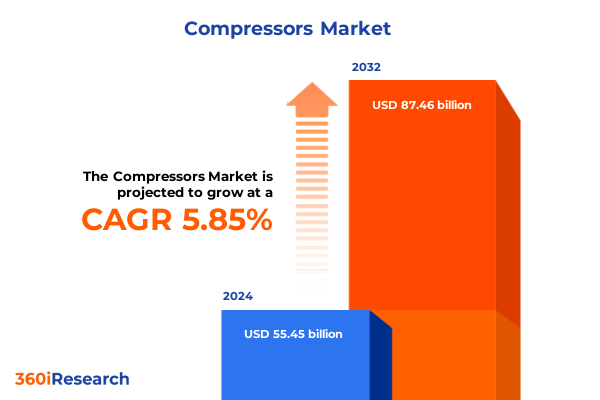

The Compressors Market size was estimated at USD 58.74 billion in 2025 and expected to reach USD 61.85 billion in 2026, at a CAGR of 5.84% to reach USD 87.46 billion by 2032.

Discover the Pivotal Role of Innovative Compressor Technologies in Shaping Industrial Efficiency and Sustainability Across Diverse Sectors

The industrial and commercial sectors increasingly rely on advanced compressor technologies to enhance process efficiency, reduce energy consumption, and meet stringent sustainability goals. As manufacturing and infrastructure projects expand worldwide, the critical role of compressors in driving operational excellence has never been more apparent. Companies across industries from HVACR to power generation are rethinking their equipment strategies to optimize performance, slash downtime, and adhere to evolving environmental regulations.

In response to market demands, compressor manufacturers are innovating across multiple fronts, integrating intelligent control systems, improving aerodynamic designs, and adopting novel materials. This trend underscores the shift toward smarter, more resilient infrastructures where real-time monitoring and predictive maintenance play key roles. Consequently, end users are positioned to achieve significant cost savings and operational improvements over the equipment lifecycle.

Looking ahead, the intersection of digital transformation and sustainability imperatives will continue to elevate the strategic importance of compressors in industrial ecosystems. By understanding the technological drivers, regulatory pressures, and end-user priorities shaping this space, stakeholders can anticipate opportunities and pitfalls. This report provides an in-depth exploration of these dynamics, equipping decision-makers with the actionable intelligence needed to navigate a rapidly evolving landscape

Unveiling the Key Transformative Forces Driving Modern Compressor Markets from Digital Integration to Decarbonization Efforts and Beyond

The compressor industry is experiencing profound shifts driven by digital integration and the global decarbonization agenda. Advancements in connected sensors and Internet of Things platforms now enable granular performance tracking, facilitating remote diagnostics and predictive maintenance that dramatically reduce unplanned downtime. As a result, maintenance strategies are evolving from reactive to proactive models, ensuring higher uptime and better asset utilization.

Simultaneously, the push toward lower carbon footprints has accelerated the adoption of electric-drive systems and variable speed drives. These innovations allow compressors to modulate output based on real-time demand, delivering substantial energy savings compared to fixed-speed counterparts. Moreover, manufacturers are increasingly exploring alternative energy sources and hybrid drive configurations to align with corporate sustainability targets and regulatory mandates.

In parallel, emerging materials science breakthroughs are enhancing compressor component durability while minimizing weight and friction losses. Next-generation alloys and advanced surface coatings extend maintenance intervals and reduce overall life cycle costs. Taken together, these transformative forces are reshaping the competitive landscape, forcing industry players to prioritize agility, collaboration, and continuous improvement in product development

Analyzing the Far-reaching Consequences of 2025 United States Tariff Measures on Compressor Supply Chains Cost Structures and Profitability

In 2025, a series of tariff adjustments in the United States have reverberated throughout compressor supply chains, pushing stakeholders to reassess sourcing strategies and cost structures. Import levies on critical raw materials such as specialty steels and aluminum grains have contributed to elevated production expenses for compressor manufacturers, prompting firms to explore domestic procurement options and qualified alternative suppliers.

End users have also felt the impact as component costs are passed through value chains. In some instances, equipment lead times have lengthened due to procurement complexities, compelling companies to maintain higher inventory levels as a buffer against supply disruptions. To mitigate these challenges, several market participants are forging closer partnerships with regional suppliers, investing in localized manufacturing sites, and fostering vertical integration to bolster resilience.

Despite these headwinds, certain domestic producers have capitalized on the tariff regime, expanding their footprint and securing government incentives aimed at revitalizing onshore manufacturing. These developments underscore the evolving interplay between trade policy and industrial strategy, revealing both risks and opportunities for stakeholders navigating an increasingly complex regulatory environment

Deep Dive into Comprehensive Segmentation Layers Revealing How Type End Use Industry Drive Lubrication Pressure Cooling Stage and Mobility Influence Market Dynamics

A nuanced examination of compressor market segmentation unveils the varied demands and technical requirements shaping equipment selection across sectors. When considering type categories, centrifugal units are favored for high‐volume, continuous‐flow applications due to their efficiency at large scales while reciprocating compressors excel in high‐pressure, intermittent‐duty contexts. Meanwhile, rotary screw models offer a balanced mix of reliability and operational simplicity, and scroll compressors find niche adoption in quieter, lower capacity scenarios.

Looking through the lens of end‐use industries, HVACR systems leverage oil‐free scroll and rotary screw compressors to ensure air purity, whereas automotive manufacturing and food processing plants predominantly rely on oil‐injected reciprocating and centrifugal machines for their ruggedness and pressure control. In chemical and petrochemical segments, the choice of drive mechanism-whether electric, diesel, or gas turbine-depends on site power availability and regulatory emissions targets. Furthermore, specialized subindustries such as agricultural chemicals prioritize hydraulic and pneumatic drive units for precise pressure modulation in formulation processes.

The lubrication dimension further differentiates market needs: oil‐free technology is critical where contamination poses risks, whereas oil‐injected designs deliver greater thermal management and longer service intervals in heavy industrial settings. Pressure range considerations similarly inform equipment selection; low‐pressure compressors meet ventilation and cooling demands while very high‐pressure units support critical applications in gas transport and specialty chemical synthesis. Cooling method also plays a pivotal role, with water‐cooled equipment prevalent in large stationary installations and air‐cooled designs preferred for portable or space-constrained environments. Lastly, the choice between single‐stage and multi‐stage configurations, as well as portable versus stationary mobility options, underscores the importance of aligning performance attributes with operational and site-specific constraints

This comprehensive research report categorizes the Compressors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Drive Type

- Lubrication Type

- Pressure Range

- Cooling Type

- Stage

- Mobility

- End Use Industry

Assessing Regional Developments and Strategic Market Drivers in the Americas Europe Middle East Africa and Asia Pacific Within the Global Compressor Ecosystem

Regional analysis highlights divergent growth trajectories and strategic priorities across the Americas, Europe Middle East and Africa, and Asia Pacific territories. In the Americas, sustained investment in petrochemical and power generation facilities underpins demand for large-scale centrifugal and reciprocating compressors, while a strong emphasis on nearshoring drives expansion of electric drive technologies in manufacturing hubs.

Within Europe Middle East and Africa, stringent emissions regulations and energy efficiency directives are catalyzing the retrofitting of legacy systems with variable speed and oil‐free compressor solutions. In the Middle East, rapid infrastructure development and growing manufacturing sectors are creating pockets of high‐pressure demand, particularly in oil and gas upstream operations. Meanwhile, Africa’s emerging industrial corridors are spurring opportunities for portable compressor units in mining and construction projects.

Asia Pacific remains a powerhouse of compressor consumption, with major economies prioritizing automation and digital integration. The region’s manufacturing heartlands are increasingly deploying smart compressors equipped with IoT connectivity to optimize process workflows. Additionally, water‐cooled rotary screw systems are widespread across heavy industries, while scroll and centrifugal models gain traction in commercial HVAC applications. These regional nuances underscore the need for tailored go‐to‐market strategies that reflect local regulatory environments, energy landscapes, and infrastructure development plans

This comprehensive research report examines key regions that drive the evolution of the Compressors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Leading Industry Players Strategies Innovations and Collaborations Redefining Competitive Landscapes in Industrial Compressor Technologies Worldwide

A handful of global and regional equipment suppliers dominate the competitive landscape, continually investing in product innovation, strategic acquisitions, and service excellence. Established multinational players have broadened their portfolios to include smart compressors featuring advanced analytics platforms that deliver insights on performance, maintenance needs, and energy consumption patterns. These integrated solutions not only enhance customer value but also drive recurring revenue streams through software subscriptions and predictive maintenance services.

Meanwhile, nimble regional manufacturers leverage local market expertise to tailor configurations for specific end‐use requirements and regulatory conditions. By offering rapid delivery times and on-site customization, these firms maintain strong footholds in high‐growth emerging economies. Collaboration between component specialists and system integrators has further accelerated the development of modular compressor packages that simplify installation and maintenance while supporting seamless scalability.

In addition, partnerships between technology providers and academic institutions are fostering breakthroughs in material science and aerodynamics, yielding compressors with reduced weight and enhanced thermal efficiency. As the pace of innovation picks up, the competitive dynamic is shifting toward companies that can rapidly translate R&D efforts into market‐ready products and deliver holistic service models that address the end‐to-end needs of industrial clients

This comprehensive research report delivers an in-depth overview of the principal market players in the Compressors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ariel Corporation

- Atlas Copco AB

- Baker Hughes Company

- Bauer Compressors GmbH

- BOGE Kompressoren GmbH

- BORSIG GmbH

- Burckhardt Compression AG

- Compressor Products International, LLC

- ELGi Equipments Limited

- Emerson Electric Co.

- Fusheng Group Co., Ltd.

- Gardner Denver LLC

- Howden Group Ltd.

- Ingersoll Rand Inc.

- Kaeser Kompressoren SE

- MAN Energy Solutions SE

- Mitsubishi Heavy Industries, Ltd.

- Quincy Compressor LLC

- Siemens Energy AG

- Sullair LLC

Actionable Strategies for Industry Leaders to Capitalize on Emerging Compressor Trends Enhance Operational Resilience and Drive Sustainable Growth Trajectories

To maintain a competitive edge amid mounting complexity, industry leaders should prioritize a holistic digital transformation roadmap that encompasses equipment upgrades, data analytics integration, and workforce training. Decision makers are advised to conduct comprehensive asset performance evaluations to identify legacy units ripe for retrofitting with variable speed drives or advanced monitoring systems. By doing so, organizations can unlock energy savings while minimizing unplanned downtime.

Furthermore, strategic partnerships with regional supply chain partners and material specialists can mitigate exposure to tariff fluctuations and geopolitical disruptions. Investing in localized manufacturing or final assembly hubs offers dual benefits of cost efficiency and faster time to market. Concurrently, companies should explore hybrid drive options and energy recovery systems that align with decarbonization targets and position them favorably in procurement processes favoring low-emission solutions.

Finally, cultivating multidisciplinary teams capable of interpreting data insights and adjusting maintenance schedules in real time will be crucial to achieving operational resilience. Upskilling technicians on digital tools and predictive analytics will not only optimize performance but also foster a culture of continuous improvement and innovation across compressor fleets

Methodical Overview of Research Approaches Employed in Assembling Reliable Compressor Market Insights Through Rigorous Data Collection and Analytical Frameworks

The research underpinning this executive summary combines a rigorous multi-tiered approach, beginning with an exhaustive review of technical white papers, regulatory filings, and patent databases to map the evolution of compressor technologies. Secondary data from industry journals, trade associations, and government publications provided contextual layers on regional policy dynamics and sustainability initiatives.

Primary insights were gathered through interviews with senior executives across manufacturing, oil and gas, chemical processing, and HVAC service providers, ensuring direct validation of market drivers, adoption barriers, and technology roadmaps. Survey data collected from end users across multiple continents offered quantitative perspectives on purchasing criteria, maintenance practices, and long-term investment priorities.

Data triangulation techniques were applied to cross-verify findings, integrating trade shipment statistics, company financial disclosures, and aftermarket service records. Statistical analyses and scenario modeling enabled the identification of key trends and stress testing of external variables such as tariff shifts and energy price volatility. This methodological framework ensures that the conclusions and recommendations are grounded in robust evidence and real-world stakeholder input

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Compressors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Compressors Market, by Type

- Compressors Market, by Drive Type

- Compressors Market, by Lubrication Type

- Compressors Market, by Pressure Range

- Compressors Market, by Cooling Type

- Compressors Market, by Stage

- Compressors Market, by Mobility

- Compressors Market, by End Use Industry

- Compressors Market, by Region

- Compressors Market, by Group

- Compressors Market, by Country

- United States Compressors Market

- China Compressors Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1749 ]

Synthesizing Core Insights and Implications from Compressor Market Analyses to Inspire Strategic Decision Making and Future Industry Roadmaps

This executive summary highlights the imperative convergence of digital innovation, sustainability mandates, and geopolitical factors in shaping the modern compressor landscape. Technological advances from predictive maintenance platforms to high-efficiency drive systems are redefining performance benchmarks and compelling stakeholders to adopt more integrated solutions. At the same time, evolving regulatory environments and trade policies are influencing sourcing decisions and investment priorities globally.

Segment-specific insights reveal that equipment selection hinges on a complex interplay of technical requirements-ranging from pressure and lubrication preferences to cooling methods and mobility needs-tailored to diverse end-use industries. Regional analyses underscore the importance of adaptive strategies that reflect local energy infrastructures, regulatory frameworks, and growth trajectories.

As competitive dynamics intensify, success will favor organizations that blend deep technical expertise with agile supply chain management and a commitment to sustainability. By leveraging the comprehensive insights presented here, decision makers can craft informed strategies that anticipate market shifts, optimize asset performance, and drive long-term value creation

Take the Next Step Toward Informed Investment with Direct Access to In-depth Compressor Market Intelligence Through Personalized Consultation with Ketan Rohom

Are you ready to transform strategic planning and drive competitive advantage with granular insights into today’s compressor market? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, for a tailored discussion and uncover how our comprehensive research can empower your next move. Engage directly to explore custom solutions, deepen your market understanding, and secure exclusive access to the full report. Take this opportunity to translate data into actionable strategies and maintain your leadership edge in a highly dynamic industry.

- How big is the Compressors Market?

- What is the Compressors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?