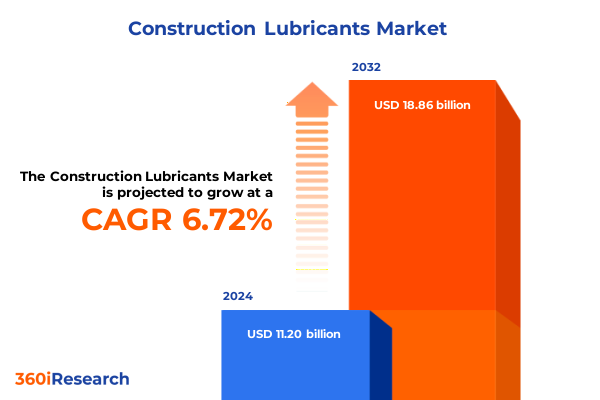

The Construction Lubricants Market size was estimated at USD 11.94 billion in 2025 and expected to reach USD 12.73 billion in 2026, at a CAGR of 6.74% to reach USD 18.86 billion by 2032.

Unveiling the Modern Trends Shaping the Construction Lubricants Market and Their Strategic Importance for Infrastructure Efficiency and Durability

The construction lubricants sector has entered a transformational era where the convergence of industry demands, sustainability mandates, and technological advances is reshaping the fundamentals of market competition and product development. As infrastructure projects worldwide ramp up in scale and complexity, the demand for specialized lubricants that ensure equipment longevity, operational efficiency, and regulatory compliance has never been more pronounced. Stakeholders must now navigate an environment that calls for not only superior performance characteristics-such as high-temperature stability, enhanced wear resistance, and eco-compatibility-but also adherence to increasingly stringent environmental guidelines.

Against this backdrop, market participants across the value chain are accelerating their focus on innovative formulations that leverage bio-based additives, advanced polymer matrices, and nanotechnology-enhanced friction modifiers. Simultaneously, the push for digitalization is giving rise to smart lubrication systems that integrate sensors and real-time monitoring, enabling predictive maintenance and reducing unplanned downtime. In parallel, the shift toward circular economy principles is encouraging lubricant re-refining and the adoption of closed-loop supply models that minimize waste while preserving quality. This introduction frames the critical interplay of forces that are defining new benchmarks of performance, sustainability, and efficiency within the global construction lubricants landscape.

Understanding the Key Technological and Regulatory Transformations Driving Disruption and Growth in Construction Lubricant Applications Across Industries

The landscape for construction lubricants is undergoing transformative shifts driven by a triad of technological breakthroughs, regulatory evolution, and shifting end-user priorities. Technological innovation is most evident in the rapid adoption of sensor-enabled lubrication systems embedded with IoT capabilities. These systems deliver continuous data streams that inform predictive maintenance algorithms, thereby reducing the risk of catastrophic failures and optimizing equipment uptime. Additionally, advanced research into synthetic esters, polymer thickeners, and nano-additives is expanding the performance envelope of lubricants, enabling machinery to operate under more extreme pressure, temperature, and contamination scenarios.

Meanwhile, environmental regulations have tightened globally, with many jurisdictions imposing lower thresholds for volatile organic compound emissions, biodegradability requirements, and restrictions on hazardous constituents. These regulatory imperatives have prompted raw material suppliers to reformulate existing products and accelerate the development of next-generation bio-based and semi-synthetic alternatives. As a result, industry players are collaborating with chemicals innovators and academic institutions to expedite product approvals and certifications. Finally, contractors and heavy-equipment operators are increasingly valuing total cost of ownership metrics over simple purchase price; this paradigm shift is driving demand for high-performance lubricants that extend service intervals, reduce consumption volumes, and lower overall lifecycle costs. Together, these factors constitute a fundamental realignment of competitive dynamics in the construction lubricants market.

Analyzing the Broad and Cascading Effects of Recent United States Tariff Policies on Raw Materials and Supply Chains in the Construction Lubricants Sector

The implementation of new United States tariff policies in early 2025 has produced a cascading ripple effect throughout the construction lubricants supply chain. Raw materials such as base oils, specialty additives, and filler compounds have experienced variable duty adjustments, leading manufacturers to reassess sourcing strategies and cost structures. Some feedstocks previously imported at preferential rates now attract higher levies, directly impacting production economics. Consequently, North American producers have had to balance short-term price pass-throughs with longer-term investments in alternative raw material streams and domestic refining capabilities.

These tariff-induced shifts have also influenced distribution agreements, particularly for products dependent on cross-border logistics. Distributors and equipment OEMs are renegotiating contracts to mitigate margin erosion, exploring joint optimization of warehousing networks, and diversifying supplier portfolios to reduce dependency on any single region. At the same time, service centers and end users are recalibrating maintenance schedules to maximize existing lubricant reserves before anticipated price surges. Despite the initial cost pressures, the tariffs have stimulated greater vertical integration among select manufacturers, who are now investing in proprietary additive plants and recycling facilities. This evolution suggests a long-term trend toward self-sufficiency, supply chain resilience, and strategic agility in response to shifting trade landscapes.

Delving into Critical Market Segmentation Perspectives to Reveal Comparative Strengths in Product Types Applications and Distribution Channels for Lubricants

In dissecting the market through a product-type lens, grease formulations continue to command attention for their ability to maintain viscosity under heavy loads and resist water washout, while metalworking fluids distinguish themselves with precision cooling and chip evacuation capabilities in machining operations. Oils remain the most diverse category, encompassing compressor oils engineered for high compression ratios, gear oils optimized for extreme-pressure applications, and hydraulic oils designed to deliver consistent performance across variable thermal and pressure conditions. Recognizing these functional disparities allows manufacturers to tailor offerings that directly address equipment-specific wear challenges and maintenance protocols.

From an application standpoint, cooling lubricants have emerged as critical enablers in high-speed drilling and cutting processes, leveraging advanced heat transfer properties to sustain performance under thermal stress. Corrosion protection lubricants, incorporating inhibitory chemistries, are indispensable for safeguarding metal surfaces in humid or marine environments where oxidative degradation can occur rapidly. Traditional lubrication fluids form the core necessity across moving components such as pins, bushings, and track rollers, demanding formulations that simultaneously reduce friction and prolong service intervals.

When evaluating distribution channels, direct sales channels facilitate closer collaboration between producers and large-scale end users, driving customized service packages and bulk procurement efficiencies. Distributor networks-both independent and OEM affiliated-offer expansive reach into tiered dealer systems and after-sales service points, ensuring availability and technical support in remote projects. Online sales platforms are gaining traction as digital ordering simplifies transaction workflows for smaller contractors and rental fleets, often bundling real-time inventory visibility with expedited delivery options. These segmentation insights illuminate where strategic investments in formulation, service, and go-to-market approaches will yield the greatest returns.

This comprehensive research report categorizes the Construction Lubricants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Sales Channel

- Application

Exploring Regional Market Variations and Strategic Opportunities across the Americas Europe Middle East Africa and Asia Pacific Construction Lubricants Landscape

Across the Americas, infrastructure modernization initiatives and robust public spending on transportation and energy projects are driving heightened demand for specialized lubricants that maximize equipment uptime in both urban construction and remote resource extraction. Latin American markets, in particular, are witnessing increased adoption of mid-tier synthetic oils and biodegradable greases to meet environmental mandates and support rugged operational conditions prevalent in mining and oilfield applications.

In Europe, the Middle East, and Africa, regulatory frameworks are among the most stringent, with Europe leading in circular economy adoption for lubricant re-refining and strict biodegradability standards. Middle Eastern markets rely heavily on high-performance oils for heavy-industry and oil-and-gas equipment, while North African infrastructure projects necessitate corrosion protection formulations capable of withstanding saline air and high humidity. Sub-Saharan Africa’s nascent construction sector is gradually integrating advanced lubricant solutions, driven by partnerships between international OEMs and local distributors.

Within Asia-Pacific, the rapid urbanization of Southeast Asian cities and large-scale infrastructure investments in India and China have spurred aggressive procurement of next-generation hydraulic fluids and gear lubes. Australia and New Zealand show a growing preference for green formulations that align with sustainability targets and offset stringent environmental regulations. Meanwhile, emerging economies in the Pacific Islands are establishing distribution hubs to improve access to lubricants that meet both performance and ecological criteria. Understanding these regional dynamics allows market participants to calibrate product portfolios and channel strategies in alignment with local operational and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Construction Lubricants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Strategic Partnerships Innovations and Competitive Advantages Defining the Construction Lubricants Market Ecosystem

Leading companies in the construction lubricants arena are differentiating through strategic partnerships, targeted R&D investments, and integrated service offerings. Major multinational chemical manufacturers leverage extensive additive portfolios and global distribution networks to introduce advanced synthetic and bio-based product lines tailored for high-demand applications. Mid-sized specialty lubricant firms, in turn, focus on niche segments-such as biodegradable greases or ultra-high-viscosity gear oils-where they can exercise greater pricing power and technical agility.

Collaborations between lubricant suppliers and OEMs have become increasingly prevalent, resulting in co-branded products that carry performance guarantees and optimized maintenance schedules. This trend underscores the competitive imperative of offering end-to-end solutions rather than standalone fluid products. Meanwhile, independent service providers and lubricant re-refiners are forging alliances with equipment rental companies and regional distributors to capture incremental value through field services, condition monitoring, and closed-loop reclamation programs.

Start-ups and chemical innovators are also gaining traction by introducing disruptive technologies, such as nanoparticle-enhanced friction reducers and enzyme-based corrosion inhibitors, which promise to extend equipment life and reduce lifecycle costs. These entrants often partner with academic institutions or pilot programs to validate performance, subsequently scaling production through contract manufacturing partnerships. Taken together, these initiatives reflect a marketplace that rewards both deep technical expertise and collaborative go-to-market strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Lubricants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ADDINOL Lube Oil GmbH

- Berg Chilling Systems Inc.

- Boss Lubricants

- Brit-Lube Ltd.

- Calumet Branded Products, LLC

- Chevron Corporation

- CONDAT

- D-A Lubricant Company

- Eni S.p.A.

- Exxon Mobil Corporation

- FUCHS Group

- Gulf Oil Lubricants India Limited

- Highline Warren, LLC.

- Hyundai Construction Equipment Co., Ltd.

- Indian Oil Corporation Ltd.

- KLONDIKE Lubricants Corporation

- Kuwait Petroleum (Belgium) N.V.

- Leahy-Wolf Company

- LIQUI MOLY GmbH

- Morris Lubricants Online

- Penrite Oil Co. Pty. Ltd.

- PETRONAS Lubricants International Sdn. Bhd.

- Petro‐Canada Lubricants Inc.

- Phillips 66

- RBM Oil Corporation

- Schaeffer Manufacturing Co.

- Shell PLC

- Tata Hitachi Construction Machinery Company Private Limited

- TotalEnergies S.A.

- TotalEnergies SE

- Trent Oil Lubricants

- Valvoline Inc.

- YORK SAS

Providing Targeted Strategic Imperatives and Action Plans for Construction Sector Stakeholders to Capitalize on Emerging Lubricant Market Opportunities

Industry leaders should prioritize investments in sustainable formulation technologies to meet evolving environmental regulations and end-user sustainability goals. By accelerating the development and certification of bio-based esters, vegetable oil derivatives, and fully biodegradable greases, companies can establish first-mover advantage in high-growth green segments. Furthermore, forging innovation partnerships with additive specialists and materials science research centers will expedite product validation cycles and enrich intellectual property portfolios.

To enhance supply chain resilience, stakeholders must diversify raw material sourcing through a dual-sourcing strategy that blends domestic feedstock production with selective imports. In tandem, expanding in-region refining or blending capacity reduces exposure to trade fluctuations and enables faster responsiveness to market shifts. Integrating digital platforms for real-time inventory monitoring and predictive ordering will also elevate service levels and optimize working capital across distribution networks.

On the go-to-market front, embracing a consultative sales model that bundles technical support, condition monitoring services, and customized maintenance plans can differentiate offerings and deepen customer loyalty. Training distributor partners on value-based selling and fluid analysis interpretation will further amplify reach and reinforce technical credibility. By executing these strategic imperatives, industry leaders can capture incremental market share, improve margins, and fortify their positions against both economic volatility and competitive disruption.

Describing the Comprehensive Research Framework Methodologies Data Sources and Analytical Techniques Underpinning the Construction Lubricants Market Assessment

The research underpinning this analysis drew upon a multi-faceted methodology combining primary qualitative interviews, secondary data compilation, and proprietary analytical frameworks. Primary insights were obtained through in-depth conversations with executive leadership from lubricant manufacturers, OEM maintenance managers, distribution channel executives, and end-user procurement specialists across key geographic regions. These firsthand perspectives informed trend validation and enriched context around technological adoption and regulatory impacts.

Secondary sources included peer-reviewed journals on tribology and materials science, industry publications tracking sustainability regulations, government trade and tariff databases, and financial disclosures from publicly listed sector participants. Data triangulation between independent market trackers and regional trade associations ensured a balanced representation of competitive dynamics and supply chain developments. The analytical framework employed scenario planning techniques to assess the ramifications of tariff changes, segmentation analysis to identify high-potential product and channel combinations, and regional prioritization matrices to align strategic focus areas.

Finally, the study incorporated cross-validation workshops with subject-matter experts to refine assumptions and stress-test findings under varying macroeconomic and geopolitical conditions. This rigorous approach guarantees that the conclusions and recommendations presented herein are grounded in both quantitative evidence and qualitative expertise, offering decision makers a robust foundation for strategic planning in the construction lubricants domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Lubricants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Lubricants Market, by Product Type

- Construction Lubricants Market, by Sales Channel

- Construction Lubricants Market, by Application

- Construction Lubricants Market, by Region

- Construction Lubricants Market, by Group

- Construction Lubricants Market, by Country

- United States Construction Lubricants Market

- China Construction Lubricants Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Synthesizing Key Takeaways and Strategic Insights to Inform Decision Making and Guide Future Endeavors in the Evolving Construction Lubricants Sector

The insights distilled throughout this executive summary underscore a market at the nexus of performance innovation, sustainability pressures, and evolving trade dynamics. Technological advances such as smart lubrication systems and next-generation synthetic chemistries are redefining standards for equipment uptime and operational efficiency. Simultaneously, new tariff structures are accelerating supply chain reconfiguration, prompting manufacturers to bolster local refining capabilities and diversify sourcing strategies.

Segmentation analysis reveals that product-type differentiation-across grease, metalworking fluids, and multifunctional oils-coupled with application-specific performance requirements and channel optimization will be pivotal in capturing value. Regional variances further highlight the need for adaptive strategies; while mature markets emphasize biodegradability and re-refining, emerging economies prioritize robust performance in challenging environments.

Ultimately, companies that align sustainable innovation with resilient supply chains and consultative go-to-market models are best positioned to thrive. By leveraging the research methodologies and actionable recommendations outlined in this summary, stakeholders can navigate uncertainties and seize growth opportunities. The conclusion reaffirms the imperative for data-driven decision making and strategic collaboration as the industry moves into its next chapter of transformation.

Engaging Decision Makers with a Direct Opportunity to Acquire a Comprehensive Construction Lubricants Market Research Report through Expert Consultation

To explore the full depth of the construction lubricants market and secure strategic insights tailored to your organization’s goals, reach out directly to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Ketan is equipped to guide you through customized research deliverables, answer your specific inquiries, and facilitate a seamless acquisition of the comprehensive market report that will empower your decision-making and accelerate your competitive advantage in this dynamic sector

- How big is the Construction Lubricants Market?

- What is the Construction Lubricants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?