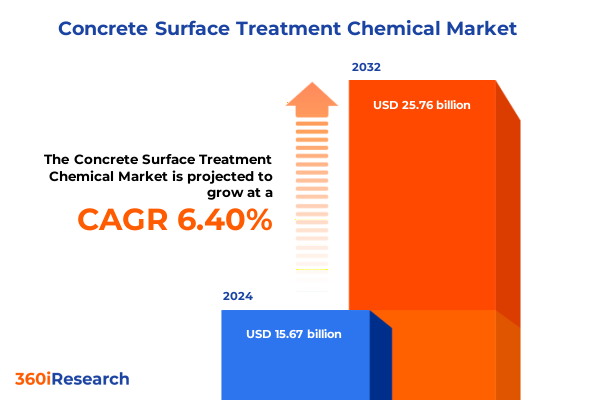

The Concrete Surface Treatment Chemical Market size was estimated at USD 16.54 billion in 2025 and expected to reach USD 17.45 billion in 2026, at a CAGR of 6.53% to reach USD 25.76 billion by 2032.

Comprehensive introduction to the concrete surface treatment chemical landscape highlighting objectives, scope, and value for diverse industry stakeholders

The concrete surface treatment chemical market has become an indispensable component of modern infrastructure and construction practices, responding to heightened expectations for durability, aesthetic appeal, and long-term performance. As cities expand and existing structures face increasingly rigorous environmental and usage demands, the need for advanced chemical solutions that protect, enhance, and extend the life of concrete surfaces has never been more acute. Innovations in materials science, heightened regulatory scrutiny, and a growing emphasis on sustainability are collectively driving stakeholders-from raw material suppliers to end-use contractors-to reevaluate their approaches and prioritize specialized surface treatments.

This executive summary serves as a foundational overview, outlining the primary objectives of this analysis and defining the scope of inquiry. It presents a structured lens through which manufacturers, distributors, and industry investors can explore critical themes such as market segmentation, regulatory impacts, and regional variations. By establishing the context and highlighting the methodologies employed, this introduction ensures that readers will appreciate the depth and relevance of the insights that follow, fostering a clear understanding of how these findings can inform strategic planning and operational excellence.

Exploring technology breakthroughs, evolving regulations, and sustainability drivers sparking a paradigm shift in concrete surface treatment chemicals

Technological breakthroughs are redefining the capabilities of surface treatment chemicals. Emerging nanotechnology additives are enhancing abrasion resistance and chemical bonding, while advanced polymer formulations improve adhesion and flexibility under variable weather conditions. Concurrently, digital process controls and automated application systems-leveraging robotics and IoT sensors-are optimizing consistency and reducing waste. These innovations are not isolated; they interact with each other to create a synergistic effect, driving both product performance and operational efficiency.

Regulatory frameworks are also evolving in tandem with these technological shifts. Governments and standards bodies are implementing stricter limits on volatile organic compounds (VOCs) and prioritizing low-emission, eco-friendly formulations. In many regions, incentives for green building certifications and sustainability targets are encouraging manufacturers to reformulate legacy products to comply with new thresholds. This regulatory momentum is shifting the competitive landscape, rewarding companies that can rapidly adapt their portfolios to meet emerging compliance demands.

At the core of this transformation lies a sustainability imperative. Lifecycle assessments and circular economy principles are guiding the development of water-based sealers and silicate densifiers that minimize environmental impact without compromising efficacy. Collectively, these drivers are converging to spark a paradigm shift in concrete surface treatment chemicals, one marked by smarter materials, rigorous standards, and a more holistic approach to environmental stewardship.

Assessing the impact of 2025 United States tariffs on supply chains, cost structures, and market dynamics in the concrete surface treatment chemical industry

In 2025, the United States implemented new tariff measures targeting select chemical imports, significantly altering cost structures and supply chain configurations for concrete surface treatment products. These duties, applied at rates higher than historical averages, have increased landed costs for solvent-based sealers and specialized polymer adhesives. As a result, domestic producers with integrated upstream capabilities have gained a pricing advantage, while companies reliant on imported intermediates have been compelled to reassess procurement strategies.

To mitigate these cost increases, many manufacturers have pursued nearshoring initiatives, relocating critical component production closer to final assembly facilities. This geographic realignment has introduced operational complexities, including talent acquisition and capital expenditure for new facilities. Some organizations have also turned to alternative raw materials-such as local silicate sources-to reduce exposure to imported inputs. Together, these adjustments are reshaping competitive dynamics, compelling industry participants to balance cost management with the need to maintain product quality and regulatory compliance.

Illuminating insights from segmentation across treatment type, product form, end-use applications, and application techniques to drive strategic decision-making

The concrete surface treatment chemical space can be dissected by treatment type, revealing specialized segments that cater to distinct performance requirements. Adhesives, encompassing epoxy and polyurethane variants, deliver robust bond strength for overlays and repair mortars. Curing agents split between silicate-based and chloride-based formulations accelerate strength development and reduce shrinkage cracks. Densifiers composed of lithium silicate, potassium silicate, or sodium silicate enhance surface hardness and chemical resistance, while hardeners-either epoxy or pure polyurea-impart high tensile resilience. Finally, sealers available in solvent-based or water-based forms protect against moisture ingress and chemical etchants.

Analyzing product form further refines the picture, with liquid solutions offering easy application and rapid curing, contrasted by powder blends that facilitate on-site mixing and extended shelf life. End-use industries such as commercial construction prioritize surface aesthetics and ease of maintenance, whereas industrial settings demand chemical resistance and abrasion protection. Infrastructure projects emphasize long-term durability under vehicular loads, and residential applications balance cost with functional performance. Application methods-ranging from brush roller and spray to trowel pad-further influence material selection by dictating viscosity, drying time, and substrate compatibility. This segmentation framework enables targeted strategy development, ensuring that each specialization aligns with market demands and operational capabilities.

This comprehensive research report categorizes the Concrete Surface Treatment Chemical market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Product Form

- Application Method

- End Use Industry

Unveiling dynamics in the Americas, Europe Middle East and Africa, and Asia Pacific markets driving demand and innovation in concrete surface treatment chemicals

Regional dynamics in the Americas reveal a dual narrative of mature North American markets and rapidly evolving Latin American sectors. In the United States and Canada, demand centers on renovation projects and high-spec commercial builds that require premium sealing and densification solutions. Mexico and Brazil are experiencing infrastructure booms in highways and public transit, spurring interest in cost-effective curing agents and hardeners that balance performance with budget constraints.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts-particularly in the European Union-are shaping product profiles. Companies in Western Europe are advancing low-VOC, water-based sealers to comply with stringent environmental directives. Meanwhile, the Middle East prioritizes high-temperature resilient coatings for desert climates, and Africa’s growing urban centers demand scalable curing technologies. In the Asia-Pacific region, fast-paced urbanization in China and India is fueling large-scale residential and industrial projects, while Australia’s emphasis on R&D is driving adoption of next-generation polymer adhesives and silicate densifiers. Understanding these regional nuances is essential for crafting market entry strategies and optimizing product portfolios.

This comprehensive research report examines key regions that drive the evolution of the Concrete Surface Treatment Chemical market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting competitive strategies and innovation of leading companies driving partnerships and market positioning in concrete surface treatment chemicals

Leading companies in the concrete surface treatment chemical arena are leveraging strategic acquisitions and R&D investments to fortify their market positions. Global specialty chemical firms have been expanding their decorative and performance coating portfolios through targeted mergers, enabling them to offer end-to-end solutions-from surface preparation to finishing. Concurrently, several enterprises are forging partnerships with equipment manufacturers to integrate application systems that enhance product efficacy and reduce labor costs.

Innovation remains a central battleground. Market leaders are accelerating pipeline development of low-temperature curing agents and high-performance silicate densifiers, often collaborating with academic institutions to harness novel chemistries. These R&D initiatives are complemented by enhanced customer support services, including digital formulation tools and on-site technical assistance. Collectively, these strategic maneuvers are reinforcing competitive moats and setting new benchmarks for product performance, quality assurance, and customer engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Concrete Surface Treatment Chemical market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- BASF SE

- Compagnie de Saint-Gobain S.A.

- Dow Inc.

- Fosroc International Ltd.

- GCP Applied Technologies Inc.

- MAPEI S.p.A.

- PPG Industries, Inc.

- RPM International Inc.

- Sika AG

- The Sherwin-Williams Company

Actionable recommendations guiding industry leaders toward sustainable growth and operational resilience in the concrete surface treatment chemical market

To thrive in this dynamic environment, industry stakeholders should prioritize the development of next-generation formulations that anticipate tightening environmental regulations. Investing in research of bio-based additives and low-VOC water-based sealers can position companies ahead of compliance curves and resonate with sustainability-driven end users. Strengthening supplier relationships through long-term contracts and diversified sourcing will enhance resilience against tariff-related supply disruptions.

Operational excellence can be achieved by implementing advanced analytics to monitor production yields, raw material costs, and customer feedback in real time. Adopting modular production techniques and flexible manufacturing lines will enable rapid adaptation to shifting demand patterns. Finally, fostering collaborative industry consortia can accelerate the dissemination of best practices and drive collective progress on safety, efficacy, and sustainability benchmarks.

Detailing research approach including data collection, validation methods, and analytical frameworks guiding this concrete surface treatment chemical study

This study employs a rigorous research approach to ensure robust, actionable insights. Secondary research included a thorough review of industry publications, regulatory filings, and corporate disclosures to map the competitive landscape and emerging trends. Primary research involved structured interviews with chemical engineers, construction contractors, and procurement specialists to validate product performance attributes and supply chain dynamics.

Data validation methods encompassed cross-referencing manufacturer specifications with field performance case studies and independent laboratory results. Analytical frameworks such as SWOT analysis, value chain mapping, and competitive benchmarking were applied to synthesize findings and uncover strategic imperatives. This methodical approach guarantees that conclusions are grounded in both quantitative evidence and firsthand industry expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Concrete Surface Treatment Chemical market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Concrete Surface Treatment Chemical Market, by Treatment Type

- Concrete Surface Treatment Chemical Market, by Product Form

- Concrete Surface Treatment Chemical Market, by Application Method

- Concrete Surface Treatment Chemical Market, by End Use Industry

- Concrete Surface Treatment Chemical Market, by Region

- Concrete Surface Treatment Chemical Market, by Group

- Concrete Surface Treatment Chemical Market, by Country

- United States Concrete Surface Treatment Chemical Market

- China Concrete Surface Treatment Chemical Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Drawing conclusions that distill key findings, reveal implications, and guide stakeholders toward future opportunities in concrete surface treatment chemistry

The analysis distills core findings that underscore the sector’s evolution toward higher-performance, eco-conscious chemistries. Technological innovation, regulatory realignment, and supply chain reconfiguration are collectively driving a more sophisticated marketplace, where the ability to integrate advanced materials and compliance strategies defines competitive advantage.

Looking ahead, stakeholders should embrace collaborative R&D, agile manufacturing practices, and proactive regulatory engagement to seize emerging opportunities. By aligning product roadmaps with sustainability mandates and leveraging data-driven decision-making, organizations can navigate challenges and deliver superior solutions that meet the evolving demands of the built environment.

Compelling call to action to connect with Associate Director Ketan Rohom to secure the concrete surface treatment chemical market research report

Engaging directly with Ketan Rohom presents an opportunity to secure definitive market intelligence tailored to your strategic objectives. As Associate Director of Sales & Marketing, he can provide you with detailed insights, comprehensive analytics, and bespoke advisory to align this research with your specific business needs.

By partnering with Ketan, you will gain expedited access to the full concrete surface treatment chemical market research report, including nuanced breakdowns of treatment types, regional dynamics, and actionable recommendations. Reach out today to enhance your competitive intelligence and drive informed decisions that accelerate growth and resilience.

- How big is the Concrete Surface Treatment Chemical Market?

- What is the Concrete Surface Treatment Chemical Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?