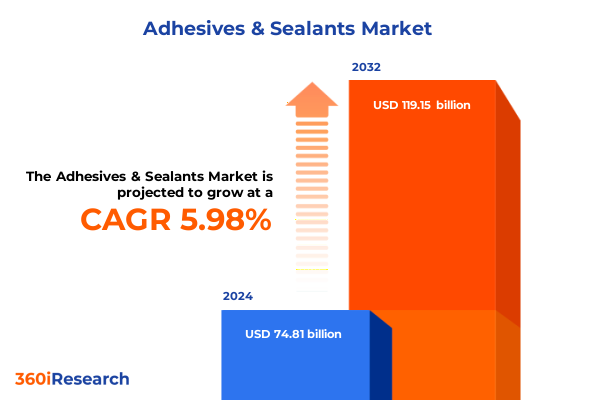

The Adhesives & Sealants Market size was estimated at USD 79.31 billion in 2025 and expected to reach USD 83.33 billion in 2026, at a CAGR of 5.98% to reach USD 119.15 billion by 2032.

Introducing the Driving Forces Shaping the Modern Adhesives and Sealants Industry Toward Unprecedented Innovation Sustainability and Efficiency

Adhesives and sealants have evolved far beyond their traditional roles as simple bonding or sealing agents. In today’s complex manufacturing and construction landscapes, these materials serve as critical enablers of innovation, sustainability, and performance. From lightweight assemblies in electric vehicles to hermetic sealing in advanced electronics, the demands placed on bonding technologies have multiplied in both scope and complexity. As environmental regulations tighten and end users seek more durable, energy-efficient solutions, the industry has responded with breakthroughs in green formulations, smart chemistries, and high-performance systems that align with broader corporate sustainability goals.

To grasp the full scope of this transformation, this report delves into the underlying drivers reshaping the adhesives and sealants market. It examines how resource scarcity is accelerating the shift toward bio-based chemistries, how digitalization is enabling real-time quality control in manufacturing, and how end-use industries-from construction to medical-are demanding tailored solutions that enhance productivity while minimizing environmental impact. By framing these developments within a cohesive narrative, our introduction sets the stage for a deeper exploration of the pivotal changes, policy influences, segmentation insights, regional dynamics, and strategic imperatives that define the current market landscape.

Unveiling Pivotal Technological Advances Regulatory Pressures and Digital Transformation Redefining Adhesives and Sealants Applications

The adhesives and sealants market is in the midst of a profound metamorphosis, driven by technological breakthroughs, sustainability mandates, and shifting end-use requirements. Reactive chemistries that cure on demand under ultraviolet or thermal activation are giving way to hybrid systems that combine rapid processing with superior long-term durability. Meanwhile, the proliferation of additive manufacturing has spurred demand for specialized paste and powder formulations capable of precise deposition and layer-by-layer bonding, pushing material science to new frontiers.

Sustainability considerations are catalyzing another wave of transformation. Water-based and bio-derived formulations are rapidly gaining traction as global regulations phase out volatile organic compounds, while closed-loop manufacturing and circular economy principles encourage recyclability and waste reduction. The growing emphasis on product lifecycle assessment is prompting companies to integrate end-of-life strategies directly into formulation development, thereby positioning adhesives and sealants as not just enablers of assembled products but as integral components of an eco-conscious value chain.

At the same time, industry digitization is fueling efficiency and quality gains. Advanced process monitoring drives real-time adjustments on the production line, ensuring consistent application thickness and bond integrity. Predictive maintenance, powered by IoT sensors embedded in dispensing equipment, minimizes downtime and optimizes throughput. Collectively, these shifts herald a new era in which adhesives and sealants are measured not only by their performance attributes, but also by their contribution to broader operational excellence and environmental stewardship.

Evaluating the Structural Repercussions of 2025 Tariff Policies on Sourcing Strategies and Domestic Manufacturing Dynamics

In 2025, U.S. trade policy adjustments have introduced tariff measures that recalibrate cost structures for imported adhesive and sealant raw materials and finished products. These levies, imposed on select solvent-based resins and specialty thermosetting polymers, reflect a broader strategy to encourage domestic manufacturing and safeguard critical supply chains. The immediate effect has been a discernible rise in sourcing costs for manufacturers reliant on offshore material streams, prompting a strategic pivot toward local suppliers and vertically integrated production models.

This realignment carries both challenges and opportunities. On one hand, end users in electronics and transportation industries have encountered cost headwinds as manufacturers pass through higher input expenses. On the other hand, domestic resin producers have benefited from increased demand and capacity utilization, spurring investments in new reactor lines and expanded R&D to tailor formulations for high-growth segments. Over time, this tariff-driven dynamic is likely to foster a more resilient domestic ecosystem, characterized by shorter lead times, enhanced quality control, and reduced geopolitical risk exposure.

Moreover, the tariff measures have accelerated innovation within the industry. Formulators are exploring alternative chemistries that circumvent tariff constraints, including water-based adhesives designed to replicate the performance of traditional solvent-based systems. In parallel, partnerships between material suppliers and end users are intensifying, as stakeholders collaborate to co-develop next-generation products that align with both performance targets and tariff-sensitive supply chains. This cumulative impact underscores how policy interventions can catalyze both short-term adjustments and long-term structural evolution.

Dissecting Market Behavior through Integrated Perspectives on Product Types End-Use Industries Technology Trends and Distribution Strategies

A nuanced understanding of product type distinctions reveals that adhesives continue to dominate applications requiring high shear strength, such as structural bonding in automotive and aerospace assemblies, while sealants excel in demanding sealing scenarios like window glazing and pipeline encapsulation. At the same time, end use industries exhibit disparate growth trajectories: construction projects increasingly prioritize sealants for energy-efficient building envelopes, whereas electronics and electrical sectors drive demand for electrically insulating adhesives with precise dispensing requirements. In the medical field, biocompatible formulations for wound closure and device assembly underscore the importance of regulatory compliance and sterility assurance.

Technology segmentation further delineates market behavior. Hot melt systems offer rapid set times for packaging and woodworking, whereas UV curable and reactive chemistries provide unparalleled bond performance for precision applications. Solvent-based solutions maintain a foothold where chemical resistance and temperature tolerance are paramount, despite regulatory pressures driving conversion to water-based alternatives. Meanwhile, form factors such as films, liquids, pastes, powders, and tapes deliver tailored application workflows, from automated lamination lines to manual sealing tasks. Distribution channels-including direct sales, distributors, and online platforms-shape customer engagement and service models, with digital procurement tools gaining traction across all segments.

These interconnected segmentation insights illustrate that success in the adhesives and sealants landscape requires a holistic view, one that accounts for the interplay between product attributes, end use demands, technological capabilities, application methods, form factors, and evolving go-to-market strategies.

This comprehensive research report categorizes the Adhesives & Sealants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Form

- End Use Industry

- Application

- Distribution Channel

Illuminating Regional Market Drivers and Regulatory Landscapes Shaping Adhesives and Sealants Adoption Worldwide

Regional dynamics in the adhesives and sealants sector reflect diverse economic drivers, regulatory frameworks, and infrastructure investments across the globe. In the Americas, growth is underpinned by robust automotive electrification programs and green building initiatives, which together fuel demand for eco-friendly sealants and high-performance adhesives. North America’s emphasis on reshoring critical supply chains dovetails with tariff-induced shifts, creating fertile ground for domestic material innovation and localized service offerings.

In Europe, the Middle East, and Africa, stringent environmental mandates and circular economy targets propel water-based and UV-curable technologies to the forefront. The European Union’s focus on low-VOC content and end-of-life recyclability has stimulated collaborations between chemical manufacturers and end users to create compliant formulations. Meanwhile, the Middle East’s expanding infrastructure projects and the African continent’s burgeoning manufacturing hubs drive adoption of versatile sealants and adhesives tailored to climatic extremes.

Asia-Pacific remains a powerhouse of demand, driven by electronics manufacturing in East Asia, construction booms in Southeast Asia, and automotive expansion in India. The region’s price sensitivity challenges brands to balance cost-effectiveness with performance, spurring lightweight packaging adhesives and rapid-curing sealants for high-volume applications. Overall, each regional cluster presents unique imperatives, reinforcing the need for adaptive product portfolios and regionally attuned strategies.

This comprehensive research report examines key regions that drive the evolution of the Adhesives & Sealants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Alliances Digitalization Initiatives and Sustainability Leadership among Top Market Players

Leading players in the adhesives and sealants domain are navigating an increasingly competitive environment marked by strategic partnerships, mergers, and targeted R&D initiatives. Global chemical conglomerates are leveraging their scale to expand production footprint and integrate downstream applications, while specialized mid-tier firms differentiate through nimble innovation and customer-centric service models. Investment in application development centers underscores a commitment to co-creation, enabling end users to optimize bond performance in real-world manufacturing contexts.

Moreover, digital transformation is a focal point for top companies seeking to streamline supply chains and enhance customer engagement. Advanced analytics and AI-driven formulation platforms accelerate product development cycles, while e-commerce portals and virtual labs offer customers self-service tools for selecting optimal adhesive and sealant solutions. Sustainability credentials have also emerged as a key battleground, with leading organizations publishing transparent environmental, social, and governance metrics, and formulating clear roadmaps for transitioning to bio-based and low-VOC systems.

Collectively, these strategic endeavors highlight a concerted push toward integrated value creation-one that combines material science prowess, digital enablement, and sustainability leadership to capture the next wave of growth opportunities across industries.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adhesives & Sealants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arkema S.A.

- Ashland Global Holdings Inc.

- Avery Dennison Corporation

- BASF SE

- Berry Global Inc.

- DELO Industrial Adhesives

- Dow Inc.

- DuPont

- Evonik Industries AG

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman Corporation

- Illinois Tool Works Inc.

- Jowat SE

- LINTEC Corporation

- Lord Corporation

- Mapei S.p.A.

- Nan Pao Resins Chemical Co., Ltd.

- Pidilite Industries Ltd

- RPM International Inc.

- Sika AG

- Soudal N.V.

- Toagosei Group

- Wacker Chemie AG

Implementing Co-Development Models Advanced Digital Tools and Sustainability-Driven Supply Chain Resilience for Market Leadership

To stay ahead in this rapidly evolving landscape, industry leaders should consider several actionable steps. First, forging strategic alliances with resin producers and end users can accelerate joint innovation efforts and de-risk new product introductions. Co-development agreements that align formulation science with application-specific requirements will shorten time to market and amplify value creation. Second, accelerated investment in digital formulation and predictive maintenance tools can yield significant cost savings and quality improvements; real-time process data should inform continuous improvement programs on the manufacturing floor.

Third, companies must prioritize sustainability not as a compliance checkbox, but as a core growth driver. Integrating circular economy principles into product design, such as developing recyclable adhesive films and modular sealing systems, can open new revenue streams and strengthen brand reputation. Additionally, embracing modular manufacturing capabilities and regional production hubs will enhance supply chain resilience and responsiveness to tariff shifts and geopolitical disruptions.

Finally, a customer-centric mindset, bolstered by omnichannel distribution strategies that combine direct engagement, distributor networks, and online sales platforms, is essential for capturing diverse end-use segments. Tailoring service offerings-such as technical training, virtual application support, and localized inventory management-to specific industry needs will differentiate leading players in a crowded marketplace.

Detailing a Robust Research Framework Combining Primary Industry Interviews Secondary Data Review and Quantitative Supply Chain Analysis

This report synthesizes insights from a comprehensive, multi-pronged research approach. Primary research was conducted through in-depth interviews with industry executives, R&D leaders, procurement managers, and application engineers across major end-use sectors. These conversations provided nuanced perspectives on current formulation challenges, supply chain considerations, and emerging performance requirements.

Secondary research encompassed an extensive review of scientific journals, patent filings, regulatory databases, and corporate publications. This phase enabled cross-validation of market dynamics and technological trends. Additionally, trade associations and government agencies provided data on production capacities, import-export statistics, and environmental regulations, ensuring a robust foundation for policy-related analysis.

Quantitative analysis involved mapping supply chain flows, assessing historical trade data, and evaluating technology adoption curves. Regional focus studies leveraged localized market intelligence to capture country-level variances. Finally, all findings underwent rigorous validation through expert panels to ensure accuracy, relevance, and actionable insights for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adhesives & Sealants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adhesives & Sealants Market, by Product Type

- Adhesives & Sealants Market, by Technology

- Adhesives & Sealants Market, by Form

- Adhesives & Sealants Market, by End Use Industry

- Adhesives & Sealants Market, by Application

- Adhesives & Sealants Market, by Distribution Channel

- Adhesives & Sealants Market, by Region

- Adhesives & Sealants Market, by Group

- Adhesives & Sealants Market, by Country

- United States Adhesives & Sealants Market

- China Adhesives & Sealants Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing Key Strategic Insights and Collaborative Imperatives Guiding the Future of Adhesives and Sealants Markets Worldwide

The adhesives and sealants industry stands at an inflection point defined by accelerating technological progress, evolving regulatory pressures, and shifting global trade patterns. Stakeholders who harness emerging chemistries and digital capabilities while embedding sustainability at the core of their strategies will gain a decisive edge. As end-use industries demand ever-greater performance, consistency, and environmental responsibility, the most successful companies will be those that seamlessly integrate formulation expertise, agile manufacturing, and customer-centric service models.

In this dynamic environment, policy interventions such as tariff adjustments serve not only as short-term disruptors, but also as catalysts for strengthening domestic value chains and fostering local innovation. Regional market nuances further underscore the importance of tailored portfolios, whether addressing Europe’s stringent environmental standards, Asia-Pacific’s high-volume requirements, or the Americas’ reshoring momentum.

Ultimately, the path forward lies in collaborative ecosystems where raw material suppliers, formulators, equipment providers, and end users coalesce around common objectives. By embracing a holistic perspective that spans product development, digitalization, sustainability, and regional adaptation, market participants can unlock new opportunities and drive long-term growth.

Empower Your Business Decisions with Personalized Insights from Our Dedicated Sales and Marketing Leader

Ready to redefine your strategic approach and capitalize on emerging opportunities in the adhesives and sealants industry? Connect with Ketan Rohom, Associate Director, Sales & Marketing, to secure your comprehensive market research report and unlock the insights critical to your next breakthrough.

- How big is the Adhesives & Sealants Market?

- What is the Adhesives & Sealants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?