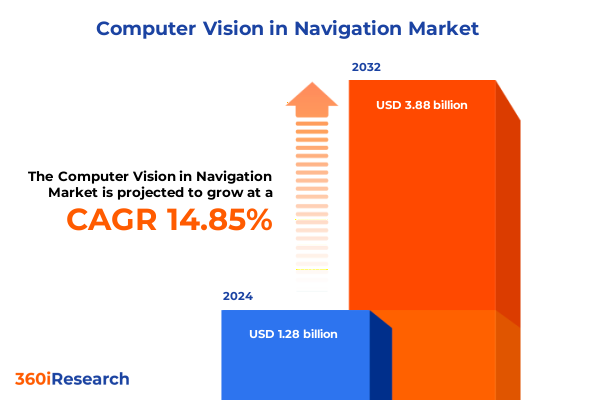

The Computer Vision in Navigation Market size was estimated at USD 1.46 billion in 2025 and expected to reach USD 1.66 billion in 2026, at a CAGR of 14.99% to reach USD 3.88 billion by 2032.

Exploring the Convergence of Computer Vision and Navigation Technologies that Are Redefining Geospatial Intelligence and Mobility Frameworks Worldwide

Computer vision has emerged as a transformative force in navigation, transcending traditional geographic positioning to enable real-time environmental interpretation and decision-making. By leveraging advanced imaging, pattern recognition, and machine learning algorithms, these systems bridge the gap between digital perception and physical movement. The integration of vision capabilities into navigation frameworks is not merely an incremental enhancement, but a foundational shift toward autonomous and augmented experiences across multiple industries.

In recent years, the confluence of high-resolution camera modules, cost-effective solid-state LiDAR, and powerful AI accelerators has accelerated the adoption of vision-based navigation solutions. This technological synergism has unlocked new applications that extend far beyond standard wayfinding, reshaping sectors from automotive safety systems and unmanned robotics to immersive augmented reality overlays in consumer electronics. As sensor components become smaller and processing moves to the network edge, the potential for seamless, context-aware mapping and guidance has expanded dramatically.

This report delves into the intricate landscape of computer vision in navigation, weaving together the latest advancements, market drivers, and strategic imperatives. The analysis spans transformative shifts in technology architectures, the impact of recent trade policies, detailed segmentation studies, and regional dynamics that define adoption patterns. Through this comprehensive lens, stakeholders will gain clarity on emerging opportunities and the pathways to sustainable growth in this rapidly evolving domain.

Understanding the Transformative Shifts in Computer Vision Navigation as Artificial Intelligence, Edge Processing, and Sensor Innovations Reshape Operational Paradigms

The advent of deep learning has reshaped the core of navigation intelligence, enabling vision systems to move beyond static object detection toward dynamic scene understanding. Convolutional neural networks now power real-time semantic segmentation, giving machines the ability to differentiate between roadways, obstacles, and pedestrians with unprecedented accuracy. At the same time, the emergence of recurrent architectures has enhanced predictive path planning by analyzing temporal sequences of visual data, thereby improving decision-making in dynamic environments.

Sensor fusion architectures are another leap forward, combining inputs from camera systems, LiDAR, and radar to construct reliable three-dimensional representations of surrounding spaces. Mechanical LiDAR scanning has gradually given way to solid-state designs that offer greater durability and lower cost, while stereo cameras paired with advanced perception software produce rich depth mapping without the complexity of rotating arrays. These innovations reduce system redundancy and enable more compact form factors for both vehicle-mounted and wearable navigation platforms.

Edge computing has also played a pivotal role in realigning system architectures, shifting intensive AI workloads from centralized data centers to on-device processors. GPUs and AI-optimized ASICs now facilitate low-latency inference directly at the source of data capture, ensuring responsive tracking and guidance even in connectivity-challenged settings. This realignment supports emerging applications such as augmented reality wayfinding in indoor venues and autonomous drones performing complex search-and-rescue missions.

Assessing the Cumulative Impact of Recent United States Tariffs Enacted in 2025 on Supply Chains, Component Costs, and Strategic Sourcing for Vision Navigation Systems

The imposition of new tariffs by the United States in early 2025 on semiconductor components and optical sensors has recalibrated supply chain economics for vision navigation solutions. These measures, aimed at bolstering domestic production of critical technologies, have introduced additional duties on key imports including high-precision camera modules and advanced LiDAR elements. Consequently, manufacturers and integrators face elevated procurement costs and are reevaluating supplier relationships to mitigate margin erosion.

In response, industry participants have accelerated diversification of sourcing strategies, seeking alternative suppliers in Southeast Asia and Europe to offset tariff-induced price pressures. This geographical redistribution of component procurement not only addresses short-term cost challenges but also enhances overall supply chain resilience. Forward-looking companies are engaging in strategic partnerships and joint ventures that secure local production capabilities, thereby qualifying for tariff exemptions or preferential trade treatment under bilateral agreements.

These shifts are also sparking innovation in component design, with vendors optimizing optical and processing modules to reduce reliance on tariff-sensitive imports. By integrating greater functionality into single ASIC packages and exploring hybrid sensor arrays, organizations are lowering their bill of materials while maintaining performance standards. Over the long term, these adjustments will reshape competitive positioning, driving a new wave of vertically integrated vision navigation solutions.

Gaining Deep Segmentation Insights Revealing How Application, Component, Technology, Vehicle Type, Deployment, and End Use Dynamics Drive Market Differentiation

A comprehensive analysis of market segmentation reveals a multifaceted landscape defined by application diversity, component specialization, and technology differentiation. In the realm of Advanced Driver Assistance Systems, adaptive cruise control and automatic emergency braking harness vision algorithms alongside lane departure warnings and traffic sign recognition to elevate road safety. Augmented reality navigation overlays contextual driving information directly onto windshields, while autonomous commercial and passenger vehicles leverage camera-LiDAR integration for self-guided transit. Unmanned aerial platforms, including fixed wing and rotary wing drones, employ computer vision to execute precise inspection and mapping tasks. Meanwhile, indoor navigation systems guide personnel in complex facilities, and maritime applications on subsea vehicles and surface vessels extend situational awareness to the aquatic domain. Service robots and warehouse automation similarly draw upon embedded vision for reliable navigation in dense operational environments.

Component segmentation further underscores market differentiation, with monocular and stereo camera architectures serving as the visual cornerstone, complemented by mechanical and solid-state LiDAR variants for depth sensing. Radar subsystems, categorized into long-range and short-range profiles, enhance environmental perception in adverse conditions. At the heart of processing sits a trifecta of ASIC, FPGA, and GPU platforms, each optimized for the computational intensity of mapping and perception software. The software layer itself bifurcates into specialized mapping engines that construct high-fidelity spatial models and perception modules that classify and track dynamic elements in real time.

Technology segmentation highlights the interplay between two-dimensional imaging and full-scale three-dimensional modeling, accelerated by deep learning frameworks such as convolutional and recurrent neural networks. Sensor fusion techniques then unify disparate data streams into cohesive, actionable insights. Vehicle type segmentation, distinguishing commercial transport from passenger automobiles, influences system requirements and deployment strategies. Deployment channels span aftermarket upgrades and original equipment installations, shaping go-to-market approaches. Finally, the end-use industry dimension covers aerospace and defense, automotive, consumer electronics, and industrial automation, illustrating the broad applicability of vision navigation across critical sectors.

This comprehensive research report categorizes the Computer Vision in Navigation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Technology

- Vehicle Type

- Application

- Deployment

- End Use Industry

Uncovering Key Regional Insights Demonstrating the Unique Adoption Patterns, Regulatory Ecosystems, and Growth Drivers Across Americas, EMEA, and Asia-Pacific Geographies

Regional analysis illuminates the varying maturity levels and regulatory landscapes that guide the adoption of computer vision navigation solutions. In the Americas, robust automotive R&D hubs and burgeoning e-commerce logistics networks have propelled demand for advanced driver assistance and warehouse robotics. Government incentives for smart city initiatives and unmanned aerial systems further stimulate adoption, while established semiconductor supply chains ensure component availability.

Europe, the Middle East, and Africa present a complex tapestry of regulatory frameworks and industrial use cases. Stringent vehicle safety mandates have accelerated the integration of vision-enabled ADAS across commercial fleets, while defense and aerospace programs drive investment in subsea navigation and unmanned maritime vehicles. In parallel, industrial robotics for manufacturing and warehousing rely on perception software tailored to meet diverse regional standards and certification protocols.

Asia-Pacific stands out as a dynamic growth arena, underpinned by large-scale production centers and rapidly expanding consumer electronics markets. Manufacturers in this region are at the forefront of embedding vision navigation into next-generation smartphones, wearables, and autonomous logistics platforms. Concurrently, government sponsorship of smart infrastructure deployments in urban centers fosters experimentation with AR-enabled wayfinding and drone-based surveillance, solidifying the region’s role as both a production powerhouse and an innovation incubator.

This comprehensive research report examines key regions that drive the evolution of the Computer Vision in Navigation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Critical Company Strategies and Competitive Moves by Leading Players to Capitalize on Innovation, Partnerships, and Integrated Solutions in Vision Navigation

Leading stakeholders are executing a range of strategic initiatives to secure dominance in the computer vision navigation space. Sensor manufacturers are channeling resources into next-generation solid-state LiDAR designs that reduce manufacturing complexity and enable broader integration across vehicle platforms. Concurrently, camera system specialists are refining stereo vision modules to deliver higher frame rates and improved low-light performance, catering to both automotive and industrial requirements.

On the processing front, semiconductor incumbents are forging alliances with AI software developers to co-optimize neural network inference engines, resulting in chip architectures tailored specifically for mapping and perception workloads. Radar innovators are aligning with original equipment manufacturers to embed dedicated long-range and short-range sensors into new model lines, ensuring compliance with emerging safety regulations. In parallel, software providers are expanding platforms that seamlessly integrate mapping engines with perception frameworks, offering modularity that accelerates time to deployment.

Strategic collaborations between technology leaders and end-use enterprises are also on the rise, with joint ventures spanning the aerospace, logistics, and automotive sectors. These partnerships focus on piloting integrated vision navigation solutions in live environments, from autonomous fleet trials to warehouse automation rollouts. Such cooperative efforts not only validate system performance but also pave the way for co-development agreements that share risk and align incentive structures.

This comprehensive research report delivers an in-depth overview of the principal market players in the Computer Vision in Navigation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Allied Vision Technologies GmbH

- Amazon Web Services, Inc.

- Beeline

- Blippar Group Limited

- Furuno Electric Co., Ltd.

- instinctools GmbH

- Intel Corporation

- Konecranes

- Northrop Grumman Corporation

- Orca AI

- Qualcomm Technologies, Inc.

- STRONG ANALYTICS LLC

- Tangar Technologies AB

- UAV Navigation S.L.

Formulating Actionable Recommendations for Industry Leaders to Leverage Cutting-Edge Computer Vision Advances and Navigate Geopolitical and Regulatory Complexities Effectively

Industry leaders should prioritize the development of edge-native vision processing architectures that minimize latency and reduce dependence on continuous connectivity. By optimizing neural network models for deployment on embedded AI accelerators and leveraging sensor fusion, organizations can deliver robust performance in diverse operational conditions. At the same time, establishing strategic alliances with regional component suppliers will mitigate exposure to tariff fluctuations and reinforce supply chain agility.

It is equally important to adopt modular software platforms that abstract hardware heterogeneity, enabling rapid configuration across vehicle types and deployment channels. These frameworks should support plug-and-play integration of mapping engines, perception modules, and sensor interfaces to reduce engineering overhead and accelerate pilot programs. Furthermore, engaging with standards bodies and regulatory agencies early in product development ensures compliance and can unlock incentives under emerging safety and infrastructure mandates.

Finally, embedding cross-industry collaboration into corporate innovation strategies will yield synergistic benefits, whether through co-development with aerospace integrators or partnerships with logistics providers for warehouse automation pilots. Such alliances not only distribute development risk but also facilitate access to real-world datasets, driving iterative improvement of vision algorithms and solidifying market positioning.

Elucidating the Rigorous Research Methodology Employing Primary Interviews, Desk Research, and Data Triangulation to Deliver Authoritative Insights into Vision Navigation Markets

The research methodology underpinning this analysis combines rigorous primary and secondary research protocols to ensure data integrity and actionable insights. Primary research efforts included in-depth interviews with experts across sensor manufacturing, semiconductor design, vehicle OEMs, and software development, capturing qualitative perspectives on technology trends and strategic priorities. These subject-matter discussions were supplemented by workshops and surveys with key industry participants to validate emerging hypotheses.

Secondary research spanned exhaustive reviews of technical white papers, patent filings, and regulatory documentation to trace the evolution of core algorithms and hardware innovations. Market intelligence was further enhanced by analyzing corporate disclosures, investor presentations, and industry conference proceedings. Triangulation techniques were employed to reconcile divergent data points, applying cross-validation approaches to verify equipment performance metrics and adoption timelines.

Quantitative datasets were processed using statistical models to identify correlation patterns between tariff events and procurement strategies, while qualitative coding of interview transcripts extracted thematic insights on competitive dynamics. A multi-stage validation process, including peer reviews by senior analysts and external domain specialists, ensured that findings are robust, unbiased, and reflective of real-world conditions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Computer Vision in Navigation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Computer Vision in Navigation Market, by Component

- Computer Vision in Navigation Market, by Technology

- Computer Vision in Navigation Market, by Vehicle Type

- Computer Vision in Navigation Market, by Application

- Computer Vision in Navigation Market, by Deployment

- Computer Vision in Navigation Market, by End Use Industry

- Computer Vision in Navigation Market, by Region

- Computer Vision in Navigation Market, by Group

- Computer Vision in Navigation Market, by Country

- United States Computer Vision in Navigation Market

- China Computer Vision in Navigation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Drawing Comprehensive Conclusions That Synthesize Technology Trends, Market Dynamics, and Strategic Imperatives Shaping the Future of Computer Vision in Navigation Solutions

This executive summary synthesizes the pivotal trends and strategic considerations defining the future of computer vision in navigation. Advancements in deep learning architectures, sensor fusion, and edge computing are collectively elevating perception capabilities, enabling systems to operate with greater autonomy and contextual awareness. Meanwhile, trade policy developments in the United States have underscored the necessity of diversified sourcing and component innovation to sustain competitive pricing.

The granular segmentation analysis highlights how applications ranging from automotive safety systems to industrial robotics are driving differentiated requirements in components and software. Regional variations in regulatory environments and investment focus demonstrate the importance of tailored go-to-market strategies. Company initiatives around vertical integration and collaborative pilots further illustrate the dynamic interplay between technological leadership and market access.

As stakeholders chart their course, the convergence of architectural innovation, strategic alliances, and regulatory engagement will determine long-term success. This report provides a foundational understanding for executives and decision-makers seeking to harness the full potential of vision navigation technologies and navigate the complexities of an evolving global ecosystem.

Seize Strategic Advantage by Engaging with Ketan Rohom, Associate Director of Sales & Marketing, to Access Exclusive Vision Navigation Market Intelligence and Elevate Decision-Making

The comprehensive study offers unparalleled visibility into the evolving dynamics of computer vision in navigation, equipping decision-makers with robust data and analysis to inform strategic initiatives. Prospective buyers will gain access to detailed segments, regional comparisons, and actionable insights, all synthesized into an integrated narrative that supports high-impact investment decisions. By connecting directly with Ketan Rohom, Associate Director of Sales & Marketing, you will unlock tailored guidance for leveraging this intelligence to accelerate innovation and drive competitive advantage. Engage now to ensure your organization is positioned at the forefront of vision navigation transformation.

- How big is the Computer Vision in Navigation Market?

- What is the Computer Vision in Navigation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?