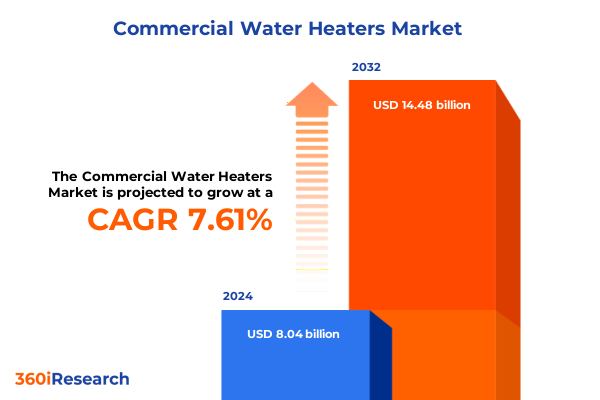

The Commercial Water Heaters Market size was estimated at USD 8.65 billion in 2025 and expected to reach USD 9.31 billion in 2026, at a CAGR of 7.62% to reach USD 14.48 billion by 2032.

Exploring the Present State of Commercial Water Heating Ecosystem Highlighting Core Drivers, Stakeholder Dynamics, and Emerging Technologies

The commercial water heating sector is at a critical juncture, shaped by a complex interplay of energy policy reforms, technological breakthroughs, and evolving end-user demands. Organizations across industries are under increasing pressure to reduce operating costs while meeting rigorous sustainability targets and ensuring uninterrupted hot water supply. As a result, the industry’s traditional paradigm-centered on fossil fuel–driven boilers-has given way to a more diverse ecosystem of electrically powered heat pump systems, hybrid configurations, and renewable energy integrations.

Against this backdrop, decision-makers require a clear understanding of the forces driving market dynamics. Regulatory frameworks at the federal, state, and local levels have introduced increasingly stringent efficiency standards and incentive programs, encouraging the adoption of low-carbon solutions. Simultaneously, manufacturers are investing heavily in digital monitoring, predictive maintenance, and controls integration, positioning water heaters not only as standalone appliances but as critical components of intelligent building management systems. These developments are paving the way for enhanced reliability, lower total cost of ownership, and higher resource utilization rates.

This report dives deeply into the contemporary market landscape, elucidating the strategic implications of these macro drivers for stakeholders at every point in the value chain. By articulating the core trends, emerging technologies, and evolving regulatory mandates, the analysis seeks to equip manufacturers, facility managers, and investors with the actionable intelligence needed to navigate an increasingly competitive and innovation-driven environment.

Unraveling the Transformational Technological, Regulatory, and Sustainability Shifts Reshaping the Commercial Water Heating Industry Trajectory

Over the past few years, the commercial water heating industry has undergone a transformative shift, driven by advances in heat pump technology, the proliferation of Internet of Things (IoT) connectivity, and the growing imperative for environmental stewardship. Early adopters of air-source and water-source heat pump water heaters have demonstrated significant reductions in energy consumption, spurring broader market acceptance and catalyzing economies of scale in manufacturing. Concurrently, emerging hybrid systems that combine condensing gas burners with heat pump modules have offered a compelling value proposition in both retrofit and new-build applications, blending high efficiency with proven reliability.

On the digital front, manufacturers have introduced remote monitoring platforms that provide real-time performance metrics, predictive fault alerts, and remote commissioning capabilities. These innovations have not only reduced maintenance downtime but have also enabled data-driven optimizations in energy use and system sizing. Integration with building automation systems has further blurred the lines between water heating and broader facility management, positioning water heaters as intelligent assets within smart building portfolios.

Regulatory momentum has accelerated these technological transitions. New performance standards across major markets require minimum coefficient of performance (COP) thresholds for heat pump water heaters, while renewable energy credits and rebate programs have created financial incentives for installations tied to on-site solar and geothermal sources. These policy developments have rewritten the competitive playbook, compelling legacy manufacturers to pivot toward high-efficiency solutions and opening the door for new entrants with innovative business models focused on energy-as-a-service and circular economy principles.

Assessing the Aggregate Impact of Recent United States Trade Tariffs Instituted in 2025 on Commercial Water Heater Supply Chains and Pricing Models

In 2025, the United States implemented a series of trade measures aimed at protecting domestic manufacturing and addressing perceived imbalances in global supply chains. While these policies were not targeted exclusively at water heating equipment, they indirectly impacted the sector by raising duties on imported steel and aluminum-core inputs for tank and heat exchanger fabrication. As a result, domestic producers experienced higher input costs that rippled through the supply chain, contributing to elevated equipment pricing for end users and challenging manufacturers to preserve margin integrity.

Manufacturers that rely on imported subcomponents, such as electronic controls and specialized valves from Asia and Europe, also faced increased landed costs as tariff schedules expanded to include additional machinery parts. Some companies responded by petitioning for temporary tariff exclusions or shifting purchases toward duty-free trade zones, but these measures provided only partial relief. In parallel, the threat of tariff escalation introduced an element of uncertainty that complicated long-term capital investment decisions. Project planners and facility owners became increasingly sensitive to potential cost volatility, often opting for modular or phased procurement approaches to mitigate risk.

On the upside, the tariff landscape spurred renewed interest in onshore production facilities and galvanized strategic partnerships between manufacturers and domestic steel mills. Several industry leaders announced capacity expansion plans in the Midwest and Southeast, leveraging government incentives tied to reshoring initiatives. While these developments have contributed to a more resilient supply chain, they have also highlighted the trade-off between localized manufacturing and scale economies. Ultimately, the 2025 tariff environment has reshaped sourcing strategies, accelerated supply chain diversification, and elevated the strategic importance of procurement agility.

Revealing Critical Market Segmentation Perspectives Spanning Energy Sources, Product Types, Capacities, Applications, Installation Practices, Channels, and End-User Industries

Critical market segmentation analysis reveals nuanced adoption patterns across energy sources, product typologies, capacity ranges, application contexts, installation modalities, distribution pathways, and end-user sectors. In the energy source dimension, electric water heaters-particularly heat pump variants-have gained traction in regions with decarbonizing grids, whereas gas-fired condensing models remain predominant in markets with abundant natural gas infrastructure. Conventional gas systems continue to serve cost-sensitive projects, while oil and solar thermal systems occupy specialized niches tied to off-grid or high-insolation applications.

From a product type perspective, heat pump water heaters are dissected into air-source and water-source configurations, each optimized for specific climate and facility characteristics. Combination systems that blend hybrid and modulating controls offer a compromise between rapid recovery times and peak-efficiency operation, appealing to retrofit scenarios with variable hot water demand. Traditional storage systems-both conventional and high-efficiency-continue to underpin large capacity applications, while tankless models subdivided into condensing and non-condensing options serve point-of-use requirements and space-constrained installations.

Capacity segmentation underscores a clear delineation between small (<100 gallon) units tailored for low-volume office and hospitality settings, medium (100–500 gallon) systems designed for multi-tenant buildings and light industrial sites, and large (>500 gallon) installations that support manufacturing processes, institutional needs, and district-level heating loops. Application analysis highlights the bespoke requirements of commercial offices seeking quiet, compact solutions; food and beverage operations demanding rapid recovery and precise temperature control; healthcare facilities prioritizing redundancy and compliance; hospitality venues valuing guest comfort and energy management integration; and industrial users requiring robust materials and specialized certification.

Installation practices split along indoor versus outdoor deployments, each presenting unique considerations for freeze protection, ventilation, and service access. Distribution channel intelligence indicates that dealer networks retain influence in project specification phases, direct sales teams accelerate high-value enterprise deals, distributors provide breadth in stock and logistics, and original equipment manufacturers consolidate aftermarket service offerings. Finally, an end-user industry breakdown shows that food and beverage, healthcare, hospitality, institutional bodies, and manufacturing sectors each elevate distinct performance attributes-from sanitization capabilities to duty cycle endurance-shaping how suppliers position their value propositions.

This comprehensive research report categorizes the Commercial Water Heaters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Energy Source

- Capacity

- Application

- Installation

- Distribution Channel

- End-User Industry

Distilling Regional Market Dynamics Across the Americas, Europe Middle East Africa, and Asia-Pacific Foreshadowing Localized Opportunities and Challenges

Regional market dynamics exhibit a spectrum of regulatory rigor, infrastructure maturity, and customer behavior. In the Americas, the United States leads with incentive programs under the Inflation Reduction Act and state-level efficiency mandates, while Canada’s retrofit market is buoyed by carbon pricing and utility rebate schemes. Latin American markets are in earlier adoption phases, often constrained by budgetary and grid reliability concerns, yet selective urban centers are exploring solar-assisted water heating to reduce fossil fuel consumption.

Across Europe, Middle East, and Africa, the European Union’s EcoDesign Directive has set minimum performance criteria, catalyzing a shift toward condensing and electric heat pump technologies in commercial installations. The Middle East continues to leverage its natural gas resources for combined heat and water heating plants, with an emerging interest in solar thermal systems to address peak cooling and hot water integration. In sub-Saharan Africa, infrastructure limitations and intermittent power supply have restricted widespread uptake of advanced systems, though pilot projects in hospitality and healthcare sectors point toward gradual modernization.

In the Asia-Pacific region, China’s manufacturing prowess dominates global supply, with domestic policies incentivizing energy-efficient appliances and urban district heating schemes. Japan remains at the forefront of high-efficiency heat pump innovation, while Australia’s energy market reforms and renewable energy commitments are driving heat pump adoption in commercial office complexes. Southeast Asia and India present a high-growth frontier, where rising commercial development is matched by evolving regulations and growing awareness of lifecycle cost benefits, setting the stage for accelerated technology transfer and investment.

This comprehensive research report examines key regions that drive the evolution of the Commercial Water Heaters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players’ Strategic Movements, Innovation Portfolios, and Collaborative Ventures Driving Competitive Advantage in Commercial Water Heating

Major industry participants have adopted differentiated strategies to secure competitive advantages through innovation, partnerships, and geographic expansion. Leading manufacturers are investing heavily in next-generation heat pump research, developing proprietary refrigerant management systems and advanced compressor designs to optimize performance in extreme climates. At the same time, established brands with deep service networks are emphasizing digital platforms that integrate equipment monitoring, predictive maintenance alerts, and automated parts replenishment to minimize downtime for critical facilities.

Strategic alliances between component suppliers, software firms, and engineering consultants are on the rise. These collaborations aim to deliver turnkey solutions that encompass system design, installation, and post-commissioning analytics. Companies are also pursuing bolt-on acquisitions to broaden product portfolios-targeting niche players in solar thermal, modulating gas burners, and IoT connectivity-to create more holistic offerings. In parallel, some firms are forging joint ventures with regional distributors to accelerate market entry in high-potential emerging economies.

Consolidation is another prominent trend, with mergers and acquisitions enabling scale economies in production and procurement while also facilitating cross-brand licensing of patented technologies. This wave of consolidation has intensified competition around service contracts and aftermarket support, prompting several global players to launch dedicated training academies for installation partners. Collectively, these corporate strategies underscore a market shifting toward integrated solutions, end-to-end value chains, and digitally enabled services that extend beyond mere equipment sales.

This comprehensive research report delivers an in-depth overview of the principal market players in the Commercial Water Heaters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. O. Smith Corporation

- Ariston Thermo S.p.A.

- Bradford White Corporation

- Navien Inc.

- Noritz Corporation

- Rheem Manufacturing Company

- Rinnai Corporation

- Robert Bosch GmbH

- State Industries, LLC

- Viessmann Werke GmbH & Co. KG

Proposing Targeted Strategic Actions for Industry Leaders to Capitalize on Market Trends, Policy Incentives, and Technological Innovations in Commercial Water Heating

Industry leaders should prioritize investments in heat pump and hybrid technologies, ensuring that product roadmaps align with tightening efficiency standards and leveraging renewable energy credits where available. Integrating advanced sensors and cloud-based analytics into core offerings will enable predictive maintenance services, unlocking a recurring revenue stream and enhancing customer retention through performance guarantees.

Diversifying supply chains beyond single-country dependencies will mitigate the financial impact of potential trade disruptions. Establishing strategic partnerships with domestic steel and component manufacturers can provide greater cost stability while demonstrating commitment to localized production and sustainability goals. Furthermore, firms should engage proactively with policymakers and industry associations to shape emerging regulatory frameworks and secure favorable provisions for next-generation technologies.

To capture growth in emerging markets, commercial water heater providers must tailor their go-to-market strategies to regional infrastructure profiles and financing mechanisms. Offering flexible financing options such as power-purchase agreements or energy-as-a-service models can lower adoption barriers for capital-constrained end users. Finally, investing in workforce development through certified training programs will be critical to support complex installations and ensure high service quality, positioning companies as trusted advisors in a rapidly evolving landscape.

Outlining Rigorous Multi-Source Research Methodologies Integrating Primary Insights, Secondary Data, and Triangulation Techniques Ensuring Robust Market Analysis

This analysis is grounded in a hybrid research methodology blending primary stakeholder engagements with comprehensive secondary data reviews. The primary component comprised in-depth interviews with senior executives at leading equipment manufacturers, facility managers in key end-user verticals, and policy experts shaping regulatory standards. Insights from these interviews were used to validate emerging trends and understand decision-making criteria at the project level.

Secondary research included a systematic examination of government publications, efficiency mandate documentation, patent filings, academic journals, and company disclosures. Industry association reports provided historical context on technology adoption curves, while technical white papers and engineering case studies informed the assessment of performance benchmarks. Data triangulation techniques were applied to reconcile divergent viewpoints and ensure consistent interpretation across source categories.

Analytical rigor was enhanced through the use of scenario analysis to explore the impact of varying policy trajectories, tariff regimes, and energy price fluctuations. Segmentation matrices were developed to map product attributes against application requirements and regional nuances. Finally, all findings underwent peer review by an independent panel of industry veterans to certify methodological robustness and factual accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Commercial Water Heaters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Commercial Water Heaters Market, by Product Type

- Commercial Water Heaters Market, by Energy Source

- Commercial Water Heaters Market, by Capacity

- Commercial Water Heaters Market, by Application

- Commercial Water Heaters Market, by Installation

- Commercial Water Heaters Market, by Distribution Channel

- Commercial Water Heaters Market, by End-User Industry

- Commercial Water Heaters Market, by Region

- Commercial Water Heaters Market, by Group

- Commercial Water Heaters Market, by Country

- United States Commercial Water Heaters Market

- China Commercial Water Heaters Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings to Present a Cohesive Perspective on Market Transformations, Segmentation Relevance, Regional Variances, and Strategic Imperatives

The commercial water heating market is in the midst of a substantive transformation driven by regulatory pressure, technological innovation, and shifting end-user priorities. Segmentation analysis underscores the growing importance of heat pump and hybrid configurations, while capacity, application, and channel insights illuminate the diverse performance requirements across industries. Regional dynamics reveal a patchwork of maturity levels, with established markets focused on efficiency upgrades and high-growth regions laying the groundwork for technology adoption.

Corporate strategies are coalescing around integrated solutions that combine advanced equipment, digital services, and flexible procurement models. These developments signal a departure from traditional goods-only offerings to more holistic value propositions that emphasize lifecycle performance and sustainability outcomes. To thrive in this evolving environment, stakeholders must adopt agile R&D roadmaps, resilient supply chain frameworks, and active policy engagement to navigate tariff uncertainties and efficiency mandates.

The conclusions drawn herein provide a cohesive view of market catalysts and barriers, offering strategic clarity for manufacturers, distributors, and end users. By synthesizing segmentation, regional, and competitive insights, this analysis equips decision-makers with the foresight needed to harness emerging opportunities and mitigate risks. The actionable recommendations serve as a blueprint for bridging current capabilities with future market demands, ensuring sustained leadership in the commercial water heating landscape.

Encouraging Direct Engagement With Ketan Rohom to Secure the Comprehensive Commercial Water Heater Market Research Report Driving Informed Decision Making

Leverage this comprehensive analysis to guide your strategic investments and operational plans by securing the full Commercial Water Heater Market Research Report. Engage directly with Ketan Rohom (Associate Director, Sales & Marketing) to obtain unmatched insights, detailed data breakdowns, and customized consulting options that will empower your organization’s next wave of innovation and market expansion. Reach out today to transform research findings into actionable growth strategies and stay ahead in the rapidly evolving water heating industry.

- How big is the Commercial Water Heaters Market?

- What is the Commercial Water Heaters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?