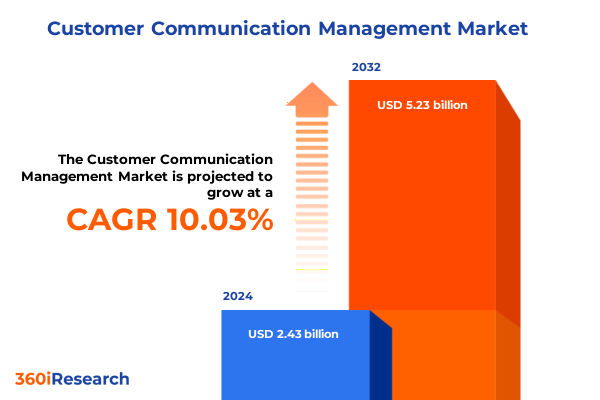

The Customer Communication Management Market size was estimated at USD 2.66 billion in 2025 and expected to reach USD 2.91 billion in 2026, at a CAGR of 10.12% to reach USD 5.23 billion by 2032.

Elevating Customer Engagement Strategies through Innovative Communication Management Solutions to Thrive in a Rapidly Evolving Global Market Landscape

In today’s hyperconnected world, organizations face mounting pressure to deliver seamless, personalized and data-driven customer interactions across an ever-expanding array of digital and traditional channels. An executive summary of this caliber offers decision-makers a distilled yet comprehensive view of the prevailing trends, strategic considerations and emerging technologies shaping the customer communication management landscape. By synthesizing qualitative insights with robust quantitative analysis, this report equips stakeholders with the knowledge required to navigate complexity and drive tangible business outcomes.

Drawing on extensive primary interviews, secondary research and rigorous data validation, the subsequent sections will articulate the transformative forces at play, the impact of geopolitical and economic factors, and the strategic segmentation that underpins market dynamics. This overview aims to serve as both a strategic compass for senior leadership and a practical toolkit for product, marketing and operations teams striving to optimize communication workflows, elevate customer experience and sustain competitive differentiation.

Uncovering the Transformational Forces Driving the Evolution of Customer Communication Management and Omnichannel Engagement Practices Across Industries

The customer communication management landscape is in the midst of a profound metamorphosis, catalyzed by rapid technological innovation, shifting consumer expectations and new regulatory paradigms. Organizations are embracing artificial intelligence, machine learning and advanced analytics to deliver hyper-personalized messaging at scale, while simultaneously managing the complexity of omnichannel orchestration. As these capabilities mature, businesses are transitioning from reactive, campaign-driven approaches to predictive, context-aware engagement models that anticipate customer needs in real time.

Concurrently, regulatory frameworks around data privacy, digital taxation and content security are reshaping the rules of engagement. Enterprises must now balance compliance with global standards-ranging from GDPR-like statutes to emerging digital services levies-without compromising the agility required to innovate swiftly. Moreover, the proliferation of cloud-native platforms and microservices architectures is enabling rapid deployment of next-generation communication tools, fostering a marketplace where nimble solution providers can outpace legacy incumbents.

In this dynamic environment, strategic partnerships and ecosystem integrations have emerged as key differentiators. Companies that seamlessly embed communication modules into broader CRM and ERP suites are unlocking new value chains, while those that leverage open APIs and platform-agnostic frameworks are positioning themselves to capitalize on accelerating demand. As a result, the industry is witnessing a shift from monolithic solutions toward modular, composable architectures designed for continuous evolution and extensibility.

Analyzing the Compounding Effects of United States Tariffs Implemented in 2025 on Technology-Driven Customer Communication Ecosystems

The tariff measures introduced by the United States in early 2025 have generated far-reaching implications for technology procurement and service delivery in the customer communication management sector. Through a complex web of reciprocal duties, enterprises across the economy have faced an incremental cost burden estimated at hundreds of billions of dollars annually, equating to an additional daily outlay of approximately one to two billion dollars on imported technology components and software licensing. These tariffs encompass not only hardware and electronics but also extend to digital services, marking a significant expansion of traditional trade policy into the realm of software and cloud-based solutions.

Supply chain disruptions have further compounded cost pressures, as vendors adjust sourcing strategies to mitigate the impact of elevated duties on critical communication infrastructure. Companies that previously relied on established manufacturing hubs in key Asia-Pacific regions have been compelled to diversify production across alternative geographies, resulting in longer lead times and increased logistical complexity. Moreover, the introduction of digital services levies by trading partners, notably within Europe, has triggered a cascade of retaliatory measures, intensifying pricing volatility and undermining budget predictability for enterprise-level deployment of customer engagement platforms.

In response, forward-looking organizations have prioritized strategic resilience by renegotiating vendor contracts, adopting hybrid multi-cloud architectures to optimize total cost of ownership, and accelerating the shift toward subscription-based consumption models. These approaches aim to absorb tariff-induced inflation while preserving the agility required to maintain continuity of service and innovation velocity. Ultimately, the cumulative impact of these trade policies underscores the necessity for dynamic cost management frameworks and scenario planning to safeguard both short-term performance and long-term competitive positioning.

Gaining Actionable Insights from Multi-Dimensional Segmentation of Customer Communication Management Components Channels Deployments Industries and Organization Sizes

A nuanced understanding of customer communication management arises from evaluating the interplay of solution components, channel preferences, deployment modes, industry-specific demands and organizational scale. When dissecting the component dimension, service offerings exhibit distinct growth trajectories: managed services enable enterprises to outsource operational complexity, professional services drive bespoke system integrations, and solution modules ranging from chatbot engines to customer portals furnish the building blocks for rich, interactive experiences. Each of these facets must be orchestrated coherently to deliver end-to-end value without duplication or functional gaps.

Equally critical is the examination of communication channels. Organizations must calibrate their channel mix-be it email, SMS, voice or web portal-to align with customer behavior patterns and regulatory constraints. This channel strategy is not static but evolves as emerging modalities, such as conversational AI and interactive dashboards, reshape expectations and engagement metrics. At the same time, the choice between cloud and on-premise deployment hinges on considerations around data governance, scalability, cost control and interoperability with existing infrastructure.

Industry verticals further nuance the segmentation landscape. Banking, financial services and insurance demand stringent security and compliance controls; healthcare stakeholders prioritize patient privacy and omnichannel continuity; IT and telecommunications firms seek high-throughput, low-latency solutions; manufacturing subsegments-from automotive to heavy machinery-require integrated end-to-end communication frameworks; and retail entities balance in-store and e-commerce touchpoints to foster seamless customer journeys. Finally, organizational scale drives procurement dynamics: large enterprises often opt for comprehensive suites with global support, while small and medium-sized enterprises favor modular, rapid-deployment options with predictable pricing. Through this multi-dimensional lens, stakeholders can pinpoint the precise intersection of capabilities and contexts that will yield the greatest return on investment.

This comprehensive research report categorizes the Customer Communication Management market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Communication Channel

- Deployment

- Industry Vertical

- Organization Size

Mapping Regional Dynamics and Strategic Imperatives Shaping Customer Communication Management Adoption across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics exert a profound influence on the adoption and evolution of customer communication management practices, with each geographic cluster presenting unique opportunities and challenges. In the Americas, maturity in digital infrastructure and a strong emphasis on customer experience have driven widespread adoption of AI-powered engagement tools. North American organizations are often early pilots for advanced conversational interfaces and analytics-driven personalization, buoyed by a regulatory framework that encourages innovation while managing privacy imperatives.

Across Europe, the Middle East and Africa, data sovereignty and digital services taxation have emerged as pivotal considerations. GDPR-style regulations and recent discussions around levying digital services duties necessitate that enterprises deploy localized data handling protocols, regional data centers and adaptive pricing models. This regulatory complexity can inhibit rapid scale-up but also fosters an ecosystem of compliance-centric solution providers and regional technology partnerships.

Asia-Pacific stands out for its rapid digital transformation and mobile-first engagement culture. High smartphone penetration, expansive cloud infrastructure investment and government-driven digital initiatives underpin accelerated growth in this region. Enterprises in APAC are pioneering use cases such as ultra-personalized customer journeys powered by real-time data analytics and ubiquitous conversational commerce, setting benchmarks that reverberate across other markets. Despite facing headwinds from trade policy fluctuations, the region’s agility and emphasis on innovation continue to solidify its position as a bellwether for next-generation communication management strategies.

This comprehensive research report examines key regions that drive the evolution of the Customer Communication Management market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Market Participants Shaping the Future of Customer Communication Management through Innovation Strategic Partnerships and Technology Investments

Leading providers in the customer communication management domain are distinguished by their commitment to innovation, strategic collaborations and an expanding ecosystem of integrations. Market front-runners have leveraged acquisitions of emerging AI and analytics startups to enrich their platforms with natural language understanding, predictive modeling and automated content generation. Partnerships with complementary software ecosystems-ranging from CRM and marketing automation suites to workforce engagement hubs-enhance interoperability and create a seamless user experience across the customer lifecycle.

Many of these organizations have also invested heavily in developer tools and open APIs, empowering clients and third-party vendors to build custom extensions that address vertical-specific use cases. Strategic alliances with consulting firms and system integrators further amplify deployment success rates, ensuring that complex digital transformation projects adhere to timelines, budgets and compliance objectives. In a climate where time-to-value is a key performance indicator, such collaborative models have proven instrumental in driving rapid adoption and minimizing total cost of ownership.

Furthermore, vendor roadmaps are increasingly emphasizing AI governance, ethical data stewardship and end-to-end encryption as competitive differentiators. By embedding robust privacy-by-design principles and transparent algorithmic audit trails, these companies are addressing both customer trust concerns and evolving regulatory mandates. This dual focus on innovation and responsibility underscores the strategic direction for top-tier participants committed to shaping the future of customer communication management.

This comprehensive research report delivers an in-depth overview of the principal market players in the Customer Communication Management market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Systems Inc

- Doxee

- Freshworks Inc

- Hiver

- HP Inc

- HubSpot

- Intense Technologies Limited

- Intercom

- ISIS Papyrus Europe AG

- Kofax Inc

- Messagepoint

- Microsoft Corporation

- Newgen Software Technologies Limited

- OpenText Corporation

- Oracle Corporation

- Pitney Bowes Inc

- Podium

- Quadient

- Salesforce Inc

- Sefas

- Smart Communications

- Upland Software Inc

- Xerox Corporation

- Zendesk

- Zoho Corporation

Delivering Targeted Recommendations for Industry Leaders to Seize Growth Opportunities and Navigate Challenges in Customer Communication Management

To capitalize on emerging opportunities within the customer communication management arena, industry leaders should prioritize the integration of advanced AI and analytics capabilities into their existing workflows. This entails not only upgrading underlying infrastructure but also fostering a culture of data-driven decision-making by equipping teams with intuitive visualization and self-service tools. By accelerating the adoption of machine learning models for predictive engagement, organizations can anticipate customer needs, reduce churn and enhance upsell potential.

At the same time, enterprises must implement a robust governance framework that balances innovation with compliance. Establishing cross-functional oversight committees-comprising representatives from legal, IT, marketing and operations-ensures that privacy regulations, digital taxation policies and security requirements are woven into project lifecycles from inception. This governance approach mitigates risk and cultivates stakeholder alignment, enabling smoother execution of complex transformation initiatives.

Additionally, forging strategic alliances across the technology ecosystem can unlock new avenues for differentiation. Collaborations with cloud hyperscalers, cybersecurity specialists and industry-specific solution integrators can accelerate time-to-market and extend the value proposition of communication platforms. By co-innovating in targeted verticals and co-marketing tailored solutions, industry leaders can gain a decisive edge and foster long-term customer loyalty.

Detailing a Robust Mixed Methodology Framework Combining Qualitative and Quantitative Research to Ensure Rigorous Customer Communication Management Insights

This research employs a rigorous mixed methodology approach, combining qualitative insights from in-depth interviews with CXO-level executives and IT decision-makers alongside quantitative data drawn from proprietary surveys of end-user organizations. Secondary research sources-including regulatory filings, public company disclosures and technology white papers-have been systematically reviewed to validate market narratives and identify emerging trends.

A detailed vendor analysis was conducted using a standardized evaluation framework, incorporating factors such as technology architecture, solution breadth, deployment flexibility and partner ecosystem strength. Each vendor’s capabilities were mapped against key criteria-ranging from AI-driven personalization to multi-channel orchestration-to ensure an objective assessment. Scenario planning and sensitivity analysis were applied to account for macroeconomic variables, geopolitical developments and regulatory changes, enabling a dynamic interpretation of market drivers and inhibitors.

Data integrity is maintained through cross-validation across multiple sources, and findings were subjected to a peer review process by domain experts to eliminate bias. The synthesis of primary and secondary research yields a holistic perspective that informs strategic decision-making, investment prioritization and go-to-market planning for stakeholders navigating the complex customer communication management terrain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Customer Communication Management market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Customer Communication Management Market, by Component

- Customer Communication Management Market, by Communication Channel

- Customer Communication Management Market, by Deployment

- Customer Communication Management Market, by Industry Vertical

- Customer Communication Management Market, by Organization Size

- Customer Communication Management Market, by Region

- Customer Communication Management Market, by Group

- Customer Communication Management Market, by Country

- United States Customer Communication Management Market

- China Customer Communication Management Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Concluding Insights Synthesizing Key Findings to Illuminate Strategic Pathways for Effective Customer Communication Management Excellence

In synthesizing the core findings of this executive summary, several key themes emerge: the pivotal role of AI and data analytics in driving personalization, the critical importance of compliance and governance in a rapidly evolving regulatory environment, and the necessity for modular, interoperable architectures capable of responding to dynamic market needs. Additionally, geopolitical factors-most notably the U.S. tariff policy-underscore the value of strategic cost management and operational resilience.

The interplay of segmentation dimensions highlights that no single approach will suffice; rather, success hinges on a nuanced alignment of components, channels, deployment models, vertical use cases and organizational priorities. Regional variations further reinforce the need for localized strategies that reflect distinct regulatory landscapes and customer expectations. Meanwhile, the competitive landscape underscores the imperative for continuous innovation and partnership-driven expansion.

Ultimately, organizations that leverage these insights to craft a coherent, forward-looking customer communication management strategy will be best positioned to cultivate enduring customer relationships, optimize operational efficiency and unlock new growth trajectories. By embracing a holistic, data-centric approach and fostering cross-functional collaboration, companies can transform communication challenges into strategic advantages and drive sustainable value creation.

Engage with Ketan Rohom to Secure Comprehensive Customer Communication Management Market Research Insights and Accelerate Strategic Decision Making

If your organization is poised to harness the full potential of advanced customer communication management solutions, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to gain immediate access to an in-depth and forward-looking market research report. Discover critical insights tailored to your objectives, engage in personalized briefings, and obtain strategic recommendations that can be rapidly operationalized. By collaborating directly with Ketan, you will accelerate your competitive advantage, validate your strategic roadmap, and secure the confidence of stakeholders through data-driven evidence. Begin the conversation today to unlock the transformative intelligence that will empower your customer engagement strategies for the year ahead.

- How big is the Customer Communication Management Market?

- What is the Customer Communication Management Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?