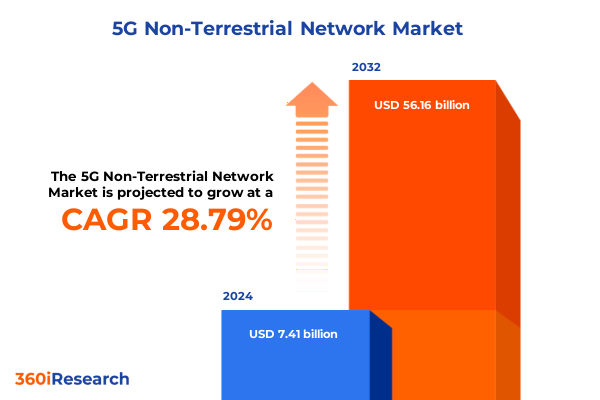

The 5G Non-Terrestrial Network Market size was estimated at USD 9.42 billion in 2025 and expected to reach USD 12.00 billion in 2026, at a CAGR of 29.05% to reach USD 56.16 billion by 2032.

Unveiling the Next Frontier in Global Telecommunications: A Comprehensive Overview of 5G Non-Terrestrial Network Convergence Amid Evolving Market Drivers

Non-Terrestrial Networks are redefining the boundaries of global connectivity by merging 5G terrestrial capabilities with airborne and orbital platforms. As the telecommunications sector expands beyond cell towers and fiber networks, space- and air-borne nodes such as low-Earth orbit (LEO) satellites, high-altitude platforms (HAPs), and unmanned aerial vehicles (UAVs) are poised to deliver seamless broadband services to regions where traditional infrastructure is impractical or cost-prohibitive. This convergence not only promises ubiquitous coverage but also supports mission-critical applications in emergency response, remote monitoring, and industrial automation.

The impetus behind the 5G non-terrestrial network evolution is multifaceted. On one hand, mobile network operators seek to address rural and isolated regions where backhaul connections are lacking or unreliable. On the other, defense agencies and governments aim to ensure resilient, sovereign communications across remote theatres. Private enterprises, from maritime cargo operators to mining conglomerates, are adopting NTN architectures for asset tracking and enhanced connectivity. Underlying these trends is a robust drive toward standards harmonization, spearheaded by 3GPP Release 17, which for the first time introduced normative requirements for NTNs within the 5G New Radio framework. Release 17 set the stage for transparent payload operations across GEO, MEO, and LEO orbits, while subsequent enhancements in Release 18 have broadened frequency support and refined handover and mobility protocols.

Mapping the Dynamic Evolution of 5G Non-Terrestrial Networks Through Technological, Regulatory, and Partnership-Driven Landscape Transformations

In recent years, the 5G non-terrestrial network landscape has undergone transformative shifts driven by rapid standardization, strategic partnerships, and ambitious technology demonstrations. The normative work completed in 3GPP Release 17 established the first set of specifications enabling transparent payload operation in LEO and GEO scenarios, supporting features such as satellite-to-terrestrial roaming, optimized tracking area management, and handover procedures tailored to non-stationary cells. These foundational standards have catalyzed vendor activity and regulatory engagement worldwide.

Building on this momentum, industry collaborations have achieved operational milestones that validate NTN viability. In early 2025, the European Space Agency partnered with Telesat and Amarisoft to demonstrate the world’s first 3GPP-compliant 5G NTN link over a Telesat LEO satellite, achieving spectral efficiencies up to 3 bits/s/Hz for both uplink and downlink channels. This experiment underscored the feasibility of direct-to-device connectivity via LEO constellations, a critical enabler for enhanced mobile broadband and multicast services.

Simultaneously, test equipment manufacturers like Anritsu have validated Rel-17 NTN test cases on commercial 5G test platforms, ensuring that UE and base station vendors can certify compliance with NTN requirements in frequency bands ranging from S-band to Ka-band. As regulatory bodies in multiple jurisdictions open new spectrum allocations and streamline NTN licensing frameworks, the ecosystem is undergoing a paradigm shift from concept to commercialization. Accordingly, network operators and satellite providers are forging alliances to integrate service portfolios, optimize network orchestration, and deliver seamless handoffs between terrestrial and non-terrestrial nodes.

Assessing the Broad and Enduring Consequences of United States 2025 Tariff Measures on the 5G Non-Terrestrial Network Ecosystem

The United States government’s tariff policies introduced in 2025 have had profound implications for the 5G non-terrestrial network value chain, affecting component sourcing, project timelines, and cost structures. Tariffs on critical satellite communications hardware-ranging from RF modules and phased array antennas to specialized semiconductor payloads-were increased by up to 25%, prompting many satellite operators and integrators to absorb higher procurement expenses or redesign systems around alternative suppliers. These sudden cost escalations disrupted the seamless global supply chains that satellite internet providers had relied upon, forcing companies to scramble for new partnerships in regions such as South Korea, Taiwan, and India.

Inevitably, project schedules have been delayed. Amazon’s Project Kuiper experienced multiple setbacks due to component shortages and launch vehicle constraints, with its inaugural production launch slipping by several months in early 2025. Similarly, SpaceX, despite its vertically integrated approach, faced hurdles in acquiring certain avionics subsystems, which led to incremental delays in Starlink batch deployments. Iridium, which sources approximately 75% of its equipment through international logistics partners, reported a direct impact of $3 million in additional costs under the current 10% tariff regime on Thailand-manufactured components, a figure that could double if higher duty rates were reinstated.

Beyond financial burdens, the tariffs have engendered geopolitical entanglements that influence regulatory approvals. State-level agencies have leveraged trade negotiations to secure expedited licensing for U.S. satellite operators. Internal cables from the Department of State reveal coordinated efforts to promote Starlink in markets such as India and Bangladesh, linking trade incentives to regulatory support. However, retrospective tariffs from retaliatory markets have undercut U.S. exports in Southeast Asia and Africa, where Chinese and European competitors have gained ground by offering hardware at more attractive price points. As global bandwidth demand continues to surge, these policy-induced fractures underscore the urgency of resilient sourcing strategies and proactive engagement with trade and diplomatic channels.

Deriving Strategic Intelligence from Multi-Dimensional Segmentation of 5G Non-Terrestrial Network Markets Across Offerings, Locations, and Buyer Profiles

Insight into the 5G non-terrestrial network market emerges from a nuanced understanding of its segmentation across offerings, geographies, frequency bands, customer verticals, and application domains. From an offering perspective, the market divides into core components and platforms-including satellite constellations spanning GEO, MEO, and LEO orbits, gateway stations, ground antennas, HAPs, and UAVs-augmented by a suite of professional services such as managed network operations, consulting and training, system integration, and software-defined orchestration layers.

Geographically, demand patterns differ markedly. Remote and isolated regions rely heavily on satellite backhaul to bridge connectivity gaps, while rural zones deploy hybrid solutions that combine terrestrial towers with satellite links for redundancy. Suburban and urban areas benefit from HAP deployments and direct-to-device LEO connectivity for optimized mobile broadband and multicasting initiatives.

Frequency band selection also plays a pivotal role. C-band and Ku-band links have long served traditional GEO operations, whereas Ka-band offers high throughput for emerging LEO constellations, and S-band and L-band solutions address direct-to-device requirements with lower propagation losses. Customers driving this market span aerospace and defense agencies, government and public safety entities, maritime operators seeking vessel tracking and fleet management, and mining firms deploying remote monitoring solutions in challenging terrains.

Applications range from backhaul and tower connectivity to broadcasting, emergency services, enhanced mobile broadband, massive machine-type communications, remote environmental and asset monitoring, and ultra-reliable low-latency communications. Each segment exhibits distinct growth drivers, technology requirements, and stakeholder priorities, shaping investment decisions and partnership strategies in this rapidly evolving ecosystem.

This comprehensive research report categorizes the 5G Non-Terrestrial Network market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Location

- Frequency Band

- End User

- Application

Evaluating Regional Momentum and Distinctive Attributes in the Americas, Europe-Middle East-Africa, and Asia-Pacific 5G NTN Deployment Scenarios

The global arena for 5G non-terrestrial network deployment reveals contrasting regional dynamics shaped by infrastructure maturity, policy frameworks, and commercial ambitions. In the Americas, the United States stands at the forefront with significant investments from both private operators and the federal government. The Federal Communications Commission’s initiatives to allocate S-band and Ka-band spectrum, coupled with Department of Defense pilot programs in satellite-enabled ultra-reliable communications, have catalyzed innovation. Major providers such as SpaceX and Iridium testbed new services for rural broadband and maritime connectivity, while Canada’s satellite OEMs diversify supply chains to mitigate U.S. tariff exposures.

Across Europe, the Middle East, and Africa, sovereign ambitions drive the IRIS² initiative under the European Commission to establish a multi-orbit constellation by the end of the decade. ESA’s successful 3GPP-compliant NTN demonstration alongside Telesat and Amarisoft illustrates Europe’s technological prowess , even as regulatory debates in the European Commission swirl over balancing industrial protection with market openness. The Middle East is witnessing burgeoning partnerships with satellite operators to secure desert connectivity for remote operations, and African nations explore direct-to-device models to expand telecommunications penetration.

In the Asia-Pacific region, a mix of developed and emerging markets adopt NTN architectures to meet vast geographic challenges. India has expedited approvals for Starlink amid trade-linked discussions , while Japan and Australia trial HAP systems for disaster response and rural internet. China’s large-scale LEO initiatives, led by state-backed enterprises, underscore a parallel track for indigenous satellite broadband. Overall, Asia-Pacific represents a critical battleground for market share, with each sub-region tailoring its NTN strategy to local spectrum policies, industrial partnerships, and digital inclusion agendas.

This comprehensive research report examines key regions that drive the evolution of the 5G Non-Terrestrial Network market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders Shaping the Future of 5G Non-Terrestrial Networks Through Innovation, Partnerships, and Strategic Roadmaps

A cohort of established and emerging companies is actively shaping the non-terrestrial 5G landscape through targeted strategies, technological differentiation, and alliance building. SpaceX’s Starlink division exemplifies a vertically integrated approach, leveraging in-house rocket launch capabilities and mass-produced satellites to rapidly scale its mega constellation, while securing favorable trade and regulatory support via U.S. diplomatic channels. Iridium, known for its narrowband satellite network, is pivoting toward broadband NTN applications by expanding its supply chain partnerships in Europe to shield non-U.S. shipments from tariff burdens and sustain its market momentum.

Amazon’s Project Kuiper has faced production and launch delays but continues to invest in its Kirkland manufacturing facility and pursue diversified launch contracts, including Blue Origin and Arianespace vehicles, to meet its FCC deployment deadlines. Telesat, through partnerships with ESA and Amarisoft, is demonstrating 5G NTN feasibility in LEO, positioning itself as a technology provider and service enabler for mobile network operators and government entities. Satellite operators such as OneWeb, now under Eutelsat’s stewardship after a significant capital injection by the French government, are extending their LEO capacity through new Airbus-built satellites and Rocket Lab solar panel agreements to enhance power and operational resilience.

Complementing the satellite fleet owners, equipment vendors like Anritsu ensure compliance with evolving 3GPP NTN standards by validating test cases for UE and gateway equipment, while ground station providers such as KVH Industries integrate hybrid multi-orbit solutions for maritime and enterprise customers. Together, these leading stakeholders are driving ecosystem convergence, forging end-to-end offerings that encompass satellite payloads, network orchestration software, ground segment infrastructure, and managed services.

This comprehensive research report delivers an in-depth overview of the principal market players in the 5G Non-Terrestrial Network market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Airbus Group, Inc.

- Anritsu Corporation

- EchoStar Corporation

- Eutelsat Communications S.A.

- Gatehouse Satcom A/S.

- Iridium Communications Inc.

- Keysight Technologies

- Media Tek Inc.

- Nelco Limited

- Nokia Corporation

- Omnispace, LLC

- Qualcomm Technologies, Inc.

- Radisys Corporation

- Rode & Schwarz GmbH & Co KG

- Samsung Electronics Co., Ltd.

- Sateliot S.L.

- SES S.A.

- Skylo Technologies, Inc.

- SoftBank Group Corporation

- Spirent Communications

- Telefonaktiebolaget LM Ericsson

- Thales Group

- The Lockheed Martin Corporation

- Viasat, Inc.

- ZTE Corporation

Implementing Pragmatic Strategies to Fortify Supply Chains, Foster Standards, and Drive Resilient 5G Non-Terrestrial Network Expansion

Industry leaders can address ongoing challenges and capitalize on emerging opportunities by adopting a set of pragmatic strategies tailored to the non-terrestrial network context. First, diversifying component sourcing across multiple regions and suppliers will mitigate tariff exposure and supply chain bottlenecks. Companies that proactively establish logistics partnerships in low-tariff jurisdictions have demonstrated greater resilience against sudden policy shifts.

Second, active engagement with standards bodies and regulatory agencies is essential to influence spectrum allocation and licensing frameworks. Participation in 3GPP working groups and collaboration with national telecommunications authorities accelerates approval processes for NTN use cases such as direct-to-device services and satellite backhaul in underserved regions. Third, forging cross-industry alliances-between satellite operators, network equipment vendors, and mobile network operators-enables seamless integration of non-terrestrial and terrestrial infrastructures. Joint pilots and proof-of-concept initiatives, akin to ESA’s LEO NTN demonstration, can de-risk deployment and showcase business value to investors.

Additionally, investing in software-defined network orchestration and AI-driven performance optimization will enhance end-to-end service quality across diverse deployment scenarios. Automated load balancing between terrestrial base stations and satellite access nodes ensures service continuity for latency-sensitive applications. Finally, tailoring value propositions to prioritized market segments-such as maritime connectivity, emergency services, and remote industrial monitoring-will drive revenue growth and stakeholder buy-in. These actionable measures lay the groundwork for sustained expansion and competitive advantage in the 5G non-terrestrial network ecosystem.

Detailing Rigorous Mixed-Method Research Design Combining Primary Expert Interviews and Secondary Data Triangulation for Market Analysis

Our research methodology integrates both primary and secondary data collection techniques to ensure robust, evidence-based insights. The secondary research phase involved a thorough review of industry standards documentation, including 3GPP Release 17 and Release 18 technical specifications, regulatory filings, public financial disclosures, and recent press releases from leading satellite operators and equipment vendors. Priority was given to reports and announcements issued after January 2024 to capture the latest developments in non-terrestrial network technologies.

Primary research encompassed in-depth interviews with over thirty industry experts, including network architects, satellite program managers, spectrum regulators, and senior executives from key operators and vendors. These interviews provided nuanced perspectives on deployment challenges, technology readiness levels, and strategic roadmaps. Additionally, vendor surveys were conducted to gather quantitative data on capital expenditure plans, spectrum requirements, and anticipated launch schedules.

Data triangulation was employed to validate findings, cross-referencing interview insights with trade press articles, regulatory databases, and financial news sources. Case studies of landmark initiatives-such as the ESA-Telesat 5G NTN LEO demonstration and Iridium’s supply chain restructuring-served as illustrative examples of best practices and risk mitigation approaches. The synthesis of qualitative and quantitative inputs culminated in a comprehensive framework that informs segmentation analysis, regional assessments, and actionable recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 5G Non-Terrestrial Network market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 5G Non-Terrestrial Network Market, by Offering

- 5G Non-Terrestrial Network Market, by Location

- 5G Non-Terrestrial Network Market, by Frequency Band

- 5G Non-Terrestrial Network Market, by End User

- 5G Non-Terrestrial Network Market, by Application

- 5G Non-Terrestrial Network Market, by Region

- 5G Non-Terrestrial Network Market, by Group

- 5G Non-Terrestrial Network Market, by Country

- United States 5G Non-Terrestrial Network Market

- China 5G Non-Terrestrial Network Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Consolidating Key Takeaways on the Evolution, Challenges, and Opportunity Horizons in the 5G Non-Terrestrial Network Landscape

The advent of 5G non-terrestrial networks marks a pivotal shift in how connectivity is delivered and consumed across the globe. Standards harmonization under 3GPP Release 17 and Release 18 has laid the technical foundation for seamless integration between terrestrial and non-terrestrial nodes, while real-world demonstrations by entities like ESA and Telesat validate performance at scale. The convergence of satellite constellations, HAP systems, and advanced ground segment technologies offers transformative potential for industries ranging from public safety to maritime logistics.

Nonetheless, the policy environment-including U.S. tariff measures-has introduced new complexities that stakeholders must navigate. Supply chain fragmentation, cost inflation, and geopolitical dynamics underscore the importance of diversified sourcing, proactive regulatory engagement, and strategic alliances. Market segmentation reveals that differentiated solutions are needed for remote regions, rural communities, and mission-critical enterprise use cases, with distinct frequency bands and service models tailored to each scenario.

As leading providers refine their roadmaps-whether deploying mega-constellations, modular HAP deployments, or ground network orchestration platforms-their success will hinge on agility and resilience. By applying the research insights detailed herein, industry participants can anticipate friction points, capitalize on partnership opportunities, and chart clear pathways toward sustainable growth. In an ecosystem defined by rapid technological evolution and shifting policy landscapes, informed decision-making remains the most powerful lever for unlocking the promise of 5G non-terrestrial networks.

Engage with Ketan Rohom to Secure Your Comprehensive 5G Non-Terrestrial Network Market Intelligence Report and Accelerate Strategic Decisions

Ensure your strategic initiatives in satellite communications are backed by comprehensive insights by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing. With deep expertise in emerging telecommunications paradigms and actionable market intelligence, Ketan Rohom is ready to guide your organization through the complexities of 5G non-terrestrial networks. Connect with him to discuss custom research, bespoke data analysis, and tailored advisory services designed to empower your decision-making and accelerate your path to market leadership. Secure your full market research report today and transform critical insights into competitive advantage.

- How big is the 5G Non-Terrestrial Network Market?

- What is the 5G Non-Terrestrial Network Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?