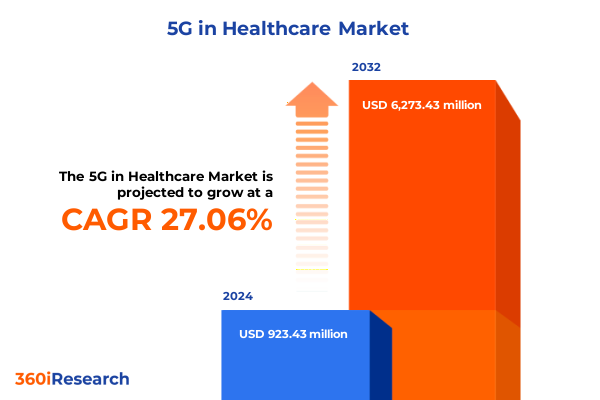

The 5G in Healthcare Market size was estimated at USD 1.17 billion in 2025 and expected to reach USD 1.50 billion in 2026, at a CAGR of 27.82% to reach USD 6.57 billion by 2032.

Transforming Patient Care and Operational Efficiency through Next-Generation 5G Connectivity That Paves the Way for Seamless Clinical Innovation Across Healthcare Ecosystems

The convergence of fifth-generation wireless technology and healthcare delivery models is ushering in a new era of clinical innovation and operational efficiency. 5G networks boast unprecedented speeds, ultra-low latency, and enhanced reliability, forming the digital backbone for a spectrum of applications that were once the realm of science fiction. From real-time remote monitoring of patient vitals to immersive virtual reality training for surgical teams, the promise of 5G is catalyzing a paradigm shift that redefines patient engagement and care coordination.

Against this backdrop, healthcare stakeholders-including providers, equipment manufacturers, and technology vendors-are reevaluating their strategies to harness the full potential of 5G-enabled ecosystems. As the industry navigates regulatory complexities, infrastructure deployments, and evolving clinical workflows, an in-depth understanding of the foundational drivers and emerging use cases is crucial. This executive summary frames the strategic implications of 5G adoption, spotlighting the pivotal trends, challenges, and opportunities shaping the future of connected healthcare environments.

Redefining Healthcare Delivery through Edge Computing and IoMT Applications Enabled by Unprecedented 5G Network Performance

The rollout of 5G has triggered transformative shifts that transcend incremental improvements, fundamentally altering how care is delivered, accessed, and managed. The surge in network bandwidth and reliability is enabling healthcare providers to deploy edge computing solutions that process critical patient data locally, reducing latency and ensuring prompt clinical decision-making. This shift from centralized data centers to distributed architectures fosters resilient telemedicine services capable of supporting high-definition video consultations and complex diagnostic imaging analyses.

Moreover, the integration of Internet of Medical Things (IoMT) devices underpinned by 5G connectivity is reshaping preventive care paradigms. Wearable sensors now stream continuous health metrics to cloud platforms in real time, empowering clinicians to detect anomalies and intervene proactively. Simultaneously, the convergence of augmented reality with 5G networks is revolutionizing medical training, allowing remote experts to guide procedures live without perceptible lag. These transformative shifts underscore a landscape where seamless connectivity drives enhanced patient outcomes and operational agility.

Navigating Elevated Equipment Costs and Strategic Collaborations in Response to Evolving United States Tariffs on 5G Infrastructure

In 2025, the imposition of updated United States tariffs on network infrastructure and communication equipment has introduced new considerations for healthcare organizations seeking to deploy 5G technologies. The revised tariff framework affects components ranging from radio access equipment to core network switches, prompting stakeholders to reevaluate procurement strategies. These cumulative impacts have led to an increased focus on total cost of ownership assessments as providers balance capital investments with long-term operational benefits.

Amid rising equipment costs, collaboration between healthcare institutions and telecom operators has intensified, giving rise to innovative financing models and public-private partnerships that mitigate upfront expenditure. At the same time, domestic equipment vendors are accelerating local production capabilities to navigate tariff constraints and ensure supply chain resilience. This dynamic environment underscores the need for agility in sourcing and deployment planning, as organizations strive to deliver advanced connectivity without jeopardizing budgetary targets.

Unveiling Multidimensional Insights across Technology Layers Applications End Users and Deployment Models Shaping Healthcare Connectivity

A comprehensive segmentation analysis reveals that the 5G in Healthcare market spans multiple layers of technology, application, user, deployment, and protocol parameters. Component segmentation examines the interplay between devices such as wearable biosensors and patient terminals, the underpinnings of network infrastructure spanning transport networks and radio access nodes, and professional service offerings that guide implementation and ongoing management. Application segmentation highlights the diverse clinical and operational use cases, including real-time location systems for asset tracking, advanced imaging modalities such as MRI and CT, telemedicine consultations augmented by analytics, and immersive virtual reality environments tailored to medical training.

End users range from outpatient settings-encompassing diagnostic centers and ambulatory clinics-to large hospitals, and extend to home healthcare ecosystems orchestrated by agency-based and independent providers. Deployment models contrast private campus networks optimized for secure on-site applications with public mobile operator networks delivering broad coverage. Finally, the distinction between non-standalone architectures that leverage existing LTE platforms and purpose-built standalone 5G networks shapes performance and scalability outcomes. Together, these segmentation lenses provide a multidimensional view, enabling stakeholders to pinpoint areas of greatest strategic relevance.

This comprehensive research report categorizes the 5G in Healthcare market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Type

- Technology

- Application

- End User

Examining Regional Divergence in 5G Healthcare Adoption Driven by Infrastructure Strategies and Regulatory Frameworks

Regional dynamics play a pivotal role in the adoption trajectory of 5G-enabled healthcare solutions, reflecting varying infrastructure maturity, regulatory landscapes, and market priorities. In the Americas, widespread fiber backhaul and active private network initiatives have catalyzed deployments in leading healthcare systems, while strategic alliances between medical centers and telecom operators accelerate pilot programs across urban hubs. Policymakers are advancing spectrum allocation frameworks to support dedicated healthcare bands, fostering an environment conducive to innovation in telehealth and remote monitoring.

Across Europe, the Middle East, and Africa, disparate levels of network readiness coexist with a surge in cross-border collaborations aimed at standardizing interoperability and data security protocols. Several EU nations are integrating 5G into public health strategies, enabling large-scale remote diagnostics and tele-ICU networks. In parallel, GCC countries are leveraging national digital transformation agendas to deploy smart hospital infrastructures underpinned by low-latency connectivity.

In the Asia-Pacific region, ambitious 5G rollouts in advanced economies coincide with rapid infrastructure buildouts in emerging markets. Public-private partnerships are funding IoT-driven chronic disease management programs in community health centers, while leading metropolitan hospitals adopt private campus networks to support robotic surgery suites. This regional mosaic underscores the global momentum and localized nuances governing 5G-enabled healthcare evolution.

This comprehensive research report examines key regions that drive the evolution of the 5G in Healthcare market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Cross-Industry Partnerships and Technology Advances Driving Competitive Differentiation in 5G Healthcare Solutions

Leading technology vendors and healthcare innovators are at the forefront of driving 5G-enabled solutions, each leveraging core competencies to address critical market demands. Network equipment providers are advancing modular, software-defined platforms that simplify integration with healthcare IT systems, while semiconductor firms are optimizing chipset designs for ultra-low power consumption in wearable monitors. Telecom operators have introduced managed service offerings specifically tailored to medical facilities, bundling network deployment with maintenance, security, and analytics capabilities.

Collaborative consortiums between device manufacturers, cloud providers, and research institutions are accelerating the development of specialized applications-ranging from AI-assisted diagnostic imaging to secure data exchange frameworks. Furthermore, healthcare systems are partnering with start-ups to pilot specialized use cases, such as robotics-assisted surgery in rural settings. These cross-industry alliances highlight how convergence among equipment makers, service providers, and clinical organizations is shaping a vibrant ecosystem of 5G healthcare solutions and driving competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the 5G in Healthcare market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AT&T Inc.

- China Mobile Limited

- Deutsche Telekom AG

- Huawei Technologies Co., Ltd.

- Nokia Corporation

- Samsung Electronics Co., Ltd.

- Sequans Communications S.A

- T-Mobile US, Inc

- Telefonaktiebolaget LM Ericsson (publ)

- Verizon Communications Inc.

- Vodafone Group Plc

- ZTE Corporation

Strategic Roadmap for Healthcare Organizations to Safely Deploy 5G Solutions Minimize Risk and Maximize Clinical and Operational Value

To capitalize on the transformative potential of 5G, industry leaders should adopt a holistic, phased approach that balances strategic ambition with pragmatic execution. Begin by conducting cross-functional readiness assessments that examine network infrastructure, clinical workflows, and cybersecurity protocols, ensuring alignment with organizational risk tolerance and regulatory requirements. Next, prioritize high-impact use cases-such as remote patient monitoring for chronic disease management and real-time imaging diagnostics-to generate early wins and validate performance benchmarks.

Simultaneously, forge strategic alliances with telecom operators and device vendors to secure favorable terms for equipment procurement and network services. Explore alternative financing mechanisms, including leasing and managed services, to minimize capital outlays. Invest in workforce training programs that equip clinical and IT staff with the skills needed to deploy, manage, and optimize 5G-enabled applications. Finally, measure outcomes against predefined metrics-such as reductions in emergency response times and increases in telehealth utilization-to build a data-driven case for broader implementation.

Integrating Primary Stakeholder Interviews and Industry Literature to Develop a Robust Understanding of Healthcare Connectivity Trends

Our research methodology combines primary and secondary data collection techniques to ensure a comprehensive understanding of the 5G in Healthcare market dynamics. Primary research involved in-depth interviews with key stakeholders across the healthcare value chain, including hospital IT leaders, network architects, telecom executives, and regulatory experts. These conversations provided firsthand perspectives on deployment challenges, technology preferences, and evolving use case requirements.

Secondary research encompassed a thorough review of industry publications, technical standards documentation, regulatory filings, and thought leadership reports from leading telecommunications and healthcare bodies. The triangulation of insights from these multiple sources enabled validation of trends, confirmation of technology roadmaps, and identification of emerging market entry strategies. Rigorous data synthesis and qualitative analysis underpin the key observations and recommendations presented in this executive summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our 5G in Healthcare market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- 5G in Healthcare Market, by Component

- 5G in Healthcare Market, by Deployment Type

- 5G in Healthcare Market, by Technology

- 5G in Healthcare Market, by Application

- 5G in Healthcare Market, by End User

- 5G in Healthcare Market, by Region

- 5G in Healthcare Market, by Group

- 5G in Healthcare Market, by Country

- United States 5G in Healthcare Market

- China 5G in Healthcare Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3498 ]

Converging Technology and Clinical Workflows to Unlock Transformative Patient-Centric Innovations and Operational Resilience

The convergence of 5G technology and healthcare operations is reshaping the future of patient care delivery, enabling real-time diagnostics, immersive training, and proactive health management at an unprecedented scale. As tariff landscapes evolve and regional deployment strategies diverge, organizations must navigate a complex web of technical, financial, and regulatory considerations to realize the full benefits of advanced connectivity.

By leveraging the segmentation insights outlined herein, stakeholders can strategically target initiatives that align with their clinical objectives and infrastructure capabilities. The successful integration of devices, network architectures, and services will require collaboration across traditional industry boundaries, fostering ecosystems that prioritize patient-centric innovation and operational resilience. Ultimately, the 5G revolution in healthcare is not merely a technological upgrade-it is a catalyst for meaningful transformation that promises to elevate the quality, accessibility, and efficiency of care worldwide.

Unlock Exclusive Market Intelligence on 5G in Healthcare by Connecting with Our Associate Director of Sales & Marketing for Personalized Insights

With the healthcare industry standing at the cusp of a connectivity revolution, securing access to comprehensive market intelligence is more critical than ever. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to gain exclusive insights into the 5G in Healthcare market’s evolving dynamics. By partnering with our team, you will benefit from personalized guidance on how the report’s findings align with your strategic objectives, ensuring that you remain at the forefront of technological innovation.

Take the next step toward informed decision-making by discussing customization options, detailed data breakdowns, and tailored competitive landscapes with Ketan Rohom. This conversation will empower your organization to capitalize on the transformative power of 5G, drive operational efficiencies, and deliver patient-centered care solutions. Reach out today to secure your copy of the report and unlock the full potential of advanced connectivity in healthcare settings.

- How big is the 5G in Healthcare Market?

- What is the 5G in Healthcare Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?