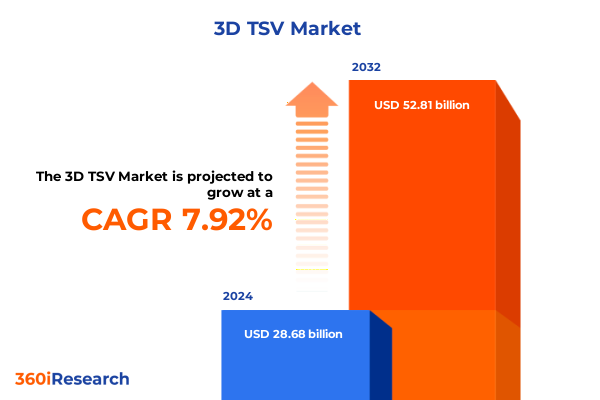

The 3D TSV Market size was estimated at USD 30.89 billion in 2025 and expected to reach USD 33.27 billion in 2026, at a CAGR of 7.96% to reach USD 52.81 billion by 2032.

Innovating Semiconductor Performance and Miniaturization Through 3D Through Silicon Via Technologies Paving the Way for Next-Generation Device Integration

Innovating Semiconductor Performance and Miniaturization Through 3D Through Silicon Via Technologies Paving the Way for Next-Generation Device Integration

Three-dimensional Through Silicon Via (TSV) technology represents a paradigm shift in semiconductor integration, enabling vertical interconnects that dramatically shorten signal paths, reduce power consumption, and increase functional density. By drilling microscopic vias through silicon wafers and filling them with conductive materials, this advanced packaging method overcomes the limitations of traditional two-dimensional layouts. As modern applications-from artificial intelligence accelerators to automotive sensor systems-demand ever greater performance within shrinking footprints, TSV solutions are emerging as critical enablers for heterogeneous integration of logic, memory, and sensor elements in a single stack.

This executive summary synthesizes the most significant developments in the 3D TSV ecosystem, examining transformative shifts in materials and wafer scaling, the ramifications of recent trade policies, and granular segmentation insights across material types, wafer dimensions, packaging formats, application domains, and end-user industries. Additionally, regional dynamics and competitive landscapes are explored to illuminate strategic positioning by leading providers. Complementing this analysis, actionable recommendations are offered for industry leaders seeking to capitalize on emerging opportunities, while a transparent research methodology underscores the rigor and reliability of the findings presented herein.

Emerging Advances in Materials, Wafer Scaling, and Packaging Architectures Reshaping the Future of 3D Through Silicon Via Integration

Emerging Advances in Materials, Wafer Scaling, and Packaging Architectures Reshaping the Future of 3D Through Silicon Via Integration

The 3D TSV landscape has undergone a remarkable evolution fueled by breakthroughs in conductive materials and wafer geometries. Innovations in copper fill processes have unlocked higher aspect ratios and lower electrical resistance, while experimental adoption of tungsten lining addresses electromigration and reliability concerns in high-temperature environments. Concurrently, the transition from 200 mm to 300 mm wafers has delivered economies of scale that reduce per-unit costs and open pathways for broader commercial adoption, especially in high-volume consumer and communication applications.

Packaging architectures have also shifted dramatically. Whereas early implementations emphasized two-and-a-half-dimensional interposers to bridge separate die, the industry is now embracing true three-dimensional stacks that integrate logic, memory, and sensor elements in a single compact footprint. This transition to immersive, heterogeneous integration is supported by advances in thermal management, design collaboration platforms, and standardization initiatives that streamline cross-supplier interoperability. As a result, organizations across the value chain-from fabless design houses to OSAT partners-are forging new alliances to co-develop end-to-end solutions capable of meeting the rigorous demands of next-generation computing, imaging, and automotive systems.

Evaluating the Comprehensive Effects of United States Tariff Measures on 3D Through Silicon Via Supply Chains, Costs, and Strategic Sourcing in 2025

Evaluating the Comprehensive Effects of United States Tariff Measures on 3D Through Silicon Via Supply Chains, Costs, and Strategic Sourcing in 2025

The introduction of new tariff measures on semiconductor-related equipment and materials by the United States in 2025 has reverberated across the 3D TSV sector, prompting a strategic reassessment of supply chains and procurement models. Increased duties on imported lithography tools and chemical precursors have elevated production costs, incentivizing manufacturers to negotiate long-term agreements with domestic suppliers or to relocate key processes closer to home markets. This shift has not only mitigated exposure to fluctuating trade policies but also fostered the growth of local ecosystems capable of supporting advanced packaging requirements.

Simultaneously, raw material tariffs have introduced volatility in copper and tungsten pricing, compelling end users to explore alternative sourcing strategies or to secure hedging arrangements. In response, several foundries and OSAT providers have established diversified supplier networks spanning North America, Europe, and Asia-Pacific. These strategic adjustments have also accelerated investments in automation and yield-improvement initiatives to counterbalance cost pressures. Ultimately, the cumulative impact of tariff policies is driving a new era of regionalization and collaborative risk-sharing agreements aimed at sustaining the momentum of 3D TSV innovation.

Uncovering In-Depth Insights Across Material Types, Wafer Dimensions, Packaging Approaches, Applications, and End-User Verticals in 3D TSV Ecosystem

Uncovering In-Depth Insights Across Material Types, Wafer Dimensions, Packaging Approaches, Applications, and End-User Verticals in 3D TSV Ecosystem

Insights across material type reveal a nuanced balance between copper’s superior electrical performance and tungsten’s reliability in harsh conditions, guiding selection based on application-specific requirements. In parallel, wafer size segmentation highlights the ongoing coexistence of 200 mm facilities-with their optimized throughput for legacy and niche products-and 300 mm lines that deliver cost efficiencies for high-volume consumer electronics, networking equipment, and server components.

The packaging landscape is similarly bifurcated between two-and-a-half-dimensional interposers and fully three-dimensional stacks, each offering distinct thermal and signal-integrity profiles. In terms of applications, CMOS image sensors leverage TSVs to achieve compact camera modules, while high-performance logic die-spanning both CPU and GPU architectures-rely on dense vertical interconnects to maintain bandwidth in artificial intelligence and data-center workloads. Memory solutions, whether DRAM or NAND Flash, utilize TSV integration to enhance data throughput and power efficiency in multicore computing systems.

End-user industries exhibit divergent adoption trajectories: automotive programs increasingly integrate ADAS and infotainment modules using TSV-enabled sensor arrays, whereas consumer electronics brands strive for slimmer smartphones, tablets, and personal computing devices. In healthcare, diagnostics and imaging equipment benefit from stacked sensor arrays and processing units, while information communication technology segments- covering networking equipment and servers- prioritize TSV solutions to address bandwidth and latency challenges in hyperscale environments.

This comprehensive research report categorizes the 3D TSV market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- TSV Material Type

- Wafer Size

- Packaging Type

- Application

- End User Industry

Mapping Regional Dynamics and Demand Drivers Shaping the Trajectory of 3D Through Silicon Via Adoption Across Major Global Markets

Mapping Regional Dynamics and Demand Drivers Shaping the Trajectory of 3D Through Silicon Via Adoption Across Major Global Markets

In the Americas, government incentives supporting semiconductor fabrication and advanced packaging have bolstered investments in local foundries and OSAT facilities. The region’s strong demand for data-center acceleration and automotive electronics drives rapid uptake of TSV-enabled logic and sensor solutions. Meanwhile, partnerships between universities and semiconductor consortia are fostering next-generation materials research that could yield performance breakthroughs.

Across Europe, Middle East & Africa, a blend of industrial automation expertise and robust automotive supply chains is propelling targeted deployments of TSV-enabled modules in both electric vehicles and industrial imaging systems. Collaborative frameworks within the European Union emphasize sustainability and energy efficiency, steering design priorities toward materials that offer reduced thermal impact and lower power draw. Concurrently, select governments in the Middle East are launching technology investment funds to anchor advanced packaging hubs.

Asia-Pacific remains the largest adopter of 3D TSV technologies, underpinned by established manufacturing ecosystems in China, Taiwan, South Korea, and Japan. Here, wafer fabs and OSAT providers benefit from vertically integrated supply chains that streamline access to raw materials, lithography tools, and design services. Consumer electronics OEMs in the region continue to push the envelope on smartphone and wearable device form factors, while hyperscale data-center operators are partnering with local suppliers to co-develop TSV-based memory and logic stacks.

This comprehensive research report examines key regions that drive the evolution of the 3D TSV market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Positions, Innovation Pipelines, and Partnership Ecosystems of Leading Providers in the 3D Through Silicon Via Market

Analyzing Strategic Positions, Innovation Pipelines, and Partnership Ecosystems of Leading Providers in the 3D Through Silicon Via Market

Market leaders in 3D TSV integration have fortified their positions through a combination of in-house R&D and strategic alliances with design-tool vendors. Select foundries have expanded pilot lines dedicated to high-aspect-ratio TSVs, enabling iterative optimization of etch and fill processes. In parallel, several OSAT specialists have invested in automated inspection systems to enhance yield and reliability, with real-time defect detection that reduces costly rework.

Partnership ecosystems are evolving as a critical enabler of value creation. Foundries are co-developing collaborative design-for-manufacturing flows with EDA providers to ensure electrical and thermal models accurately reflect three-dimensional interconnect behavior. At the same time, memory manufacturers are working with equipment suppliers to refine deposition and planarization techniques that support ultra-thin die stacking for DRAM and NAND Flash modules.

Emerging entrants are also making targeted investments to challenge established incumbents. Leveraging niche expertise in compound semiconductors or precision micromachining, these players are carving out specialized service offerings tailored to high-reliability sectors such as aerospace and defense. Their presence is intensifying competitive dynamics, while simultaneously raising the bar for quality, innovation cycles, and time-to-market execution.

This comprehensive research report delivers an in-depth overview of the principal market players in the 3D TSV market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amkor Technology, Inc.

- Applied Materials, Inc.

- ASE Technology Holding Co., Ltd.

- Broadcom Inc.

- GlobalFoundries Inc.

- IBM Corporation

- Intel Corporation

- JCET Group Co., Ltd.

- Lam Research Corporation

- Micron Technology, Inc.

- Nanya Technology Corporation

- Powertech Technology Inc.

- Qualcomm Technologies, Inc.

- Samsung Electronics Co., Ltd.

- Siliconware Precision Industries Co., Ltd.

- SK hynix Inc.

- Sony Corporation

- STMicroelectronics N.V.

- SÜSS MicroTec AG

- Taiwan Semiconductor Manufacturing Company Limited

- Texas Instruments Incorporated

- Tezzaron Semiconductor Corporation

- Tongfu Microelectronics Co., Ltd.

- Toshiba Corporation

- UTAC Holdings Ltd.

Essential Strategic Imperatives and Tactical Approaches for Industry Leaders to Capitalize on Opportunities in the 3D Through Silicon Via Domain

Essential Strategic Imperatives and Tactical Approaches for Industry Leaders to Capitalize on Opportunities in the 3D Through Silicon Via Domain

Industry leaders should prioritize the establishment of cross-functional innovation platforms that bring together materials scientists, design engineers, and process technologists under a unified roadmap. By fostering the concurrent development of copper and tungsten TSV capabilities, organizations can mitigate technical risk and optimize solutions for distinct thermal and reliability requirements. In addition, investment in wafer-scale automation will be instrumental in driving yield improvements and reducing cycle times as wafer sizes expand from 200 mm to 300 mm.

Strategic diversification of supply chains is equally critical. Companies are advised to secure dual-sourcing agreements across multiple geographies to cushion against tariff-induced cost inflation and geopolitical disruptions. Engaging with qualified domestic equipment and materials suppliers can enhance resilience while unlocking co-innovation opportunities that accelerate throughput and quality gains.

Finally, industry players must align their product roadmaps with the precise needs of end-user verticals. Developing turnkey TSV-enabled camera modules for automotive ADAS or modular memory stacks for hyperscale data centers will differentiate offerings in crowded markets. By coupling deep domain expertise with flexible manufacturing platforms, organizations can capture new revenue streams and reinforce their leadership in the rapidly evolving 3D TSV ecosystem.

Comprehensive Research Framework Combining Primary Engagements, Secondary Analysis, and Triangulation Techniques for Robust 3D TSV Insights

Comprehensive Research Framework Combining Primary Engagements, Secondary Analysis, and Triangulation Techniques for Robust 3D TSV Insights

This study employed a rigorous multi-phased research framework designed to ensure methodological transparency and data integrity. The initial phase comprised secondary research encompassing industry publications, patent databases, and technical white papers, which established a foundational understanding of material properties, wafer geometries, and packaging innovations. Concurrently, proprietary databases were used to map global production capacities and identify key supply chain nodes across regions.

In the primary research phase, in-depth interviews were conducted with senior executives, process development engineers, and equipment suppliers to capture qualitative insights on emerging trends, challenges, and investment priorities. These engagements provided nuanced perspectives on tariff impacts, partnership models, and application-specific requirements. All primary data points were then cross-validated through a triangulation process that integrated quantitative estimates from public filings, collaborative input from academic research labs, and verification against industry benchmarks to deliver a comprehensive and balanced view of the 3D TSV landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 3D TSV market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 3D TSV Market, by TSV Material Type

- 3D TSV Market, by Wafer Size

- 3D TSV Market, by Packaging Type

- 3D TSV Market, by Application

- 3D TSV Market, by End User Industry

- 3D TSV Market, by Region

- 3D TSV Market, by Group

- 3D TSV Market, by Country

- United States 3D TSV Market

- China 3D TSV Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesis of Strategic Takeaways Highlighting Transformative Trends, Tariff Implications, and Segmentation Nuances Driving the Future of 3D TSV

Synthesis of Strategic Takeaways Highlighting Transformative Trends, Tariff Implications, and Segmentation Nuances Driving the Future of 3D TSV

Throughout this analysis, the confluence of materials innovation, wafer-scale economies, and packaging architecture evolution has been evident as the driving force behind the rapid adoption of three-dimensional Through Silicon Via solutions. The discipline has moved beyond proof-of-concept demonstrations to mature, high-volume implementations in consumer electronics, automotive systems, and data-center environments, reflecting the technology’s versatility and performance advantages.

Equally, the impact of 2025 United States tariff measures underscores the necessity of resilient supply chain strategies and regional diversification to safeguard manufacturing continuity. Organizations that have proactively restructured procurement models and invested in local supplier ecosystems are poised to maintain competitive pricing and deliver uninterrupted product roadmaps. Moreover, the granular segmentation insights across material type, wafer size, packaging style, applications, and end-user verticals serve as a vital blueprint for tailoring offerings to precise market needs.

Looking ahead, industry participants that can harmonize advanced R&D with agile manufacturing platforms-and that align their solutions with the strategic imperatives of end-user industries-will chart the next frontier of growth. By synthesizing the insights presented here with a clear action plan, decision-makers can navigate complexity, mitigate risk, and drive sustainable innovation within the 3D TSV domain.

Take Proactive Steps to Secure Comprehensive 3D TSV Market Intelligence by Connecting with Ketan Rohom to Access Exclusive Research Insights

We invite you to embark on a journey toward unparalleled clarity and confidence in your strategic planning by securing the complete market research report on 3D Through Silicon Via technologies. Connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, to discuss customized insights, explore sample chapters, and learn how this comprehensive intelligence can be tailored to address your organization’s unique challenges and objectives. By engaging with this decisive resource, you will gain exclusive access to qualitative analyses, expert perspectives, and actionable recommendations that can sharpen your competitive edge and guide your investment decisions. Reach out today to schedule a consultation and take the first step toward mastering the complexities of the 3D TSV landscape.

- How big is the 3D TSV Market?

- What is the 3D TSV Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?