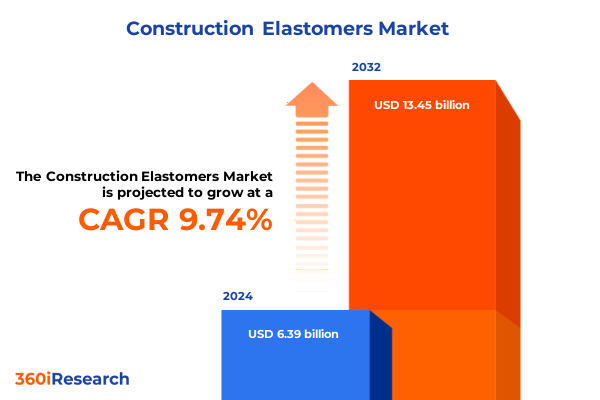

The Construction Elastomers Market size was estimated at USD 6.95 billion in 2025 and expected to reach USD 7.57 billion in 2026, at a CAGR of 9.88% to reach USD 13.45 billion by 2032.

Exploring the Evolving Dynamics of the Construction Elastomers Market and Its Role in Driving Innovative and Sustainable Building Solutions

The construction elastomers market has emerged as a critical enabler of resilience and longevity in modern infrastructure, driven by increasing demand for durable, high-performance materials that address evolving environmental and regulatory requirements. Elastomers, with their unique ability to combine elasticity, strength, and chemical resistance, have become integral to a wide range of applications-from waterproof membranes on skyscraper rooftops to anti-corrosion coatings in industrial pipelines. In recent years, this market has witnessed a convergence of sustainability mandates, innovation in material science, and shifting supply chain dynamics that together are reshaping the way builders and developers specify and source elastomeric products.

As the built environment becomes more complex and carbon-conscious, stakeholders across the construction value chain are seeking elastomer solutions that offer not only superior performance but also reduced lifecycle environmental impact. Meanwhile, advancements in polymer chemistry and processing technologies are unlocking new possibilities for synthetics and biobased formulations. Against this backdrop, the industry must navigate a landscape defined by trade policy changes, raw material volatility, and an intensifying focus on circularity. This executive summary provides a strategic overview of the key factors driving change, highlights actionable insights, and sets the stage for a deeper exploration of market segmentation, regional dynamics, and competitive moves.

Identifying Transformational Shifts in Industry Dynamics and Technology Adoption That Are Redefining the Construction Elastomers Landscape

Throughout the past decade, the construction elastomers landscape has undergone transformative shifts driven by innovation, regulatory pressures, and global supply realignments. The growing emphasis on green building certifications has accelerated the adoption of low-VOC adhesive and coating systems, prompting chemical suppliers to reformulate products with waterborne and bio-based chemistries. At the same time, digitalization in construction-ranging from advanced material specification platforms to automated quality testing-has increased transparency around performance metrics and accelerated time-to-market for next-generation elastomeric solutions.

Concurrently, the industry has seen a strategic pivot toward resilient infrastructure, with rising investments in water treatment plants and transportation networks that require robust membranes and expansion joints capable of withstanding extreme weather events. This trend has driven research into high-temperature-stable and UV-resistant rubbers, as well as the integration of nanomaterials to enhance mechanical properties. Moreover, supply chain diversification efforts have gained momentum as manufacturers mitigate risks associated with geopolitical disruptions and raw material shortages. In response, leading elastomer producers have forged collaborative partnerships with regional resin suppliers, leveraging localized production to ensure continuity of supply and reduce carbon emissions associated with long-distance logistics.

Assessing the Cumulative Impact of Recent United States Tariff Policies Through 2025 on Construction Elastomers Supply Chains and Cost Structures

United States tariff policies enacted since 2018, coupled with subsequent adjustments through 2025, have exerted a substantial influence on the cost structures and sourcing strategies within the construction elastomers sector. With a suite of Section 301 and Section 232 measures targeting chemical imports, synthetic rubber feedstocks such as chloroprene and nitrile have experienced duty rates that have occasionally surged by up to 25 percent. Such impositions have not only increased landed costs but also prompted manufacturers to reevaluate long-standing procurement agreements with international suppliers.

The cumulative effect of these tariffs has compelled the industry to explore domestic production capacity expansions, as well as to secure alternative feedstock channels across North America and allied trading partners. While this nearshoring trend has introduced advanced manufacturing investments in rubber compounding and polymerization facilities, it has also led to transitional challenges associated with scale-up timelines and potential quality variation. Moreover, downstream converters and sealant formulators have encountered more frequent contract renegotiations to absorb or pass through these additional costs. Looking ahead, ongoing policy reviews and potential tariff rollbacks will remain a key variable affecting raw material inflation, supply chain resilience, and the competitive positioning of both domestic and international elastomer producers.

Deriving Critical Insights from Elastomer Type Application End User and Distribution Channel Segmentation in Construction Markets

Analyzing the market through the lens of elastomer type, synthetic rubbers-including chloroprene, EPDM, nitrile, and styrene-butadiene-have asserted dominance due to their tailored performance in harsh environmental conditions, even as natural rubber retains relevance for select sealing and membrane applications that prioritize elasticity and sustainability. This duality underscores the importance of a balanced portfolio approach that aligns product characteristics with project specifications. Application-wise, adhesives and coatings segments are experiencing rapid growth fueled by anti-corrosion and protective coatings designed for infrastructure and marine environments, while advanced membranes for roofing, waterproofing, and pond liners demand formulations that combine flexibility with long-term UV and chemical resistance.

End-user segmentation reveals that industrial and infrastructure sectors, particularly energy, transportation, and water treatment facilities, are driving robust demand for high-performance gaskets, expansion joints, and sealants capable of coping with high pressures and temperature extremes. In parallel, residential and commercial construction continues to absorb sizable volumes of waterproofing membranes and decorative sealants. Finally, distribution channel dynamics have evolved, with direct sales channels enabling custom compound development and technical support for large-scale projects, while distributors and e-commerce platforms serve a broader base of contractors and smaller specifiers seeking rapid delivery and off-the-shelf solutions.

This comprehensive research report categorizes the Construction Elastomers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Elastomer Type

- Application

- End-User Industry

- Distribution Channel

Uncovering Regional Market Nuances and Strategic Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific Zones

Regional dynamics shape the trajectory of elastomer demand and innovation, beginning with the Americas, where North American infrastructure investments, particularly in highway reconstruction and renewable energy installations, have spurred demand for robust synthetic rubber formulations. Latin American markets, while smaller in asphalt and roofing membrane consumption, are poised for growth as urbanization intensifies and foreign direct investment in utilities projects increases. Transitioning to Europe, the Middle East, and Africa, stringent environmental regulations in the European Union have accelerated the shift toward bio-based elastomers and recycled content mandates, while the Middle East’s petrochemical resources have underpinned competitively priced EPDM and nitrile output, supporting both domestic consumption and export.

Asia-Pacific continues to stand out as the largest regional elastomers market, propelled by massive infrastructure buildouts in China, India, and Southeast Asia. Government-led projects, such as high-speed rail networks and water management systems, have stimulated demand for advanced membranes and sealants. Meanwhile, regional trade partnerships and free trade agreements have facilitated raw material flows, even as some economies seek greater self-sufficiency through local polymer production. Across all these regions, emerging priorities around circularity and life-cycle assessment are fostering collaborative initiatives between suppliers, contractors, and regulatory bodies to drive product innovation that reduces environmental footprints.

This comprehensive research report examines key regions that drive the evolution of the Construction Elastomers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Key Corporate Players and Their Strategic Initiatives Driving Innovation Collaboration and Competitive Edge in Elastomers for Construction

Global leaders in construction elastomers have pursued differentiated strategies to maintain competitive advantage and drive innovation. Major specialty chemical corporations have leveraged their extensive R&D investments to introduce next-generation polymer blends that enhance tensile strength and elongation while offering reduced volatile organic compound emissions. At the same time, agile compounders and mid-tier producers have carved out niches by offering custom formulations tailored to regional regulatory requirements and unique application demands, such as high-frequency expansion joints in seismic zones.

Collaboration has also emerged as a key theme, with joint ventures between rubber producers and coating formulators enabling end-to-end solutions that streamline project timelines and ensure material compatibility. Some leading firms have established innovation centers adjacent to major construction hubs, providing on-site testing and validation services that accelerate product adoption. Moreover, strategic acquisitions of specialized membrane technology providers are reshaping the competitive landscape, allowing incumbent players to broaden their portfolios and enter adjacent markets such as waterproofing and corrosion protection more rapidly. Through these concerted efforts, industry participants are reinforcing their foothold and responding proactively to evolving customer requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Elastomers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arkema S.A.

- BASF SE

- Celanese Corporation

- Covestro AG

- DuPont de Nemours, Inc.

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Mapei S.p.A.

- MITSUBISHI CHEMICAL ADVANCED MATERIALS AG

- RPM International Inc.

- RTP Company

- Saint-Gobain Group

- Sika AG

- The Dow Chemical Company

- The Dow Chemical Company

- Wacker Chemie AG

Presenting Actionable Recommendations to Drive Strategic Decision Making Operational Efficiency and Growth in the Construction Elastomers Industry

Industry leaders should prioritize integrated supply chain strategies that blend localized manufacturing with strategic stockholding to mitigate the impact of tariff-induced volatility and logistics disruptions. By establishing regional compounding facilities closer to major construction markets, manufacturers can accelerate delivery lead times and enhance responsiveness to project changes. At the same time, collaboration with key raw material suppliers to secure long-term agreements on chloroprene, EPDM, and nitrile feedstocks will reduce risk and create more predictable cost frameworks.

From a product development standpoint, companies must intensify investment in sustainable chemistries, such as bio-based monomers and reclaimed rubber content, to align with tightening environmental regulations and growing customer demand for green building materials. Cross-functional teams should engage with leading architects and contractors early in the specification process to co-create solutions that meet performance and sustainability targets. Finally, leveraging digital tools for predictive maintenance monitoring and digital twin simulations can help end users optimize material life cycles and demonstrate value through data-driven case studies, reinforcing the total cost of ownership benefits of premium elastomer products.

Detailing Research Methodologies Data Collection and Analysis Approaches Ensuring Rigorous Insights into Construction Elastomers Market Dynamics

This analysis draws upon a multi-tiered research framework combining primary interviews with supply chain executives, formulation scientists, and construction project managers alongside secondary data from industry publications, technical white papers, and trade association reports. Expert perspectives were solicited through structured questionnaires, focusing on raw material sourcing strategies, regulatory compliance challenges, and emerging application requirements. Quantitative insights were validated through comparative analysis of import-export data and customs tariffs schedules.

Analytical methodologies included segment mapping to identify high-growth applications, scenario analysis to evaluate tariff impact thresholds, and supply chain network modeling to assess resiliency under various disruption scenarios. Qualitative trend analysis highlighted innovation trajectories in biopolymer adoption and digital integration. Rigorous data triangulation ensured consistency across information sources, while peer review by industry experts provided an additional layer of verification. This comprehensive approach guarantees that the findings offer reliable, actionable insights tailored to the strategic needs of executives, R&D leaders, and procurement specialists operating in the construction elastomers sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Elastomers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Elastomers Market, by Elastomer Type

- Construction Elastomers Market, by Application

- Construction Elastomers Market, by End-User Industry

- Construction Elastomers Market, by Distribution Channel

- Construction Elastomers Market, by Region

- Construction Elastomers Market, by Group

- Construction Elastomers Market, by Country

- United States Construction Elastomers Market

- China Construction Elastomers Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Drawing Conclusive Perspectives on the Strategic Imperatives and Future Outlook for Construction Elastomers Across Global Infrastructure Landscape

In summary, the construction elastomers sector stands at a pivotal juncture where sustainability imperatives, tariff policies, and technological advancements converge to reshape market opportunities. Companies that navigate this complex environment through adaptive supply chain strategies, focused R&D investment, and close collaboration with key stakeholders will secure a competitive edge. Understanding the nuanced interplay between elastomer type selection, application requirements, and regional regulatory landscapes is essential for informed decision making.

Looking ahead, the alignment of circular economy principles with robust performance standards will define the next wave of innovation, empowering construction professionals to deliver resilient, eco-efficient infrastructure. By embracing data driven insights and fostering strategic partnerships, industry participants can transform emerging challenges into avenues for growth and differentiation. This executive summary lays the groundwork for deeper exploration of thematic opportunities, equipping leaders with the clarity and foresight needed to steer their organizations toward sustained success.

Compelling Invitation to Engage with Associate Director of Sales Marketing for Exclusive Construction Elastomers Report Acquisition and Strategic Advantage

Connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure your personalized access to the definitive construction elastomers market research report. Ketan will guide you through key insights tailored to your organizational needs and demonstrate how this comprehensive analysis can inform your strategic planning, drive innovation, and strengthen your competitive positioning. Engage now to unlock exclusive data, detailed segmentation analysis, and actionable recommendations that will empower your team to navigate market complexities and capitalize on emerging opportunities without delay.

- How big is the Construction Elastomers Market?

- What is the Construction Elastomers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?