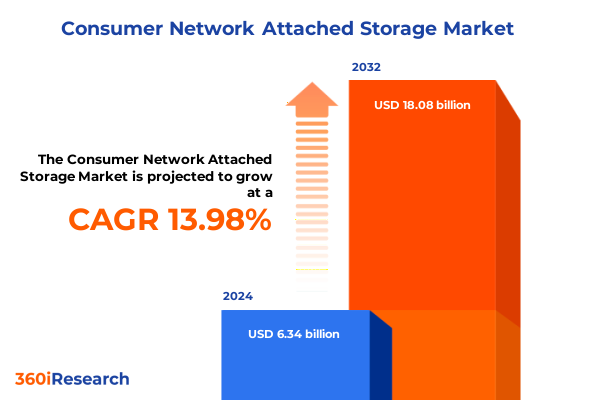

The Consumer Network Attached Storage Market size was estimated at USD 7.14 billion in 2025 and expected to reach USD 8.04 billion in 2026, at a CAGR of 14.18% to reach USD 18.08 billion by 2032.

Comprehensive Introduction Illuminating the Evolutionary Drivers and Market Dynamics Shaping the Future of Consumer Network Attached Storage

Consumer network attached storage has evolved into a cornerstone for digital content management in homes and small businesses, driven by an unprecedented surge in data generation. As media libraries expand, remote work becomes ubiquitous, and IoT devices proliferate across the connected landscape, end users demand seamless access, robust security, and scalable solutions. The contemporary consumer seeks not only capacity but also performance, aiming to consolidate backups, media streaming libraries, personal cloud directories, and surveillance footage under a unified, easy-to-manage infrastructure.

This introduction elucidates the moving parts reshaping the consumer NAS market, from hardware modularity to software-driven intelligence. As data volumes skyrocket, solutions have matured from simplistic home file servers to feature-rich appliances. Enhanced RAID configurations, automatic tiering between HDD and SSD, and integrated backup to cloud services mark the frontier of user expectations. Through this lens, stakeholders can appreciate how hardware vendors, software developers, and integrators coalesce to support today’s digital lifestyles and tomorrow’s smart homes.

Examining the Pivotal Technological Innovations and Emerging Consumer Behaviors Disrupting Established Consumer Network Attached Storage Paradigms

The consumer NAS landscape is experiencing transformative shifts, propelled by converging technological leaps and changing usage patterns. Edge computing paradigms are pushing data storage closer to devices, ensuring low-latency access for real-time applications such as home surveillance and VR media playback. Concurrently, AI-powered data indexing and search functionalities are redefining user interactions, allowing instantaneous retrieval of specific video clips or documents through intuitive interfaces. These advances are reshaping expectations for performance and simplicity in equal measure.

Moreover, the integration of hybrid cloud workflows is dissolving the boundaries between on-premises devices and public cloud platforms, enabling seamless migration of archives for disaster recovery or overflow storage. With virtualization features, select NAS models now support containerized applications, turning the appliance into a mini-data center capable of hosting lightweight services. These innovations are catalyzing a paradigm shift toward intelligent, multifunctional storage nodes that serve as the bedrock of the connected home ecosystem.

Analyzing the Aggregate Effects of the 2025 United States Tariff Adjustments on Supply Chains Cost Structures and Consumer Storage Choices

In 2025, newly imposed United States tariffs on select imported storage components have rippled through global supply chains, reconfiguring cost structures industry-wide. Manufacturers reliant on overseas assembly have grappled with increased inbound duties, prompting a reevaluation of sourcing strategies and localized production options. This realignment has driven some vendors to diversify their supplier base, securing alternative partners in tariff-free regions to maintain competitive pricing for consumer NAS units.

As cost pressures mount, end users are becoming increasingly price-sensitive, leading to a notable shift toward entry-level models and diskless configurations that let consumers source their own drives. At the same time, vendors are absorbing a portion of the tariff impact through optimized logistics and leaner packaging, preserving brand value and customer loyalty. Ultimately, the cumulative effect of these 2025 tariff adjustments underscores the resilience of the consumer NAS market but also highlights the importance of agile supply chain management.

Deriving Strategic Intelligence from Core Product, Enclosure, Drive Bay and Application Segment Dynamics Shaping the Consumer Network Attached Storage Spectrum

A nuanced examination of segment dynamics reveals distinct patterns across product offerings, enclosure types, bay configurations, and application use cases. In the sphere of product category, systems that ship with pre-installed disks continue to satisfy consumers seeking turnkey convenience, with high-capacity HDD preconfigured units offering affordability and SSD preconfigured variants delivering enhanced throughput. Conversely, diskless platforms appeal to enthusiasts who prefer to tailor their storage media, optimizing cost-to-performance ratios by selecting drives that align with their specific use requirements.

Turning to enclosure type, compact desktop devices remain the mainstay of home users valuing discreteness and silence, while rackmount form factors gain traction among prosumers assembling centralized closets for media distribution. Tower models bridge the gap between these extremes, providing expandable storage capabilities suitable for evolving needs. Drive bay count further differentiates offerings, with two bay systems attracting newcomers, four bay models striking a balance of capacity and redundancy, and six bay and above arrays addressing power users who require extensive storage pools for archives or multi-camera surveillance networks.

Application segmentation paints another layer of the landscape, where backup and recovery functions remain foundational, ensuring data integrity against hardware failure or accidental deletion. Media streaming deployments leverage built-in transcoding engines to serve diverse devices seamlessly, while personal cloud implementations furnish remote access with privacy assurances. Surveillance storage solutions, optimized for constant write workloads and high endurance, are increasingly preferred by smart home adopters seeking reliable video retention and rapid retrieval.

This comprehensive research report categorizes the Consumer Network Attached Storage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Enclosure Type

- Drive Bay Count

- Application

Uncovering the Diverse Growth Trajectories and Consumer Adoption Patterns Across the Americas Europe Middle East Africa and Asia Pacific Regions

Regional variations reflect divergent adoption curves and infrastructure maturity across three global markets. In the Americas, widespread broadband penetration and a strong DIY culture have accelerated uptake of desktop and tower NAS units, particularly among content creators and small office environments. Subscription services for remote backup and add-on apps bolster recurring revenue streams as consumers adopt storage appliances as the nexus for digital lifestyles.

In Europe, Middle East, and Africa, regulatory emphasis on data sovereignty and privacy has driven localized demand for personal cloud solutions, prompting manufacturers to embed enhanced encryption and compliance modules. Urban densification and shared living scenarios further spur demand for compact, quiet devices that cater to communal media libraries.

Meanwhile, Asia-Pacific markets exhibit rapid growth fueled by smart home initiatives and government-backed digital infrastructure programs. Rackmount and high-bay count systems are increasingly deployed in micro-data centers to serve multi-unit residential complexes, while surveillance storage with AI analytics capabilities emerges as a critical component of citywide security implementations. These regional patterns underscore how cultural, regulatory, and infrastructural elements converge to create diverse growth pathways.

This comprehensive research report examines key regions that drive the evolution of the Consumer Network Attached Storage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Participants Innovations Partnerships and Competitive Strategies in the Consumer Network Attached Storage Arena

Competitive dynamics in the consumer NAS market are marked by a mix of legacy storage vendors, network equipment specialists, and innovative startups. Incumbent manufacturers leverage deep channel ecosystems and established brand trust to introduce next-generation models, while networking companies enrich their portfolios by embedding NAS functionality into routers and mesh systems for all-in-one home solutions. Differentiation often centers on software ecosystems, where preloads of multimedia server capabilities, mobile backup tools, and third-party application marketplaces can tilt purchaser decisions.

Meanwhile, emerging challengers exploit nimbleness to deliver niche features such as integrated AI video analytics, hybrid NLMe caching architectures, or ultra-compact fanless designs. Strategic alliances between hardware providers and cloud service operators further blur the line between local and remote storage, enabling hybrid offerings that adapt to shifting consumer preferences. In this competitive environment, brand reputation, software support lifecycles, and the depth of partner integrations prove as pivotal as raw hardware specifications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Consumer Network Attached Storage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acer Incorporated

- ASUSTOR Inc.

- ASUS Tekcomputer Incorporated

- Buffalo Americas, Inc.

- Buffalo Inc

- Dell Technologies Inc.

- Drobo Inc.

- D‑Link Corporation

- Hewlett Packard Enterprise Company

- Lenovo Group Limited

- NEC Corporation

- Netgear Inc.

- QNAP Systems, Inc.

- Seagate Technology Holdings Public Limited Company

- StorCentric Inc.

- Synology Inc.

- TerraMaster Technology Co., Ltd.

- Thecus Technology Corporation

- Western Digital Corporation

- Zyxel Communications Corporation

Formulating Targeted Action Plans for Industry Executives to Capitalize on Emerging Trends and Navigate the Competitive Consumer NAS Landscape

To capitalize on prevailing trends, industry leaders should prioritize modular product roadmaps that accommodate both HDD and SSD preconfigurations while offering diskless flexibility for power users. Enhancing enclosure portfolios with a spectrum from two bay desktop units to scalable tower and rackmount arrays will address the full gamut of user segments. Additionally, tailoring drive bay counts to specific use cases-ranging from entry-level two bays for simple backups to high-density six bay and above systems for content professionals-will enable more targeted go-to-market campaigns.

Actionable strides include deepening integration with backup and recovery services, building in transcoding engines for seamless media streaming, and packaging personal cloud functions with intuitive mobile applications. Further, embedding hardened surveillance storage features such as circular recording and tamper alerts can unlock the security segment. Regionally, customizing software languages, compliance toolkits, and localized support will resonate with disparate markets in the Americas, EMEA, and APAC. Collectively, these recommendations form a blueprint for sustaining growth and capturing incremental share.

Describing the Rigorous Multifaceted Research Framework Data Validation and Analytical Techniques Underpinning the Consumer Network Attached Storage Study

This study employs a blend of primary and secondary research methodologies to ensure the veracity and depth of insights. Primary data was obtained through structured interviews with OEM decision-makers, channel partners, and end-user focus groups, complemented by questionnaires to capture preferences across product, enclosure, bay count, and application dimensions. Secondary sources included technical white papers, regulatory filings, industry journals, and publicly disclosed financial reports, enabling triangulation and validation of market perspectives.

Quantitative analyses involved correlating shipment statistics with broadband penetration rates and home automation adoption curves, providing a multi-layered view of demand drivers. Qualitative assessment of competitive positioning leveraged SWOT frameworks and partner ecosystem maps to contextualize strategic moves. Throughout the research, rigorous data cleaning procedures and cross-referencing protocols were applied to mitigate bias and ensure that conclusions reflect the current state of consumer network attached storage dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Consumer Network Attached Storage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Consumer Network Attached Storage Market, by Product Category

- Consumer Network Attached Storage Market, by Enclosure Type

- Consumer Network Attached Storage Market, by Drive Bay Count

- Consumer Network Attached Storage Market, by Application

- Consumer Network Attached Storage Market, by Region

- Consumer Network Attached Storage Market, by Group

- Consumer Network Attached Storage Market, by Country

- United States Consumer Network Attached Storage Market

- China Consumer Network Attached Storage Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Drawing Together Critical Insights and Visionary Perspectives to Conclude the Executive Assessment of the Consumer Network Attached Storage Market

This executive assessment has mapped the multifaceted evolution of consumer network attached storage, tracing technological innovations, tariff-induced market realignments, and granular segment and regional analyses. As end users demand ever greater integration between on-premises appliances and cloud ecosystems, the market’s trajectory hinges on the ability of vendors to fuse hardware flexibility with software intelligence. Sustained differentiation will stem from delivering turnkey experiences that align with specific applications-from home surveillance to personal cloud-while accommodating evolving performance expectations.

Moving forward, the competitive landscape will reward those who proactively address cost pressures, regional regulatory nuances, and user behavior shifts. The findings herein serve as a strategic compass, guiding decision-makers through a complex environment characterized by rapid innovation and dynamic consumer needs. With a clear understanding of segment and regional drivers, alongside robust company profiles, stakeholders are well positioned to chart a course that leverages emerging opportunities.

Engaging Decision Makers to Secure the Definitive Consumer Network Attached Storage Market Report Through Direct Consultation with the Associate Director of Sales and Marketing

Unlock unparalleled market intelligence and strategic advantage by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing. Benefit from a personalized consultation that outlines how this comprehensive report answers your organization’s unique challenges in consumer network attached storage. Secure detailed insights on market drivers, segmentation nuances, regional dynamics, and competitive strategies, all tailored to inform your next steps.

By contacting Ketan Rohom, you gain direct access to expert guidance on leveraging the full breadth of our research deliverables. Experience expedited delivery of critical data, exclusive briefing sessions, and customized executive summaries aligned with your business objectives. Don’t miss this opportunity to reinforce your decision-making with a resource designed for industry leaders ready to shape the future of storage solutions.

- How big is the Consumer Network Attached Storage Market?

- What is the Consumer Network Attached Storage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?