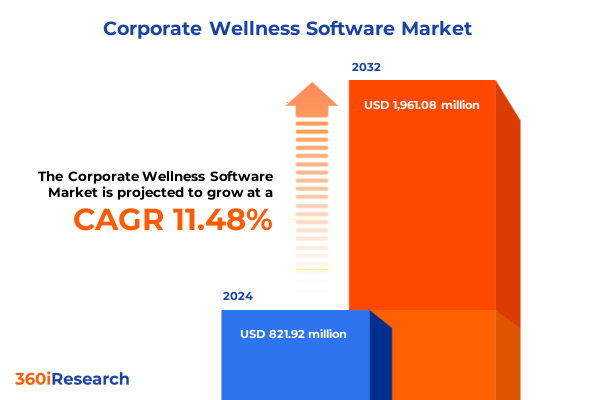

The Corporate Wellness Software Market size was estimated at USD 901.70 million in 2025 and expected to reach USD 993.50 million in 2026, at a CAGR of 11.73% to reach USD 1,961.07 million by 2032.

Discover How Corporate Wellness Software Is Shaping Executive Priorities And Organizational Outcomes In A Rapidly Evolving Health Landscape

In recent years, corporate wellness platforms have evolved beyond basic fitness tracking to offer sophisticated AI-driven interventions and holistic health management. Leading solutions now analyze real-time biometrics and work patterns to deliver personalized fitness plans that account for sleep quality, stress markers, and genetic predispositions. For example, AI-driven wellness coaches can generate individualized recovery and nutrition schedules based on continuous monitoring data, driving engagement and reducing burnout across the workforce. This shift towards data-driven personalization reflects a broader trend where employers leverage fitness trackers and smart wearables to inform mental health and nutrition strategies while proactively addressing employee well-being challenges.

Simultaneously, telehealth services embedded in wellness platforms offer on-demand access to counseling and medical consultations, empowering employees to seek care without logistical barriers. According to Accenture, 83% of employees now favor virtual health visits over in-person appointments, indicating strong demand for always-on corporate teleclinic capabilities. In this context, comprehensive mental wellbeing modules guide users through mindfulness exercises, meditation sessions, and cognitive behavioral techniques, contributing to a significant improvement in stress management and resilience. However, privacy remains a critical concern: a recent MIT study revealed that 58% of employees might decline AI-enabled wellness initiatives if personal health data is shared without clear consent.

Examine The Major Transformational Drivers Redefining Corporate Wellness Platforms And Their Integration Across Organizational Ecosystems

The corporate wellness landscape is undergoing a profound transformation shaped by digital immersion and human-centric leadership paradigms. Executives increasingly value empathy and inclusion as they guide AI-augmented teams, recognizing that emotional intelligence remains indispensable even as automation handles routine tasks. Organizations now prioritize health equity initiatives to ensure accessible wellness resources for diverse workforces, reflecting a broader commitment to inclusive well-being practices. Moreover, by retraining experienced professionals and acknowledging the value of older workers, companies foster a culture of continuous learning and sustainable health support across all career stages.

At the same time, the integration of wearable biometrics, AI-powered coaching, and virtual care is redefining how employees engage with wellness services. Personalized workout routines driven by smart algorithms and biometric feedback have become commonplace, while hybrid fitness experiences blend studio-quality on-site classes with interactive virtual sessions. Group fitness communities and gamified wellness challenges further bolster social cohesion, making health programs a dynamic part of corporate culture. By embracing these transformative drivers, organizations can elevate employee engagement, reinforce collective resilience, and position wellness as a strategic enabler of productivity and retention.

Explore The Comprehensive Implications Of Newly Implemented United States Tariffs In 2025 On Corporate Wellness Technology Adoption And Supply Chains

The wave of reciprocal tariffs introduced by the U.S. government in early 2025 has ushered in the highest import duties in decades, with baseline levies of 10% on medical and electronic imports and surcharges up to 50% for certain regions. As a result, corporate wellness providers are confronting elevated costs for key hardware components such as microchips, sensors, and wearables-inputs critical for fitness trackers and telehealth devices. Many importers have delayed passing costs onto end consumers, choosing to absorb tariff impacts to preserve competitive pricing, a dynamic echoed across multiple sectors including automotive and aerospace.

Amid the tariff turbulence, supply chain strategies are rapidly evolving, with organizations diversifying manufacturing footprints and exploring nearshore production options in Mexico and Southeast Asia to temper duty exposures. Cloud-based deployment models have concurrently gained appeal as software-centric solutions mitigate hardware import costs, prompting a marked shift away from capital-intensive on-premises investments. Nevertheless, analysts caution that indirect inflationary pressures-such as increased expenses for server and networking infrastructure-are likely to elevate operational budgets for wellness platforms. While pending trade agreements with the European Union and Japan may alleviate some pressures over time, the near-term environment underscores the critical need for agile sourcing and flexible technology architectures.

Uncover The Segmentation Insights Across Solution Type Deployment Patterns Organization Scales And Licensing Models Driving Tailored Wellness Solutions

Segmentation analysis reveals that solution type differentiation plays a pivotal role in shaping program outcomes and user engagement. Fitness tracking solutions span mobile applications that deliver on-demand workout guidance and wearable device integrations that capture continuous biometric data. Health risk assessment platforms combine biometric screenings, such as blood pressure and glucose monitoring, with structured questionnaire assessments to identify population health trends and personalized risk profiles. Meanwhile, mental wellbeing offerings integrate one-on-one counseling services with guided meditation modules to address emotional resilience and stress reduction. Nutrition management tools leverage calorie tracking algorithms alongside diet planning engines to inform individualized meal recommendations, and telehealth services enable both remote patient monitoring and real-time video consultations, bridging the gap between virtual care and traditional clinic interactions.

Deployment type further differentiates competitive positioning, with cloud-based models accelerating time-to-value and on-premises implementations emphasizing data sovereignty and granular security controls. Organization size also influences feature preferences: large enterprises often require comprehensive analytics dashboards and multi-hierarchy access controls, whereas small and medium enterprises tend to favor streamlined user experiences and cost-efficient solutions. Delivery model dynamics extend this stratification, as perpetual license agreements appeal to organizations with established budgets and static requirements, while subscription offerings attract those seeking scalability, continuous innovation, and reduced maintenance overhead.

This comprehensive research report categorizes the Corporate Wellness Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Delivery Model

- Organization Size

- Deployment Type

Delve Into The Regional Nuances And Strategic Imperatives Within The Americas Europe Middle East Africa And Asia Pacific Markets For Wellness Platforms

In the Americas, corporate wellness adoption remains most advanced, driven by substantial enterprise investments in integrated analytics platforms and wearable-enabled health initiatives. North American companies frequently pilot cross-functional wellness programs that combine virtual fitness challenges, telehealth consultations, and personalized coaching, reflecting a sophisticated approach to employee well-being that extends beyond traditional benefits. Early success stories from technology and financial services firms have catalyzed broader corporate commitments, with regional regulators also encouraging public-private partnerships to foster population health.

Europe, Middle East, and Africa present a complex tapestry of regulatory frameworks and wellness priorities. In the European Union, stringent data protection regulations necessitate robust consent management and privacy-by-design features, shaping vendors’ product roadmaps. Meanwhile, Middle Eastern markets are rapidly embracing digital health mandates-anchored by national vision initiatives-to support remote care and workforce resilience. Across Africa, emerging telemedicine networks are integrating wellness software into broader healthcare infrastructure investments, often in collaboration with international development agencies.

Asia-Pacific markets exhibit rapid growth fueled by government incentives for digital health transformation and increasing corporate focus on preventive care. In markets such as China and India, local manufacturing hubs underpin cost-effective production of wearable sensors and telemonitoring devices, while regional enterprises deploy mobile-first wellness solutions to engage distributed workforces. The convergence of rising healthcare expenditures, expanding digital literacy, and supportive policy frameworks continues to propel Asia-Pacific as the fastest-evolving region for corporate wellness technologies.

This comprehensive research report examines key regions that drive the evolution of the Corporate Wellness Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyze The Competitive Landscape Through Profiles Of Leading Software Providers And Innovators Shaping The Future Of Corporate Wellness Technologies

A dynamic mix of global giants and innovative specialists defines the competitive landscape. Virgin Pulse maintains its leadership position by serving a diverse array of industries with a modular wellness suite that encompasses physical activity tracking, nutrition guidance, and mental health support, all backed by engaging gamification and comprehensive analytics. This extensive presence enables the platform to draw on a rich repository of behavioral data to refine personalization and drive sustained participation.

Wellable has distinguished itself as a nimble challenger, offering customizable wellness challenges and evidence-based health assessments that integrate seamlessly with popular wearable devices. Its focus on client-driven program design enables organizations to align wellness initiatives with unique cultural and demographic profiles. Similarly, Fitbit Health Solutions extends its consumer-grade device expertise into the enterprise arena, providing scalable activity and sleep monitoring capabilities alongside telehealth and nutrition modules. MoveSpring’s platform stands out for its community-driven engagement features and compatibility with a broad ecosystem of trackers, fostering social accountability to amplify participation. In parallel, emerging providers such as Panda leverage AI-powered coaching and live group sessions to address emotional well-being in real time, ensuring that mental health remains a central pillar of modern wellness strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Corporate Wellness Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BurnAlong, Inc.

- Castlight Health, Inc.

- Gympass, Inc.

- HealthJoy, Inc.

- Limeade, Inc.

- Omada Health, Inc.

- Virgin Pulse, LLC

- Vitality Group International, Inc.

- WellSteps, Inc.

- Welltok, Inc.

Implement Impact Strategies And Operational Best Practices To Accelerate Wellness Software Adoption Enhance Engagement And Drive Organizational Health Outcomes

To navigate the evolving landscape, industry leaders should prioritize cloud-native architecture for their wellness platforms, thereby mitigating exposure to hardware tariffs and enabling rapid feature deployment. By shifting from capital-intensive on-premises systems to subscription-based delivery models, organizations can allocate resources more strategically and benefit from continuous innovation cycles. Additionally, enhancing privacy and data governance frameworks is essential to address employee concerns highlighted by the MIT consent study, ensuring transparent data use policies and building user trust.

Moreover, executive teams are encouraged to design hybrid delivery strategies that blend localized telehealth clinics with global analytics engines, accommodating regional regulatory variances and user preferences. Segmented solution offerings-from mobile application–driven fitness modules to comprehensive remote monitoring services-allow for targeted program customizations across enterprise and SME contexts. By engaging cross-functional stakeholders early and incorporating employee feedback loops, organizations can refine wellness experiences to maximize engagement, fortify resilience, and advance holistic health outcomes.

Outline The Rigorous Research Methodology Employed To Ensure Data Integrity Sampling And Validated Insights For Corporate Wellness Software Analysis

Our research methodology integrates both primary and secondary approaches to ensure a comprehensive and objective analysis. Secondary research entailed a thorough review of industry publications, regulatory filings, technical white papers, and recent news articles to capture the latest trends, technological developments, and policy changes shaping the corporate wellness software arena.

Primary research consisted of structured interviews and surveys with key stakeholders, including C-suite executives, HR leaders, wellness program managers, and technology vendors. These engagements yielded insights into implementation challenges, user adoption dynamics, and best practices in solution deployment. To validate qualitative findings, we conducted a series of quantitative surveys across a representative sample of large enterprises and small and medium businesses, stratified by industry, region, and organization size.

Subsequently, the collected data underwent rigorous triangulation and cross-validation through statistical analysis and expert panel reviews. This iterative process involved testing hypotheses, reconciling discrepancies, and refining the segmentation framework to reflect real-world usage patterns. Throughout, we adhered to strict data integrity protocols and ethical guidelines, ensuring confidentiality and unbiased representation of findings. The result is a robust, evidence-based foundation for strategic decision-making within the corporate wellness software market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Corporate Wellness Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Corporate Wellness Software Market, by Solution Type

- Corporate Wellness Software Market, by Delivery Model

- Corporate Wellness Software Market, by Organization Size

- Corporate Wellness Software Market, by Deployment Type

- Corporate Wellness Software Market, by Region

- Corporate Wellness Software Market, by Group

- Corporate Wellness Software Market, by Country

- United States Corporate Wellness Software Market

- China Corporate Wellness Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesize The Key Findings And Strategic Insights To Provide A Cohesive Perspective On The Corporate Wellness Software Industry Trajectory And Imperatives

The analysis underscores a consistent narrative: corporate wellness software has transitioned from siloed fitness applications to integrated health ecosystems that address physical, mental, and nutritional needs. Transformative factors such as AI-driven personalization, telehealth expansion, and data-driven decision-making are redefining engagement models and elevating program outcomes. At the same time, external pressures-particularly the imposition of new tariffs-have catalyzed shifts toward cloud-native deployments and agile sourcing strategies, highlighting the importance of flexible technology stacks.

Segmentation insights reveal that solution type, deployment model, organization size, and licensing preferences each exert significant influence on program design and adoption. Regional dynamics further underscore the need for localized approaches, with regulatory environments and market maturities shaping vendor offerings. Competitive analysis of leading and emerging providers illustrates an environment marked by innovation, strategic partnerships, and evolving differentiation through advanced analytics and AI capabilities.

In light of these findings, it is evident that strategic alignment between wellness objectives and technological capabilities will be paramount for enterprises and SMEs alike. By embracing hybrid delivery models, reinforcing data privacy safeguards, and prioritizing employee-centric design, industry leaders can foster resilient, healthy workforces prepared to meet the demands of a dynamic business landscape.

Contact Ketan Rohom Associate Director Sales And Marketing To Unlock Corporate Wellness Software Insights And Secure Access To Detailed Market Research Report

To explore how leading-edge corporate wellness software can transform your workforce’s well-being, contact Ketan Rohom, Associate Director Sales And Marketing. He will guide you through tailored packages that align with your organization’s unique health objectives and operational priorities. Reach out today to secure access to the detailed market research report, unlocking vital insights on solution type innovations, deployment models, regional dynamics, and competitive differentiators that will elevate your wellness strategy and drive sustainable organizational health outcomes.

- How big is the Corporate Wellness Software Market?

- What is the Corporate Wellness Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?