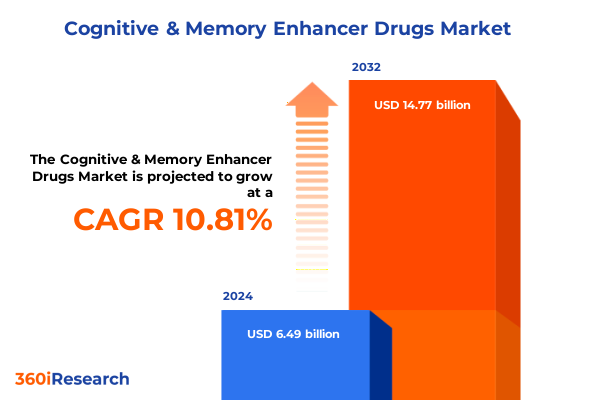

The Cognitive & Memory Enhancer Drugs Market size was estimated at USD 7.13 billion in 2025 and expected to reach USD 7.84 billion in 2026, at a CAGR of 10.95% to reach USD 14.77 billion by 2032.

Unveiling the Dynamics of Cognitive and Memory Enhancement: Exploring Evolving Therapeutic Paradigms and Market Forces Driving Innovation

The landscape of cognitive and memory enhancement has witnessed profound evolution driven by breakthrough research in neuropharmacology and an expanding demographic of individuals seeking improved mental performance. Over the past decade, rising awareness of neurodegenerative disorders such as Alzheimer’s and increased diagnosis rates of attention deficit hyperactivity disorder have catalyzed significant interest in therapeutic agents that support cognitive resilience. Simultaneously, off-label use of nootropic compounds by healthy professionals and students has underscored a broader cultural shift toward preventive mental fitness.

Amidst these converging trends, the industry has responded with a diversified pipeline of pharmacological interventions. Mechanisms ranging from cholinesterase inhibition to modulation of glutamatergic pathways now occupy center stage in clinical development. Emerging modalities also harness psychostimulant action or racetam-derived scaffolds to target synaptic plasticity and neuroprotection. As a result, stakeholders across pharmaceutical companies, research institutions, and health-tech startups are forging new collaborations to accelerate translational research.

By contextualizing the market through the lens of scientific innovation, regulatory evolutions, and changing patient expectations, this introduction sets the stage for a detailed exploration of transformative shifts, tariff landscapes, segmentation insights, regional dynamics, and actionable strategies shaping the future of cognitive enhancement.

Navigating Disruptive Advances in Cognitive Therapies: How Technological Breakthroughs and Regulatory Revisions Are Redefining Treatment Landscapes

Recent years have brought a wave of transformative shifts that are redefining the cognitive and memory enhancement domain at its core. On the technological front, novel drug delivery platforms such as long-acting injectables and targeted nanocarriers have emerged, enhancing bioavailability and reducing dosing burdens. Allied to this, the integration of digital therapeutics-mobile applications that complement pharmacotherapy with cognitive training-has paved the way for holistic treatment regimens that address both neurochemical and behavioral dimensions.

Concurrently, regulatory frameworks have adapted to accommodate accelerated approval pathways for therapies addressing unmet cognitive needs, enabling orphan drug designations for rare neurocognitive conditions. This regulatory agility has incentivized smaller biotechs to pursue niche candidates, spurring an uptick in merger and acquisition activity as larger entities seek to augment their pipelines.

In the realm of clinical practice, there has been a discernible pivot toward precision medicine, underpinned by biomarker-guided patient stratification. Genetic profiling and neuroimaging now inform personalized dosing and agent selection, improving therapeutic outcomes. Taken together, these advancements constitute a seismic shift in how cognitive health is understood, measured, and managed, setting a transformative trajectory for the market.

Assessing the Ripple Effects of US Tariff Measures in 2025 on Cognitive Enhancer Supply Chains, Manufacturing Costs, and Strategic Sourcing Decisions

The imposition of heightened US tariffs in 2025 on imported active pharmaceutical ingredients and finished nootropic formulations has exerted substantial pressure on global supply chains. Manufacturers reliant on overseas synthesis of key compounds, particularly from Asian markets, have encountered elevated input costs that have translated into margin compression or downstream pricing adjustments. In response, procurement teams are reengineering supplier portfolios, diversifying away from tariff-impacted geographies toward strategic partners in Latin America and select European Union states under preferential trade agreements.

Moreover, domestic production incentives introduced by the federal government have accelerated capacity expansion within US-based contract manufacturing organizations. While this reshoring trend offers long-term resilience against trade volatility, it has also triggered short-term capital intensiveness as facilities adapt to stringent Good Manufacturing Practice requirements for neurotherapeutics. The dual forces of tariff-driven cost escalation and incentivized local production are reshaping procurement strategies, compelling industry leaders to balance near-term profitability with sustainable supply security.

Ultimately, the 2025 tariff landscape has underscored the critical importance of agile sourcing frameworks and cross-border collaboration, setting a new strategic imperative for stakeholders navigating the cognitive enhancement market.

Delineating Key Segmentation Patterns in Cognitive Enhancers Based on Mechanism, Formulations, Clinical Applications, Distribution, and End-User Profiles

Insight into segmentation reveals distinct value pools driven by both pharmacological characteristics and end-user preferences. When examining mechanism of action, the market comprises cholinesterase inhibitors such as donepezil, galantamine, and rivastigmine alongside NMDA antagonists, psychostimulant classes including amphetamines and methylphenidate, and racetam derivatives like aniracetam and piracetam. Each subclass targets discrete neurochemical pathways, enabling differentiated therapeutic positioning.

Formulation preferences further segment market performance across dosage forms. Capsules, tablets, injectables, and oral powders each present unique advantages in terms of patient adherence, stability, and dosing precision. This drives a nuanced interplay between formulation innovation and prescribing patterns, particularly in chronic neurodegenerative conditions where long-term compliance is paramount.

Clinical application underscores another layer of segmentation, spanning Alzheimer’s disease management through attention deficit hyperactivity disorder treatment to off-label general cognitive enhancement and Parkinson’s disease adjunct therapy. Distribution dynamics then reflect the channels through which these therapies reach patients, with hospital pharmacies, retail pharmacies, and emerging online platforms each playing pivotal roles in accessibility.

Finally, clinics and hospitals as end users illustrate how institutional procurement frameworks and treatment protocols influence adoption, underscoring the strategic importance of stakeholder education and formulary inclusion.

This comprehensive research report categorizes the Cognitive & Memory Enhancer Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mechanism Of Action

- Dosage Form

- Application

- Distribution Channel

- End User

Examining Regional Market Dynamics Across the Americas, Europe Middle East Africa, and Asia Pacific to Understand Demand Drivers and Adoption Trends

Regional dynamics in the cognitive enhancement sector are characterized by varied regulatory landscapes, healthcare infrastructures, and cultural attitudes toward nootropic use. In the Americas, robust reimbursement frameworks and high prevalence of Alzheimer’s and ADHD drive institutional adoption, while an established generics manufacturing base supports cost-effective scale production. Conversely, middle-income markets in Latin America exhibit a growing appetite for novel therapies, tempered by budgetary constraints and complex import regulations.

In Europe, Middle East, and Africa, fragmented regulatory requirements present both challenges and opportunities. Western Europe’s centralized approval mechanisms facilitate faster market entry for pioneering compounds, yet elevated pricing scrutiny demands clear value propositions. Meanwhile, certain Middle Eastern nations are fostering biotechnology hubs through incentive programs, creating regional centers for clinical trials and manufacturing. African markets, though nascent in cognitive enhancer uptake, display potential growth as healthcare access expands and neurodegenerative disease awareness increases.

Asia-Pacific showcases dynamic growth trajectories driven by large aging populations, particularly in East Asia, and an expanding middle class in Southeast Asia seeking preventive cognitive solutions. Regulatory harmonization efforts among regional blocs are streamlining approval pathways, while strategic partnerships with global pharmaceutical players are bolstering local R&D capabilities. These regional nuances underscore the need for tailored market entry strategies and differentiated engagement models.

This comprehensive research report examines key regions that drive the evolution of the Cognitive & Memory Enhancer Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Pharmaceutical Innovators and Generic Manufacturers Shaping the Cognitive Enhancement Space Through R&D Collaborations and Strategic Alliances

A cohort of pioneering pharmaceutical companies and agile generic manufacturers are shaping the cognitive and memory enhancement landscape through targeted research and collaborative ventures. Leading originators such as Eisai, Janssen, and Novartis continue to leverage deep neuroscience expertise to optimize cholinesterase inhibitors and NMDA antagonists, while deploying expansive clinical networks to generate robust real-world evidence.

In parallel, specialty biotech firms are advancing psychostimulant and racetam chemistries through strategic alliances with academic institutions, aiming to validate novel mechanisms of synaptic modulation. Generic manufacturers, including Teva and Sun Pharmaceutical, are capitalizing on patent expirations to widen access through bioequivalent formulations, often collaborating with contract research organizations to expedite regulatory submissions.

Cross-industry partnerships are particularly notable, with technology companies integrating digital monitoring tools into therapeutic regimens and logistics providers enhancing cold-chain solutions for temperature-sensitive neuropharmaceuticals. This ecosystem of innovators and enablers underscores a concerted drive toward holistic solutions that extend beyond conventional drug delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cognitive & Memory Enhancer Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc

- Allergan Plc

- AstraZeneca plc

- Bayer AG

- Biogen Inc

- Eisai Co., Ltd

- Eli Lilly and Company

- GlaxoSmithKline plc

- Johnson & Johnson

- Lundbeck A/S

- Merck & Co., Inc.

- Novartis AG

- Pfizer Inc

- Roche Holding AG

- Sanofi S.A.

- Takeda Pharmaceutical Company Limited

- Teva Pharmaceutical Industries Limited

Strategic Imperatives for Industry Stakeholders to Capitalize on Emerging Growth Vectors in Cognitive Enhancement Through Innovation and Operational Agility

Industry leaders seeking to secure competitive advantage must adopt a multi-pronged strategy that harmonizes innovation with operational dexterity. Prioritizing pipeline diversification across novel mechanisms of action, while concurrently optimizing existing asset portfolios for life-cycle management, will ensure robust therapeutic breadth. In parallel, investing in platform technologies such as sustained-release formulations and companion digital tools can deepen patient engagement and support differentiated value propositions.

Supply chain resilience must be addressed through proactive risk mapping of tariff-exposed suppliers and strategic development of alternative manufacturing sites. Collaborative models, such as joint ventures with emerging region contract manufacturers, can mitigate geopolitical uncertainties while preserving cost competitiveness. Furthermore, forging alliances with payers to establish outcomes-based reimbursement frameworks can accelerate market access, particularly for high-value cognitive therapies with demonstrable real-world benefits.

Lastly, fostering cross-functional teams that integrate medical affairs, market access, and digital health expertise will be critical in translating scientific breakthroughs into sustainable commercial success. By embracing these imperatives, industry stakeholders can position themselves to navigate evolving market dynamics and capitalize on growth opportunities.

Outlining Rigorous Quantitative and Qualitative Research Approaches Employed to Capture Market Insights and Validate Trends in Cognitive Enhancement Therapeutics

This analysis is grounded in a rigorous research framework combining primary and secondary intelligence to yield comprehensive market insights. Secondary research encompassed a review of peer-reviewed journals, regulatory filings, patent databases, and company disclosures to map the therapeutic landscape, formulation trends, and competitive activity. Data triangulation was employed to cross-validate findings with publicly available financial reports and clinical trial registries.

Primary research involved structured interviews with key opinion leaders in neurology and psychiatry, procurement executives from leading hospitals and clinics, and senior R&D personnel within pharmaceutical and biotech companies. These interviews provided nuanced perspectives on unmet clinical needs, pricing dynamics, and formulation preferences. Additionally, surveys of regional distributors and pharmacy chains offered quantitative insights into channel performance and adoption rates.

Analytical methodologies included SWOT analyses for major segments, Porter’s Five Forces evaluations to assess competitive intensity, and scenario modeling to understand the impact of external factors such as tariffs and regulatory shifts. Qualitative inputs were synthesized through thematic coding, ensuring that strategic recommendations are firmly rooted in empirical evidence and stakeholder sentiment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cognitive & Memory Enhancer Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cognitive & Memory Enhancer Drugs Market, by Mechanism Of Action

- Cognitive & Memory Enhancer Drugs Market, by Dosage Form

- Cognitive & Memory Enhancer Drugs Market, by Application

- Cognitive & Memory Enhancer Drugs Market, by Distribution Channel

- Cognitive & Memory Enhancer Drugs Market, by End User

- Cognitive & Memory Enhancer Drugs Market, by Region

- Cognitive & Memory Enhancer Drugs Market, by Group

- Cognitive & Memory Enhancer Drugs Market, by Country

- United States Cognitive & Memory Enhancer Drugs Market

- China Cognitive & Memory Enhancer Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Core Insights and Strategic Considerations Highlighted Throughout the Report to Guide Decision Makers in Cognitive Enhancement Investments

The aggregated insights presented underscore the multifaceted nature of the cognitive and memory enhancement market, influenced by scientific innovation, geopolitical dynamics, and evolving patient expectations. Breakthroughs in drug delivery and biomarker-guided precision medicine are setting new therapeutic benchmarks, while digital integration is redefining holistic care paradigms. Concurrently, heightened US tariffs in 2025 have underscored the criticality of agile supply chain strategies and regional diversification.

Segmentation analysis reveals that differentiated mechanisms of action, alongside emerging dosage forms and application areas, offer clear pathways for targeted portfolio optimization. Regional nuances across the Americas, Europe Middle East Africa, and Asia Pacific highlight the necessity of localized strategies that align with reimbursement landscapes and regulatory intricacies. Moreover, the competitive environment, characterized by a mix of originators, biotechs, and generics, demands that organizations forge collaborative alliances and leverage real-world evidence to maintain differentiation.

Moving forward, industry stakeholders must synthesize these strategic considerations to craft responsive business models that balance innovation investments with operational resilience. By doing so, they can unlock sustainable growth and deliver meaningful cognitive health solutions to diverse patient populations.

Connect with Ketan Rohom to Secure Detailed Market Intelligence and Customized Strategic Support for Maximizing Opportunities in Cognitive Enhancers

To explore how this comprehensive analysis can inform your strategic roadmap, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engaging with Ketan will grant you access to the full market research dossier, replete with in-depth data, company profiles, and scenario analyses tailored to your organization’s objectives.

By initiating a conversation, you will receive expert guidance on how to leverage the insights within for competitive positioning, partnership opportunities, and innovative product development. Whether you seek deeper dives into specific segments, a customized workshop on regional dynamics, or direct support integrating findings into your business plans, Ketan stands ready to facilitate your success in the cognitive and memory enhancement market.

Connect today to secure your copy of the report and unlock strategies designed to elevate your decision-making, accelerate time-to-market, and maximize ROI in this fast-evolving therapeutic domain.

- How big is the Cognitive & Memory Enhancer Drugs Market?

- What is the Cognitive & Memory Enhancer Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?