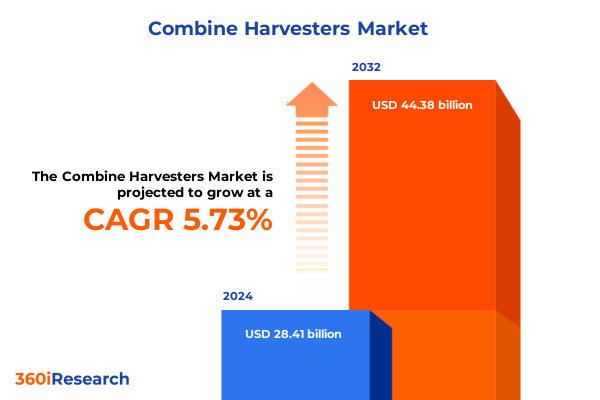

The Combine Harvesters Market size was estimated at USD 29.81 billion in 2025 and expected to reach USD 31.27 billion in 2026, at a CAGR of 5.84% to reach USD 44.38 billion by 2032.

Foundational Perspectives on Evolution and Strategic Importance of Combine Harvesters Shaping Global Agricultural Mechanization Trends

The modern agricultural paradigm is undergoing a fundamental transformation, driven by the relentless pursuit of efficiency, sustainability, and precision. Combine harvesters, which have long served as indispensable assets on farms worldwide, now occupy a central role in enabling producers to meet the intensifying demands of food security and operational optimization. Against the backdrop of global population growth and shifting dietary preferences, these advanced machines are evolving beyond mere harvesters to become fully integrated nodes within digital and connected farm ecosystems. This executive overview lays the groundwork for a detailed exploration of how combine harvesters are adapting to changing agronomic, economic, and regulatory landscapes.

As agricultural operations expand in scale and complexity, the expectations placed on combine harvester performance, reliability, and adaptability have risen sharply. From the integration of real-time yield monitoring and data analytics to the advancement of low-emission powertrains, manufacturers are racing to deliver solutions that not only harvest more efficiently but also align with sustainability mandates. Transitioning seamlessly into this new era of mechanization demands a clear understanding of the current state of the market, the technological forces at play, and the strategic considerations that will define competitive success. This section establishes that foundation, setting the stage for in-depth analysis of transformative shifts, policy impacts, and actionable strategic imperatives.

Uncovering the Paradigm-Altering Forces Driving Change in the Combine Harvester Industry and Redefining Competitive and Technological Landscapes

The combine harvester industry is at the nexus of several converging forces that are reshaping competitive dynamics and technological trajectories. Foremost among these is the digital revolution, which has redefined the very architecture of modern farm machinery. Through the seamless integration of sensors, telematics, and cloud-based analytics platforms, combine harvesters have transcended their traditional mechanical roles to become sophisticated decision-support tools. This shift has enabled real-time optimization of harvesting parameters, driving yield improvements and reducing resource wastage.

Concurrently, environmental regulations and sustainability commitments are exerting upward pressure on emission reduction and fuel efficiency targets. In response, industry leaders are investing in electrified drivetrains, hybrid power management systems, and alternative fuel compatibility. These advancements are redefining performance benchmarks while simultaneously addressing concerns around carbon footprints and operating costs in remote fields.

Moreover, the rise of contract harvesting services and custom hire models is expanding the accessibility of high-capacity combine harvesters across diverse farming operations. This trend is elevating the importance of modular design and rapid deployment capabilities, as manufacturers strive to deliver adaptable platforms that can seamlessly transition between crops and terrains. Consequently, strategic alliances and partnerships with technology providers, as well as mergers and acquisitions, are becoming increasingly common as players seek to bolster their innovation pipelines and distribution networks.

Assessing the Comprehensive Effects of 2025 U.S. Tariff Measures on Combine Harvester Trade, Supply Chains, and Cost Structures Across Key Stakeholders

In 2025, United States tariff policies have significantly influenced the combine harvester supply chain, altering import dynamics, pricing structures, and cross-border engagements. Tariff escalations on essential components and finished machines have prompted original equipment manufacturers to reassess sourcing strategies and cost frameworks. Many producers have shifted toward regionalized supply networks to mitigate exposure to punitive duties, in some cases inaugurating component manufacturing facilities closer to key end markets.

The indirect effects of these measures have also been substantial. As tariffs raised input costs for steel, electronics, and precision-engineered parts, machine prices have seen upward pressure, influencing investment cycles among farmers and custom operators. To maintain competitiveness, manufacturers have accelerated efforts to localize high-value manufacturing processes and pursue preferential trade agreements. These strategies have not only alleviated some of the immediate cost burdens but also reinforced more resilient supply chains that can withstand further policy fluctuations.

Furthermore, the 2025 tariff landscape has spurred innovation in alternative sourcing and design optimization. By leveraging advanced materials with reduced import exposure and standardizing modular subsystems across global platforms, original equipment manufacturers are enhancing production agility. As a result, industry participants are better positioned to navigate future trade uncertainties, ensuring continuity in equipment availability while maintaining equipment affordability.

Illuminating Critical Product and Market Segmentation Insights That Guide Strategic Investment Decisions in Diverse Combine Harvester Categories

Delving into the nuanced segmentation of the combine harvester market reveals a mosaic of strategic imperatives and growth vectors. When considering machine type, the divide between self-propelled units and tractor-mounted attachments underscores the varying operational needs of large-scale farms versus smaller or specialty producers. Within tractor-mounted configurations, the choice between towed and trailed models further differentiates the balance of capital investment, maneuverability, and maintenance requirements.

In terms of application, the deployment of combine harvesters across corn, rice, soybean, and wheat harvesting illuminates distinct performance criteria and market niches. Corn and rice operations often prioritize high-throughput machines with robust residue management systems, whereas soybean and wheat fields may focus on adaptability to varying swath conditions and grain handling precision. These application-driven preferences influence equipment specifications and aftermarket service models alike.

Engine power segmentation-spanning units under 150 horsepower, those in the 150–200 horsepower bracket, and machines exceeding 200 horsepower-serves as a bellwether for farm scale and intensity. Lower-powered units are typically favored by smaller holdings seeking cost-effective entry points, while higher-powered platforms address the demands of extensive acreage and high-yield environments. Drive type choices between four wheel drive and two wheel drive further reflect terrain challenges and traction requirements, particularly in regions with inconsistent field conditions.

Lastly, the sales channel landscape-comprising aftermarket channels and original equipment manufacturer networks-highlights the dual importance of parts availability and integrated support. Within the aftermarket domain, parts and services offerings must deliver rapid responsiveness to minimize downtime, whereas OEM channels emphasize bundled solutions and warranty-backed maintenance agreements. This layered segmentation informs both strategic product development and distribution frameworks.

This comprehensive research report categorizes the Combine Harvesters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Engine Power

- Drive Type

- Application

- Sales Channel

Exploring Regional Nuances and Growth Trajectories in the Americas, Europe Middle East & Africa, and Asia-Pacific Combine Harvester Markets

While global trends set the overarching agenda, regional dynamics impart critical texture to the combine harvester market. In the Americas, expansive row-crop operations in the United States, Brazil, and Argentina drive demand for high-capacity, technologically advanced machines. Producers in these countries often invest in the latest precision agriculture features to optimize yields across large contiguous fields, and local manufacturers benefit from developed dealer networks and after-sales support systems that reinforce equipment uptime.

Across Europe, the Middle East, and Africa, the market landscape is more heterogeneous. European producers prioritize stringent emission standards and sustainability certifications, prompting manufacturers to tailor powertrains and residue handling systems to meet exacting environmental regulations. Meanwhile, in parts of the Middle East and Africa, smaller-scale farms and challenging terrain necessitate compact designs and robust drivetrains that can function reliably under diverse climatic conditions. This regional diversification fosters innovation in machine adaptability and aftermarket service models.

In Asia-Pacific, a combination of high-density smallholder farms in countries like India and China and rapidly mechanizing markets in Southeast Asia produces dual demand for both cost-effective entry-level harvesters and increasingly sophisticated self-propelled units. Local partnerships between global OEMs and regional assemblers have emerged as a key enabler for market penetration, providing a blend of international technology standards and local customization. These collaborative models ensure machines meet local agronomic needs while adhering to emerging agricultural modernization programs.

This comprehensive research report examines key regions that drive the evolution of the Combine Harvesters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Combine Harvester Manufacturers and Their Strategic Initiatives to Secure Market Leadership Through Innovation and Operational Excellence

The competitive arena for combine harvester manufacturers is marked by a blend of legacy players and emerging innovators, each pursuing differentiated strategies. Leading global firms continue to invest heavily in research and development, focusing on electrification, connectivity, and operator ergonomics. Their sizeable patent portfolios and extensive dealer networks grant them a notable advantage in rolling out next-generation platforms and supporting service infrastructures.

At the same time, specialized equipment companies and regional producers are leveraging agile development cycles to introduce niche solutions tailored to specific crop types or regulatory environments. These players often excel in rapid customization, offering modular attachments or localized engineering modifications that address unique agronomic challenges. Strategic collaborations between these companies and technology startups in the fields of artificial intelligence and advanced materials science have further accelerated prototype-to-production timelines.

Underlying these efforts is a pronounced shift toward digital business models. Manufacturers large and small are expanding beyond hardware sales to deliver subscription-based software services, data analytics packages, and predictive maintenance offerings. By building integrated platforms that link field operations, service schedules, and supply chains, these companies are embedding themselves more deeply in their customers’ value chains, enhancing retention and creating recurring revenue streams.

Investment trends also indicate a growing emphasis on sustainability partnerships, with select manufacturers collaborating with energy providers and waste management firms to develop closed-loop resource cycles. Such initiatives not only meet environmental compliance threshold requirements but also resonate with farm operators seeking to reduce operational externalities and bolster their own sustainability credentials.

This comprehensive research report delivers an in-depth overview of the principal market players in the Combine Harvesters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGCO Corporation

- Balkar Combines

- Caterpillar Inc.

- China National Machinery Industry Corporation

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Deere & Company

- DEUTZ-FAHR by SDF GROUP

- Fieldking

- Gomselmash India Private Limited

- International Tractors Limited

- Iseki & Co., Ltd.

- Jiangsu Changfa Agricultural Equipment Co., Ltd.

- KS AGROTECH PVT.LTD.

- Kubota Corporation

- KZ Rostselmash LLC

- Mahindra & Mahindra Limited

- Malkit AGRO TECH Private Limited

- Manku Agro Tech Pvt. Ltd.

- Pickett Equipment

- Preet Tractors

- Tractors and Farm Equipment Limited

- Weichai Lovol Intelligent Agricultural Technology CO., LTD

- Yanmar Holdings Co., Ltd.

- Zoomlion Heavy Industry Science & Technology Co., Ltd.

Delivering Actionable Strategic Recommendations for Industry Leaders to Navigate Emerging Challenges and Capitalize on Evolving Agricultural Mechanization Opportunities

To navigate the complex interplay of technological advance, regulatory flux, and competitive intensity, industry leaders must adopt a multipronged approach. First, embedding modular architecture in combine harvester design allows for rapid product adaptation in response to shifting crop patterns, emission standards, and service models. By prioritizing platform commonality across powertrains and harvesting assemblies, manufacturers can reduce development cycles and achieve economies of scale.

Additionally, cultivating local partnerships-whether for component sourcing, assembly, or after-sales services-fortifies supply chain resilience and enables tailored market entry strategies. Collaborative ventures with regional OEMs or technology firms supporting precision agriculture are especially vital in high-growth markets where localization dictates competitive success.

Digital transformation remains another cornerstone of strategic imperatives. Executing a clear roadmap for telematics integration, data management, and cloud-based analytics platforms ensures that harvesters deliver continuous performance improvements and become strategic assets rather than simple mobile machines. Investments in operator training and remote diagnostics capabilities further safeguard uptime and foster stronger customer relationships.

Finally, adopting a forward-looking view on sustainability will separate leaders from followers. Pursuing alternative power solutions, resource recycling programs, and lifecycle impact assessments not only aligns with environmental commitments but also unlocks potential cost savings and attracts farm operators seeking greener equipment portfolios. A holistic sustainability strategy, embedded from design through end-of-life, can become a compelling differentiator in a crowded marketplace.

Detailing Rigorous Research Methodology Employed to Ensure Depth, Reliability, and Transparency in Combine Harvester Market Analysis and Insights

This research draws upon a meticulously structured methodology designed to deliver comprehensive and unbiased insights. Primary interviews were conducted with senior executives, product development leads, and farm operators across major production regions to capture firsthand perspectives on market drivers and technology adoption trends. These qualitative inputs were complemented by a rigorous review of industry publications, regulatory filings, and patent databases to ensure the analysis reflects the latest legislative frameworks and innovation pipelines.

Quantitative data was gathered from publicly available trade statistics, equipment registration records, and corporate annual disclosures. The data collection process prioritized cross-validation through multiple independent sources, ensuring the reliability of findings on supply chain dynamics and industry cost structures. Statistical techniques, including regression analysis and scenario modeling, were employed to identify significant correlations and explore potential policy impact trajectories, without asserting specific market sizing or forecasting figures.

The segmentation framework was informed by machine typology, application usage, engine output ranges, drivetrain configurations, and sales channel distributions. Segments were validated through customer feedback loops with both dealer networks and contract harvesting service providers, ensuring that the categories accurately reflect real-world decision drivers. Regional analyses incorporated national agricultural census data and local expert consultations to capture the nuances of each market.

Overall, this multiphase methodology balances quantitative rigor with qualitative depth, delivering a holistic perspective on the combine harvester ecosystem while maintaining strict adherence to objectivity and transparency.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Combine Harvesters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Combine Harvesters Market, by Type

- Combine Harvesters Market, by Engine Power

- Combine Harvesters Market, by Drive Type

- Combine Harvesters Market, by Application

- Combine Harvesters Market, by Sales Channel

- Combine Harvesters Market, by Region

- Combine Harvesters Market, by Group

- Combine Harvesters Market, by Country

- United States Combine Harvesters Market

- China Combine Harvesters Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Concluding Synthesis of Key Insights, Strategic Imperatives, and Future Outlook Shaping the Next Generation of Combine Harvester Market Evolution

Drawing together the insights from technological evolution, policy impacts, segmentation nuances, regional dynamics, and competitive strategies reveals several overarching themes. The digitalization of combine harvesters has transformed these machines into critical data hubs, unlocking operational efficiencies and forging deeper client relationships through service-oriented business models. At the same time, regulatory pressures have catalyzed material and powertrain innovations, accelerating the shift toward sustainable mechanization.

Segment-specific perspectives highlight the importance of tailoring solutions: whether through powertrain scalability for diverse power requirements, modular attachments for multi-crop flexibility, or localized manufacturing to alleviate trade policy challenges. Regional variations underscore the need for market-specific strategies, from leveraging established dealer networks in the Americas to constructing hybrid distribution models in the Asia-Pacific region.

Competitive landscapes are being redefined by strategic partnerships that bridge hardware, software, and service domains. As legacy producers and agile newcomers vie for leadership, the critical success factors will hinge on the ability to integrate cross-disciplinary expertise and rapidly adapt to evolving farm economics.

Ultimately, success in the combine harvester market will depend on a balanced emphasis on technological innovation, supply chain resilience, localized execution, and sustainability. Industry participants that align these elements cohesively will navigate uncertainties more effectively and set the pace for the next wave of agricultural mechanization.

Engaging Next Steps and Direct Access to Expert Support From Ketan Rohom to Secure Comprehensive Combine Harvester Market Intelligence

To explore how this comprehensive report can inform your strategic planning and drive competitive advantage, we invite you to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. Ketan’s deep expertise in agricultural machinery market dynamics and discreet guidance on customizing report insights for your organization ensures you extract maximum value from every data point and analysis provided. By coordinating a call or meeting, you can clarify specific research objectives, discuss tailored insights relevant to your product lines, and secure proprietary access to the data visualizations that support critical decision making.

Partnering with Ketan at this stage accelerates your time to insight and empowers you to anticipate market shifts with confidence. His collaborative approach aligns the report’s strategic recommendations with your operational imperatives, yielding actionable roadmaps that drive growth. To take the next step and purchase the full Combine Harvester Market Intelligence report, please reach out to Ketan Rohom today and begin leveraging market-leading research designed to position you at the forefront of agricultural mechanization innovation.

- How big is the Combine Harvesters Market?

- What is the Combine Harvesters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?