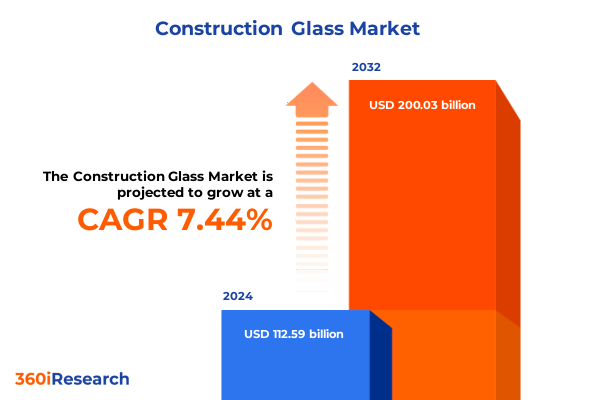

The Construction Glass Market size was estimated at USD 121.08 billion in 2025 and expected to reach USD 130.22 billion in 2026, at a CAGR of 7.43% to reach USD 200.03 billion by 2032.

Discovering the Cornerstones of Modern Construction Glass Dynamics and Market Drivers Shaping the Industry’s Future Growth Trajectory

The modern construction landscape is undergoing a profound metamorphosis driven by evolving architectural paradigms, heightened sustainability mandates, and the relentless quest for energy-efficient building envelopes. At the heart of this transformation lies construction glass, a material whose functional and aesthetic versatility underpins contemporary design principles while satisfying increasingly stringent regulatory frameworks. In an era characterized by ambitious net-zero targets and the pursuit of occupant wellness, glass is no longer a passive element but an active contributor to environmental performance and human comfort.

Moreover, the convergence of digital design tools and advanced fabrication technologies has redefined the potential of glass in the built environment. From parametric façade systems to dynamic glazing solutions, stakeholders are leveraging unprecedented capabilities to optimize daylighting, thermal control, and visual comfort. This fusion of form and function has elevated glass to a strategic asset, driving collaboration between architects, engineers, and material scientists to push the boundaries of what is feasible.

Consequently, understanding the multifaceted drivers of demand-spanning regulatory catalysts, technological breakthroughs, and shifting end-user preferences-is essential for industry participants seeking to navigate the evolving marketplace. This introduction lays the groundwork for a comprehensive exploration of the key dynamics, transformative trends, and strategic imperatives shaping the future of construction glass.

Unveiling the Technological Innovations and Sustainability-Driven Evolutions Revolutionizing the Construction Glass Landscape for Enhanced Performance

The construction glass sector has witnessed a series of transformative shifts that are redefining its competitive landscape and expanding the scope of applications. Notably, the integration of smart glazing technologies-such as electrochromic and thermochromic systems-has introduced adaptive façades that regulate solar infiltration and enhance occupant comfort. These innovations not only reduce reliance on mechanical HVAC systems but also open avenues for digital building management platforms to harness real-time data for performance optimization.

In parallel, sustainably sourced materials and circular economy principles are gaining momentum, prompting manufacturers to explore low-carbon cullet recycling, bio-based coatings, and closed-loop production processes. This sustainability drive is further amplified by collaborations across the value chain, with architects and developers demanding transparency in life-cycle assessments and end-of-life recyclability. As a result, the industry is transitioning from linear supply models toward more resilient and resource-efficient configurations.

Furthermore, the proliferation of Building Information Modeling and prefabrication methodologies has streamlined project delivery timelines and enhanced precision in glass fabrication. Off-site manufacturing coupled with automated quality controls ensures tighter tolerances and reduced waste, while digital twins facilitate performance simulations ahead of installation. Together, these evolutions underscore a paradigm shift in which technological convergence and environmental stewardship catalyze the next wave of growth.

Assessing the Far-Reaching Consequences of 2025 U S Tariff Measures on Supply Chains, Material Costs, and Industry Competitiveness

The imposition of tariffs by the United States in 2025 has exerted a profound influence on the procurement strategies and cost structures within the construction glass supply chain. By levying duties on both raw materials and finished glass imports, these measures have prompted manufacturers to reassess sourcing geographies and deepen engagement with domestic suppliers. As a result, glass producers have accelerated investments in localized furnace capacity and supply partnerships to mitigate the impact of increased import expenses.

This shift in procurement dynamics has also reverberated downstream, affecting fabricators and installers who face elevated glass prices and extended lead times. In response, many stakeholders are exploring alternative material blends and optimizing panel configurations to balance performance requirements with budget constraints. Additionally, collaborative contracts and long-term supply agreements have gained prominence as means to secure cost predictability and inventory stability.

Moreover, the tariff environment has stimulated innovation in raw material substitution and process efficiencies, as manufacturers strive to offset duty-related cost inflation. From developing hybrid glass composites that utilize higher proportions of recycled cullet to adopting advanced coating processes that enhance thermal performance, the industry’s adaptive measures underscore a commitment to preserving competitiveness amid evolving trade policies.

Understanding Diverse Material, Type, Process, Channel, Application, and End-User Segments Shaping Tailored Strategies Within the Construction Glass Domain

Deep analysis of raw material segmentation reveals that aluminosilicate substrates are increasingly favored for their thermal resilience, while borosilicate variants offer superior chemical durability in specialized applications. At the same time, traditional soda lime remains the baseline for float and insulated glass units, and lead glass retains niche relevance in radiation shielding and industrial contexts. These substrate dynamics inform material selection decisions throughout the value chain, with performance attributes and cost considerations guiding specifier preferences.

Exploring type-based segmentation highlights the ascendancy of coated glass, particularly in low-emissivity formulations that meet stringent energy codes and anti-glare variants designed for high-occupancy spaces. Reflective coatings are resurging in commercial high-rises where solar heat gain control is paramount. Meanwhile, insulating glass units-ranging from double to triple glazing-continue to dominate façades seeking optimal U-values, and laminated solutions incorporating PVB or SGP interlayers are prized for acoustic attenuation and safety performance. Tinted glass retains relevance for aesthetic differentiation and solar management, particularly in hospitality and retail developments.

Process-centric segmentation underscores the pivotal role of tempering technologies-both heat-soaked and chemically strengthened-in achieving the high-strength requirements of structural glazing. Coating innovations, encompassing both physical vapor deposition and chemical vapor deposition techniques, enable advanced functionalities such as self-cleaning and switchable transparency. Laminating processes leveraging EVA and PVB interlayers further enhance impact resistance and post-breakage integrity, while bending capabilities permit the realization of complex curved geometries that define contemporary architectural statements.

Distribution channel segmentation demonstrates that offline sales channels, through a network of retailers and wholesalers, remain critical for project-based procurement, whereas online platforms-spanning manufacturer websites and leading e-commerce portals-are unlocking new direct-to-consumer niches. Each channel’s logistical footprint and service offerings shape the buyer experience and underscore the need for omnichannel strategies.

Finally, application segmentation delineates the distinct requirements of curtain walls and structural glazing systems in façades, furniture and partition glazing within interiors, and the performance-driven designs of casement, fixed, and sliding units in windows and doors. End-user segmentation further differentiates commercial offices and retail spaces from industrial energy and manufacturing facilities, as well as residential multi-family and single-family dwellings, each with their unique regulatory, thermal, and acoustic imperatives.

This comprehensive research report categorizes the Construction Glass market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Raw Material

- Type

- Process

- Distribution Channel

- Application

- End User

Deciphering Regional Nuances from Americas to Asia-Pacific That Drive Demand Patterns, Regulatory Frameworks, and Growth Opportunities in Construction Glass

Regional nuances are shaping the construction glass narrative in distinct ways. In the Americas, sustainability certifications and energy efficiency incentives are propelling demand for high-performance glazing solutions. The region’s mass timber and modular construction trends further necessitate lightweight composite glass systems that align with carbon reduction objectives, reinforcing a commitment to innovation in building materials.

Across Europe, the Middle East, and Africa, heritage preservation requirements and stringent EU energy directives are driving retrofitting initiatives that prioritize upgradeable glazing units over full-scale façade replacements. In the Gulf Cooperation Council nations, rapid urbanization continues to fuel high-rise developments, while in Africa, infrastructure and industrial projects are creating pockets of emerging demand for functional glass in manufacturing and energy facilities.

Asia-Pacific stands at the forefront of high-density urban growth, with megacity expansions in China and Southeast Asia demanding advanced solar control glass and smart façades to mitigate climatic extremes. Furthermore, government-led green building frameworks in Australia and New Zealand are accelerating the adoption of dynamic glazing technologies, catalyzing a regional ecosystem increasingly attuned to climate-responsive design.

This comprehensive research report examines key regions that drive the evolution of the Construction Glass market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players’ Strategic Initiatives, Competitive Positioning, and Innovation Pipelines Redefining the Competitive Construction Glass Arena

Leading industry players are fortifying their positions through a combination of strategic partnerships, R&D investments, and forward-looking sustainability roadmaps. Vertically integrated manufacturers are leveraging upstream raw material control to enhance supply chain visibility and cost stability, while specialized coating firms are forging alliances with technology providers to co-develop next-generation glazing solutions.

In addition, market frontrunners are differentiating through digital service offerings, including online specification tools and performance simulation platforms that streamline the design process. These value-added services not only foster customer loyalty but also generate data insights that inform continuous product refinement. Meanwhile, midmarket players are capitalizing on niche segments-such as architectural heritage restoration and high-end residential projects-by offering bespoke glass configurations and expedited delivery models.

Moreover, emerging entrants are focusing on sustainability certifications and localized manufacturing footprints to cater to region-specific regulatory requirements. By aligning product portfolios with green building standards and optimizing logistics networks, these companies are carving out competitive advantages in an increasingly fragmented marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Glass market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Group

- Asahi Glass Co., Ltd.

- Central Glass Co., Ltd. by Evotec SE

- Corning Incorporated

- Fuyao Glass America

- GIBCA Group of Companies

- GSC GLASS LTD.

- Guardian Industries Corp. by Koch Industries, Inc.

- Jinjing Group Co., Ltd.

- Kopp Glass, Inc.

- McGrory Glass, Inc.

- Nippon Sheet Glass Co., Ltd.

- O-I Glass, Inc.

- Obeikan Investment Group

- Pegasus Glassworks, Inc.

- Pella Corporation

- PPG Industries, Inc.

- S.A. Bendheim Co., Inc.

- Saint-Gobain S.A.

- Schott AG

- Sejal Glass Ltd.

- Technical Glass Products Inc.

- Viracon by Apogee Enterprises, Inc.

- VITRO Flat Glass LLC

- Şişecam by Sisecam Chemicals Wyoming

Charting Proactive Strategies and Best Practices that Industry Leaders Can Implement to Capitalize on Emerging Trends and Navigate Market Challenges

To navigate the evolving landscape and secure a competitive foothold, industry leaders should prioritize investment in smart glazing technologies that align with digital building management systems, thereby unlocking new value propositions in the operational phase of assets. Furthermore, strengthening ties with domestic raw material suppliers can mitigate tariff-related risks and reduce supply chain vulnerabilities by promoting localized production hubs.

Simultaneously, companies would benefit from expanding omnichannel distribution strategies, integrating offline expertise with digital platforms to enhance customer reach and service flexibility. In tandem, collaborating with architectural and engineering consultancies on pilot projects can accelerate validation of advanced coatings and façades, fostering early adoption and establishing demonstrable case studies.

Finally, embedding sustainability metrics into product development cycles-through life-cycle assessments and circularity initiatives-will meet rising regulatory and corporate governance requirements. By prioritizing eco-design principles and transparent reporting, organizations can cultivate brand equity and resonate with end users who increasingly demand environmentally responsible building materials.

Illustrating the Rigorous Multi-Source Research Framework, Data Collection Processes, and Analytical Techniques Underpinning the Comprehensive Market Study

The research underpinning this report draws upon a meticulously structured methodology that integrates primary and secondary data sources to ensure comprehensive market understanding. Expert interviews with C-suite executives, façade consultants, and facility managers provided qualitative insights into adoption drivers, pain points, and future priorities. At the same time, extensive secondary research included industry association publications, trade journals, and regulatory documents to validate market drivers and technological trajectories.

Quantitative data collection involved analyzing company financial statements, procurement records, and global trade databases to map supply chain flows and material pricing trends. A rigorous process of data triangulation was applied, cross-referencing multiple independent sources to resolve discrepancies and reinforce the credibility of findings. Statistical techniques, including trend analysis and comparative benchmarking, further contextualized the relative performance of market segments and regional markets.

This blended approach ensures that the report delivers actionable intelligence grounded in real-world insights, enabling stakeholders to make informed decisions with confidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Glass market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Glass Market, by Raw Material

- Construction Glass Market, by Type

- Construction Glass Market, by Process

- Construction Glass Market, by Distribution Channel

- Construction Glass Market, by Application

- Construction Glass Market, by End User

- Construction Glass Market, by Region

- Construction Glass Market, by Group

- Construction Glass Market, by Country

- United States Construction Glass Market

- China Construction Glass Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3339 ]

Synthesizing Core Findings and Strategic Implications to Empower Stakeholders with Insights for Informed Decision-Making in the Construction Glass Sector

The synthesis of key findings illustrates a market in the midst of rapid evolution, driven by regulatory imperatives, technological breakthroughs, and shifting supply chain paradigms. Smart glazing, circular economy principles, and robust domestic production models emerge as pivotal themes guiding the next phase of industry growth. Moreover, segmentation analysis underscores the need for nuanced strategies that address diverse substrate properties, coating functionalities, and performance requirements across verticals.

Regional insights highlight the differentiated demand landscapes from the Americas to Asia-Pacific, emphasizing the importance of tailored go-to-market approaches that align with local regulations, environmental objectives, and construction practices. Competitive analysis further reveals that success will hinge on strategic partnerships, digital service integration, and sustainability leadership.

Ultimately, stakeholders who embrace innovation, cultivate resilient supply chains, and proactively respond to evolving end-user needs will be best positioned to capitalize on the unfolding opportunities in the construction glass sector.

Engaging with Ketan Rohom to Secure Full Market Intelligence and Unlock Competitive Advantages through the In-Depth Construction Glass Research Report

To unlock the full breadth of analysis and empower your strategic initiatives, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His specialized knowledge and hands-on experience in the construction glass domain will guide you through customized insights that address your company’s unique opportunities and challenges. Seize the opportunity to secure this definitive market research report and harness actionable intelligence to elevate your competitive strategy and drive sustained growth.

- How big is the Construction Glass Market?

- What is the Construction Glass Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?