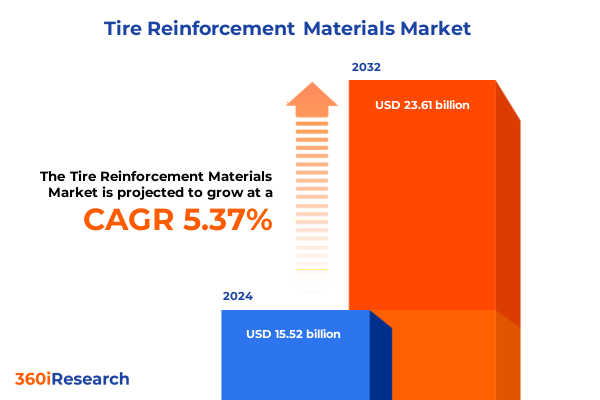

The Tire Reinforcement Materials Market size was estimated at USD 16.30 billion in 2025 and expected to reach USD 17.14 billion in 2026, at a CAGR of 5.43% to reach USD 23.61 billion by 2032.

Navigating the Complex Terrain of Tire Reinforcement Materials Through a Focused Overview of Market Drivers and Technological Evolution

The tire reinforcement materials sector is at a pivotal juncture, where advances in composite engineering and evolving automotive demands are redefining foundational product attributes. Reinforcement cords-whether fashioned from high-strength steel, advanced aramid fibers, or legacy textile formulations-serve as the structural backbone of modern tire assemblies, delivering the tensile strength, fatigue resistance, and dimensional stability required for contemporary performance benchmarks. In recent years, heightened consumer expectations for longevity, fuel efficiency, and ride comfort have driven original equipment manufacturers and aftermarket suppliers alike to scrutinize material selection, processing methods, and end-use adaptation with unprecedented rigor.

Against this backdrop, the following analysis provides a strategic overview of the forces shaping the tire reinforcement materials market. Through an examination of emerging technologies, regulatory shifts, tariff implications, and granular segmentation trends, decision-makers will gain a clear line of sight into growth corridors and risk mitigants. Transitional dynamics-from the migration toward radial and belted radial constructions to the accelerated adoption of meta-aramid fibers-are charted alongside regional and competitive intelligence. The ensuing sections equip stakeholders with actionable perspectives to navigate supply chain complexities, capitalize on segment-specific momentum, and future-proof product strategies in an increasingly sustainability-driven ecosystem.

Unraveling Groundbreaking Disruptions Transforming the Tire Reinforcement Materials Landscape with Innovative Composites and Shifting Industry Paradigms

The landscape of tire reinforcement materials is experiencing transformative shifts as automakers and material innovators converge on performance, durability, and sustainability. High-performance aramid fibers are supplanting traditional cord formulations in premium segments, while refinements in cold-drawn and hot-rolled steel cord processes are boosting tensile strength and corrosion resistance to meet the exacting demands of heavy-duty and specialty off-road applications. Concurrently, bio-based and recycled textile cords are emerging from prototype to pilot-scale production, reflecting both regulatory imperatives and consumer pressure for circularity.

These material innovations coincide with fundamental changes in demand profiles. The proliferation of electric vehicle platforms is accelerating the need for low-rolling-resistance constructions, prompting a reexamination of radial tire architectures and a surge in belted radial uptake. Parallel to this, rising interest in ultra-high-performance passenger car tires is expanding the role of non-belted radial formats engineered for weight reduction and rapid heat dissipation. Underpinning these shifts are digital manufacturing techniques, including automated cord placement and in-line quality monitoring, which are enabling scale-efficient customization and tighter tolerances across both original equipment and replacement markets.

Analyzing the Comprehensive Effects of 2025 United States Tariffs on Tire Reinforcement Material Supply Chains Cost Structures and Sourcing Strategies

The introduction of new tariff measures by the United States in 2025 has reshaped cost structures and supply chain strategies for tire reinforcement materials. Increased duties on select cord imports have driven manufacturers to reevaluate global sourcing models, with many redirecting procurement to low-cost steel and textile cord producers in Mexico and Southeast Asia. Vertical integration initiatives are gaining traction as original equipment suppliers and independent cord manufacturers seek to lock in domestic capacity and hedge against volatile international trade policies.

Cost pass-through effects are most pronounced in specialty reinforcements such as aramid fibers, where limited supplier alternatives amplify price sensitivity. As a result, some tire OEMs have accelerated joint-development partnerships with fiber producers to secure preferential capacity allocations and embed cost containment clauses. In the replacement segment, distributors and workshops are redistributing their product portfolios toward domestically produced radial and belted radial offerings, mitigating lead-time risks. Meanwhile, ongoing tariff reviews and trade negotiations inject a degree of uncertainty, underscoring the importance of robust scenario planning and agile procurement frameworks.

Deciphering Intricate Segmentation Dynamics Illuminating Distinct Growth Pathways Across Tiered Tire Construction Material Use Cases and Vehicle Applications

Deciphering the complex segmentation of the tire reinforcement materials market reveals distinctive growth pathways across construction types, material chemistries, end-use channels, and vehicle categories. Bias tire cords, though historically significant, have ceded share to belted radial formats prized for superior stability and uniform contact patches. Within radial constructions, non-belted designs are carving out niches in weight-sensitive and thermal-management-critical applications, manifesting especially in electric and ultra-high-performance passenger car segments.

Material segmentation charts another trajectory: meta-aramid fibers are achieving newfound adoption thanks to their thermal stability, while para-aramid variants continue to dominate applications requiring maximum tensile performance. Steel cord remains the workhorse for commercial vehicles, with cold-drawn grades providing consistent fatigue life and hot-rolled alternatives offering cost advantages in standard duty cycles. Textile cords-spanning rayon, polyester, and the expanding polyamide 6 and 66 classes-are prized for flexibility in workshop and e-commerce channels, enabling aftermarket suppliers to offer tailored, cost-competitive solutions.

The original equipment domain is characterized by deep engineering collaborations between auto manufacturers and tier-1 suppliers, driving incremental innovation in cord placement patterns and composite layup sequences. Conversely, the replacement landscape is defined by rapid fulfillment models through e-commerce platforms, traditional tire dealers, and independent workshops, requiring distribution networks to balance inventory breadth with forecast agility. In the vehicle type spectrum, passenger cars and SUVs command the largest volume, yet commercial buses and trucks are exhibiting notable growth as fleet operators prioritize long-haul reliability. Off-the-road segments in agricultural and mining contexts remain specialized yet critical for sustaining overall market resilience.

This comprehensive research report categorizes the Tire Reinforcement Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Tire Construction

- Reinforcement Form

- Tire Component

- End User

- Vehicle Type

Exploring Critical Regional Variations Shaping Tire Reinforcement Materials Demand Patterns and Manufacturing Ecosystems in the Americas EMEA and APAC Markets

Regional dynamics exert a powerful influence on the trajectory of tire reinforcement materials demand and manufacturing footprints. In the Americas, nearshoring trends have accelerated following trade policy shifts, prompting cord producers to bolster capacity in the United States and Mexico. OEM partnerships with regional steel cord mills have been formalized to safeguard supply continuity for commercial vehicle tire assemblies, while aftermarket participants are expanding distribution hubs to shorten replenishment cycles across North and South America.

Europe, Middle East & Africa unite regulatory rigor with ambitious sustainability targets, catalyzing investment in bio-derived and recycled textile cord innovations. Leading European tire companies are commissioning pilot plants for circular cord reclamation, leveraging the region’s advanced recycling infrastructure. Concurrently, Middle Eastern and African markets are emerging as inbound demand corridors, with distributors seeking robust radial tire reinforcement solutions tailored to extreme temperature and terrain conditions.

Asia-Pacific continues to command the largest production share, underpinned by China’s dominant steel and textile cord manufacturing base and India’s rapidly expanding automotive sector. Government incentives for domestic material innovation have spurred R&D clusters in South Korea and Japan focusing on next-generation aramid derivatives. At the same time, Southeast Asian nations are capitalizing on cost advantages to attract new cord capacity, supporting a diversified supply network that balances high-volume and specialized reinforcement requirements.

This comprehensive research report examines key regions that drive the evolution of the Tire Reinforcement Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling Strategic Competitive Moves and Collaborative Ventures Accelerating Innovation and Operational Excellence Among Leading Cord and Tire Manufacturers

Industry leaders are intensifying efforts to capture the next wave of innovation and operational excellence in tire reinforcement materials. Major tire manufacturers have forged strategic alliances with aramid fiber producers to co-develop high-temperature resistant cord constructs for electric and high-performance vehicle segments. Concurrently, established steel cord suppliers are investing in automated cold-drawing lines to enhance throughput while reducing dimensional variability, thereby addressing growing quality demands from tier-1 tire OEMs.

In the textile cord realm, market participants are launching pilot recovery programs for nylon and polyester fibers, tapping into sustainability frameworks mandated by leading regulatory bodies. Ambitious capacity expansions are underway in North America and Europe, supported by public-private partnerships aimed at decarbonizing the value chain. On the aftermarket front, digital platforms are being integrated with blockchain-enabled traceability solutions, providing end users with transparent material provenance and reinforcing brand trust.

Emerging players are differentiating through niche specialization, such as developing hybrid cords combining aramid and textile fibers to balance cost and performance. These agile entrants are collaborating with research universities to fast-track material testing protocols and secure early adopters among boutique and large-scale tire producers alike. Across the competitive landscape, M&A activity remains robust, as vertically integrated models are favored to consolidate raw material streams and streamline product development timelines.

This comprehensive research report delivers an in-depth overview of the principal market players in the Tire Reinforcement Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aarti Steels Ltd.

- Bansal Wire Industries Ltd.

- Bridgestone Corporation

- Century Enka Ltd.

- Coats Group PLC

- Colmant Coated Fabrics

- Cordenka GmbH & Co. KG

- DuPont de Nemours, Inc

- Formosa Taffeta Co., Ltd.

- Hanoi Industrial Textile JSC

- Henan Hengxing Science & Technology Co., Ltd.

- HS HYOSUNG ADVANCED MATERIALS

- Indorama Ventures Public Company Limited

- Jiangsu Taiji Industry New Materials Co., Ltd.

- Kolon Industries, Inc.

- Kordsa Technical Textile Co. Inc.

- Milliken & Company

- NV Bekaert SA

- Passaic Rubber Company

- Rajratan Global Wire Limited

- Saarstahl AG

- Shakti Cords Pvt. Ltd.

- Shanghai Metal Corporation

- SRF Limited

- Suzhou kingdom textile technology Co., Ltd.

- Teijin Limited

- TOKYO ROPE MFG. CO., LTD.

- Toray Industries, Inc.

- Toyobo Co., Ltd.

- Zhejiang Hailide New Material Co., Ltd.

Embedding Holistic Supply Chain Resilience and Circular Innovation Strategies to Secure Competitive Advantage in the Evolving Reinforcement Materials Arena

To thrive amidst evolving market dynamics, industry leaders must prioritize an integrated approach that aligns material innovation with supply chain resilience. Establishing long-term partnerships with aramid and steel cord suppliers will secure preferential capacity amid tariff uncertainties, while co-investment in regional production facilities will mitigate logistics risk and optimize total cost of ownership. Adopting advanced digital manufacturing tools such as real-time cord placement monitoring and in-line defect detection can accelerate new product introduction cycles and enhance overall quality consistency.

Embedding circular economy principles across cord lifecycles-from On-spec reclaim of textile fibers to closed-loop recovery of steel scrap-will become a differentiator both in meeting stringent environmental mandates and appealing to eco-conscious end users. Deployment of predictive analytics for demand forecasting will enable distribution networks to balance inventory depth against obsolescence risk in e-commerce, dealer, and workshop channels. Ultimately, integrating these capabilities with collaborative R&D frameworks will empower original equipment and aftermarket stakeholders to deliver differentiated tire reinforcement solutions that resonate in passenger, commercial, and off-road applications.

Detailing a Rigorous Multi‐Modal Research Framework Blending Primary Executive Interviews with Secondary Data Triangulation to Validate Segmentation and Regional Trends

The research methodology underpinning this analysis integrates a robust blend of primary and secondary research techniques to ensure comprehensive coverage and data integrity. In-depth interviews were conducted with industry executives spanning tire original equipment manufacturers, tier-1 suppliers, cord producers, and aftermarket distributors. These conversations provided nuanced insights into material selection criteria, strategic investment priorities, and emerging risk factors associated with trade policy shifts and sustainability mandates.

Secondary research encompassed the review of technical publications, regulatory filings, corporate financial disclosures, and trade association reports. Market intelligence data was triangulated through cross-referencing shipment statistics, customs databases, and manufacturing capacity records to validate regional production trends. Segmentation frameworks were rigorously tested against real-world case studies, ensuring that construction types, material variants, end-use channels, and vehicle categories accurately reflect current industry practices and evolving usage scenarios.

Quantitative findings were subjected to multi-layered quality assurance protocols, including peer reviews by subject-matter experts and sensitivity analyses to account for market volatility. As a result, stakeholders can trust that the insights presented here rest on a foundation of methodical research design, credible data sources, and transparent analytical processes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Tire Reinforcement Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Tire Reinforcement Materials Market, by Material Type

- Tire Reinforcement Materials Market, by Tire Construction

- Tire Reinforcement Materials Market, by Reinforcement Form

- Tire Reinforcement Materials Market, by Tire Component

- Tire Reinforcement Materials Market, by End User

- Tire Reinforcement Materials Market, by Vehicle Type

- Tire Reinforcement Materials Market, by Region

- Tire Reinforcement Materials Market, by Group

- Tire Reinforcement Materials Market, by Country

- United States Tire Reinforcement Materials Market

- China Tire Reinforcement Materials Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Synthesizing Strategic Imperatives and Segmentation Insights to Chart a Resilient Future Course for Tire Reinforcement Ecosystems

In summation, the tire reinforcement materials market is poised at the intersection of technological innovation, trade dynamics, and sustainability imperatives. Differentiation through advanced aramid, steel, and textile cord solutions is increasingly vital as vehicle OEMs and aftermarket suppliers seek to optimize performance, cost, and environmental footprint. The ripple effects of 2025 United States tariffs underscore the importance of agile sourcing strategies and regional manufacturing partnerships to safeguard supply continuity and margin stability.

Segmentation insights reveal that belted radial constructions and meta-aramid fibers are among the most promising growth vectors, while e-commerce and workshop channels drive replacement market agility. Regional analysis highlights the Americas’ nearshoring momentum, EMEA’s regulatory-driven innovation focus, and APAC’s production scale advantages. Competitive intelligence points toward strategic alliances, digital manufacturing adoption, and circular economy initiatives as key differentiators for leading cord and tire manufacturers.

By implementing the actionable recommendations outlined, stakeholders can enhance resilience, foster innovation, and capitalize on the evolving landscape of tire reinforcement materials. The strategic interplay of material science, supply chain design, and market segmentation will define competitive leadership in the years ahead.

Unlock Exclusive Intelligence on Tire Reinforcement Materials and Drive Strategic Market Leadership by Partnering Directly with Our Expert for Your Customized Report

To explore the full depth of these insights and translate them into strategic advantage, contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to secure your comprehensive market research report. Engage with an expert who understands the nuances of tire reinforcement materials and can guide you through leveraging this analysis to optimize supply chains, identify growth opportunities, and strengthen your competitive positioning. Take the next step toward informed decision-making and sustainable market leadership by obtaining the definitive industry study today.

- How big is the Tire Reinforcement Materials Market?

- What is the Tire Reinforcement Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?