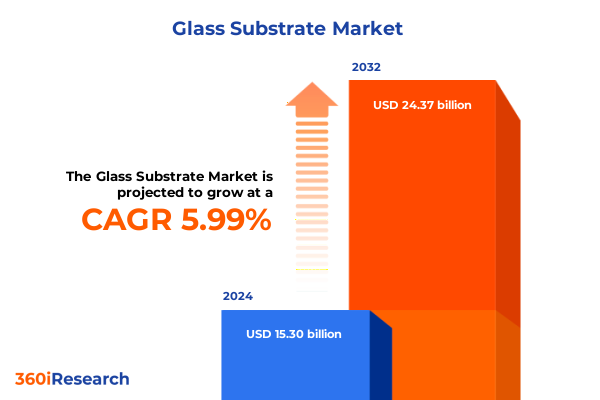

The Glass Substrate Market size was estimated at USD 16.15 billion in 2025 and expected to reach USD 17.04 billion in 2026, at a CAGR of 6.05% to reach USD 24.37 billion by 2032.

Emerging Performance Demands Are Propelling Glass Substrate Technologies into New Frontiers of Innovation Across High-Growth Industrial and Electronics Applications

The glass substrate industry stands at the crossroads of technological innovation and burgeoning end-market demand, driven by rapid advancements in electronics, energy storage, and specialty manufacturing. Emerging applications such as bendable displays, micro-LED lighting, and high-density packaging have thrust glass substrates into the spotlight as a critical enabler of next-generation devices. As materials science breakthroughs unlock new performance thresholds, companies are compelled to reassess their material selection criteria and manufacturing footprints to remain competitive.

Furthermore, evolving end-user requirements around durability, thermal stability, and optical clarity have intensified the focus on advanced glass formulations. Materials such as fused silica and borosilicate are increasingly prized for their low thermal expansion and chemical resistance, while innovations in silicon-based glasses promise to enhance performance in semiconductor packaging. Given this backdrop, stakeholders across the value chain must navigate a complex matrix of technical requirements, cost pressures, and sustainability imperatives to capitalize on growth opportunities. Consequently, a holistic understanding of material characteristics, processing technologies, and strategic market drivers is essential to inform investment decisions and long-term planning.

Rapid Technological Advancements and Sustainable Practices Are Reshaping the Glass Substrate Landscape for Electronics, Energy, and Manufacturing Ecosystems

The glass substrate landscape is undergoing transformative shifts spurred by the convergence of digitalization, environmental mandates, and advanced manufacturing techniques. Industry participants are harnessing data-driven process optimization and automation to achieve unprecedented levels of production precision and throughput. This digitization trajectory is complemented by the adoption of sustainable practices, including closed-loop recycling initiatives and low-carbon manufacturing processes, which are rapidly becoming non-negotiable for both upstream suppliers and downstream integrators.

Simultaneously, the integration of hybrid materials-such as glass-ceramic composites and functional coatings-has expanded the performance envelope of traditional substrates. These innovations enable substrates to withstand higher thermal loads, exhibit improved wear resistance, and deliver superior optical properties. In parallel, public and private sector investments in domestic semiconductor and renewable energy supply chains have galvanized efforts to localize high-purity glass production, mitigating geopolitical risks and ensuring supply resilience. Taken together, these shifts underscore a dynamic ecosystem where technological agility and sustainability are interwoven to propel the glass substrate market forward.

Escalating United States Trade Measures Have Eroded Profit Margins and Altered Global Supply Chains for Glass Substrate Manufacturers and Importers

Over the past several years, escalating United States trade measures have materially altered the cost structure and competitive dynamics of the global glass substrate market. Under Section 301 of the Trade Act, glass substrates and related glass products imported from China were subjected to a 25% tariff, significantly elevating landed costs for downstream manufacturers and OEMs. As these duties have persisted into 2025, companies reliant on imported substrates have faced sustained margin pressure, prompting a strategic pivot toward alternative sourcing and domestic production capabilities.

Moreover, the U.S. International Trade Commission’s recent investigations into glass substrates for liquid crystal displays have introduced additional uncertainty regarding intellectual property and potential exclusion orders. This evolving regulatory environment has compelled firms to reassess supply agreements, diversify supplier portfolios, and accelerate vertical integration strategies. In response, several glass producers and electronics assemblers have announced expansion plans for domestic glass substrate lines, signaling a concerted effort to offset the long-term impacts of punitive tariffs. Ultimately, the cumulative effect of these trade measures has been a recalibration of global supply chains and a renewed emphasis on resilience and autonomy.

Multifaceted Segmentation Reveals Critical Interplay between Glass Types, Category Innovations, Application-specific Dynamics, and Diverse End-user Requirements Driving Market Strategies

Insights derived from an in-depth segmentation analysis reveal the nuanced interplay between material types, product categories, application-end markets, and end-user demands. When assessing the spectrum of glass types, borosilicate glass and fused silica continue to emerge as foundational materials for high-precision electronics and semiconductor applications, while soda lime glass remains prevalent for cost-conscious, general-purpose needs. Ceramic glass variants are gaining traction in high-temperature and high-wear environments, and specialized silicon-based glasses are carving out niches where integration with semiconductor processes is critical.

Examining product categories uncovers shifting preferences between coated and uncoated substrates. Coated glass offers enhanced surface functionalities-such as anti-reflective, hydrophobic, and scratch-resistant properties-favoring optics and display segments, whereas float glass retains widespread use in architectural and standard fabrication contexts. Low iron glass has also seen targeted uptake in solar photovoltaic applications due to its superior light transmission. In parallel, key applications such as substrate carriers, through-glass via (TGV) interposers, and wafer packaging exhibit distinct material performance requirements, influencing supplier roadmaps and R&D priorities. Finally, end-user groups ranging from government research institutions and utilities to electronics manufacturers and dedicated R&D firms each drive unique demand profiles, underscoring the importance of tailored product strategies and service models.

This comprehensive research report categorizes the Glass Substrate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Category

- Application

- End User

Regional Dynamics Highlight North American Capacity Expansion, EMEA Value Chains Optimization, and Asia-Pacific Production Dominance in Glass Substrate Ecosystems

An analysis of regional market dynamics underscores diverging strategic imperatives across the globe. In the Americas, significant investments in domestic semiconductor fabrication and renewable energy installations have catalyzed local capacity expansion for specialty glass substrates. This trend is reinforced by policy incentives aimed at bolstering critical material supply chains and reducing reliance on Asian imports. Consequently, North American manufacturers are scaling up production lines for high-purity glass and investing in collaborative research partnerships with academic and governmental institutions.

In Europe, Middle East, and Africa, the focus has centered on optimizing value chains and fostering technology clusters. European glass producers have accelerated adoption of advanced production methods-such as chemical vapor deposition and precision molding-to meet stringent performance and sustainability targets. Regional consortia are also exploring circular economy initiatives, recycling post-industrial glass residues to minimize environmental footprints. Meanwhile, the Middle East’s growing interest in solar power and North Africa’s emerging electronics hubs are broadening the sub-regional demand base.

Asia-Pacific remains the largest and most diversified market, driven by established glass substrate giants in Japan and South Korea, burgeoning capacity in China, and dynamic innovation ecosystems in Taiwan. Regional suppliers have leveraged scale economies and local supply integration to maintain cost leadership, while simultaneously investing in next-generation materials tailored for 5G, electric vehicles, and smart manufacturing applications. This confluence of scale, technology, and policy support ensures the Asia-Pacific region will continue to shape global material flows and innovation trajectories.

This comprehensive research report examines key regions that drive the evolution of the Glass Substrate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Glass Substrate Innovators Are Leveraging Technological Synergies and Strategic Partnerships to Consolidate Market Positions and Advance Product Portfolios

Leading companies within the glass substrate arena are differentiating themselves through targeted innovation, strategic partnerships, and capacity investments. Industry stalwarts renowned for specialty glass formulations have deepened their R&D portfolios to incorporate functional coatings and hybrid composite structures, aligning product roadmaps with advanced electronics and energy storage needs. In parallel, diversified materials conglomerates are pursuing vertical integration by acquiring precision manufacturing facilities, enabling end-to-end control over glass quality and customization.

Collaboration between glass manufacturers and semiconductor equipment vendors has emerged as a critical competitive lever, facilitating co-development projects that address thermal management, mechanical stability, and electrical performance challenges. At the same time, several players have forged alliances with research institutions to explore next-generation substrates capable of supporting flexible form factors, integrated sensors, and embedded photonics. These cooperative models not only accelerate time-to-market but also de-risk development costs and foster knowledge exchange. As geopolitical and trade pressures intensify, companies with robust global footprints and adaptive supply chains are best positioned to navigate sustained volatility and capture nascent growth opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Glass Substrate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Inc.

- Applied Materials, Inc.

- AvanStrate Inc. by Vedanta Limited

- Codex International

- Compagnie de Saint-Gobain S.A.

- Coresix Precision Glass, Inc.

- Corning Incorporated

- Coursen Coating Labs. Inc.

- GAGE-LINE TECHNOLOGY, INC.

- Hoya Corporation

- Koch Industries, Inc.

- Kyodo International, Inc.

- Merck KGaA

- MTI Corporation

- Nippon Sheet Glass Company, Limited

- Ohara Inc.

- Ossila Ltd.

- Otto Chemie Pvt. Ltd.

- Plan Optik AG

- Resonac Holdings Corporation

- Schott AG

- Specialty Glass Products

- Swift Glass Company

- Sydor Optics

- Techinstro

- Viracon

Strategic Roadmap for Industry Leaders to Enhance Resilience through Supply Chain Diversification, Innovation Investment, and Collaborative Ecosystem Development

To navigate the evolving glass substrate landscape, industry leaders must adopt a strategic framework that emphasizes agility, collaboration, and sustainability. First, prioritizing supply chain diversification will mitigate exposure to geopolitical disruptions and punitive tariffs, ensuring uninterrupted access to critical materials while maintaining cost competitiveness. Concurrently, targeted investment in automation and digital quality control systems will enhance production efficiency, reduce defect rates, and support rapid scaling of high-purity glass lines.

Moreover, fostering cross-industry partnerships-particularly between material suppliers, semiconductor foundries, and renewable energy integrators-can create co-innovation platforms to tackle emerging performance requirements in wafer packaging, energy harvesting, and flexible electronics. Such collaborative ecosystems enable the pooling of technical expertise and capital resources, accelerating the development of breakthrough substrate solutions. Finally, embedding sustainability at the core of operational and product strategies-through initiatives like glass recycling loops and low-emission manufacturing processes-will not only address regulatory mandates but also resonate with environmentally conscious end users, enhancing brand reputation and unlocking new market segments.

Robust Mixed-method Research Framework Integrating Primary Expert Interviews, Secondary Data Triangulation, and Quantitative Analysis for Comprehensive Market Insights

This report’s methodology integrates a robust mixed-method approach to ensure comprehensive and reliable insights. Primary research comprised in-depth interviews with senior executives and technical experts across glass manufacturing, electronics assembly, and energy sectors. These engagements provided first-hand perspectives on material performance challenges, capacity planning, and strategic priorities, enriching the qualitative analysis.

Secondary research involved systematic review of public filings, patent disclosures, trade commission releases, and industry journals, complemented by meticulous data validation using proprietary databases. Quantitative modeling techniques were employed to analyze historical production volumes, trade flows, and capacity utilization trends, enabling identification of patterns and inflection points. Triangulation across these diverse data sources ensured consistency and mitigated bias. Finally, expert panel discussions were convened to review preliminary findings, offering critical feedback that refined the report’s analytical framework and bolstered the credibility of key conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Glass Substrate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Glass Substrate Market, by Type

- Glass Substrate Market, by Category

- Glass Substrate Market, by Application

- Glass Substrate Market, by End User

- Glass Substrate Market, by Region

- Glass Substrate Market, by Group

- Glass Substrate Market, by Country

- United States Glass Substrate Market

- China Glass Substrate Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesis of Glass Substrate Industry Trends Underscores the Imperative for Agile Innovation and Strategic Adaptation to Geopolitical and Technological Disruptions

In summary, the glass substrate market is at an inflection point, shaped by rising performance demands, evolving regulatory landscapes, and transformative technological breakthroughs. Geopolitical trade measures have underscored the importance of supply chain resilience, prompting a strategic shift toward localized production and diversified sourcing. Simultaneously, the convergence of digitalization and sustainability imperatives is redefining manufacturing practices, compelling stakeholders to adopt advanced materials and circular economy principles.

As regional dynamics and end-user requirements continue to evolve, success will hinge on the ability to integrate material science innovations with agile operational strategies. Companies that proactively invest in collaborative R&D, vertical integration, and sustainable initiatives will be best positioned to capture growth in emerging applications such as micro-LED displays, wafer-level optics, and renewable energy substrates. Ultimately, the industry’s capacity to adapt to shifting market drivers and regulatory constraints will determine its trajectory in the coming decade.

Connect with Ketan Rohom for Immediate Access to the Comprehensive Glass Substrate Market Research Report and Actionable Strategic Insights

Engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, will help you secure this in-depth Glass Substrate Market Research Report and gain timely, actionable insights. He can guide you through tailored options that align with your strategic objectives and ensure you access the granular analysis needed to stay ahead of evolving market dynamics. By partnering proactively with Ketan Rohom, you will equip your organization with a robust framework for decision-making, identify new business opportunities, and enhance competitive positioning. Reach out today to obtain immediate clarity on segmentation strategies, regional developments, tariff implications, and the latest technological advancements impacting the glass substrate ecosystem. This partnership will empower your team to translate complex research findings into high-impact actions and sustained growth.

- How big is the Glass Substrate Market?

- What is the Glass Substrate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?