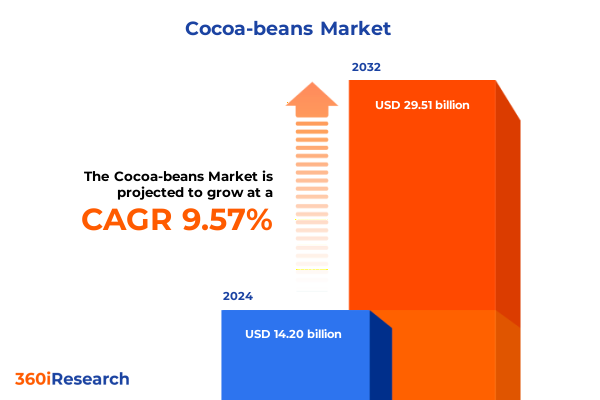

The Cocoa-beans Market size was estimated at USD 15.43 billion in 2025 and expected to reach USD 16.76 billion in 2026, at a CAGR of 9.70% to reach USD 29.51 billion by 2032.

Unveiling the Cocoa Bean Market’s Fundamental Dynamics Shaped by Consumer Demand Evolution, Sustainability Imperatives, and Supply Chain Innovations

The cocoa bean market stands at a pivotal juncture, experiencing a confluence of factors that are reshaping its fundamental dynamics. Growing consumer interest in premium chocolate products has spurred innovation across the value chain, prompting stakeholders to explore single-origin beans, nuanced flavor profiles, and artisanal production techniques. Concurrently, heightened awareness of ethical sourcing has placed sustainability at the forefront, compelling actors to adopt transparent supply chain practices, adhere to stringent environmental standards, and forge direct relationships with farming communities.

Meanwhile, climate variability has underscored the importance of resilience, leading market participants to invest in advanced agronomic practices and adaptive cultivation methods. This focus on future-proofing production capabilities intersects with digitalization trends, as blockchain-enabled traceability systems and data-driven risk management tools gain traction. As a result, the industry is witnessing a transition from volume-driven strategies toward value-creation models that prioritize product differentiation, corporate responsibility, and long-term supply security.

In this rapidly evolving environment, understanding the interplay between evolving consumer preferences, regulatory developments, and technological innovations is essential. By examining these core drivers, industry decision-makers can identify opportunities to optimize operations, enhance brand equity, and foster sustainable growth. This introduction establishes the context for a comprehensive exploration of the transformative shifts, regulatory impacts, and strategic imperatives that will define the cocoa bean sector in the coming years.

Mapping Transformative Shifts Redefining the Cocoa Bean Sector from Sustainability Pressure and Climate Risks to Technological Traceability Breakthroughs

In recent years, the cocoa bean sector has undergone transformative shifts that are redrawing traditional paradigms. Sustainability pressure has catalyzed a systemic reorientation toward regenerative agriculture, as producers and buyers seek to mitigate deforestation risks and improve soil health. These environmental imperatives have accelerated the adoption of agroforestry systems and climate-smart cultivation practices, which not only reduce carbon footprints but also enhance farmer livelihoods through diversified income streams.

Alongside sustainability, technological traceability breakthroughs are revolutionizing supply chain transparency. End-to-end digital platforms now enable real-time tracking of cocoa beans from farm to factory, empowering brands to substantiate ethical claims and comply with increasingly stringent regulatory requirements. Furthermore, consumer demand for authenticity has given rise to bean-to-bar micro-producers, who leverage small-batch processing and storytelling to capture premium market segments.

Simultaneously, shifts in consumption patterns reveal a growing appetite for health-oriented cocoa applications, driving innovation in functional ingredients and fortified formulations. Plant-based trends have also contributed to the development of defatted and full-fat cocoa powders that appeal to vegan and fitness-focused demographics. As these diverse forces converge, the industry is evolving from a commodity frontier into a sophisticated ecosystem where value is generated through differentiation, responsible sourcing, and technological enablement.

Examining the Comprehensive Repercussions of Newly Implemented 2025 US Tariffs on Cocoa Bean Imports and Domestic Value Chains

The introduction of new US tariffs on cocoa bean imports in early 2025 has generated far-reaching consequences across domestic value chains. By imposing additional duties on raw beans and derivative forms, these measures have led to cost inflation at multiple stages of processing and manufacturing. As a result, importers have been compelled to renegotiate supplier contracts, while domestic intermediaries are reassessing sourcing strategies to mitigate margin compression.

Consequently, a growing number of manufacturers are exploring near-shoring of processing facilities and vertical integration initiatives to counterbalance tariff-induced cost pressures. This shift has underscored the importance of operational agility, prompting investment in flexible processing lines capable of handling varying bean origins and quality grades. At the same time, price-sensitive segments have felt the impact most acutely, with foodservice operators and entry-level confectionery brands encountering tighter budget constraints.

However, these tariffs have also generated strategic opportunities. Domestic value-added activities, such as butter, mass, and cocoa powder production, are capturing increased attention as companies seek to unlock higher margins within the US market. In addition, the elevated cost of imported beans has fueled interest in alternative origins and emerging growing regions, driving diversification of supplier portfolios. Understanding this multifaceted response to the 2025 tariff landscape is critical for stakeholders aiming to sustain competitiveness and navigate an increasingly complex cost environment.

Illuminating Profound Segmentation Insights Spanning Type, Form, Processing, and End Use That Drive Targeted Strategies in the Cocoa Bean Market

A nuanced examination of market segmentation reveals distinct pathways for targeted growth. Based on Type, the landscape is organized around Criollo varieties prized for their nuanced flavor notes, Forastero beans valued for their robust yields and widespread availability, and Trinitario cultivars that combine aromatic complexity with resilience. This tripartite classification underpins sourcing decisions and product positioning, as brands calibrate their offerings to match consumer expectations and supply considerations.

In terms of Form, raw beans form the foundational trading unit, while paste is bifurcated into butter, sought after for its smooth mouthfeel in confectionery, and mass, which serves as the primary building block for cocoa solids. Powder applications are segmented between defatted varieties favored in health-oriented and dairy-analog formulations, and full-fat options that deliver richer sensory profiles. These form distinctions drive manufacturing workflows and dictate investment priorities for processing capabilities.

The End Use dimension encompasses bakery applications such as cakes and pastries, which leverage cocoa’s flavor and visual appeal; beverage segments spanning hot cocoa beverages for indulgence and instant mixes designed for convenience; and confectionery, where chips provide functional inclusions, chocolate bars deliver premium experiences, and fillings enable innovative product formats. Finally, Processing styles are divided into alkalized treatments-dark, light, and medium roasts that modulate acidity and color-and natural beans that preserve original flavor attributes. Together, these segmentation insights inform strategic roadmap development and performance optimization across the value chain.

This comprehensive research report categorizes the Cocoa-beans market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- End Use

- Processing

Unveiling the Distinct Regional Perspectives Across the Americas, EMEA, and Asia-Pacific That Shape Cocoa Bean Demand, Trade Flows, and Growth Opportunities

Regional patterns of demand and supply are strikingly diverse across the Americas, Europe, Middle East & Africa, and Asia-Pacific, each presenting unique growth trajectories and challenges. In the Americas, traditional producing nations continue to dominate primary bean exports, yet increasing domestic consumption in North America has fueled on-shore processing investments and premium chocolate innovation. This dual dynamic has strengthened regional resilience while elevating value-added activity.

Meanwhile in Europe, Middle East & Africa, well-established cocoa-processing hubs maintain leadership in confectionery manufacturing and specialty ingredient development. Regulatory priorities around deforestation-free supply chains and fair labor practices have driven stringent due-diligence requirements, influencing sourcing practices and partnerships with origin-country cooperatives. These standards have, in turn, spurred collaborative initiatives to improve farm-gate incomes and drive community empowerment.

Turning to Asia-Pacific, rising consumer incomes and expanding retail channels have catalyzed demand for both mass-market and premium chocolate products. Markets in China, India, and Southeast Asia are emerging as growth hot spots, with local manufacturers investing in processing facilities and tailored formulations. Simultaneously, government incentives and trade agreements are shaping import flows and encouraging cross-regional collaboration. Recognizing these contrasting regional dynamics is essential for stakeholders aiming to align supply chain structures, product portfolios, and market entries with localized imperatives.

This comprehensive research report examines key regions that drive the evolution of the Cocoa-beans market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies and Innovation Initiatives From Leading Players to Illuminate the Corporate Landscape of the Cocoa Bean Industry

Leading global players are adopting differentiated strategies to secure competitive advantages in the cocoa bean industry. One major processor has enhanced its value proposition by integrating digital traceability tools that capture farm-level data on cultivation practices, environmental impact, and quality attributes. This initiative not only bolsters sustainability credentials but also fosters direct relationships with smallholder networks.

Another multinational has prioritized capacity expansion through strategic acquisitions of mid-sized processors in key origin countries, thereby securing upstream supply while optimizing processing efficiencies. At the same time, a large confectionery manufacturer is spearheading regenerative cultivation programs, partnering with financial institutions to provide micro-loans and technical assistance that increase farmer resilience and improve bean yields.

In parallel, several specialty ingredient firms are accelerating product innovation, launching novel cocoa powders tailored for plant-based dairy alternatives and sports nutrition applications. Their investments in R&D have led to versatile ingredient solutions that address evolving consumer preferences and regulatory landscapes. Together, these corporate initiatives illuminate how innovation, sustainability, and strategic integration converge to reshape the competitive landscape and generate differentiated value within the cocoa bean market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cocoa-beans market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Barry Callebaut AG

- Blommer Chocolate Company

- Cargill, Incorporated

- Cemoi SAS

- Cocoa Processing Company Limited

- COFCO International Limited

- CÉMOI Group

- ECOM Agroindustrial Corp Ltd

- Fuji Oil Holdings Inc.

- Guan Chong Berhad

- Guan Chong Berhad

- Indcresa S.A.

- Jindal Cocoa Private Limited

- Lindt & Sprüngli AG

- Meiji Holdings Company, Limited

- NATRA S.A.

- Olam International Limited

- Plot Enterprise Ltd

- Puratos Group

- Touton S.A.

- Tradin Organic Agricultural B.V.

- United Cocoa Processor, Inc.

Formulating Actionable Recommendations That Empower Industry Leaders to Navigate Market Complexities and Capitalize on Emerging Opportunities in Cocoa Beans

To navigate the complexities of today’s cocoa bean market, industry leaders should prioritize investments that bolster supply chain resilience. Fostering direct partnerships with producer cooperatives and leveraging digital platforms for traceability will secure quality consistency and strengthen sustainability positioning. In addition, diversifying origin sources beyond traditional regions can mitigate the risks associated with climate volatility and tariff fluctuations.

Furthermore, developing flexible processing infrastructures that accommodate a spectrum of bean types, forms, and processing methods will unlock new product opportunities and streamline cost management. Embedding agility into manufacturing operations enables rapid response to shifts in consumer demand, regulatory requirements, and competitive moves. Concurrently, crafting premium and health-oriented product lines-particularly those leveraging full-fat and defatted powders-will tap into burgeoning segments such as plant-based beverages and functional confectionery.

Finally, establishing collaborative platforms with stakeholders across the value chain, including NGOs, financial partners, and research institutions, will drive regenerative agriculture practices and foster shared value creation. By aligning innovation pipelines with sustainability imperatives and consumer trends, companies can secure long-term growth, brand loyalty, and a competitive foothold in the evolving cocoa bean ecosystem.

Detailing the Rigorous Research Framework and Methodological Approach Underpinning the Cocoa Bean Market Analysis for Robust and Transparent Insights

The analysis underpinning this report combines a rigorous blend of primary and secondary research methodologies. Primary insights were gathered through interviews with key industry stakeholders, including producers, processors, brand executives, and supply chain experts. These discussions provided real-time perspectives on operational challenges, investment priorities, and strategic planning across different market segments and geographies.

Secondary research encompassed an exhaustive review of public filings, trade data, industry publications, and regulatory frameworks. Complementing this desk research, a proprietary database was employed to track production volumes, trade flows, and pricing trends over multiple crop cycles. Data triangulation techniques ensured the validity and reliability of findings by cross-referencing disparate sources and reconciling quantitative metrics with qualitative insights.

Advanced analytical tools, including scenario modeling and sensitivity analysis, were applied to assess the impact of key variables such as tariff adjustments, climatic shifts, and evolving consumer preferences. The resulting framework delivers robust and transparent insights, enabling stakeholders to make informed decisions with confidence. This methodological approach has been designed to uphold the highest standards of accuracy, relevance, and actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cocoa-beans market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cocoa-beans Market, by Type

- Cocoa-beans Market, by Form

- Cocoa-beans Market, by End Use

- Cocoa-beans Market, by Processing

- Cocoa-beans Market, by Region

- Cocoa-beans Market, by Group

- Cocoa-beans Market, by Country

- United States Cocoa-beans Market

- China Cocoa-beans Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Synthesizing Core Insights and Strategic Imperatives to Chart the Future Trajectory of the Global Cocoa Bean Market Amid Evolving Industry Dynamics

This executive summary has distilled the core dynamics, strategic shifts, and market imperatives defining the global cocoa bean landscape. From evolving consumer demands and traceability innovations to the ramifications of newly imposed tariffs, stakeholders must embrace a holistic approach that integrates sustainability, agility, and value creation. Segmentation insights have underscored the importance of tailoring offerings by bean type, product form, processing style, and end-use application, while regional analyses have highlighted distinct growth corridors and regulatory considerations across the Americas, EMEA, and Asia-Pacific.

Corporate case studies have illuminated how leading players are leveraging technology, strategic acquisitions, and regenerative agriculture to differentiate their value propositions. Drawing from these examples, actionable recommendations emphasize the need for supply chain diversification, flexible processing investments, and collaborative partnerships to drive resilience and profitability. Finally, a rigorous research methodology undergirds these insights, ensuring that the findings rest on robust data and verifiable sources.

As the cocoa bean market continues to evolve in response to sustainability imperatives, technological advancements, and shifting trade landscapes, the strategic choices made today will chart the course for future growth. Organizations that adopt a proactive, data-driven stance and align their strategies with emerging trends will be best positioned to thrive in this dynamic environment.

Engage With Associate Director Sales & Marketing to Secure Your Comprehensive Cocoa Bean Market Research Report and Gain Strategic Competitive Advantage

We invite you to connect with Ketan Rohom, our Associate Director of Sales & Marketing, to discuss how this comprehensive cocoa bean market analysis can support your strategic objectives. By securing a copy of this in-depth research report, you will gain privileged access to actionable insights, competitive benchmarking, and a nuanced understanding of evolving market drivers. Reach out to Ketan directly to explore customized solutions, plan a walkthrough of the report’s key findings, and tailor the analysis to your organization’s unique needs. Elevate your decision-making with data-driven recommendations that empower you to navigate market complexities and capitalize on emerging opportunities in the cocoa bean landscape.

- How big is the Cocoa-beans Market?

- What is the Cocoa-beans Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?