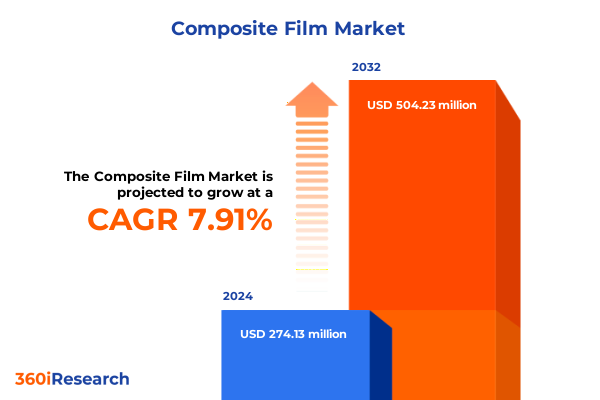

The Composite Film Market size was estimated at USD 295.66 million in 2025 and expected to reach USD 324.54 million in 2026, at a CAGR of 7.92% to reach USD 504.22 million by 2032.

Exploring the Composite Film Industry’s Evolution and Unveiling the Key Drivers Reshaping Material Technologies, Applications, and Strategic Market Dynamics

The composite film industry has undergone remarkable evolution over the past decade, driven by shifting material requirements and intensifying performance demands across end-use sectors. As lightweight alternatives and high-performance barrier solutions become critical for packaging, automotive, electronics, and healthcare applications, composite films are increasingly recognized as transformative enablers of both functional excellence and cost efficiency. Consequently, companies are channeling investments into advanced polymer blends and fabrication technologies to meet stringent safety, sustainability, and regulatory criteria.

Furthermore, consumer preferences and environmental imperatives are reshaping product development roadmaps, placing a premium on recyclability and resource optimization. Against this backdrop, the industry is experiencing a convergence of material science breakthroughs, digital manufacturing innovations, and cross-sector collaborations. This convergence is poised to redefine market dynamics, necessitating a holistic understanding of underlying drivers, emerging challenges, and strategic levers for differentiation.

Understanding the Transformative Shifts Redefining Composite Film Production Processes, Supply Chains, and Sustainability Imperatives

The landscape of composite film production is being redefined by transformative shifts that encompass technological, environmental, and economic dimensions. On the technological front, the proliferation of multi-layer fabrication methods and precision extrusion systems is enabling thinner, more durable films with complex barrier properties. Moreover, the integration of sensor‐embedded films and conductive layers is opening pathways toward smart packaging, flexible electronics, and real-time quality monitoring.

Simultaneously, sustainability mandates and circular economy principles are compelling stakeholders to innovate beyond traditional polymer matrices. Biopolymers and advanced recycling techniques are emerging as pivotal solutions to regulatory pressures and consumer demand for eco-friendly materials. Consequently, supply chains are becoming more collaborative, with upstream raw material suppliers partnering closely with converters and brand owners to optimize resource utilization and reduce carbon footprints.

Analyzing the Cumulative Impact of Recent United States Tariff Measures on Composite Film Imports, Costs, and Competitive Positioning

The introduction of new United States tariff measures in early 2025 has had a cumulative effect on composite film imports, influencing cost structures and strategic sourcing decisions. By imposing additional duties on selected polymer and composite film categories, these measures have increased landed costs for importers and shifted the economic balance in favor of domestic production. As a result, several converters and brand owners have accelerated plans to localize their supply chains and deepen relationships with North American resin and film manufacturers.

Furthermore, the tariff landscape has stimulated innovation within the domestic sector, with manufacturers investing in capacity expansion and process optimization to capitalize on reduced foreign competition. At the same time, end users are reassessing their procurement strategies, blending domestic and near-shore sourcing to mitigate cost volatility and maintain operational resilience. Consequently, companies that swiftly adapt to the new tariff environment are positioning themselves to secure stable access to critical composite film solutions.

Illuminating Key Market Segmentation Dimensions Revealing Distinct Composite Film Applications, Functional Requirements, and Production Modalities

Insight into market segmentation reveals nuanced dynamics that inform product development and go-to-market strategies across sales channels. While offline distribution remains vital for bulk orders and long-standing industrial relationships, the rise of digital procurement platforms is transforming how converters and end users engage with suppliers. Online marketplaces now facilitate rapid custom quoting, small-batch ordering, and real-time inventory visibility, thereby enhancing responsiveness to fluctuating demand patterns.

Material category selection also underpins differentiated offerings in composite films. Polyester continues to dominate high-temperature and moisture-sensitive applications, whereas polyethylene and polypropylene are preferred for cost-efficient packaging solutions. PVC retains a niche presence in decorative and protective films, especially where impact resistance and scratch protection are critical. These material preferences are further shaped by the emergence of advanced resin grades and recycled feedstock, which are gaining traction in sustainable packaging initiatives.

Examining film type and manufacturing process sheds light on performance stratification. Multi-layer constructs-particularly five-layer, seven-layer, and three-layer configurations-are favored for sophisticated barrier and mechanical properties, while single-layer films deliver economical solutions for less demanding contexts. Coating, extrusion, and lamination technologies each play distinct roles: solvent-based and water-based coatings enhance surface functionality; extrusion methods ensure uniform thickness; and adhesive or thermal lamination creates robust multi-material assemblies. Functionally, films span barrier roles-including moisture and oxygen barriers-conductive layers for electronics, decorative embossed or printed finishes, protective impact-resistant or scratch-resistant surfaces, and UV-resistant coatings for outdoor longevity. Thickness ranges from below 20 micron films for ultra-light applications to above 100 micron laminates for heavy-duty industrial uses. Across end-use industries such as aerospace, automotive, electronics, healthcare, industrial equipment, and packaging, these segmentation insights guide the development of tailored composite film solutions that align with application-specific requirements.

This comprehensive research report categorizes the Composite Film market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Category

- Film Type

- Manufacturing Process

- Function

- Thickness Range

- Sales Channel

- End-Use Industry

Delineating Regional Trajectories Highlighting Americas, EMEA, and Asia-Pacific Influences on Composite Film Demand, Innovation, and Partnerships

Regional dynamics are instrumental in shaping composite film adoption and innovation pathways across global markets. In the Americas, robust e-commerce expansion and rigorous food safety regulations are driving high demand for barrier films in packaging. Companies in North America and Latin America are leveraging digital sales channels and regional converter networks to streamline distribution and support rapid product customization.

Meanwhile, Europe, the Middle East, and Africa present a diverse tapestry of regulatory and technological landscapes. Stringent sustainability targets in the European Union are fueling the adoption of recyclable and bio-based films, while the Middle East is prioritizing high-performance barrier materials for food preservation under extreme climates. In Africa, growth is anchored by industrial infrastructure projects and automotive component manufacturing, which rely on durable composite films to meet stringent performance and safety standards.

Asia-Pacific stands out for its accelerated manufacturing capabilities and cost-competitive supply chains. Regional converters and resin producers are collaborating to introduce advanced film grades and multi-layer structures tailored to electronics, healthcare disposables, and flexible packaging. At the same time, environmental regulations in countries like Japan, South Korea, and Australia are catalyzing research into biodegradable and compostable films, positioning the region at the forefront of sustainable composite film innovation.

This comprehensive research report examines key regions that drive the evolution of the Composite Film market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Showcasing Strategic Alliances, Technological Advancements, and Operational Excellence across Composite Film Worldwide

Leading industry players are forging strategic alliances and pursuing technological advancement to reinforce their market positions. Major integrated chemical companies have announced joint development programs with equipment manufacturers to co-create next-generation multi-layer extrusion lines and inline quality control systems. At the same time, specialized film converters are partnering with material science startups to access proprietary resin formulations that enhance barrier performance or introduce smart functionality, such as embedded sensors for supply chain traceability.

In parallel, operational excellence remains a key differentiator. Industry frontrunners are optimizing plant layouts, implementing digital twins for process simulation, and deploying advanced analytics to predict maintenance needs and reduce downtime. These initiatives are often supported by cross-functional teams that align R&D, manufacturing, and commercial operations, ensuring that new composite film products can be scaled efficiently and introduced to market at pace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Composite Film market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M

- Amcor plc

- Berry Global, Inc.

- Constantia Flexibles GmbH

- Gurit

- Hexcel Corporation

- Huhtamaki Oyj

- Klöckner Pentaplast GmbH

- Mitsubishi Chemical Corporation

- Mondi plc

- Sealed Air Corporation

- SKC Co., Ltd.

- Solvay

- Teijin Limited

- Toray Industries, Inc.

Implementing Actionable Strategies Empowering Industry Leaders to Capitalize on Composite Film Innovations, Supply Chain Optimization, and Sustainability Goals

To capture emerging opportunities, industry leaders should prioritize investment in next-generation material research and pilot production of sustainable composite films. By establishing cross-industry consortia, companies can share R&D costs, pool technical expertise, and accelerate the commercialization of bio-based and recycled film technologies. Furthermore, diversifying supply chain footprints across multiple regions will enhance resilience against geopolitical disruptions and tariff fluctuations.

Simultaneously, digital transformation of sales and production processes will be critical. Implementing IoT-enabled equipment and cloud-based order management platforms can streamline operations, provide real-time visibility, and support predictive demand planning. Equally, embedding sustainability metrics into product development cycles and engaging with end users on circular economy initiatives will not only meet regulatory expectations but also create differentiated value propositions.

Detailing Rigorous Research Methodology Ensuring Robust Data Collection, Analytical Rigor, and Comprehensive Validation for Composite Film Insights

The research underpinning these insights combined extensive primary and secondary data sources to ensure analytical rigor and validity. Primary research involved in-depth interviews with senior executives across material suppliers, film converters, and end-use industry stakeholders, complemented by technical consultations with process engineers and sustainability experts. Concurrently, a thorough review of patent filings, academic publications, and industry conference proceedings provided a solid basis for identifying emerging material trends and manufacturing innovations.

Secondary research encompassed cross-industry reports, trade association publications, regulatory filings, and company disclosures, all of which were systematically triangulated to validate market observations. Quantitative analysis of trade data and supply chain flows was integrated with qualitative assessments to construct a comprehensive market landscape. Throughout the process, data points were corroborated through multiple independent sources, and findings were subjected to peer review to ensure consistency and accuracy.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Composite Film market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Composite Film Market, by Material Category

- Composite Film Market, by Film Type

- Composite Film Market, by Manufacturing Process

- Composite Film Market, by Function

- Composite Film Market, by Thickness Range

- Composite Film Market, by Sales Channel

- Composite Film Market, by End-Use Industry

- Composite Film Market, by Region

- Composite Film Market, by Group

- Composite Film Market, by Country

- United States Composite Film Market

- China Composite Film Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings to Illuminate Future Pathways and Strategic Imperatives for Stakeholders in the Composite Film Domain

In summary, the composite film industry stands at a pivotal juncture characterized by technological breakthroughs, evolving regulatory landscapes, and shifting end-user expectations. Stakeholders must navigate tariff complexities, harness segmentation insights, and engage with regional dynamics to remain competitive. The convergence of sustainable material innovation and digital manufacturing presents unparalleled opportunities to redefine product capabilities and operational models.

As organizations chart their strategic roadmaps, the emphasis should be on agile collaboration, targeted investment in advanced materials, and leveraging data-driven decision-making. By synthesizing the key themes outlined in this report, decision-makers can prioritize initiatives that deliver the greatest impact, manage emerging risks, and unlock sustained value creation in the composite film space.

Take the Next Step to Acquire In-Depth Composite Film Market Research and Propel Your Business Forward with Expert Consultation

To secure your comprehensive composite film market research report and gain a competitive edge, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expert guidance will help tailor the insights to your strategic priorities and ensure you receive the most relevant analysis for your unique business challenges.

Reach out today to discuss pricing options, customization opportunities, and delivery timelines that align with your decision-making cycle. This conversation will be the first step toward unlocking actionable market intelligence and driving impactful growth initiatives across your organization.

- How big is the Composite Film Market?

- What is the Composite Film Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?