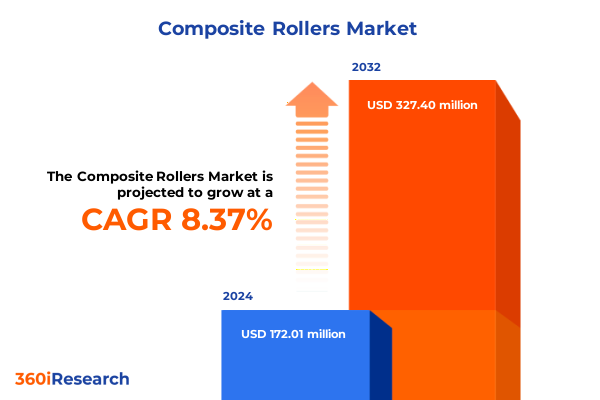

The Composite Rollers Market size was estimated at USD 184.22 million in 2025 and expected to reach USD 201.29 million in 2026, at a CAGR of 8.56% to reach USD 327.39 million by 2032.

Unveiling the Complex Dynamics Shaping the Composite Rollers Landscape and Its Strategic Importance Across Modern Industrial Operations

The composite rollers market has emerged as a focal point for industries striving to balance performance, durability, and cost efficiency in material handling and processing applications. As manufacturing processes evolve, so too does the demand for rollers that can withstand higher speeds, elevated temperatures, and increasingly abrasive operational environments. Composite materials offer a unique combination of lightweight properties and high mechanical strength, positioning them as an indispensable component across sectors that range from automotive production lines to food processing equipment.

In recent years, innovations in fiber technologies and resin systems have accelerated the development of composite rollers capable of delivering enhanced wear resistance and reduced maintenance cycles. These technological strides have coincided with intensified sustainability goals, prompting manufacturers to seek solutions that minimize downtime and energy consumption. Moreover, the competitive landscape has grown more complex as specialized coatings and hybrid material formulations broaden the spectrum of available products. Navigating this dynamic environment requires a deep understanding of material characteristics, performance trade-offs, and end user requirements.

This executive summary offers an expert perspective on the current market dynamics, transformative shifts, tariff impacts, key segmentations, geographic variations, and leading players shaping the future of composite rollers. By examining the interplay of technological innovation, regulatory developments, and shifting demand patterns, stakeholders will gain the clarity needed to make strategic sourcing and investment decisions.

Embracing Next-Generation Manufacturing and Predictive Technologies to Revolutionize Roller Performance and Operational Sustainability

The composite rollers sector is undergoing a pronounced transformation driven by intersecting technological and market forces. First, the rapid progression of additive manufacturing techniques has unlocked new possibilities for custom roller geometries and internal reinforcements, enabling lightweight designs without sacrificing structural integrity. As manufacturers refine these processes, they can produce rollers with tailored fiber orientations that optimize load distribution and reduce stress concentrations during high-speed operations.

Second, the expanding integration of smart sensors within roller assemblies is redefining maintenance paradigms. Embedded temperature and vibration monitoring systems provide real-time diagnostics, allowing operators to predict wear patterns and schedule interventions before critical failures occur. This shift from reactive to predictive maintenance not only improves equipment uptime but also extends service life and reduces total cost of ownership.

Additionally, increasing regulatory emphasis on reducing greenhouse gas emissions has incentivized production facilities to adopt energy-efficient rolling solutions. Composite rollers, with their lower mass and reduced friction coefficients, contribute to lower motor loads and enhanced throughput. As a result, end users are prioritizing advanced material combinations that can sustain performance in elevated-temperature environments while maintaining compliance with stringent environmental standards.

Collectively, these breakthroughs are redefining industry benchmarks and creating new opportunities for specialized suppliers to collaborate closely with end users. Manufacturers that invest in co-development partnerships and digital integration will be best positioned to capitalize on this transformative wave.

Navigating the 2025 U.S. Tariff Realignment on Composite Inputs to Strengthen Domestic Supply Resilience and Material Innovation

In 2025, the framework of U.S. tariffs on key composite materials has exerted a palpable influence on sourcing strategies and cost structures for rollers. Duties imposed on certain imported fibers and resin precursors have compelled downstream manufacturers to reevaluate supply chains and adjust procurement mixes. Many producers have responded by strengthening domestic partnerships and vertically integrating critical upstream processes to insulate against tariff volatility.

This recalibrated approach also fostered increased investment in alternative fiber blends, as companies experimented with mixed composite formulations to substitute higher-duty material inputs. Although some hybrid solutions initially presented trade-offs in performance, iterative optimization of fiber ratios and resin chemistries has begun to yield comparable or superior durability under industrial stress tests.

Furthermore, tariff-induced cost pressures accelerated efforts to improve production efficiency. Roller fabricators streamlined manufacturing workflows through enhanced automation, reduced scrap rates, and optimized curing protocols. These measures compensated for margin pressures stemming from higher material costs and laid the groundwork for more resilient operational models.

While the long-term impact of these tariffs remains under close scrutiny, the 2025 measures have undoubtedly catalyzed a shift toward greater domestic capability and material innovation. Companies that have proactively diversified their fiber portfolios and embraced process enhancements are better equipped to navigate the evolving trade landscape.

Diving Deep into Material Coatings and Functional Classifications to Uncover Targeted Performance Drivers Across End User Applications

A nuanced examination of market segmentation underscores the diverse performance requirements and development pathways within the composite rollers industry. When viewed through the lens of material type, carbon fiber stands out for its exceptional stiffness and fatigue resistance, making it the material of choice for high-speed conveyors and precision coating lines. Conversely, fiberglass provides a cost-effective balance of strength and flexibility for general industrial uses, while Kevlar offers superior impact resistance in harsh processing environments. Mixed composite variants enable formulators to blend properties strategically, achieving tailored performance for specialized applications.

Coating considerations further refine product differentiation. Rubber-coated rollers deliver excellent grip and shock absorption in packaging and printing operations, whereas silicone coatings excel at high-temperature stability in ovenized processing lines. Urethane coatings, with their combined abrasion resistance and chemical inertness, serve demanding applications in paper and textile manufacturing. By aligning coating selection with operational conditions, end users can maximize roller lifespan and maintain consistent process quality.

Functional classification into drive, idler, support, and tension rollers reveals the critical roles each type plays in system performance. Drive rollers transmit power and torque precisely, requiring robust core designs and precise coating adhesion. Idler and support rollers focus on load distribution and belt tracking, necessitating low-friction bearings and balanced mass properties. Tension rollers apply uniform pressure to maintain belt tension, often integrating sensor feedback to ensure dynamic control.

Finally, segmented demand by end user industry highlights how automotive assembly lines, encompassing both commercial vehicles and passenger cars, prioritize stringent dimensional tolerance and high cycle durability. Electronics manufacturers emphasize cleanroom compatibility and antistatic coatings, while the food and beverage sector seeks hygienic surfaces and FDA-approved materials. Paper and pulp operations demand chemical resistance against solvents and high moisture levels, and textile producers require rollers that minimize fabric abrasion while sustaining long operational runs.

This comprehensive research report categorizes the Composite Rollers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Coating Type

- Roller Type

- End User Industry

Mapping Strategic Growth Corridors by Analyzing Regional Innovation Hubs and Regulatory Environments Shaping Roller Demand

Regional dynamics in the composite rollers market reflect differing industrial priorities and resource endowments across major global territories. In the Americas, a combination of advanced manufacturing hubs and proximity to raw material suppliers underpins a strong domestic rollers ecosystem. North American automakers and food processing plants drive demand for rollers with high load capacity and sanitary designs, while Latin American textile and pulp facilities seek cost-efficient, locally produced components.

The Europe, Middle East & Africa region presents a tapestry of regulatory and operational nuances. European precision engineering standards and strict environmental mandates have elevated the adoption of eco-friendly resin systems and recyclable fiber reinforcements. Middle Eastern petrochemical hubs provide access to specialized feedstocks for tailored coatings, while Africa’s emerging industrial corridors are beginning to explore composite solutions to replace traditional steel rollers in mining and agricultural processing.

Asia-Pacific remains the fastest adopter of new composite roller technologies, buoyed by expansive electronics, textile, and automotive manufacturing bases. China’s growing focus on automation and Industry 4.0 initiatives has spurred local innovators to develop rollers with integrated monitoring capabilities. Meanwhile, Japan’s emphasis on precision and longevity has led to incremental refinements in fiber alignment and thermal management, and Southeast Asian markets are increasingly embracing hybrid roller designs to meet the diverse needs of regional end users.

Comparative analysis of these territories highlights the importance of tailoring product portfolios to align with regulatory frameworks, supply chain realities, and industry concentration, ensuring that manufacturers can identify the most promising growth corridors while mitigating regional risks.

This comprehensive research report examines key regions that drive the evolution of the Composite Rollers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring How Integrated Research Collaborations and Aftermarket Services Are Redefining Competitive Advantage Among Roller Manufacturers

A review of the competitive arena reveals that leading manufacturers are differentiating through integrated R&D capabilities, collaborative partnerships, and value-added service offerings. Firms with established expertise in advanced fiber processing have invested heavily in pilot lines to test novel composite formulations under simulated operational loads. Others have built digital platforms that enable customers to configure roller dimensions, coatings, and sensor integrations online, reducing lead times and streamlining order fulfillment.

Strategic alliances with resin suppliers and research institutes are also gaining traction, as manufacturers seek early access to next-generation matrix materials and resin systems with enhanced temperature resistance. In parallel, several key players are expanding their aftermarket services footprint by offering remote condition monitoring subscriptions and automated maintenance alerts, creating new revenue streams beyond initial equipment sales.

OEM partnerships remain a critical differentiator, as companies that align closely with automotive, electronics, and food processing equipment manufacturers can co-design rollers optimized for specific machine architectures. These alliances often extend into joint engineering programs, where co-innovation of roller geometry and composite layering techniques drives incremental performance improvements.

Lastly, geographic expansion strategies are evident, with top contenders establishing manufacturing and service centers in strategic regions such as Mexico, Eastern Europe, and Southeast Asia. This localized approach not only reduces shipping costs and lead times but also enables faster adaptation to region-specific material availability and regulatory requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Composite Rollers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amalga Composites, Inc.

- AMT Composite Rollers GmbH

- Artur Küpper GmbH & Co. KG

- Bergfort Composite Systems GmbH

- CI Flex Rollers, Inc.

- Composite Conveyor Equipment Company

- FIDHOMAR Composite Roller Co., Ltd.

- LANXESS AG

- MHC Composite Rollers Private Limited

- Morgan Advanced Materials PLC

- Rulmeca Group

- Trelleborg AB

- Winding Technologies

Driving Sustainable Growth and Competitive Differentiation Through Strategic Supply Partnerships Digitalization and Service Innovation

Industry leaders must take decisive actions to secure future growth and operational resilience. First, prioritizing end-to-end supply chain integration will help buffer against raw material price fluctuations and trade policy shifts. By forging strategic partnerships with fiber producers and resin formulators, companies can lock in preferential access to capacity and co-develop bespoke material solutions that differentiate their roller offerings.

Second, investing in digital transformation initiatives is essential to unlock new value. Deploying smart sensor networks across roller fleets and integrating analytics platforms will enable predictive maintenance, reducing unplanned downtime and extending service intervals. In addition, leveraging modular factory automation can accelerate production scalability while maintaining stringent quality controls across varying roller configurations.

Third, manufacturers should deepen engagement with regulatory bodies and industry consortia to influence standards development for composite materials and coatings. Proactive participation ensures that emerging regulations align with practical performance requirements and fosters certification pathways that streamline market entry for innovative roller designs.

Finally, expanding value-added service models, such as performance monitoring subscriptions and tailored maintenance programs, can generate recurring revenue streams and reinforce customer loyalty. By transitioning from transactional sales to partnership-based service offerings, companies will be better positioned to capture long-term value and differentiate themselves in a competitive market.

Detailing a Robust Triangulated Research Framework Combining Expert Interviews Data Analytics and Case Studies to Ensure Analytical Rigor

The insights presented in this summary derive from a comprehensive research approach encompassing primary and secondary data collection, expert interviews, and rigorous analytical frameworks. Primary research involved consultations with material scientists, manufacturing engineers, and procurement leaders across key end user industries to gather firsthand perspectives on performance requirements, operational challenges, and adoption drivers.

Secondary research included the systematic review of technical journals, patent filings, industry standards publications, and corporate white papers to map recent technological advancements and regulatory developments. Quantitative analysis was supported by a database of global roller shipments, material import-export records, and manufacturing capacity data, enabling cross-validation of qualitative findings.

The study also integrated case studies from leading roller installations, highlighting real-world performance metrics and maintenance outcomes. A cross-functional advisory panel provided iterative feedback, ensuring that segmentation frameworks, regional assessments, and strategic recommendations reflect practical industry considerations. This triangulated methodology underpins the report’s credibility and equips decision-makers with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Composite Rollers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Composite Rollers Market, by Material Type

- Composite Rollers Market, by Coating Type

- Composite Rollers Market, by Roller Type

- Composite Rollers Market, by End User Industry

- Composite Rollers Market, by Region

- Composite Rollers Market, by Group

- Composite Rollers Market, by Country

- United States Composite Rollers Market

- China Composite Rollers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Key Technological and Strategic Imperatives to Chart a Forward Path for Composite Roller Excellence

In an era marked by rapid technological progress and shifting trade policies, composite rollers stand at the crossroads of performance innovation and supply chain resilience. Advances in material science, coupled with digital integration, are redefining what constitutes high-performance rollers, while tariff realignments have prompted a renewed focus on domestic capabilities and alternative composites.

By dissecting segmentation trends and regional dynamics, it becomes clear that success in the composite rollers market depends on aligning product development with specific operational demands, be it automotive assembly precision or food processing hygiene. Leading companies are already distinguishing themselves through strategic partnerships, service expansions, and localized manufacturing footprints.

As the industry moves forward, manufacturers that embrace proactive collaboration, invest in predictive maintenance technologies, and engage with regulatory frameworks will solidify their market positions. In doing so, they will not only address current challenges but also anticipate future shifts, underpinning sustainable growth and operational excellence.

The journey ahead for composite roller stakeholders promises both challenges and opportunities, with those equipped with timely insights and agile strategies poised to drive the next wave of innovation.

Empower Your Strategic Decisions with Expert Insights by Reaching Out to Secure the Definitive Report on Composite Roller Market Dynamics

If you’re seeking comprehensive insights and strategic guidance on leveraging composite roller innovations to drive operational excellence, connect with Ketan Rohom, the Associate Director of Sales & Marketing, to secure your copy of the full market research report today. He will guide you through the report’s detailed findings, methodological rigor, and actionable recommendations, ensuring you have the knowledge and tools needed to navigate emerging trends, optimize procurement strategies, and maintain a competitive edge in the evolving composites landscape.

- How big is the Composite Rollers Market?

- What is the Composite Rollers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?