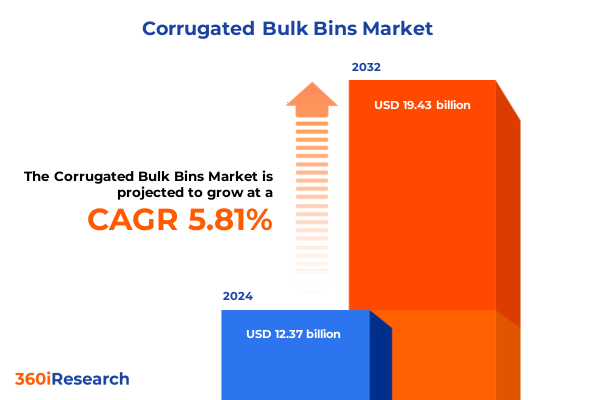

The Corrugated Bulk Bins Market size was estimated at USD 13.08 billion in 2025 and expected to reach USD 13.84 billion in 2026, at a CAGR of 5.81% to reach USD 19.43 billion by 2032.

Understanding the Emergence of Corrugated Bulk Bins as Essential Solutions in Modern Industries Focused on Efficiency, Sustainability, and Supply Chain Resilience

The corrugated bulk bin sector has emerged as a cornerstone of modern material handling, driven by a confluence of supply chain optimization and sustainability imperatives. As industries strive for cost efficiency and environmental responsibility, corrugated bulk bins offer a compelling alternative to traditional plastic or metal containers, combining lightweight design with recyclability. This surge in relevance is further underpinned by advancements in corrugation technologies, enabling higher durability and load-bearing capacities that meet the rigors of today’s logistics networks. Moreover, the global push toward circular economies has elevated the importance of recyclable packaging solutions, positioning corrugated bulk bins as a strategic asset for organizations committed to reducing their carbon footprints.

In parallel, rapid growth in e-commerce and omni-channel distribution has intensified demand for versatile, transport-friendly bulk packaging. Warehousing facilities and distribution centers are reconfiguring operations to handle increased volumes, and corrugated bulk bins are integral to these transformations. Their adaptability to automated handling systems and stackable design streamline material flow, while their cost-effectiveness appeals to budget-conscious procurement teams. As raw material costs fluctuate and regulatory landscapes evolve, stakeholders are prioritizing packaging solutions that balance performance with regulatory compliance and environmental stewardship. This introduction sets the stage for a comprehensive examination of transformative shifts, tariff impacts, segmentation insights, regional variations, leading companies, and strategic recommendations that collectively define the current state and future trajectory of the corrugated bulk bin market.

Embracing Next Generation Corrugated Bulk Bin Solutions to Address Shifting Consumer Demands Digital Transformation and Environmental Sustainability Challenges

The landscape of corrugated bulk bin utilization has undergone a profound transformation driven by industrial digitization, sustainability mandates, and evolving customer expectations. Downtime reduction initiatives have prompted the integration of smart sensors and RFID tracking, enabling real-time visibility of bin inventories and transit paths. This digital overlay not only enhances operational transparency but also mitigates loss and damage, optimizing total cost of ownership. Concurrently, a stronger emphasis on reducing greenhouse gas emissions has spurred material innovation, with manufacturers experimenting with bio-based adhesives and recycled paper fibers, reinforcing the alignment of corrugated bins with corporate sustainability goals.

Furthermore, supply chain disruptions-whether triggered by global events, labor shortages, or transportation bottlenecks-have necessitated a shift toward more flexible and resilient packaging strategies. Corrugated bulk bins, by virtue of their lightweight and collapsible designs, enable efficient backhauling and temporary storage, reducing empty-miles and slotting inefficiencies in warehouses. The confluence of e-commerce proliferation and just-in-time manufacturing philosophies has reinforced the need for packaging that can adapt to rapid inventory turnover while preserving product integrity. These transformative shifts underscore the sector’s evolution from a cost-driven commodity to a technology-enabled, sustainability-aligned strategic resource.

Assessing the Broad Repercussions of Recent United States Tariff Policies on Corrugated Bulk Bin Sourcing Manufacturing and Cost Structures

In 2025, the United States expanded its tariff regime on imports of paper-based industrial containers-including corrugated bulk bins-reflecting broader trade policy aimed at bolstering domestic manufacturing. The cumulative impact of these duties has reverberated through the supply chain, elevating input costs for companies reliant on imported linerboard and corrugated sheets. Consequently, many stakeholders have experienced margin compression, prompting negotiations with domestic producers to mitigate price surges. At the same time, a segment of the industry has shifted sourcing strategies to nearshore facilities, seeking to balance tariff exposure with transportation and labor expenses.

These tariff-induced cost pressures have also catalyzed innovation in material efficiency, as manufacturers refine flute profiles and optimize wall constructions to maintain load capacity while reducing raw material usage. Some organizations have pursued collaborative ventures with sheet plant operators to secure preferential pricing agreements tied to volume commitments. Moreover, legislative uncertainty around future trade measures has led risk-averse companies to invest in higher levels of safety stock or pursue dual-sourcing strategies. As the policy landscape continues to evolve, industry leaders are closely monitoring regulatory developments and exploring alternative fiber sources-such as recycled or agro-based feedstocks-to insulate their operations from future tariff escalations.

Unraveling Market Dynamics Through Comprehensive Segmentation Analysis Spanning End User Industries Construction Types Capacities Applications and Distribution Channels

A nuanced examination of market segmentation reveals distinct performance drivers and value propositions across various customer cohorts. Based on end user industry, adoption rates vary significantly among automotive, chemicals and pharmaceuticals, consumer goods, e-commerce, and food and beverage sectors, with each vertical demanding specific durability grades and hygiene compliance standards. Within construction type, double wall bins have gained traction for heavy-duty applications requiring higher stacking strength, whereas single wall and triple wall variants serve niche use cases demanding either lightweight economy or maximum payload protection. Capacity range segmentation highlights the popularity of configurations below 500 liters for small-part storage, 500 to 1,000 liters for intermediate distribution requirements, and greater than 1,000 liters where high-volume consolidation is paramount.

Application-focused analysis further distinguishes packaging use cases-where crush resistance and printability are crucial-from storage scenarios that prioritize compact nesting and easy assembly. Transportation applications emphasize robust corner protection and compatibility with automated forklifts. Distribution channel insights underscore the growing influence of online sales platforms in providing direct-to-buyer access and visibility, alongside established distributors who offer integrated supply chain services, and direct sales relationships that foster customized product development. Integrating these segmentation dimensions delivers a holistic view of market dynamics, enabling targeted strategies that align product design with precise end-user needs.

This comprehensive research report categorizes the Corrugated Bulk Bins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Construction Type

- Capacity Range

- End User Industry

- Application

- Distribution Channel

Examining Regional Market Variances Across the Americas Europe Middle East Africa and Asia Pacific Corrugated Bulk Bin Adoption Trends

Regional analysis underscores divergent growth trajectories shaped by localized regulatory frameworks, infrastructure maturity, and industry concentrations. In the Americas, established manufacturing hubs in North America leverage advanced recycling programs and lean logistics systems, driving adoption of corrugated bulk bins in automotive assembly plants and large-scale distribution centers. Latin American markets, while emerging, show potential as e-commerce penetration deepens, prompting investment in supply chain modernization and reusable packaging solutions.

Europe, the Middle East and Africa present a complex tapestry of sustainability regulations, particularly within the European Union’s extended producer responsibility mandates, which incentivize high-recycle content in packaging. This environment has accelerated demand for corrugated bulk bins engineered for circularity. Meanwhile, growing logistical corridors in the Middle East and Africa have generated interest in economical, lightweight bulk containers capable of supporting nascent industrial clusters. In the Asia Pacific, rapid industrialization and e-commerce growth in Southeast Asia coexist with mature markets in Japan and Australia that prioritize automation and traceability. Here, strategic alliances between local converters and global fiber suppliers are driving product innovation and capacity expansions to meet evolving regional demands.

This comprehensive research report examines key regions that drive the evolution of the Corrugated Bulk Bins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Innovators and Strategic Partnerships Driving Competitive Advantage in the Corrugated Bulk Bin Market

Key industry players are differentiating through technological advancements, strategic partnerships, and expanded service offerings. Leading fiberboard producers have invested in state-of-the-art corrugation lines and advanced finishing techniques, enabling rapid retooling for custom dimensions and print-on-demand branding capabilities. Meanwhile, packaging converters are forging alliances with automation integrators to deliver turnkey solutions that bundle bulk bins with handling equipment, maintenance services, and data analytics platforms.

Innovation is also evident among specialized suppliers that focus on biodegradable coatings and water-resistant liners to broaden application scopes into high-humidity environments and corrosive chemical handling. Some tier-one companies have established dedicated sustainability councils to benchmark lifecycle impacts and accelerate the adoption of recycled fibers. In parallel, a wave of strategic acquisitions has reshaped the competitive landscape, as regional players seek to expand geographic footprints and consolidate manufacturing capacities. These initiatives underscore a broader industry trend toward end-to-end value creation, where differentiated product portfolios and service ecosystems are becoming critical drivers of long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Corrugated Bulk Bins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ameripak

- B&B Triplewall Containers Ltd.

- BAG Corp. by Super Sack Bag, Inc.

- Borregaard AS

- Cartocor S.A.

- Cascades Inc.

- DS Smith plc

- Elite Packaging Company Ltd.

- Elsons International

- Emenac Packaging

- Graphic Packaging Holding Company, Inc.

- Greif Inc.

- INDEVCO Group

- International Paper Company

- Jayaraj Fortune Packaging Pvt. Ltd.

- Mondi plc

- Packaging Corporation of America

- Pratt Industries, Inc.

- Smurfit Kappa Group plc

- Stora Enso Oyj

- WestRock Company

Implementing Strategic Initiatives to Optimize Corrugated Bulk Bin Operations Enhance Supply Chain Resilience and Elevate Sustainability Performance

To thrive in this dynamic environment, industry leaders should adopt a proactive innovation agenda that prioritizes both operational efficiency and environmental stewardship. First, investing in digital traceability solutions-such as RFID tagging and IoT-enabled monitoring-will deliver actionable insights into bin utilization rates, damage patterns and return logistics, supporting cost optimization and asset lifecycle extension. Complementing these technologies with predictive analytics can further enhance supply chain agility by forecasting demand fluctuations and preempting stock shortages.

Simultaneously, organizations should cultivate a modular design mindset that simplifies bin assembly and disassembly, thus reducing labor costs and facilitating cross-industry reuse. Strategic collaborations with raw material suppliers can secure preferential pricing and co-development opportunities for eco-friendly substrates. Additionally, engaging with policymakers and industry consortia to shape sustainable packaging standards will ensure regulatory alignment and create first-mover advantages. By integrating these recommendations into their strategic roadmaps, companies can strengthen resilience, unlock new revenue streams through value-added services, and reinforce their leadership positions within the corrugated bulk bin ecosystem.

Leveraging Rigorous Research Methodologies Integrating Primary Interviews Secondary Data and Expert Validation to Ensure Accurate Market Insights

This research leverages a multi-faceted methodology to deliver robust and actionable insights. Primary data collection involved in-depth interviews with senior executives and supply chain managers across leading end user industries, providing first-hand perspectives on purchasing criteria, operational challenges, and evolving requirements. Complementing these qualitative inputs, a broad spectrum of secondary sources-including trade publications, industry white papers and regulatory filings-was systematically reviewed to contextualize trends and validate emerging themes.

To ensure analytical rigor, the study employed a triangulation approach, cross-referencing data points from different intelligence streams and reconciling discrepancies through targeted follow-up queries. An expert validation panel comprising packaging technologists, logistics consultants and sustainability specialists provided critical feedback on preliminary findings, refining assumptions and enhancing credibility. In addition, the research team utilized proprietary supply chain benchmarks and operational performance metrics to benchmark best practices in corrugated bulk bin deployment. Through these comprehensive measures, the report delivers a high degree of confidence in its strategic recommendations and market insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Corrugated Bulk Bins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Corrugated Bulk Bins Market, by Construction Type

- Corrugated Bulk Bins Market, by Capacity Range

- Corrugated Bulk Bins Market, by End User Industry

- Corrugated Bulk Bins Market, by Application

- Corrugated Bulk Bins Market, by Distribution Channel

- Corrugated Bulk Bins Market, by Region

- Corrugated Bulk Bins Market, by Group

- Corrugated Bulk Bins Market, by Country

- United States Corrugated Bulk Bins Market

- China Corrugated Bulk Bins Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesizing Key Findings to Illuminate the Strategic Imperatives Shaping the Future of Corrugated Bulk Bin Deployment and Innovation

Through this executive summary, we have charted the critical forces reshaping the corrugated bulk bin landscape-from technological integrations and sustainability drivers to geopolitical tariff implications and regional nuances. Strategic segmentation analysis revealed precise vectors for targeted product development, while competitive profiling highlighted the importance of innovation ecosystems and service differentiation. The actionable recommendations distilled from our findings provide a clear pathway for industry leaders to enhance operational resilience, elevate environmental performance, and unlock new growth opportunities.

Looking ahead, the interplay of digital transformation, regulatory evolution and shifting consumer preferences will continue to define success in bulk packaging. Organizations that proactively embrace data-driven decision making, sustainable material innovations and collaborative partnerships will be best positioned to capitalize on emerging market dynamics. This conclusion underscores the imperative for stakeholders to translate insights into strategic action, continually adapting to a rapidly evolving industry environment where agility and foresight are paramount.

Engage Directly with Ketan Rohom to Access In Depth Corrugated Bulk Bin Market Intelligence and Tailored Strategic Recommendations

For an in-depth exploration of evolving corrugated bulk bin market dynamics and tailored strategic guidance, connect with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By reaching out directly, you can secure comprehensive market intelligence that addresses your organization’s specific challenges, from navigating complex tariff landscapes to optimizing material innovations and sustainable practices. Ketan’s expertise will facilitate bespoke insights and support critical decision-making, ensuring you leverage the full potential of corrugated bulk bin solutions to drive operational excellence and long-term competitive advantage. Act now to transform your supply chain strategies and capitalize on emerging industry opportunities with a customized research report designed for forward-looking industry leaders

- How big is the Corrugated Bulk Bins Market?

- What is the Corrugated Bulk Bins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?