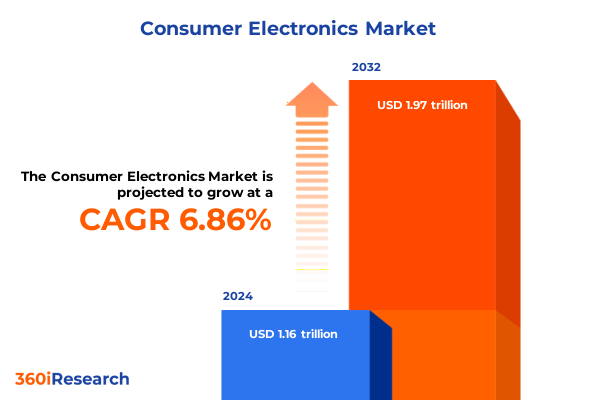

The Consumer Electronics Market size was estimated at USD 1.24 trillion in 2025 and expected to reach USD 1.31 trillion in 2026, at a CAGR of 6.87% to reach USD 1.97 trillion by 2032.

Unveiling Consumer Electronics Market Dynamics Through an Authoritative Lens to Inform Strategic Decision Making and Foster Innovation Across Digital Ecosystems

In an era defined by rapid technological advancement and shifting consumer expectations, understanding the nuances of the consumer electronics landscape has never been more critical. As devices become smarter, more interconnected, and ever more integral to daily life, businesses must navigate a landscape characterized by relentless innovation, immersive digital experiences, and intensifying competition. This section offers an authoritative opening, contextualizing the modern consumer electronics ecosystem and underscoring the imperative for data-driven decision making.

The evolution of devices from standalone gadgets to seamless elements within expansive digital ecosystems has redefined consumer engagement and loyalty paradigms. Companies that harness real-time analytics, agile supply chain operations, and user-centric design principles are positioned to capitalize on emerging trends and disrupt traditional market structures. By tracing the arc of market evolution-from the early days of standalone audio players through the proliferation of smartwatches and home automation-this introduction establishes a foundational understanding that underpins all subsequent analysis.

Evaluating Pivotal Technological and Consumer Behavior Shifts Reshaping the Competitive Terrain of Consumer Electronics in a Rapidly Evolving Digital Era

The consumer electronics sector stands at the confluence of several transformative currents that are collectively reshaping what devices look like, how they perform, and the manner in which consumers interact with technology. Advances in artificial intelligence and machine learning have enabled increasingly personalized user experiences, bringing predictive functionalities to everything from audio equipment to cameras. At the same time, sustainability considerations have driven the adoption of eco-friendly materials and energy-efficient designs, signaling a shift in procurement priorities for both manufacturers and end users.

Concurrently, the transition from product-centric to service-enabled offerings is redefining value propositions. Companies are bundling hardware with subscription-based software services, ensuring recurring revenue streams and deeper consumer engagement. This shift has been particularly pronounced in the smartphone and wearable categories, where connected platforms deliver ongoing updates, health insights, and entertainment ecosystems. Moreover, the proliferation of cloud gaming, virtual reality and immersive media is unlocking new revenue opportunities for television and gaming peripheral segments.

The rise of omnichannel commerce has also transformed distribution and marketing strategies. Consumers now expect seamless transitions between online and physical retail experiences, compelling manufacturers to integrate data capture across touchpoints and refine their direct-to-consumer channels. As a result, collaborative partnerships between technology innovators and retail leaders have become pivotal in driving product discovery, engagement and post-purchase support.

Assessing the Complex Interplay Between 2025 United States Tariff Adjustments and Supply Chain Dynamics in the Consumer Electronics Sector

In 2025, updated tariff policies implemented by the United States government have introduced multi-layered effects across the consumer electronics supply chain, affecting cost structures, supplier relationships, and go-to-market strategies. Increased duties on key components and finished goods have prompted manufacturers to reassess sourcing footprints, with some moving assembly lines closer to end markets while others pursue tariff engineering to maintain competitive pricing. Simultaneously, distribution partners have had to recalibrate inventory strategies to mitigate potential stock shortages and price volatility.

The cumulative impact of these measures has been uneven across product categories and channels. High-volume, price-sensitive segments such as entry-level smartphones and budget audio equipment have experienced margin pressure, driving some players to streamline feature sets or absorb part of the additional costs. Conversely, premium segments characterized by differentiated capabilities and brand prestige have demonstrated greater resilience, as discerning consumers exhibit a willingness to pay for cutting-edge performance and design.

From a strategic standpoint, collaboration between industry stakeholders-ranging from component suppliers to logistics providers-has become more critical than ever. Companies are leveraging advanced analytics to model tariff scenarios, optimize landed costs, and implement dynamic pricing strategies. As the regulatory environment continues to evolve, agility in procurement, clear communication with channel partners, and proactive scenario planning will distinguish market leaders from laggards.

Disentangling Market Segmentation Nuances to Illuminate Product Type Distribution Channels Price Range and End User Preferences for Strategic Targeting

A nuanced understanding of market segmentation is essential for companies seeking to tailor products, marketing strategies, and distribution models to distinct customer cohorts. Based on product type, the market encompasses categories such as audio equipment with its subsegments of headphones, soundbars and speakers; cameras spanning action models, DSLRs, mirrorless systems and point-and-shoot devices; laptops differentiated by operating systems including ChromeOS, macOS and Windows; and smartphones bifurcated between Android and iOS platforms. Similarly, tablets traverse Android, iOS and Windows ecosystems, while televisions vary across LED, OLED and QLED display technologies. Wearables complete this landscape with offerings like fitness trackers, head-mounted devices and smartwatches.

Distribution channel segmentation further refines go-to-market approaches. Offline retail comprises electronics specialists, hypermarkets and supermarkets as well as dedicated specialty stores, each demanding bespoke merchandising and training programs. By contrast, online retail has proliferated through direct-to-consumer brand websites, e-commerce platforms and third-party marketplaces, where seamless digital experiences and robust fulfillment networks drive customer satisfaction and repeat purchases.

Price range segmentation reveals three clear bands-budget, mid-range and premium-each with its unique consumer mindset and competitive benchmarks. Budget-conscious buyers often trade off advanced features for value, whereas mid-range consumers prioritize a balance of performance and affordability, and premium buyers seek state-of-the-art capabilities coupled with a strong brand narrative. End user segmentation bifurcates between consumer and enterprise demand, with consumer categories further distinguished by gamers pursuing high-performance hardware and home users seeking smart home integration. Enterprise requirements diverge between large corporations with scalable infrastructure needs and small to medium businesses that value cost efficiency and simplicity.

By weaving these segmentation dimensions together, companies can develop differentiated value propositions, anticipate channel-specific challenges, and deliver targeted messaging that resonates with each user profile.

This comprehensive research report categorizes the Consumer Electronics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Price Range

- Distribution Channel

- End User

Comparative Overview of Regional Market Characteristics Spanning the Americas Europe Middle East & Africa and Asia Pacific to Guide Expansion Strategies

Regional distinctions continue to play a decisive role in shaping consumer electronics market trajectories, each geography characterized by unique consumer behaviors, regulatory landscapes and competitive dynamics. In the Americas, strong demand persists for mobile connectivity, home entertainment upgrades and audio personalization, driven by tech-savvy populations in North America and expanding digital infrastructure across Latin America. Consumer expectations around device interoperability and service bundles have matured, compelling brands to tailor offerings to diverse economic and cultural contexts.

Moving eastward, Europe, the Middle East and Africa present a complex mosaic of markets where regulatory considerations around data privacy and environmental compliance intersect with rising digital adoption rates. European markets demonstrate a pronounced emphasis on sustainability credentials and modular product designs, while the Middle Eastern segment values luxury positioning and advanced connectivity solutions. In Africa, affordability and ruggedized form factors are prominent, reflecting the interplay of budget constraints and infrastructure variability.

The Asia-Pacific region stands out as a hotbed of innovation, with local champions driving fierce competition in smartphone upgrades, wearable health devices and next-generation display technologies. Rapid urbanization, increasing disposable incomes and strong government support for digital transformation have fueled adoption across both consumer and enterprise verticals. As regional ecosystems evolve, partnerships between global brands and local distributors or manufacturers are critical for navigating regulatory requirements and tapping into distinct consumption patterns.

This comprehensive research report examines key regions that drive the evolution of the Consumer Electronics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leading Players with Strategic Initiatives and Innovation Trajectories That Define Competitive Advantage in Consumer Electronics

Leading corporations in the consumer electronics space are pursuing multifaceted strategies to secure market share and reinforce brand loyalty. Technology-infused innovation remains at the core of these initiatives as companies invest heavily in research and development to pioneer next-generation form factors, battery technologies and artificial intelligence capabilities. Strategic alliances-from chipset co-development to content provider partnerships-are broadening value propositions and creating stickier ecosystems around flagship products.

Meanwhile, operational excellence programs are enhancing supply chain resilience and manufacturing agility, enabling rapid scaling of production in response to shifting demand curves. Many players are embracing nearshoring to mitigate tariff impacts and reduce lead times, while automation and predictive maintenance tools are lowering per-unit costs and boosting quality consistency. Sustainability commitments are also shaping corporate roadmaps, with companies pledging to increase the use of recycled materials, minimize packaging waste and improve energy efficiency throughout product lifecycles.

Marketing and sales leaders are adopting digital-first strategies that leverage data analytics to personalize campaigns, optimize customer journeys and deepen after-sales engagement. Subscription models spanning software updates, premium content and device protection plans are unlocking recurring revenue streams, while loyalty programs and experiential retail activations are fostering emotional connections with consumers. Taken together, these approaches underscore the holistic nature of modern competitive advantage, which extends far beyond product specifications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Consumer Electronics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apple Inc.

- BBK Electronics Corporation

- Canon Inc.

- Dell Technologies Inc.

- Fitbit LLC

- Garmin Ltd.

- GoPro, Inc.

- Haier Smart Home Co., Ltd.

- Hisense Co., Ltd.

- HP Inc.

- Huawei Technologies Co., Ltd.

- Lenovo Group Limited

- LG Electronics Inc.

- Nikon Corporation

- Panasonic Holdings Corporation

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Sony Group Corporation

- Toshiba Corporation

- Xiaomi Corporation

Formulating Practical Strategic Recommendations to Empower Industry Leaders in Navigating Technological Disruptions and Market Fluctuations Effectively

To thrive amid ongoing technological disruptions and geopolitical uncertainties, industry leaders must adopt a proactive, integrated strategic framework. First, enhancing supply chain visibility through digital twin simulations and blockchain-enabled traceability can safeguard against component shortages and tariff volatility while enabling real-time risk assessments. Simultaneously, diversifying sourcing strategies-by incorporating alternative suppliers and localized assembly sites-will reinforce operational resilience and buffer against sudden policy shifts.

Second, embracing modular design and over-the-air update capabilities can extend product lifecycles and reduce return rates, delivering both environmental benefits and improved customer satisfaction. By designing hardware platforms that support incremental feature rollouts, companies can sustain user engagement, drive incremental revenue and establish ongoing dialogues with end users.

Third, cultivating service ecosystems around core hardware offerings can foster recurring revenue and stickiness. Whether through subscription-based software suites, value-added content or integrated service bundles, companies that position themselves as holistic solution providers will outpace competitors focused solely on transactional sales. Developing intuitive mobile applications and cloud-native platforms will further enhance customer loyalty by delivering seamless cross-device experiences.

Finally, embedding sustainability as a strategic imperative-through ambitious circular economy programs, energy-efficient designs and transparent reporting-will resonate with increasingly conscious consumers and meet the evolving expectations of regulatory bodies. By integrating environmental, social and governance criteria into product development roadmaps, organizations can differentiate their brands while contributing to long-term industry viability.

Detailing Rigorous Research Methodology Employed to Ensure Comprehensive Data Accuracy Multi-Sourced Validation and Actionable Market Insights

This study draws upon a blend of primary and secondary research methodologies to ensure comprehensive, accurate and actionable insights. Primary research included in-depth interviews with senior executives across device manufacturers, component suppliers and retail distributors, as well as targeted surveys of end users in both consumer and enterprise segments. These engagements provided first-hand perspectives on evolving priorities, purchasing criteria and channel dynamics.

Secondary research encompassed a thorough review of regulatory filings, patent landscapes, academic publications and financial reports, complemented by an analysis of publicly available press releases and industry white papers. Proprietary data sources for supply chain shipments and e-commerce transaction volumes were leveraged to validate qualitative findings and discern emerging patterns at a granular level.

Quantitative data was synthesized using advanced statistical models to identify correlations between macroeconomic indicators, tariff structures and demand fluctuations. Scenario analysis was conducted to evaluate the impact of potential regulatory shifts, technological breakthroughs and competitive disruptions. Qualitative triangulation across multiple stakeholder viewpoints ensured that the final insights reflect a balanced and objective understanding of market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Consumer Electronics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Consumer Electronics Market, by Product Type

- Consumer Electronics Market, by Price Range

- Consumer Electronics Market, by Distribution Channel

- Consumer Electronics Market, by End User

- Consumer Electronics Market, by Region

- Consumer Electronics Market, by Group

- Consumer Electronics Market, by Country

- United States Consumer Electronics Market

- China Consumer Electronics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2544 ]

Synthesizing Key Findings to Deliver a Cohesive Market Narrative Emphasizing Core Trends Strategic Implications and Future Outlook

Throughout this report, key themes have emerged that illuminate the present and future contours of the consumer electronics industry. Technological convergence, characterized by interconnected devices and AI-driven personalization, stands out as a defining trend that will continue to reshape user expectations and product roadmaps. The strategic implications of geopolitical developments and tariff adjustments underscore the importance of supply chain agility and the imperative for diversified sourcing.

Segmentation analysis has revealed the multifaceted nature of demand, demonstrating that success hinges on delivering tailored value propositions that align with specific user profiles across product types, channels and price bands. Regional insights have highlighted the necessity for nuanced market entry strategies that consider regulatory complexities, infrastructure maturity and cultural preferences.

Leading companies are differentiating themselves through holistic approaches that combine product innovation with operational excellence, sustainability commitments and data-driven marketing. As the industry transitions toward service-oriented models, the ability to cultivate ongoing consumer relationships and monetize beyond initial hardware sales will emerge as a critical differentiator.

In sum, the interplay between technological innovation, regulatory headwinds and evolving consumer behaviors will define the next chapter of growth in consumer electronics. Organizations that integrate these insights into strategic planning and execution stand to unlock new opportunities and secure enduring competitive advantage.

Engaging Invitation to Collaborate with Ketan Rohom for Tailored Consumer Electronics Market Intelligence Solutions to Propel Your Strategic Initiatives

Are you ready to gain unparalleled clarity and strategic foresight in the consumer electronics domain? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report and unlock bespoke insights tailored to your business objectives.

Partnering with Ketan ensures you will receive expert guidance on report customization, strategic data interpretation, and priority support throughout your decision-making process. Elevate your market intelligence and accelerate your competitive edge by engaging with Ketan today. Secure your access to the definitive consumer electronics analysis that will inform your next breakthrough move and drive sustainable growth in an increasingly dynamic landscape.

- How big is the Consumer Electronics Market?

- What is the Consumer Electronics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?