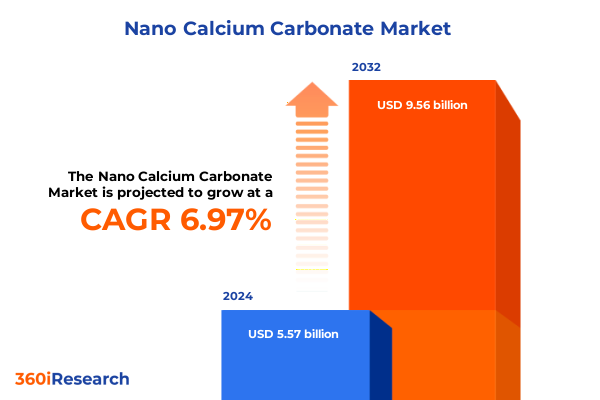

The Nano Calcium Carbonate Market size was estimated at USD 5.97 billion in 2025 and expected to reach USD 6.40 billion in 2026, at a CAGR of 7.26% to reach USD 9.76 billion by 2032.

Pioneering a New Era in Material Science: An Introduction to the Versatility and Advantages of Nano Calcium Carbonate Across Key Industrial Sectors

As materials science enters a new frontier, nano calcium carbonate stands at the forefront of transformative innovations, offering unparalleled opportunities for industrial performance enhancements and design flexibility. This introduction provides an in-depth overview of the key intrinsic properties of nano calcium carbonate, including its high surface area, tailored particle distributions, and surface chemistry tunability, which collectively drive improvements in mechanical strength, optical characteristics, and process efficiencies. Moreover, this section delineates the primary applications where nano calcium carbonate has demonstrated significant value, encompassing sectors as diverse as adhesives and sealants, paper and board, plastics and polymers, paints and coatings, cosmetics, food and beverage, pharmaceuticals, and rubber. Transitioning from conventional microscale fillers to nanoscale counterparts unlocks new functional possibilities, from enhanced rheological behavior in coatings to improved barrier properties in food packaging.

Furthermore, this narrative establishes the foundational context for understanding subsequent shifts in market dynamics, regulatory influences, and supply chain considerations. In doing so, readers will gain clarity on how nano calcium carbonate differentiates itself from traditional calcium carbonate grades, setting the stage for deeper analysis of segmentation strategies, regional drivers, and competitive landscapes. By the end of this introduction, stakeholders will appreciate both the breadth of potential applications and the nuanced technical advantages that position nano calcium carbonate as an essential component for next-generation product development and sustainable manufacturing practices.

How Emerging Innovations and Evolving Market Dynamics Are Driving Transformative Shifts in the Global Nano Calcium Carbonate Landscape

Innovation cycles and shifting customer demands continually reshape the industrial materials arena, and nano calcium carbonate exemplifies this ongoing transformation. Recently, the industry has witnessed a surge in advanced surface modification techniques, enabling manufacturers to enhance compatibility with organic matrices, thus driving widespread adoption in sectors like plastics, coatings, and adhesives. Furthermore, the convergence of digital design tools and additive manufacturing has opened new avenues for incorporating nano calcium carbonate into complex geometries and high-performance composites. Simultaneously, sustainability mandates and circular economy objectives have spurred research into greener synthesis routes, such as carbon capture integration and electrochemical precipitation methods, which reduce carbon footprints and enhance purity levels.

Moreover, regulatory frameworks governing nanoparticle usage in sensitive applications-particularly in food, pharmaceuticals, and cosmetics-have become increasingly stringent. These evolving standards have encouraged producers to implement robust quality assurance protocols, driving greater process transparency and fostering trust among end users. Consequently, strategic collaborations between materials scientists, regulatory bodies, and industry consortia have accelerated the development of standardized testing methodologies and safety assessments. Driving these transformative shifts, emerging markets in the Asia-Pacific region have contributed significant capital investments in production capacity expansions and R&D initiatives, creating a more diversified and resilient supply chain. Altogether, these cumulative forces underscore the multifaceted dynamics propelling nano calcium carbonate from niche innovation to mainstream industrial staple.

Assessing the Cumulative Impact of the 2025 United States Tariff Framework on Nano Calcium Carbonate Supply Chains, Costs, and Competitive Positioning

In early 2025, the United States implemented revised tariff schedules targeting a range of imported nano calcium carbonate products, marking a pivotal juncture for domestic supply chains and pricing strategies. While the intent was to safeguard local manufacturing capabilities and encourage onshore production, the cumulative effect has manifested in higher landed costs for end users reliant on established import channels. Consequently, procurement professionals have engaged in more rigorous supplier evaluations, negotiating term adjustments and exploring alternative origins to mitigate cost escalations. At the same time, domestic producers have ramped up capacity, albeit with lead times that initially struggled to match the sudden shift in demand patterns.

Furthermore, this policy shift spurred a pronounced acceleration in near-shoring and strategic inventory realignment. Industries such as paints and coatings, paper and board, and plastics began to reevaluate risk profiles, placing greater emphasis on supply reliability over minimal unit costs. Consequently, long-term contracts with diversified origin points and multi-sourcing strategies gained prominence, reducing vulnerability to future trade policy changes. Simultaneously, downstream manufacturers have invested in process optimization and material efficiency, seeking to offset tariff-induced cost pressures by improving filler loadings and dispersion techniques. Overall, the 2025 tariff framework has catalyzed a reconfiguration of the nano calcium carbonate value chain in the United States, emphasizing supply resilience and strategic collaboration across the ecosystem.

Unveiling Critical Insights into Nano Calcium Carbonate Market Segmentation by Application, Product Type, End User, Grade, Particle Size, and Distribution Networks

A comprehensive understanding of the nano calcium carbonate market requires an integrated examination of its diverse segmentation dimensions, which reveals how nuanced technical and commercial considerations shape product offerings and end-user adoption. When viewed through the lens of application, the material’s performance characteristics align with the specific requirements of adhesives and sealants, where improved bonding and rheology drive formulation enhancements; in the cosmetics sector, where functionalized surfaces contribute to uniform dispersion and skin feel; and in the food and beverage domain, where regulatory compliance and purity standards dictate grade selection. Shifting focus to product types underscores the contrast between ground and precipitated variants, with precipitated grades offering tighter particle size distributions for high-end coatings and polymers, while surface-coated and uncoated types cater to distinct surface energy and functionalization needs.

Moreover, end-user industry segmentation reiterates many of these themes, revealing that paper and board manufacturers leverage specialized grades for coated and uncoated substrates, whereas plastics and polymers producers target specific polymer matrices such as polyethylene and polypropylene to optimize modulus and impact resistance. Grade distinctions further delineate commercial and technical applications, with food and pharma grades adhering to stringent purity protocols and technical grades fulfilling demanding performance criteria in automotive and electronics contexts. Particle size segmentation, spanning less than 50 nanometers up to sizes exceeding 100 nanometers, highlights the critical influence of surface area on optical and mechanical properties. Finally, distribution channels, including direct sales, distributor partnerships, and online platforms, shape market accessibility and logistical effectiveness, with each model influencing inventory strategies, customer engagement dynamics, and cost structures.

This comprehensive research report categorizes the Nano Calcium Carbonate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Grade

- Particle Size

- Application

- End User Industry

- Distribution Channel

Illuminating Regional Dynamics and Growth Drivers Shaping the Nano Calcium Carbonate Market Across Americas, Europe Middle East Africa, and Asia Pacific

Regional dynamics play a pivotal role in defining the competitive contours and growth trajectories of the nano calcium carbonate market. In the Americas, demand has historically been buoyed by robust packaging and plastics sectors, where the pursuit of lightweight and high-strength composites has driven extensive adoption. Additionally, North American regulatory agencies have instituted clear guidelines on nanoparticle safety, which in turn have fostered greater confidence among consumer goods manufacturers. Transitioning to the Europe, Middle East, and Africa region, the paper and board industry remains a stalwart driver of nano calcium carbonate consumption, with coated paper grades particularly valued for their brightness and printability enhancements. Concurrently, sustainability goals and circular economy initiatives across Western Europe have spurred investments in eco-friendly filler solutions.

Turning to Asia-Pacific, the constellation of rapidly expanding end-user industries-including automotive, construction, and personal care-has yielded the fastest growth rates globally. China and India, in particular, have witnessed significant capacity expansions, underpinned by government incentives for high-purity mineral processing and nanotechnology research. Moreover, the proliferation of local surface treatment facilities has reduced lead times and transportation costs, enabling regional players to compete on both price and performance. Across all territories, cross-border partnerships and technology transfer agreements have further blurred geographical boundaries, engendering a more interconnected and resilient supply chain landscape for nano calcium carbonate.

This comprehensive research report examines key regions that drive the evolution of the Nano Calcium Carbonate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Strategic Moves, Technological Advances, and Collaborative Initiatives Among Leading Nano Calcium Carbonate Manufacturers and Innovators Worldwide

Leading manufacturers and technology providers in the nano calcium carbonate space demonstrate a broad spectrum of strategic approaches, ranging from capacity expansions and joint ventures to pioneering R&D initiatives. Several key players have invested heavily in surface functionalization capabilities, establishing dedicated pilot plants and collaborative programs with polymer compounders and coating formulators. Through these partnerships, suppliers gain real-world insights into performance requirements, enabling accelerated product optimization cycles and faster time to market. Meanwhile, other organizations have pursued mergers and acquisitions to consolidate raw material access and integrate end-to-end value chains, driving cost synergies and reinforcing market leadership in specialized segments like pharmaceuticals and food-grade powders.

In addition, forward-looking companies are embracing digitalization to enhance supply chain transparency and customer engagement. By deploying advanced analytics platforms and blockchain-based traceability solutions, they offer downstream partners detailed provenance data, quality certifications, and real-time inventory status. These technological leaps not only streamline procurement processes but also facilitate compliance with increasingly exacting regulatory frameworks governing nanoparticle usage in critical applications. Competitive differentiation now hinges on the ability to marry material science expertise with agile service models, enabling responsive scaling of nano calcium carbonate offerings to meet evolving performance and sustainability mandates.

This comprehensive research report delivers an in-depth overview of the principal market players in the Nano Calcium Carbonate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Evonik Industries AG

- Imerys SA

- J.M. Huber Corporation

- Kunal Calcium Limited

- Maruo Calcium Co., Ltd.

- Merck KGaA

- Minerals Technologies Inc.

- NanoMaterials Technology Co., Ltd. (NMT)

- Omya AG

- Shandong Bangu Secca New Materials Co., Ltd.

- Sibelco Group NV

- Toyal America, Inc.

- US NanoMaterials, Inc.

Actionable Strategies for Industry Leaders to Capitalize on Nano Calcium Carbonate Advancements in Product Development, Sustainability, and Market Penetration

Industry leaders seeking to harness the full potential of nano calcium carbonate must adopt a multifaceted approach that balances technical innovation with operational excellence and market responsiveness. First, investing in advanced surface treatment research will unlock new functionalities and broaden application scope, particularly in high-value sectors such as pharmaceuticals and electronics. Simultaneously, optimizing particle size distributions through precision synthesis techniques can enhance performance in targeted end-user industries, driving competitive differentiation. Moreover, executives should foster strategic alliances with downstream formulators, leveraging joint development projects to co-create next-generation composites and coatings that meet stringent sustainability and regulatory requirements.

Furthermore, enhancing digital capabilities across the value chain is imperative. Companies can deploy predictive analytics tools to anticipate demand fluctuations and optimize inventory levels, thereby mitigating supply disruptions. In parallel, embracing direct-to-customer digital platforms will streamline ordering processes and enable richer data capture on end-use performance metrics. Finally, decision-makers should evaluate the resilience of their sourcing strategies by diversifying supplier bases geographically and exploring near-shoring opportunities to balance cost management with supply security. By implementing these targeted recommendations, organizations will position themselves to capitalize on burgeoning market opportunities and drive enduring growth in the nano calcium carbonate landscape.

Comprehensive Overview of Research Methodology Including Data Collection, Validation Processes, and Analytical Frameworks Underpinning This Nano Calcium Carbonate Study

This report’s insights are founded on a rigorous research methodology that integrates both primary and secondary data sources, ensuring comprehensive coverage and analytical depth. Initially, we conducted structured interviews and surveys with a diverse array of stakeholders, including materials scientists, R&D directors, procurement managers, and regulatory experts, to gather firsthand perspectives on technical performance criteria, market trends, and future outlooks. Concurrently, a thorough review of open-source literature, patent filings, white papers, and industry standards provided contextual understanding of emerging synthesis techniques, surface modification strategies, and safety assessment methodologies.

Subsequently, we applied a systematic data triangulation process, cross-referencing primary inputs with secondary findings to validate key themes and identify potential discrepancies. Quality assurance protocols encompassed source credibility evaluations and consistency checks, while analytical frameworks such as SWOT and Porter’s Five Forces were employed to elucidate competitive dynamics and strategic imperatives. This multifaceted approach, underpinned by transparent documentation of data collection and validation steps, ensures that the report’s conclusions rest on a robust and verifiable foundation, offering stakeholders reliable guidance for informed decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Nano Calcium Carbonate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Nano Calcium Carbonate Market, by Product Type

- Nano Calcium Carbonate Market, by Grade

- Nano Calcium Carbonate Market, by Particle Size

- Nano Calcium Carbonate Market, by Application

- Nano Calcium Carbonate Market, by End User Industry

- Nano Calcium Carbonate Market, by Distribution Channel

- Nano Calcium Carbonate Market, by Region

- Nano Calcium Carbonate Market, by Group

- Nano Calcium Carbonate Market, by Country

- United States Nano Calcium Carbonate Market

- China Nano Calcium Carbonate Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Synthesis of Key Findings and Strategic Imperatives Highlighting the Future Trajectory of the Nano Calcium Carbonate Industry

The convergence of material science innovations, evolving regulatory landscapes, and strategic market shifts underscores a pivotal moment for the nano calcium carbonate industry. As detailed throughout this report, transformative advancements in surface functionalization and greener production techniques have expanded the material’s applicability, while policy changes such as the 2025 tariff adjustments have reshaped supply chain strategies and cost dynamics. Moreover, nuanced segmentation insights reveal how end-user requirements-spanning applications from adhesives to pharmaceuticals-demand tailored grades, precise particle size controls, and optimized distribution approaches.

Looking ahead, regional analyses indicate that growth will remain robust across Asia-Pacific, driven by manufacturing expansion and supportive policies, while the Americas and EMEA regions will continue to emphasize sustainability and regulatory alignment. Leading companies are poised to differentiate through collaborative R&D initiatives, digital supply chain enhancements, and strategic investments in high-purity production capabilities. Collectively, these factors point to a future in which nano calcium carbonate not only enhances traditional product formulations but also catalyzes the development of novel applications in emerging industries. Stakeholders who integrate these insights into their strategic planning will be well positioned to navigate challenges, seize new growth opportunities, and shape the industry’s next chapter.

Engage with Ketan Rohom to Secure Comprehensive Nano Calcium Carbonate Market Analysis and Propel Your Strategic Decision Making to New Heights

To explore the full breadth of insights and proprietary analyses presented in this comprehensive nano calcium carbonate market report, please reach out to Ketan Rohom, Associate Director, Sales & Marketing, who will guide you through customized solutions designed to meet your strategic objectives. By engaging with Ketan Rohom, you will benefit from a personalized walk-through of the report’s core findings, as well as access to value-added services, including tailored briefings, supplemental data requests, and in-depth one-on-one consultations. This partnership will ensure that your organization can leverage the report’s actionable intelligence rapidly, accelerating decision-making processes and maximizing your competitive positioning in the evolving nano calcium carbonate landscape. Contact Ketan today to secure your copy of this essential resource and embark on an informed journey toward innovation, efficiency, and market leadership.

- How big is the Nano Calcium Carbonate Market?

- What is the Nano Calcium Carbonate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?