In Asia-Pacific, rapid urbanization and industrialization drive heightened demand for flexible gas supplies. Australia remains at the forefront of export‐oriented production, leveraging expertise in large‐scale LNG projects. China continues to invest in domestic CBM extraction to reduce coal consumption, and Southeast Asian economies are evaluating pilot projects to tap into underutilized coal seam resources. These regional dynamics collectively shape a heterogeneous yet interconnected global market.

This comprehensive research report examines key regions that drive the evolution of the Coal Bed Methane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants to Reveal Their Strategic Initiatives, Technological Innovations, and Partnerships Shaping the Coal Bed Methane Ecosystem

Key players in the coal bed methane space are differentiating through strategic partnerships, technological innovation, and integrated service offerings. Leading oilfield service companies are leveraging their scale to deliver end-to-end solutions, from well characterization and drilling to completion and production optimization. Their expanded portfolios often combine digital tools with field expertise to accelerate project timelines and lower unit costs.

Independent producers are enhancing asset valuation by deploying advanced recovery techniques such as CO₂ injection pilots, while specialty equipment manufacturers are introducing modular compressor skids and next-generation monitoring systems. Collaborative ventures between drilling contractors and research institutions have given rise to proprietary fracture fluid chemistries designed to improve conductivity and reduce environmental impact.

Moreover, equipment OEMs are establishing regional fabrication hubs to address tariff pressures and compress supply chain lead times. Joint ventures with local partners facilitate market entry and compliance with regional content requirements. As competition intensifies, companies that can seamlessly integrate technology, logistics, and regulatory insight stand to capture the lion’s share of new development opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Coal Bed Methane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adani Enterprises Limited

- AGL Energy Limited

- Baker Hughes Company

- Black Diamond Energy, Inc.

- BP PLC

- CNOOC Limited

- ConocoPhillips Company

- Far East Energy Corporation

- Great Eastern Energy Corporation Ltd.

- Halliburton Energy Services, Inc.

- Metgasco Limited

- Origin Energy Limited

- Ovintiv Inc.

- Pioneer Natural Resources Company

- Quicksilver Resources

- Reliance Power Limited

- Santos Ltd.

- Senex Energy Limited

- Shell PLC

- TotalEnergies SE

Delivering Pragmatic Recommendations That Empower Industry Leaders to Capitalize on Coal Bed Methane Opportunities and Navigate Emerging Market Complexities

Industry leaders must prioritize strategic investments that align with evolving market realities. Enhancing supply chain resilience through diversified sourcing agreements and domestic manufacturing partnerships will mitigate exposure to tariff fluctuations. Simultaneously, adopting advanced digital platforms for remote monitoring and predictive maintenance can drive operational excellence and reduce unplanned downtime.

Embracing innovative recovery methods, including CO₂ and nitrogen injection, will be essential to maximize resource extraction and meet sustainability objectives. Collaborating with research institutions to validate novel fracture chemistries and carbon storage pathways can accelerate technology commercialization. Furthermore, integrating comprehensive environmental management practices, from water treatment to land reclamation, will strengthen social license to operate and align with tightening regulatory standards.

Lastly, companies should explore cross-sector partnerships to unlock new applications for coal bed methane, such as feedstock for chemical processing or blended hydrogen production. By developing value-added solutions and engaging with stakeholders across the gas value chain, organizations can establish competitive differentiation and secure long-term growth.

Detailing the Robust Research Framework Incorporating Primary Insights, Secondary Data, and Rigorous Validation Processes Underpinning the Analysis

This analysis draws from a robust research framework that integrates both primary and secondary inputs to ensure rigorous validation. Primary research consisted of in-depth interviews with industry executives, technical specialists, and regulatory authorities, providing firsthand perspectives on operational challenges and strategic priorities. Secondary sources included peer-reviewed journals, government publications, and industry white papers, offering historical context and benchmarking data.

Data triangulation techniques were applied to reconcile insights across varied sources, enhancing the accuracy of segmentation analyses and tariff impact assessments. Quantitative modeling underpinned scenario planning for market penetration and cost sensitivity, while qualitative evaluation informed strategic positioning and risk mitigation strategies. Peer review sessions with subject matter experts further refined key findings, ensuring the report’s conclusions reflect real-world market dynamics.

By maintaining methodological transparency and leveraging a multidisciplinary approach, the research delivers credible, actionable insights tailored to executive decision makers. This comprehensive framework underpins the integrity of the analysis, supporting informed investment and strategic direction in the coal bed methane sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Coal Bed Methane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Coal Bed Methane Market, by Well Type

- Coal Bed Methane Market, by Drilling Stage

- Coal Bed Methane Market, by Technology

- Coal Bed Methane Market, by End Use

- Coal Bed Methane Market, by Distribution Channel

- Coal Bed Methane Market, by Region

- Coal Bed Methane Market, by Group

- Coal Bed Methane Market, by Country

- United States Coal Bed Methane Market

- China Coal Bed Methane Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Drawing Conclusive Perspectives That Synthesize Critical Findings, Market Realities, and Strategic Imperatives for the Coal Bed Methane Sector

Synthesizing the key themes, this report underscores the emergence of coal bed methane as a versatile resource in the broader energy transition. Technological advancements in drilling, completion, and recovery methods are expanding resource access, while evolving tariff landscapes are reshaping procurement and supply chain strategies. Segmentation insights reveal that differentiated end uses, well configurations, and distribution channels each present unique value propositions for market participants.

Regional perspectives highlight the Americas as a center of innovation, EMEA as a crucible for regulatory‐driven development, and Asia-Pacific as a growth frontier driven by rising energy demand. Leading companies are navigating these complexities through partnerships, localized manufacturing, and targeted R&D. To thrive, industry players must align strategic investments with sustainability targets, regulatory compliance, and stakeholder expectations.

Ultimately, the coal bed methane sector stands at a pivotal juncture where integrated technology adoption, agile supply chain management, and collaborative innovation will define market leadership. Stakeholders equipped with these synthesized insights are well positioned to capitalize on evolving opportunities and contribute to a resilient, low-carbon energy future.

Inviting Decision Makers to Secure Invaluable Market Insights by Engaging Directly With Ketan Rohom to Access the Comprehensive Coal Bed Methane Research Report

As businesses strive to stay ahead in a highly competitive energy landscape, securing in-depth understanding of the coal bed methane market becomes imperative. Engaging with Ketan Rohom offers decision makers unparalleled access to comprehensive insights that illuminate prevailing trends, regulatory dynamics, and growth catalysts. By initiating a dialogue, stakeholders can unlock tailored perspectives on end‐use applications, drilling innovations, and emerging market hotspots. This direct engagement facilitates informed decision making, enabling organizations to refine strategies, optimize investments, and achieve sustainable returns in the evolving coal bed methane sector.

Contacting Ketan Rohom connects you to an expert versed in market intelligence and strategic advisory. His expertise spans tariff impact analysis, segmentation breakdowns, and regional assessments, ensuring you receive guidance aligned with organizational objectives. Whether exploring emerging technologies like enhanced gas recovery or navigating complex tariff landscapes, this interaction equips you with actionable recommendations. Don’t miss this opportunity to elevate your strategic roadmap with bespoke analyses and data‐driven forecasts that drive tangible business value

- How big is the Coal Bed Methane Market?

- What is the Coal Bed Methane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?