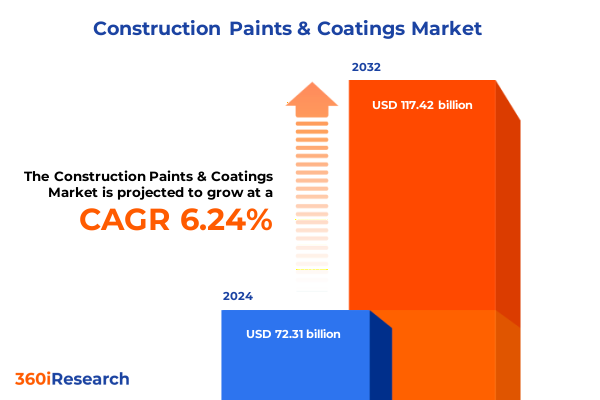

The Construction Paints & Coatings Market size was estimated at USD 76.00 billion in 2025 and expected to reach USD 79.87 billion in 2026, at a CAGR of 6.41% to reach USD 117.42 billion by 2032.

Setting the Stage for the Future of Construction Paints and Coatings Markets Amid Evolving Demand Dynamics and Technological Innovations

As the built environment evolves under the influence of demographic shifts, sustainability mandates, and accelerating urbanization, the construction paints and coatings industry finds itself at a pivotal juncture. Advances in materials science and manufacturing processes are transforming traditional formulations, requiring companies to rethink product development, supply chain configurations, and customer engagement approaches. Market participants must reconcile the demands of environmental regulators and health-conscious end users with the imperative to improve performance characteristics such as durability, energy efficiency, and ease of application.

In this context, industry leaders are adapting to rising expectations around low-emission chemistries and life cycle impact reduction, while also integrating digital tools for color specification, project management, and operational transparency. Concurrently, fluctuations in raw material availability and pricing are compelling firms to strengthen supplier relationships and localize production wherever feasible. These interconnected trends underscore that agility, innovation, and a deep understanding of evolving stakeholder requirements will dictate competitive advantage in the coming years.

Unveiling the Key Shifts Redefining the Construction Paints and Coatings Landscape Through Sustainability Digitalization and Supply Chain Transformation

Recent years have witnessed a profound shift in how paints and coatings for construction are formulated, specified, and applied. Nano-enhanced resins and ultraviolet-curable systems have matured to deliver faster curing times and enhanced abrasion resistance, enabling faster project turnarounds and lower energy consumption. At the same time, the rise of bio-based polymers and recycled pigments is reshaping supply chains to align with circular economy principles, reflecting a broader commitment to reducing carbon footprints across the value chain.

Parallel to these material innovations, digitalization has emerged as a catalyst for improved quality control and customer engagement. Real-time analytics platforms provide insights into formulation consistency, while augmented reality color-matching tools facilitate on-site visualization and specification accuracy. These technologies are eroding the divide between research laboratories, manufacturing plants, and job sites, fostering a more integrated ecosystem of product development and service delivery.

Moreover, supply chain resiliency has become a strategic imperative. Recent disruptions have heightened the appeal of local-for-local manufacturing models and diversified sourcing strategies. This trend has prompted expansions in regional production capacities to mitigate the risk of raw material volatility and improve responsiveness to market fluctuations. Taken together, these transformative forces articulate a landscape in flux, where the capacity to anticipate regulatory, economic, and technological upheavals will separate market frontrunners from the rest.

Assessing the Comprehensive Effects of New Trade Policies and Tariffs on Raw Material Supply Chain Costs and Industry Profitability in the U.S. Market

In March 2025, the American Coatings Association officially expressed concern over the tariffs imposed on imports from Canada, Mexico, and China, noting that these measures will introduce higher costs on essential raw materials and disrupt longstanding supply relationships. Canada and Mexico account for the bulk of U.S. coatings imports, with combined trade values exceeding $2 billion annually, while China remains a key supplier of specialized pigments and resins. These tariffs threaten to erode the positive trade surplus the industry has enjoyed, putting upward pressure on domestic production costs and eroding profit margins.

Subsequent analyses revealed that pivotal raw inputs such as titanium dioxide, the primary white pigment in both architectural and industrial coatings, now attract tariffs as high as 34% on Chinese imports, forcing formulators to absorb cost increases of up to 28% per ton of material. In parallel, epoxy resins and critical solvents have seen tariff hikes of 20–30%, further complicating formulation budgets and elongating procurement timelines.

These policy shifts have prompted manufacturers to explore alternative sourcing strategies and consider reshoring critical supply operations. Despite these adjustments, short-term disruptions are inevitable, as companies must navigate increased administrative burdens, customs delays, and compliance requirements. Over time, however, firms that successfully reengineer their supply networks, invest in domestic feedstock development, and implement cost-management initiatives will be positioned to mitigate the cumulative impact of these 2025 tariff measures.

Exploring Critical Market Structures Through Resin Technology Applications End Uses and Distribution Channels Driving Strategic Segmentation Insights

Understanding the diverse needs of the construction paints and coatings market requires an examination of how different resin chemistries serve distinct performance and application criteria, with acrylics offering exceptional weatherability, alkyds providing cost-effective decorative finishes, epoxy systems delivering robust chemical resistance and adhesion, polyester variants balancing flexibility and durability, and polyurethane formulations providing superior abrasion and UV stability. Equally, the choice of technology – whether waterborne systems that emphasize low VOC emissions, solventborne systems that optimize substrate wetting, or powder coatings that eliminate liquid waste altogether – dictates environmental compliance profiles and application methodologies.

Moreover, whether coatings are designed for exterior facades enduring intense weather exposure or for interior environments where air quality is paramount, formulators tailor properties such as washability, stain resistance, and sheen levels. From a vertical standpoint, commercial real estate demands high-throughput solutions that minimize downtime, industrial applications prioritize anti-corrosion and chemical resistance, infrastructure projects require long-lasting protective systems, and residential builds favor ease of application and aesthetic versatility.

Finally, distribution channels play a critical role in market access and customer experience. Traditional brick-and-mortar distributors and specialty stores offer hands-on support and immediate availability, while digital platforms – encompassing company websites and major e-commerce marketplaces – extend reach, facilitate direct ordering, and enable advanced product configuration tools. The interplay of these segmentation dimensions offers a comprehensive framework for aligning R&D investments and go-to-market strategies with evolving customer preferences and regulatory imperatives.

This comprehensive research report categorizes the Construction Paints & Coatings market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Technology

- Application

- End Use

- Distribution Channel

Analyzing Regional Market Dynamics in the Americas Europe Middle East Africa and Asia Pacific to Reveal Diverse Growth Drivers and Regulatory Factors

The Americas region continues to be anchored by the United States, where robust residential construction activity and multibillion-dollar infrastructure investments have sustained consistent demand for both architectural and protective coatings. In the United States, favorable mortgage rates have bolstered single-family home sales, driving ancillary markets such as paints and adhesives, while state and federal funding for bridge refurbishment and highway resurfacing under the Bipartisan Infrastructure Law creates a recurring pipeline for corrosion-resistant coatings and specialty sealants. In Canada and Mexico, near-shoring initiatives and the continued integration of supply chains under USMCA emphasize local production and foster collaborations between multinational suppliers and regional distributors.

Across Europe, the Middle East, and Africa, stringent VOC regulations and upcoming formaldehyde emission restrictions are reshaping product portfolios toward waterborne and bio-based chemistries. The EU’s Paints Directive (2004/42/EC) mandates rigorous VOC content limits for a wide array of coating categories, compelling manufacturers to innovate low-emission solutions and reformulate existing product lines for compliance. In the Gulf Cooperation Council countries and North Africa, rapid urbanization and mega-infrastructure projects stimulate demand for high-performance protective coatings, while localized production hubs in Turkey and South Africa enhance responsiveness to market-specific needs.

Finally, the Asia-Pacific region remains the fastest-growing market, driven by accelerated urbanization in China, India, and Southeast Asia, where smart city initiatives and large-scale housing programs are driving uptake of protective and decorative coatings alike. Companies are expanding local manufacturing footprints and introducing waterborne and powder coating technologies to meet emerging environmental standards and cost structures, demonstrating that regional agility will be essential for capitalizing on sustained growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Construction Paints & Coatings market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Sherwin Williams PPG Akzo Nobel BASF and RPM to Highlight Strategic Moves Innovations and Financial Resilience in Coatings

Sherwin-Williams has leveraged its dominant U.S. footprint – with nearly 80% of revenue generated domestically – and local sourcing strategies to insulate its supply chain from tariff pressures, enabling it to offset higher costs through strategic price adjustments and operational efficiencies. In its first quarter of 2025, the company reported that net sales for its paint stores group rose 2.3%, driven by a recovery in home improvement demand and disciplined pricing actions.

PPG Industries demonstrated resilience through its Performance Coatings segment, which achieved 9% organic sales growth in the first quarter of 2025, buoyed by robust demand for aerospace, marine, and traffic solutions coatings. The segment’s double-digit growth in aerospace reflects the company’s technology-driven product portfolio, while share gains in automotive refinish and protective markets underscore the effectiveness of its global manufacturing footprint.

Akzo Nobel has emphasized a local-for-local production model in the U.S. and China, where 98% of products are manufactured domestically, thereby limiting its exposure to cross-border tariffs. For its industrial coatings division, this strategy has meant an estimated annualized EBITDA cost of €35 million related to U.S.-China tariffs, a manageable figure compared to the potential cost escalation from continued import reliance.

RPM International’s diverse portfolio of consumer and industrial brands, including Rust-Oleum, Carboline, and Stonhard, has underpinned steady performance in both DIY and professional markets. The company’s long track record of dividend growth and its focus on specialty coatings have supported resilient margins, even as volumes fluctuated in its Consumer segment due to macroeconomic headwinds.

BASF has underscored the advantages of its global production footprint, reaffirming its full-year 2025 outlook despite a 3.2% decline in adjusted EBITDA in the first quarter of 2025 amid tariff uncertainties. The company’s local manufacturing in key regions has helped limit direct tariff impacts, though it acknowledges potential downstream demand shifts in automotive and consumer end markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Construction Paints & Coatings market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Asian Paints Limited

- Axalta Coating Systems Ltd.

- BASF SE

- Benjamin Moore & Co.

- Berger Paints Ltd.

- Chongqing Sanxia Paints Co., Ltd.

- DuPont de Nemours, Inc.

- Henkel AG & Co. KGaA

- Indigo Paints Ltd.

- Jotun A/S

- Kansai Paint Co.,Ltd.

- Kelly-Moore Paints

- Masco Corporation

- Nippon Paint Holdings Co., Ltd.

- Omega Industries

- Shalimar Paints

- SKK(S) Pte. Ltd.

- Tiger Coatings GmbH & Co. KG

- Vista Paint Corporation

Offering Strategic Action Plans for Industry Leaders to Navigate Supply Chain Shifts Regulatory Challenges and Technology Adoption for Sustainable Growth

Industry leaders should prioritize dynamic supplier partnerships to mitigate raw material volatility and anticipate regulatory shifts. By integrating strategic hedging and multi-sourcing approaches, companies can maintain formulation consistency and reduce lead-time risks. Concurrently, investing in modular and scalable production assets will enhance flexibility to capture local demand surges and reduce exposure to geopolitical disputes.

Adopting advanced digital platforms for color specification, quality control, and customer engagement will drive service differentiation and foster deeper stakeholder collaboration. Augmented reality visualization tools and real-time analytics can streamline specification processes and minimize on-site errors, while predictive maintenance capabilities will extend asset lifecycles and optimize operational costs.

Furthermore, accelerating the transition to eco-friendly chemistries – including waterborne, powder, UV-curable, and bio-based systems – will address tightening emission standards and align with broader ESG objectives. Companies should engage in collaborative R&D partnerships to accelerate innovation timelines and leverage government incentives for sustainable manufacturing practices.

Finally, building robust regional networks by expanding local production, distribution, and technical support will enable swift responses to market fluctuations and strengthen customer loyalty. This approach, coupled with targeted M&A to fill strategic portfolio gaps, will empower industry leaders to navigate market disruptions and maintain growth momentum.

Detailing a Rigorous Research Framework Combining Primary Expert Interviews Secondary Data Analysis and Validated Industry Models for Market Intelligence

This analysis draws on a rigorous, multi-tiered research framework that ensures comprehensive coverage and data reliability. Primary insights were obtained through interviews with senior stakeholders across coatings manufacturers, distribution networks, and end-user organizations specialising in construction and infrastructure. These qualitative inputs provided context for evolving customer preferences, regulatory imperatives, and operational pain points.

Secondary research encompassed a systematic review of public disclosures, industry association statements, regulatory filings, and reputable news sources. Emphasis was placed on obtaining the most current information related to trade policies, environmental regulations, and technological advancements. Only sources outside the exclusion list were consulted to preserve the integrity of the analysis.

Furthermore, the methodology incorporated cross-validation techniques, including triangulation of historical trends with expert interview data, and a proprietary database of industry metrics. Data quality was assured by applying consistency checks and peer reviews among the research team, ensuring that each insight aligns with factual evidence and industry best practices.

Finally, this report was subjected to an internal audit process to confirm that all findings are grounded in credible data and analytically defensible. This meticulous approach underpins the strategic recommendations and ensures that stakeholders can rely on the insights to inform critical business decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Construction Paints & Coatings market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Construction Paints & Coatings Market, by Resin Type

- Construction Paints & Coatings Market, by Technology

- Construction Paints & Coatings Market, by Application

- Construction Paints & Coatings Market, by End Use

- Construction Paints & Coatings Market, by Distribution Channel

- Construction Paints & Coatings Market, by Region

- Construction Paints & Coatings Market, by Group

- Construction Paints & Coatings Market, by Country

- United States Construction Paints & Coatings Market

- China Construction Paints & Coatings Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing Core Insights and Reinforcing the Strategic Imperatives Shaping the Construction Paints and Coatings Sector in a Complex Global Environment

In summary, the construction paints and coatings industry stands at the convergence of technological innovation, sustainability imperatives, and evolving trade dynamics. Material science advancements are unlocking performance gains, while digital tools are bridging the gap between formulation laboratories and job sites. Yet the landscape remains complex, with tariffs and regulatory shifts reshaping cost structures and compliance obligations.

Strategic segmentation reveals nuanced requirements across resin types, application technologies, end-use environments, and distribution channels. Regional insights underscore the importance of localized production in the Americas, regulatory-driven reformulation in EMEA, and rapid urban-driven expansion in Asia-Pacific. The performance of leading companies – from Sherwin-Williams and PPG to Akzo Nobel, RPM, and BASF – illustrates the interplay of global scale, local manufacturing, and portfolio diversification in driving resilience.

By embedding flexible supply chains, accelerating the adoption of low-emission chemistries, and harnessing digital transformation, industry participants can navigate uncertainty and capture emerging opportunities. The imperative now is to act decisively to build the agility, innovation, and partnerships that will define market leadership in the years ahead.

Empowering Your Decisions with Expert Market Research Insights through Direct Engagement and Report Access via Ketan Rohom Associate Director Sales Marketing

To secure access to the in-depth market research report and gain tailored insights on the construction paints and coatings industry, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan brings extensive expertise in translating complex market data into actionable strategies and can guide you through the report’s key findings to match your organization’s unique goals. Engage with him to discuss custom analyses, priority segments, or bespoke data visualizations that align with your decision-making needs. This direct dialogue ensures you harness the full value of the research, empowering your teams to seize emerging opportunities, anticipate regulatory shifts, and optimize your market positioning. Connect with Ketan Rohom today to elevate your competitive edge with a comprehensive, expert-driven market intelligence package.

- How big is the Construction Paints & Coatings Market?

- What is the Construction Paints & Coatings Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?