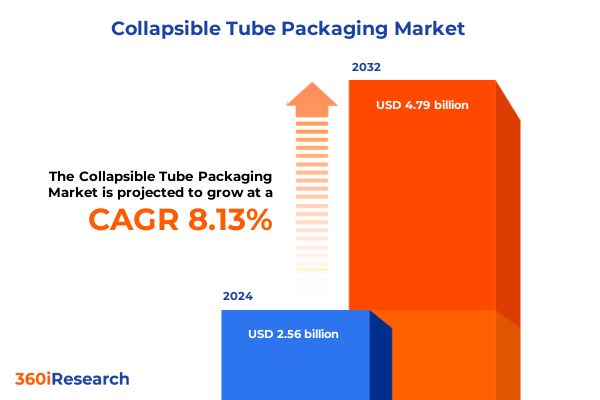

The Collapsible Tube Packaging Market size was estimated at USD 2.76 billion in 2025 and expected to reach USD 2.98 billion in 2026, at a CAGR of 8.16% to reach USD 4.79 billion by 2032.

Discover The Critical Role And Unmatched Advantages Of Collapsible Tube Packaging In Modern Cosmetics Food Oral Care And Pharmaceutical Markets

Collapsible tube packaging has evolved into a cornerstone of modern consumer goods delivery, combining functionality with aesthetic versatility in a diverse range of industries. Originally designed for ointments and artist paints, today’s squeeze tubes protect sensitive formulations while offering precise dosing and enhanced shelf presence. Their inherent flexibility and lightweight construction significantly reduce transportation costs and environmental impact compared to rigid containers. These tubes adopt a multilayer structure or mono-material design to deliver superior barrier properties against moisture, oxygen, and light, ensuring product integrity from manufacturing to end use.

In the cosmetics and personal care sector, collapsible tubes cater to high-value skin and hair treatments, leveraging advanced printing techniques for premium finishes. Meanwhile, food and beverage brands utilize foil-lined options to preserve flavors in condiments and sauces, and pharmaceuticals rely on hygienic barrier systems for gels and topical creams. Oral care products benefit from tubes that resist cracking and maintain tube shape over repeated uses. As consumer expectations for convenience and sustainability intensify, collapsible tubes offer an adaptable platform for refillable systems and post-consumer recycling initiatives.

Investigate The Transformational Innovations Driving Collapsible Tube Packaging With Sustainability Strategies Digital Printing And Smart Manufacturing Technologies

The landscape of collapsible tube packaging is being reshaped by a wave of sustainability-driven material innovations and digital manufacturing advancements. Mono-material tubes crafted from high-density polyethylene and polypropylene are gaining traction, simplifying recycling streams while maintaining structural robustness. Concurrently, the integration of post-consumer recycled content within both plastic and aluminum tubes aligns with circular economy objectives, reducing reliance on virgin resources and meeting stringent regulatory targets for recyclability and recycled content in packaging.

Technological breakthroughs in digital printing have ushered in an era of personalized tube design, where small-volume, bespoke batches can be produced with vibrant graphics and variable data printing. This flexibility empowers brands to launch limited-edition lines and region-specific promotions without incurring the high tooling costs associated with traditional labeling methods. Beyond aesthetics, smart tube solutions embedding QR codes and NFC tags facilitate interactive consumer engagement, track-and-trace capabilities, and transparent supply chain visibility. These transformative shifts collectively enhance brand differentiation, operational agility, and end-user experiences across the tube packaging market.

Analyze The Cumulative Impact Of New US Tariff Measures On Collapsible Tube Packaging Supply Chains And Cost Structures In 2025

The cumulative impact of United States tariff measures in 2025 has exerted considerable pressure on the cost structures and supply chains of collapsible tube packaging. In March 2025, the U.S. government reinstated a comprehensive 25% tariff on aluminum imports under Section 232, expanding the levy to previously exempt countries and derivative products. This action heightened price premiums in the U.S. physical market by nearly 60% since the start of the year, reflecting the sector’s heavy reliance on imported aluminum for tube components.

Simultaneously, President Trump’s administration doubled existing steel and aluminum duties to 50%, triggering concerns among packaging suppliers and consumer goods brands about rising production costs and potential pass-through to retail prices. Experts warn that these elevated tariffs may divert metal flows away from the U.S. toward markets with lower duty-paid premiums, exacerbating domestic supply chain volatility.

Complementing these measures, the administration eliminated all previous country-specific exemptions and introduced stringent “melted and poured” requirements for aluminum content, alongside a 10% baseline tariff on all imported goods under a reciprocal tariff framework. The inclusion of tube derivatives under the expanded scope of these tariffs has further challenged global sourcing strategies, leading manufacturers to explore nearshoring options and strengthened long-term contracts with domestic suppliers to mitigate duty exposure.

Deep Dive Into Segmentation Insights Revealing Key Applications Materials Distribution Capacities And Closure Preferences In Tube Packaging

Understanding the market through detailed segmentation unveils critical pointers for product development and go-to-market strategies. Across application segments, the cosmetics and personal care domain stands out for its demand for high-barrier tubes featuring precise dispensing mechanisms, while food and beverage brands seek foil-lined structures optimized for flavor preservation. Oral care and pharmaceutical segments prioritize hygienic seal integrity and dosing accuracy, driving innovations in multi-layer laminate constructions with specialized barrier layers.

Material segmentation highlights the cost efficiencies of plastic tubes, particularly those produced from HDPE and LDPE, contrasted with the premium positioning of anodized aluminum variants prized for their rigidity and upscale appearance. Laminated formats such as PetAluPe bridge the gap by delivering balanced barrier performance and printability. Distribution channel insights reveal a surge in online retail penetration, especially through brand-owned websites and third-party e-commerce platforms, fostering demand for visually compelling and protective packaging suited for direct-to-consumer fulfillment.

Analysis by capacity indicates consumer preference for mid-size tubes between 50 mL and 100 mL in personal care offerings, while larger formats above 100 mL capture pharmaceutical and bulk food applications. Closure type evaluations show that flip top mechanisms dominate in everyday hygiene products, whereas dispensing pumps-both airless and regular-are favored in premium skincare and pharmaceutical applications that demand precise metering and contamination control.

This comprehensive research report categorizes the Collapsible Tube Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Capacity

- Closure Type

- Application

- Distribution Channel

Unveil The Regional Dynamics Shaping Collapsible Tube Packaging Growth In The Americas Europe Middle East Africa And Asia Pacific

Regional market dynamics shape both demand and regulatory compliance requirements for collapsible tube packaging. In the Americas, stringent extended producer responsibility laws in jurisdictions such as California mandate that by 2032, 100% of single-use packaging be recyclable or compostable under SB 54, driving brands to adopt mono-material designs and invest in post-consumer recycled content for tubes. These legislative pressures coincide with consumer expectations for eco-friendly solutions, prompting manufacturers to prioritize lightweighting and refillable tube systems.

Within Europe, Middle East & Africa, the Packaging and Packaging Waste Regulation (PPWR) entered into force on February 11, 2025, setting harmonized requirements that all packaging be recyclable by 2030 and minimizing unnecessary material use to foster circular economy objectives. Harmonisation of standards and restrictions on single-use plastics under the new PPWR are accelerating the transition toward reusable tube formats and clear labeling to facilitate consumer recycling behavior.

Asia-Pacific markets are characterized by rapid expansion in emerging economies, where rising disposable incomes fuel increased consumption of premium personal care and pharmaceutical products. E-commerce channels in countries such as China and India continue their meteoric growth, driving demand for durable and protective tube packaging solutions optimized for long-distance shipping. Sustainability mandates in Australia and Japan are further encouraging the adoption of recycled materials and upgradable closure systems to enhance tube lifecycle performance.

This comprehensive research report examines key regions that drive the evolution of the Collapsible Tube Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Explore Key Industry Players Strategic Moves And Competitive Positioning Driving Innovation In The Collapsible Tube Packaging Market

Key industry players are deploying differentiated strategies to capture market share and drive innovation in collapsible tube packaging. Global packaging conglomerates are investing heavily in sustainable material research, partnering with recycling technology firms to scale the adoption of PCR plastics and mono-aluminum tubes. Concurrently, mid-sized packaging specialists are carving out niches through digital printing capabilities that enable rapid turnaround for limited-edition cosmetic and specialty food launches.

Several firms are expanding geographic footprints to mitigate tariff and supply risks, establishing manufacturing hubs closer to high-growth consumer markets in Asia-Pacific and Latin America. Collaborative ventures between tube suppliers and leading brands are facilitating co-development of custom barrier solutions and airless dispensing technologies that enhance product shelf life and user safety. Mergers and acquisitions activity continues, with companies seeking to augment their material portfolios and digital printing capacities to address evolving brand requirements.

Innovation partnerships with technology providers are also gaining prominence, integrating IoT-enabled tube packaging for interactive consumer engagement and streamlined supply chain tracking. By aligning sustainability commitments with advanced manufacturing capabilities, these players are positioning themselves as strategic partners for brands navigating complex regulatory landscapes and demanding end-consumer preferences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Collapsible Tube Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albéa Group

- Alltub Group

- Amcor Plc

- Berry Global Group, Inc.

- CCL Industries Inc.

- Constantia Flexibles Group GmbH

- DS Smith Plc

- EPL Limited

- Hoffmann Neopac AG

- Huhtamäki Oyj

- Impact International Pty Ltd

- Linhardt GmbH & Co. KG

- Montebello Packaging Inc.

- Sonoco Products Company

- VisiPak, Inc.

Actionable Roadmap For Industry Leaders To Enhance Sustainability Diversify Supply Chains And Leverage Digital Technologies In Tube Packaging

Industry leaders should prioritize the development of mono-material tubes incorporating high percentages of post-consumer recycled content to meet stringent regulatory deadlines and consumer sustainability expectations. Investing in advanced digital printing platforms will not only enhance brand differentiation through customizable designs, but also enable flexible, small-batch production that reduces waste and time-to-market.

To mitigate tariff and geopolitical risks, companies must diversify supply chains by forging partnerships with domestic suppliers and nearshore converters, while exploring alternative barrier materials that reduce reliance on imported aluminum. Embracing smart packaging solutions with embedded NFC and QR codes can unlock new avenues for consumer engagement and supply chain transparency, fostering brand loyalty and operational efficiencies.

Actionable initiatives include collaboration with recycling infrastructure entities to close the loop on tube packaging, and co-development projects with brand partners to optimize tube geometry and closure functionality for targeted applications. By adopting a holistic approach that integrates sustainability, digital innovation, and robust sourcing strategies, industry leaders can secure competitive advantage and future-proof their product offerings in a rapidly evolving market.

Comprehensive Overview Of Research Methodology Combining Primary Expert Interviews Secondary Data Analysis And Rigorous Validation Processes

This research methodology combined qualitative and quantitative approaches to deliver a comprehensive understanding of the collapsible tube packaging sector. Primary data were collected through expert interviews with senior executives across leading packaging suppliers, brand managers in cosmetics, food and pharmaceutical companies, and regulatory authority representatives. These insights were supplemented with a rigorous review of company annual reports, patent filings, and sustainability disclosures to triangulate emerging trends and strategic priorities.

Secondary research involved analysis of industry publications, trade association reports, and government databases to map regulatory frameworks and tariff developments affecting tube materials. Detailed segmentation analyses were conducted to assess application, material, distribution channel, capacity, and closure type dynamics, validated through proprietary surveys and panel discussions. All data points underwent stringent validation against multiple sources to ensure accuracy and reliability.

Analytical techniques included value chain mapping, SWOT assessments for key players, and scenario planning to evaluate the implications of evolving tariffs and regulatory shifts. The synthesis of these methods enabled a multi-faceted perspective, equipping stakeholders with actionable insights to navigate the complexities of the collapsible tube packaging landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Collapsible Tube Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Collapsible Tube Packaging Market, by Material

- Collapsible Tube Packaging Market, by Capacity

- Collapsible Tube Packaging Market, by Closure Type

- Collapsible Tube Packaging Market, by Application

- Collapsible Tube Packaging Market, by Distribution Channel

- Collapsible Tube Packaging Market, by Region

- Collapsible Tube Packaging Market, by Group

- Collapsible Tube Packaging Market, by Country

- United States Collapsible Tube Packaging Market

- China Collapsible Tube Packaging Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3657 ]

Conclusive Insights Emphasizing Strategic Priorities Emerging Trends And Future Opportunities In The Evolving Collapsible Tube Packaging Landscape

The collapsible tube packaging market stands at a pivotal juncture where sustainability imperatives, digitalization trends, and shifting regulatory pressures converge to redefine industry norms. Stakeholders must align product development with mono-material and recycled-content strategies to satisfy circular economy mandates while leveraging digital printing and smart packaging to enhance brand engagement and operational responsiveness.

The impact of elevated U.S. tariffs underscores the urgency of supply chain diversification and domestic manufacturing partnerships, whereas regional directives in Europe and California highlight the critical need for regulatory compliance and eco-design. By integrating the segmentation insights on application, material, distribution, capacity, and closure preferences, companies can tailor offerings to specific end-market demands and consumer behaviors.

Looking ahead, those who invest strategically in innovative materials, agile manufacturing platforms, and collaborative recycling ecosystems will be best positioned to capitalize on growth opportunities and deliver meaningful value to both brands and end users in the evolving collapsible tube packaging landscape.

Engage Directly With Associate Director Ketan Rohom To Secure Your Comprehensive Collapsible Tube Packaging Market Report And Drive Strategic Growth

I appreciate your interest in unlocking comprehensive intelligence on collapsible tube packaging. To explore the full depth of strategic insights, emerging opportunities, and detailed segment analyses, please reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the complete market research report. Engaging directly with Ketan will ensure you receive tailored guidance on how to leverage this research for competitive advantage and sustainable growth in your organization.

- How big is the Collapsible Tube Packaging Market?

- What is the Collapsible Tube Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?