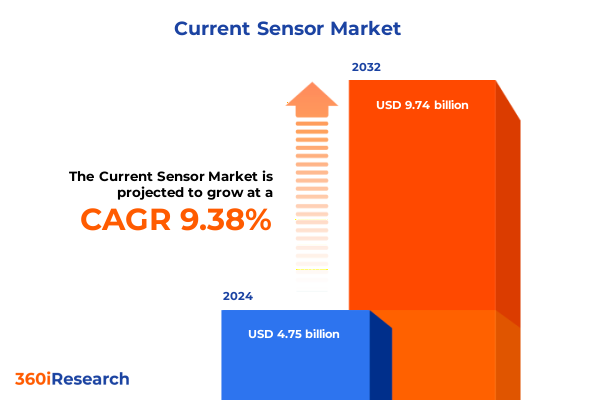

The Current Sensor Market size was estimated at USD 3.26 billion in 2025 and expected to reach USD 3.55 billion in 2026, at a CAGR of 9.41% to reach USD 6.12 billion by 2032.

Understanding the Pivotal Role of Current Sensors in Modern Electrical Systems and Their Expanding Applications Across Industries

Current sensors play an indispensable role in modern electrical systems by continuously monitoring the flow of current, safeguarding equipment, and enabling precise control across a wide range of applications. As industries pivot toward higher energy efficiency and stringent safety standards, the ability of these sensors to deliver accurate, real-time measurements has become a cornerstone of system design, from heavy industrial drives to compact consumer electronics.

The surge in electrification initiatives, spurred by the global push for decarbonization and smart grid adoption, has heightened demand for advanced sensing solutions. Electric vehicles, in particular, rely on accurate current measurement to optimize battery performance and extend driving range, while renewable energy installations depend on robust sensing to balance power generation and grid stability. In parallel, industrial automation and robotics have intensified requirements for miniaturized sensors that can integrate seamlessly into complex control loops without sacrificing performance.

Against this backdrop, this executive summary lays out the foundational trends shaping the current sensor landscape. It introduces transformative shifts driving innovation, examines the cumulative impact of recent tariff measures, and highlights key segmentation, regional nuances, and competitive strategies. By synthesizing these insights, decision-makers will gain a clear understanding of the market forces at play and the strategic imperatives needed to thrive in a rapidly evolving environment.

How Digital Integration and Advanced Analytics Are Transforming the Current Sensor Landscape to Meet Evolving Industry Demands

The current sensor landscape is undergoing a profound transformation driven by digital integration, advanced analytics, and evolving end-user expectations. Embedded sensing platforms now couple high-precision measurement with real-time data processing, enabling predictive maintenance and intelligent load management that were once the realm of specialized systems.

IoT-enabled current sensors offer seamless connectivity to cloud-based analytics engines, facilitating remote monitoring and adaptive control loops that optimize performance dynamically. At the same time, the proliferation of wide-bandgap semiconductor technologies is unlocking higher measurement bandwidths and lower power losses, a shift that supports emerging high-frequency power converters and next-generation EV charging infrastructures.

Moreover, the convergence of software-defined measurement architectures and machine learning algorithms has empowered sensor providers to deliver solutions that autonomously calibrate, compensate for drift, and detect anomalies. This convergence accelerates time-to-insight, reduces downtime, and enhances safety in mission-critical applications. As a result, the very definition of a current sensor is evolving from a discrete hardware component into an intelligent node within a larger digital ecosystem.

Assessing the Cumulative Impact of Recent United States Tariffs on Current Sensor Supply Chains, Cost Structures, and Strategic Sourcing Decisions

Since the introduction of enhanced duties on imported electrical components in 2025, United States tariffs have reshaped the economics of current sensor procurement, leading many original equipment manufacturers to reassess their global sourcing strategies. The additional levies on certain sensor types have elevated landed costs and compressed margins, particularly for high-precision Hall effect and magnetoresistive devices often sourced from overseas suppliers.

In response, manufacturers have accelerated nearshoring initiatives, forging partnerships with domestic foundries and contract manufacturers to mitigate tariff exposure and improve lead-time reliability. Concurrently, some end users are redesigning power modules to accommodate alternative sensor technologies that fall outside the scope of tariff schedules, thereby preserving performance targets while avoiding punitive duty rates.

These strategic shifts have also spurred a wave of supply-chain diversification. Firms are establishing multi-tiered supplier networks spanning Asia, Europe, and Latin America to balance cost with risk. Although inventory carrying expenses have risen due to precautionary stockpiling, these measures have delivered greater resilience against future trade policy fluctuations and geopolitical uncertainties. Ultimately, the cumulative tariff impact has acted as a catalyst for more agile and transparent supply-chain architectures across the current sensor ecosystem.

Unveiling Critical Segmentation Insights That Illuminate Type, Circuit, Technology, Application, and End Use Industry Dynamics in the Current Sensor Arena

Insight into sensor type dynamics reveals that traditional current transformers continue to dominate high-power industrial installations, while Hall effect sensors gain traction in compact electronic modules requiring galvanic isolation. Magnetoresistive sensors are carving out a niche where ultra-high sensitivity and minimal footprint are critical, and Rogowski coil devices serve rapidly fluctuating current measurement needs, particularly in power quality analytics. Meanwhile, shunt resistor sensors maintain relevance where cost-effective direct measurement is acceptable.

Analyses of circuit type deployment show analog circuits sustaining their role in legacy systems, prized for simplicity and cost efficiency. Conversely, digital circuit–based sensors are capturing new growth in applications demanding embedded signal processing and field programmability, enabling seamless integration with microcontroller units and digital control networks.

The distinction between closed-loop and open-loop technologies highlights a strategic inflection point: closed-loop sensors, available in both bidirectional and unidirectional configurations, deliver superior accuracy and faster transient response, appealing to applications such as motor control and overcurrent protection. In contrast, open-loop variants continue to serve cost-sensitive segments and scenarios where ultra-high precision is not mission-critical.

Application analysis underscores that battery management systems and electric vehicle charging stations represent high-growth frontiers, driven by global electrification mandates. Industrial automation and robotics demand robust sensing for precision motor drives, while overcurrent protection and power monitoring remain essential across both utility and commercial installations. Renewable energy systems further expand demand, requiring sensors that endure harsh environmental conditions and support distributed generation architectures.

From an end-use perspective, the automotive sector anchors sensor adoption through advanced safety and electrification initiatives, while consumer electronics prioritize miniaturization and low power consumption. The energy and power landscape emphasizes reliability and grid compliance, healthcare applications mandate stringent medical certifications, industrial automation focuses on uptime and deterministic control, and telecommunication infrastructures rely on precise power monitoring to maintain service-level agreements.

This comprehensive research report categorizes the Current Sensor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Circuit Types

- Mounting Method

- Measurement Range

- Application

- End Use Industry

Driving Market Understanding Through Key Regional Perspectives Spanning the Americas, Europe Middle East & Africa, and Asia-Pacific Territories

Regional dynamics shape both demand patterns and strategic priorities in the current sensor domain. In the Americas, pronounced investment in electric vehicle production and smart grid modernization has amplified requirements for sensors tailored to battery management and power distribution networks. Concurrently, North American manufacturers benefit from proximity to end users, enabling just-in-time delivery models and co-development partnerships with auto and industrial OEMs.

Across Europe, Middle East, and Africa, regulatory frameworks emphasizing grid resilience and energy efficiency drive sensor adoption in renewable installations and utility substation upgrades. European nations are at the forefront of deploying advanced current measurement in offshore wind and solar farms, while Middle Eastern energy hubs invest in centralized power infrastructure. In Africa, growth prospects hinge on off-grid applications and microgrid projects, where rugged sensor solutions underpin system reliability.

In Asia-Pacific, burgeoning markets in China, India, and Southeast Asia present a dual narrative of large-scale manufacturing and surging end-market demand. China’s extensive production base delivers cost-competitive sensor components, while India’s rapid industrialization stimulates domestic consumption across automotive and power sectors. Furthermore, technology hubs in Japan and South Korea are pioneering ultra-high-frequency sensing solutions, reinforcing the region’s reputation for innovation.

This comprehensive research report examines key regions that drive the evolution of the Current Sensor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Imperatives and Innovation Trajectories of Leading Global Current Sensor Providers to Decode Competitive Advantages

Leading providers within the current sensor industry are leveraging strategic alliances, targeted acquisitions, and accelerated R&D investments to fortify their market positions. Major incumbents have expanded their product portfolios through in-house development of specialized sensor cores and integrated digital front ends, ensuring tailored solutions for high-precision and high-frequency applications.

Collaborative ventures between sensor manufacturers and semiconductor foundries have yielded proprietary processes for fabricating stable magnetoresistive elements, while partnerships with software platform vendors are delivering end-to-end Internet-of-Things solutions that encapsulate measurement, analytics, and visualization. Additionally, several global players are establishing regional centers of excellence to co-innovate with local OEMs and integrators, thereby enhancing responsiveness to unique regulatory and environmental requirements.

Intellectual property accumulation has emerged as a critical competitive lever, with firms filing patents on advanced calibration algorithms, multi-sensor fusion techniques, and energy-harvesting sensor nodes. These capabilities not only differentiate product offerings but also provide entry barriers against emerging challengers. Collectively, the strategic imperatives of innovation, collaboration, and IP leadership are defining the competitive landscape and setting the stage for the next wave of technological breakthroughs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Current Sensor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Infineon Technologies AG

- Texas Instruments Incorporated

- Allegro Microsystems, Inc.

- NXP Semiconductors N.V.

- LEM Holding SA

- TDK Corporation

- STMicroelectronics International N.V.

- Yageo Corporation

- Murata Manufacturing Co., Ltd.

- Tamura Corporation

- Honeywell International Inc.

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Siemens AG

- Broadcom Inc.

- Panasonic Holdings Corporation

- Mitsubishi Electric Corporation

- Robert Bosch GmbH

- Schneider Electric SE

- ABB Ltd.

- Aceinna Inc.

- Anhui Sinomags Technologies Co.,Ltd.

- Asahi Kasei Corporation

- Cheemi Technology Co., Ltd.

- Coto Technology, Inc.

- CR Magnetics, Inc. by Khorporate Holdings, Inc.

- CTS Corporation

- DER EE Electrical Instrument CO., Ltd.

- Electrohms Private Limited

- Hitachi, Ltd.

- ICE Components, Inc.

- Littelfuse, Inc.

- Luksens Technologie GmbH

- Melexis NV

- Monnit Corporation

- Olimex Ltd.

- OMRON Corporation

- Rockwell Automation Inc.

- Silicon Laboratories Inc.

- Skyworks Solutions, Inc.

- Suncall Corporation

- Suzhou Novosense Microelectronics Co., Ltd.

- TE Connectivity Ltd.

- Vacuumschmelze GmbH & Co. KG

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Supply Chain Disruptions

To navigate ongoing supply chain volatility and capitalize on emerging growth areas, industry leaders should diversify their supplier ecosystems, incorporating both regional and strategic global partners to balance cost with resilience. By establishing dual-sourcing frameworks and integrating advanced demand forecasting tools, organizations can mitigate the impact of policy fluctuations and component shortages.

Investing in closed-loop sensing technologies and bidirectional configurations will enable companies to capture premium segments where accuracy and response time command higher value. Concurrently, forging partnerships with software and analytics providers can unlock new revenue streams through predictive maintenance and performance optimization services. This holistic offering will strengthen customer relationships and promote recurring revenue models.

In anticipation of evolving regulatory requirements and performance standards, sensor firms should intensify R&D efforts in wide-bandgap semiconductors and energy-harvesting techniques. Such technologies not only reduce system losses but also support the deployment of self-powered sensing nodes in remote or harsh environments. Finally, expanding into high-growth regions by tailoring certification and compliance roadmaps will position companies to seize opportunities in emerging markets and diversify end-market risk.

Detailing a Robust Mixed-Method Research Methodology Emphasizing Data Triangulation and Expert Validation for Market Accuracy

This research employs a mixed-methodology approach, beginning with in-depth interviews of senior engineering, procurement, and R&D professionals across key end-use industries. These primary insights were complemented by a thorough review of technical standards, patent filings, and regulatory frameworks to ensure a holistic understanding of performance benchmarks and compliance imperatives.

Secondary research included analysis of peer-reviewed journals, conference proceedings, and public company disclosures, providing a robust contextual backdrop for identifying innovation trends. Data triangulation techniques were applied to reconcile disparate sources, and validation workshops with an independent advisory board of industry experts were conducted to confirm findings and eliminate potential biases.

The result is a rigorously vetted body of intelligence that balances qualitative perspectives with quantitative validation. By coupling expert opinion with documented evidence and third-party data, this study offers a high-degree of confidence in the insights presented, ensuring they hold practical relevance for strategic decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Current Sensor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Current Sensor Market, by Technology

- Current Sensor Market, by Circuit Types

- Current Sensor Market, by Mounting Method

- Current Sensor Market, by Measurement Range

- Current Sensor Market, by Application

- Current Sensor Market, by End Use Industry

- Current Sensor Market, by Region

- Current Sensor Market, by Group

- Current Sensor Market, by Country

- United States Current Sensor Market

- China Current Sensor Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Drawing Comprehensive Conclusions on Current Sensor Market Trajectories and Strategic Imperatives for Future Industry Leadership

The current sensor market is at an inflection point characterized by rapid digitalization, shifting trade policies, and evolving application demands. Precision sensing has transcended its traditional role, becoming an integral component of smart infrastructure, electric mobility, and industrial automation ecosystems. Concurrently, tariff pressures have catalyzed supply chain innovation, encouraging diversification and local production strategies that will likely persist beyond immediate policy cycles.

Segmentation analysis has highlighted the coexistence of legacy and cutting-edge sensor technologies, with opportunities arising in closed-loop, bidirectional measurement and high-sensitivity magnetoresistive designs. Regional insights underscore the strategic importance of tailored market approaches: leveraging manufacturing strengths in Asia-Pacific, compliance expertise in Europe, and innovation partnerships in the Americas.

Competitive dynamics reveal that success will hinge on the ability to integrate sensing hardware with software intelligence, supported by partnerships and IP leadership. As industry leaders pursue diversification, R&D in energy-efficient and self-powered sensing approaches will unlock new use cases in remote monitoring and IoT deployments. Ultimately, those organizations that adopt agile supply chains, invest in future-proof technologies, and align with emerging regulatory and sustainability mandates will secure enduring competitive advantage.

Compelling Call-To-Action to Engage with Ketan Rohom for Access to the Definitive Current Sensor Market Research Insights and Purchase Path

For a deeper dive into current sensor market dynamics, tailored strategic recommendations, and comprehensive data insights, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, who is ready to guide your organization through the purchasing process for this definitive research report. Ketan’s expertise will ensure you gain full visibility into the methodologies, company benchmarks, and regional analyses that matter most to your strategic objectives. Engage with Ketan today to secure immediate access to actionable intelligence and position your business at the forefront of innovation in current sensing technologies.

- How big is the Current Sensor Market?

- What is the Current Sensor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?