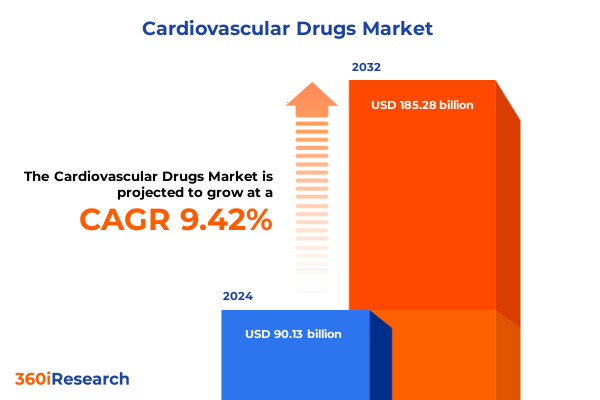

The Cardiovascular Drugs Market size was estimated at USD 98.73 billion in 2025 and expected to reach USD 107.27 billion in 2026, at a CAGR of 9.40% to reach USD 185.28 billion by 2032.

Unveiling the Critical Role of Cardiovascular Drug Innovation in Shaping Patient Outcomes, Healthcare Strategies, and Industry Trajectories

The landscape of cardiovascular therapeutics has never been more dynamic, shaped by scientific breakthroughs, regulatory adaptations, and shifting patient demographics. As cardiovascular diseases remain the leading cause of mortality worldwide, industry stakeholders are compelled to innovate at an accelerated pace. This executive summary offers a concise yet comprehensive overview of the essential trends that define the current environment, ranging from technological advances in drug discovery to evolving reimbursement frameworks. It establishes the foundation for deeper exploration in subsequent sections, arming decision-makers with a clear understanding of the forces reshaping the market.

Through an integrated lens, this introduction highlights how converging factors-such as the convergence of genomics, real-world evidence, and value-based care-are driving pharmaceutical companies to reassess their strategic priorities. It underscores the imperative for collaboration among research institutions, payers, and regulatory bodies to facilitate swift translation of innovation into improved patient outcomes. In doing so, it sets the stage for actionable insights that support robust growth strategies and sustainable competitive positioning within the cardiovascular drugs sector.

Navigating Paradigm-Shifting Trends Impacting the Global Cardiovascular Therapeutic Landscape in the Wake of Technological and Clinical Advances

Recent years have witnessed paradigm-shifting trends fundamentally altering how cardiovascular therapies are researched, developed, and delivered. Precision medicine has moved from promise to practice as genomic profiling enables identification of patient subpopulations most likely to respond to specific drug classes. Simultaneously, artificial intelligence and machine learning applications are streamlining target identification, optimizing clinical trial design, and accelerating regulatory submissions. This confluence of digital health and data analytics is revolutionizing every stage of the lifecycle, setting new benchmarks for speed and efficacy.

In parallel, breakthroughs in gene editing and RNA-based therapeutics are expanding the therapeutic toolbox beyond small molecules and biologics. These advanced modalities hold the potential to address underlying pathophysiological mechanisms rather than merely treat symptoms, signaling a shift toward curative or disease-modifying strategies. Furthermore, the rise of remote monitoring and telehealth has redefined patient engagement, enabling real-time adherence tracking and outcomes measurement. These transformative shifts demand that stakeholders adopt agile development frameworks and forge cross-sector partnerships, ensuring they remain competitive in an increasingly complex and fast-moving environment.

Analyzing the Ripple Effects of 2025 United States Tariff Policies on Cardiovascular Drug Supply Chains, Pricing Structures, and Market Access Dynamics

In 2025, new tariff measures implemented by the United States government have introduced additional layers of complexity across cardiovascular drug supply chains. The levies, affecting key raw materials and active pharmaceutical ingredients imported from major manufacturing hubs, have led to increased production costs. These cost pressures have prompted strategic reviews of sourcing strategies and accelerated interest in near-shoring and on-shoring initiatives to reduce exposure to tariff volatility and enhance supply security.

As manufacturers grapple with elevated input costs, the potential downstream impact on pricing negotiations with payers cannot be overlooked. Contractual agreements are being revisited to incorporate cost-escalation clauses and flexible pricing models that account for macroeconomic fluctuations. At the same time, stakeholders are exploring collaborative risk-sharing arrangements to mitigate the financial burden associated with regulatory compliance and market access. The cumulative effect of these tariffs underscores the importance of supply chain resilience, necessitating robust contingency planning and diversification of procurement channels to ensure uninterrupted delivery of critical cardiovascular therapies.

Deep-Dive into Multifaceted Segmentation Insights for Cardiovascular Therapies Across Product Types, Dosage Forms, Therapies, Channels, and End Users

The cardiovascular drug market’s multifaceted nature emerges most clearly when viewed through the lens of product type, where anti-hypertensives maintain a dominant presence alongside anticoagulants, lipid-lowering agents, and a diverse array of specialty drugs such as anti-arrhythmics and vasodilators. Within the anti-hypertensive class, the competition between ACE inhibitors, angiotensin receptor blockers, beta blockers, calcium channel blockers, and diuretics reflects shifting physician preferences driven by evolving safety profiles and patient tolerability data. Direct oral anticoagulants, low molecular weight heparins, and vitamin K antagonists each carve out distinct niches based on dosing convenience, monitoring requirements, and risk-benefit considerations. Lipid-lowering approaches span statins, PCSK9 inhibitors, fibrates, and niacin, highlighting a trend toward combination regimens tailored to aggressive lipid-management goals.

Dosage form plays a critical role in adoption and adherence, with injectable therapies offering rapid onset of action for acute events, while oral formulations remain the cornerstone for chronic management. Topical delivery, though less prevalent, is gaining traction in targeted vasodilator applications. The dichotomy between monotherapy and combination therapy underscores a broader shift toward personalized regimens that address multifactorial disease mechanisms. Distribution channels vary in reach and accessibility, from hospital pharmacies that dispense high-acuity care to retail outlets serving outpatient clinics, complemented by growth in online pharmacy platforms. Finally, end-user distinctions among hospitals, clinics, and home care settings reveal an ongoing push toward decentralization of treatment pathways, with home care delivery gaining momentum through patient education initiatives and remote monitoring support.

This comprehensive research report categorizes the Cardiovascular Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Dosage Form

- Therapy Type

- Distribution Channel

- End User

Illuminating Regional Market Nuances in the Americas, Europe Middle East & Africa, and Asia-Pacific across the Cardiovascular Drug Industry Spectrum

Geographic nuances exert a profound influence on the cardiovascular drug landscape, with the Americas driving innovation amid robust healthcare infrastructure and significant public-private investment in research initiatives. In North America, regulatory frameworks favor accelerated approvals for breakthrough therapies, while Latin American markets are characterized by evolving reimbursement policies that balance innovation access with cost containment imperatives. Moving eastward, Europe, the Middle East & Africa present a tapestry of healthcare systems: Western Europe leverages centralized pricing negotiations and value-based procurement, whereas emerging economies in the region are navigating budget constraints alongside rising disease prevalence.

Across the Asia-Pacific region, rapid economic growth has spurred heightened demand for advanced cardiovascular treatments. Markets such as China and India are witnessing expanding clinical trial activity and regulatory reforms aimed at aligning local standards with global benchmarks. The roll-out of national health insurance programs in Southeast Asia is enhancing drug affordability, while Japan’s aging population is accelerating adoption of high-value therapies. These regional dynamics underscore the necessity for companies to tailor market entry strategies, engage with local stakeholders, and adapt commercial models that reflect diverse regulatory, economic, and cultural environments.

This comprehensive research report examines key regions that drive the evolution of the Cardiovascular Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Leading Pharmaceutical Innovators Driving Breakthroughs and Competitive Positioning within the Cardiovascular Drug Sector

Leading pharmaceutical players continue to shape the competitive landscape through strategic pipelines, co-development alliances, and targeted acquisitions. Global giants have expanded their cardiometabolic portfolios by integrating advanced biologics with conventional small-molecule offerings, enhancing their ability to address complex patient needs. Simultaneously, mid-sized innovators are carving out differentiation by focusing on niche indications such as refractory arrhythmias and rare cardiomyopathies, leveraging specialty channels to accelerate market penetration.

Collaborations between biotech firms and large pharmaceutical partners have become increasingly prevalent, enabling resource pooling and shared regulatory expertise. These partnerships often focus on early-stage research in gene editing and RNA therapeutics, reflecting a collective drive toward disease-modifying interventions. Beyond R&D alliances, competitive positioning is reinforced through digital health integrations, where companies incorporate remote monitoring platforms and patient engagement tools into their therapeutic offerings. This holistic approach not only addresses adherence challenges but also generates real-world evidence to support label expansions and premium pricing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Cardiovascular Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amgen Inc

- AstraZeneca plc

- Bayer AG

- Boehringer Ingelheim GmbH

- Bristol‑Myers Squibb Company

- Daiichi Sankyo Company, Ltd

- Dr. Reddy’s Laboratories Limited

- Eli Lilly and Company

- Gilead Sciences, Inc

- GlaxoSmithKline plc

- Johnson & Johnson

- Lupin Limited

- Merck & Co., Inc

- Novartis AG

- Pfizer Inc

- Sanofi S.A

- Servier Laboratories

- Sun Pharmaceutical Industries Limited

- Takeda Pharmaceutical Company Limited

- Viatris Inc

Crafting Strategic Guidance for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Risks in Cardiovascular Drug Markets

To thrive in this evolving environment, industry leaders must embrace a multi-pronged strategy that aligns innovation with operational agility. First, investing in advanced analytics platforms will enable real-time insights into patient outcomes, supply chain performance, and market access hurdles. Leveraging predictive models helps anticipate demand fluctuations and optimize inventory management, thereby mitigating the impact of external shocks such as tariff adjustments. Furthermore, forging public-private partnerships with healthcare providers and governmental agencies can facilitate value-based contracting, sharing risk while demonstrating health economic value.

Another imperative is diversification of clinical pipelines by integrating next-generation modalities alongside legacy products. Companies should establish dedicated innovation units that collaborate with academic institutions and biotech startups, ensuring a steady flow of novel candidates. Concurrently, expanding patient support initiatives-ranging from digital adherence monitoring to personalized education programs-will strengthen therapeutic outcomes and bolster long-term brand equity. Finally, maintaining supply chain resilience through dual-sourcing agreements and geographic dispersion of manufacturing hubs will protect against import disruptions, guaranteeing continuity of care.

Outlining a Robust Research Methodology Integrating Data Collection, Analytical Techniques, and Validation Protocols for Cardiovascular Market Insights

This analysis is underpinned by a robust research methodology combining comprehensive secondary research, primary stakeholder engagement, and rigorous data validation. Secondary sources include peer-reviewed journals, regulatory filings, clinical trial databases, and industry publications, providing a wide-ranging view of scientific and commercial developments. Primary insights were gathered through structured interviews with key opinion leaders, payers, and senior executives at pharmaceutical and biotech companies, capturing real-time perspectives on market dynamics and strategic priorities.

Data triangulation techniques were applied to reconcile discrepancies across sources, ensuring that findings reflect the most accurate and current information available. Quantitative data were subjected to statistical validation methods, while qualitative inputs were mapped against emerging trends to elucidate causal relationships. In addition, a panel of external experts reviewed draft conclusions to confirm analytical rigor and practical relevance. This multi-layered approach guarantees that the report delivers actionable market intelligence that stakeholders can trust for strategic planning and decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Cardiovascular Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Cardiovascular Drugs Market, by Product Type

- Cardiovascular Drugs Market, by Dosage Form

- Cardiovascular Drugs Market, by Therapy Type

- Cardiovascular Drugs Market, by Distribution Channel

- Cardiovascular Drugs Market, by End User

- Cardiovascular Drugs Market, by Region

- Cardiovascular Drugs Market, by Group

- Cardiovascular Drugs Market, by Country

- United States Cardiovascular Drugs Market

- China Cardiovascular Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Highlight Strategic Imperatives and Future Pathways in the Evolving Field of Cardiovascular Drug Development

In summarizing the key themes uncovered throughout this report, several strategic imperatives emerge. The integration of precision medicine and digital health into cardiovascular drug development heralds a new era of personalized interventions, while tariff-related supply chain disruptions underscore the critical importance of operational resilience. Segmentation analysis reveals the nuanced interplay between product types, dosage forms, therapy modalities, distribution channels, and end-user settings, highlighting pathways for optimized market penetration. Regional insights emphasize the need for tailored strategies that reflect local regulatory landscapes and healthcare infrastructures.

Taken together, these findings point to a paradigm where pharmaceutical innovators must balance the pursuit of cutting-edge science with pragmatic commercial models. By harnessing advanced analytics, forging strategic alliances, and proactively managing risk factors, industry players can unlock sustainable growth opportunities. The collective strength of data-driven decision-making and collaborative partnerships will define the next chapter in cardiovascular therapeutics, shaping outcomes for patients and stakeholders alike.

Empowering Stakeholders with Direct Access to Expert Insights and Tailored Analysis to Secure a Competitive Edge with Associate Director Ketan Rohom

For tailored guidance and comprehensive insights that will elevate strategic decision-making in the cardiovascular drug landscape, reach out to Associate Director Ketan Rohom to purchase the full market research report. His expertise bridges scientific rigor with commercial acumen, ensuring that you receive actionable intelligence that aligns with your organization’s goals. Engage directly to explore customized data visualizations, granular analyses, and scenario planning tools designed to optimize product development, pricing strategies, and market entry decisions. By connecting with Ketan Rohom, you’ll gain access to exclusive executive briefings and priority support for ongoing research updates. Secure your competitive advantage today by leveraging this unparalleled resource and unlock the full potential of rich, data-driven insights specific to cardiovascular therapeutics.

- How big is the Cardiovascular Drugs Market?

- What is the Cardiovascular Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?