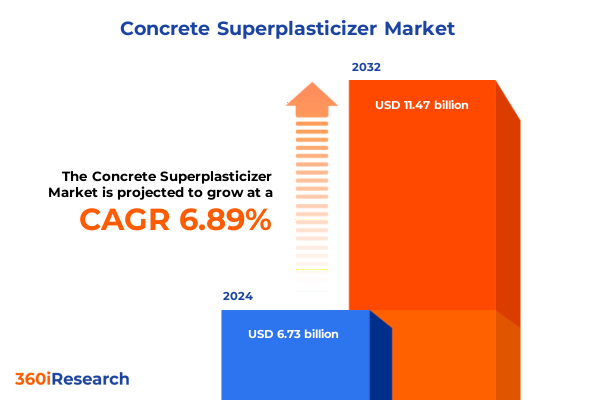

The Concrete Superplasticizer Market size was estimated at USD 7.18 billion in 2025 and expected to reach USD 7.67 billion in 2026, at a CAGR of 6.90% to reach USD 11.47 billion by 2032.

Unveiling the Game-Changing Role of Superplasticizers in Delivering High-Performance, Sustainable, and Durable Concrete Solutions

The concrete industry is at a pivotal juncture, as demands for higher performance, sustainability, and durability converge. Superplasticizers are the transformative admixtures that enable low water-to-cement ratios, enhanced workability, and superior mechanical properties in modern concrete. Originally pioneered in Japan and Germany during the 1960s and 1970s, their evolution has driven a paradigm shift in construction practices worldwide (turn3search3). Moreover, their capacity to reduce water content by up to 20% and facilitate the inclusion of supplementary cementitious materials not only improves structural resilience but also significantly lowers the embodied carbon footprint of concrete (turn2search2). As municipalities and developers strive to meet stringent environmental mandates, superplasticizers have become essential enablers of green building certifications and life cycle performance criteria. Hence, understanding their role, development, and adoption trends is critical for stakeholders seeking to optimize mix designs, reduce costs, and achieve long-term sustainability goals.

How Technological Innovations, Digitalization, and Sustainability Imperatives Are Radically Reshaping the Landscape of Concrete Superplasticizers

Advancements in molecular design and delivery mechanisms are rapidly redefining the superplasticizer landscape. Early products based on naphthalene and melamine formaldehyde condensates gave way to modified lignosulfonates, and today the third generation of polycarboxylate ether (PCE) formulations commands industry leadership. This progression has been marked by strategic innovations in macromonomer architecture, enabling superior slump retention, tailored dispersion kinetics, and compatibility across diverse cement chemistries (turn3search0). In addition, the integration of digital construction methodologies-ranging from automated batching systems to 3D concrete printing-has elevated the demand for admixtures capable of precise rheology control under varying shear conditions. Simultaneously, a global imperative to decarbonize infrastructure has accelerated research into bio-based superplasticizers, pushing performance boundaries while reducing reliance on petrochemical feedstocks (turn3search6). Consequently, significant shifts are occurring across supply chains, regulatory frameworks, and technical service offerings, as manufacturers and contractors adopt holistic strategies to address evolving performance requirements and sustainability objectives.

Analyzing the Far-Reaching Cumulative Impact of United States Tariffs Enacted in 2025 on Concrete Superplasticizer Supply Chains and Costs

A cascade of tariff measures enacted by the United States in 2025 has introduced notable complexities for the superplasticizer sector. Initially, a 25% Section 232 tariff on steel and aluminum imports was doubled to 50% in June 2025, expanding costs for intermediate goods and transport materials essential to admixture production (turn0search5). Concurrently, new duties of 10–20% on chemical imports from key partners, including Canada, Mexico, and China, have increased costs for specialty inputs such as naphtha and certain resin intermediates; although many bulk chemicals like titanium dioxide and polyethylene remain exempt, the risk of future tariff expansion remains high (turn0search3). Industry analysts warn that these measures will drive a direct 8–15% increase in specialty chemical costs, with secondary impacts from higher freight insurance premiums and supply chain re-routing requirements (turn0search2). As a result, domestic producers are front-loading shipments and seeking alternative sourcing in emerging markets, while international exporters face heightened compliance burdens, longer lead times, and potential contract renegotiations. Taken together, these cumulative policies are reshaping supply networks and prompting manufacturers to reassess global footprint strategies.

Key Insights into Market Segmentation Revealing Distinct Dynamics across Product Types, End Uses, Forms, and Multifaceted Applications

Insight into the market’s segmentation reveals nuanced drivers shaping demand across distinct categories. When categorizing by type, classic sulfonated melamine and naphthalene-based formulations coexist alongside modified lignosulfonates and high-performance polycarboxylate ethers, each appealing to different cost, performance, and sustainability profiles. In terms of end use, precast manufacturers often favor formulations optimized for extended slump retention and high early strength, whereas ready-mix operations prioritize rapid slump recovery and pumpability under variable conditions. Segmentation by form highlights that liquids dominate due to ease of dosing and on-site adjustability, though powders retain appeal in regions with constrained logistics or specialized batching practices. Finally, application-focused analysis underscores how commercial projects-spanning office buildings and retail spaces-demand aesthetic finishes and consistent performance, while industrial sectors such as factories and warehouses require admixtures that support heavy-duty flooring and rapid turnaround schedules. Infrastructure initiatives for bridges, dams, roads, and tunnels present stringent durability and long-term performance criteria, whereas residential segments, including multi-family and single-family housing, balance cost-efficiency with contractor-friendly handling.

This comprehensive research report categorizes the Concrete Superplasticizer market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- End Use

- Form

- Application

Regional Market Dynamics Explored in the Americas, Europe, Middle East & Africa, and Asia-Pacific Highlighting Unique Growth Drivers

Geographic factors further influence regional trajectories and competitive landscapes. In the Americas, robust infrastructure investment under federal initiatives has driven heightened consumption of high-performance admixtures, with North American producers benefiting from localized supply chains and technical service networks. Latin American markets, fueled by urban expansion and public works spending, are increasingly adopting superplasticizers to address water scarcity and rapid construction timelines. Across Europe, Middle East & Africa, the European Green Deal’s ambitious carbon neutrality targets and the Middle East’s megaproject pipelines combine to create strong demand for both traditional and bio-based formulations, while African urbanization trends spur broader penetration of admixture technologies. In Asia-Pacific, sustained investments in rail, toll roads, and high-rise construction in China and India reinforce the preference for polycarboxylate-based systems, whereas Australia and Southeast Asia emphasize resilience against harsh environmental conditions and integration of recycled materials in concrete mixes.

This comprehensive research report examines key regions that drive the evolution of the Concrete Superplasticizer market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strategies and Strategic Moves by Leading Companies Driving Innovation and Market Leadership in Superplasticizers

The competitive arena is characterized by strategic partnerships, targeted acquisitions, and continuous innovation from leading chemical and construction material firms. Established multinational players such as BASF, Sika, and Mapei have solidified their positions through extensive R&D pipelines and comprehensive technical support services, enabling end users to optimize mix designs for evolving performance and sustainability goals. Meanwhile, specialized admixture manufacturers like GCP Applied Technologies and Fosroc differentiate through proprietary formulations designed for niche applications, including ultra-high early strength and chloride-free systems. Collaborations with cement producers and concrete equipment manufacturers are increasingly common, reflecting an integrated approach to value creation, supply chain resilience, and digital solutions deployment. Additionally, smaller regional suppliers leverage localized production capabilities to deliver cost-effective solutions and rapid service, challenging global incumbents in emerging markets and driving overall industry competitiveness.

This comprehensive research report delivers an in-depth overview of the principal market players in the Concrete Superplasticizer market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Products & Chemicals, Inc.

- Arkema Group

- BASF SE

- CEMEX S.A.B. de C.V.

- Clariant AG

- Concrete Additives and Chemicals Pvt. Ltd.

- Construction Materials Co. Ltd.

- Enaspol a.s.

- Euclid Chemical Company

- Evonik Industries AG

- Fosroc International Ltd.

- Fritz-Pak Corporation

- GCP Applied Technologies Inc.

- Ha-Be Betonchemie GmbH & Co. KG

- Hangzhou Lans Concrete Admixture Inc.

- Kao Corporation

- LafargeHolcim Ltd.

- MAPEI S.p.A.

- Nuclear Technologies (India)

- Rhein-Chemotechnik GmbH

- Shandong Wanshan Chemical Co., Ltd.

- Sika AG

- Sobute New Materials Co., Ltd.

- W. R. Grace & Co.

- Zhe Jiang LanYa Concrete Admixture Inc.

Actionable Strategies for Industry Leaders to Capitalize on Emerging Trends, Mitigate Risks, and Drive Sustainable Growth in Superplasticizers

Industry leaders must proactively align their strategic actions with emerging market trends and risk factors to secure long-term advantage. Advancing formulation development by investing in bio-based chemistries and partnering with academic institutions can address both performance and sustainability imperatives. Strengthening supply chain resilience through nearshoring key feedstock production and diversifying supplier networks helps mitigate the impacts of tariff volatility and logistical disruptions. Integrating digital platforms for real-time mix adjustment, predictive maintenance, and remote technical support enhances customer value and operational efficiency. Furthermore, expanding service portfolios to include on-site consulting, performance testing, and lifecycle assessment fosters deeper client relationships. Finally, pursuing selective mergers or partnerships to access high-growth regional markets and complementary technology platforms ensures a balanced global footprint and accelerates time to market for next-generation superplasticizer solutions.

Robust Mixed-Method Research Methodology Ensuring Comprehensive Analysis through Primary Interviews and Rigorous Data Triangulation Techniques

This analysis was developed through a robust mixed-method research methodology, combining primary interviews with industry stakeholders, structured expert panels, and comprehensive secondary research. First, consultations with superplasticizer manufacturers, concrete producers, and regulatory authorities provided qualitative insights into innovation pipelines, regional dynamics, and policy impacts. Second, technical papers, patent filings, and trade publications were systematically reviewed to track formulation advancements and patent trends. Third, supply chain data and customs statistics were analyzed to quantify the implications of recent tariff measures. Data triangulation and iterative validation workshops ensured consistency and accuracy, while a peer review process involving independent construction chemists and market analysts bolstered the credibility of findings. Finally, illustrative case studies from key geographic markets were incorporated to contextualize broader trends and strategic considerations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Concrete Superplasticizer market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Concrete Superplasticizer Market, by Type

- Concrete Superplasticizer Market, by End Use

- Concrete Superplasticizer Market, by Form

- Concrete Superplasticizer Market, by Application

- Concrete Superplasticizer Market, by Region

- Concrete Superplasticizer Market, by Group

- Concrete Superplasticizer Market, by Country

- United States Concrete Superplasticizer Market

- China Concrete Superplasticizer Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Concluding Reflections on the Evolution, Current State, and Future Trajectory of the Concrete Superplasticizer Market Landscape

The trajectory of concrete superplasticizers underscores a dynamic interplay between performance enhancement, sustainability objectives, and evolving regulatory environments. From their inception as high-range water reducers, these admixtures have matured into sophisticated molecular systems that support cutting-edge construction techniques and environmental targets. Market segmentation highlights diverse user requirements-from precast facilities demanding rapid strength gains to ready-mix operations seeking consistent workability-while regional insights reveal how public policy, infrastructure funding, and urbanization shape adoption patterns. Competitive analysis shows that established chemical giants and agile specialized suppliers alike are investing in R&D, digital tools, and strategic alliances to capture emerging opportunities. As global priorities shift toward carbon neutrality, resource efficiency, and resilient infrastructure, superplasticizers will remain central to delivering high-performance concrete solutions. Forward-looking stakeholders who embrace integrated innovation, supply chain agility, and collaborative engagement will lead the next wave of sustainable, resilient construction.

Seize the Opportunity to Elevate Your Competitive Advantage with Our Comprehensive Concrete Superplasticizer Market Research Report

To explore and secure your copy of this in-depth concrete superplasticizer market research report, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. He can guide you through the report’s comprehensive insights and help tailor the data to your strategic needs.

- How big is the Concrete Superplasticizer Market?

- What is the Concrete Superplasticizer Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?