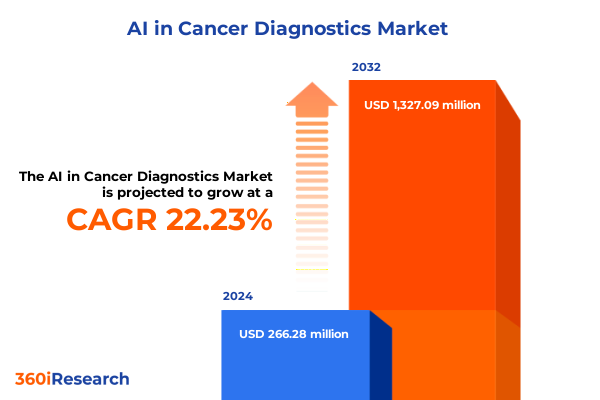

The AI in Cancer Diagnostics Market size was estimated at USD 326.78 million in 2025 and expected to reach USD 391.86 million in 2026, at a CAGR of 22.16% to reach USD 1,327.09 million by 2032.

Revolutionizing Cancer Detection Through Artificial Intelligence Innovations Shaping the Future of Early Oncology Diagnostics and Patient Management

The field of oncology diagnostics is undergoing a profound transformation as artificial intelligence technologies become integral to every stage of cancer detection and management. Beginning with advanced imaging modalities and extending through genomic analysis, pathology automation, predictive modeling, and treatment planning, intelligent systems are elevating the precision and efficiency of diagnostic workflows. Early detection rates are improving due to AI’s unparalleled capacity to identify subtle patterns in CT, MRI, PET, and ultrasound images, while genomic profiling tools powered by machine learning offer deeper insights into tumor biology. Meanwhile, digital pathology platforms equipped with deep learning algorithms are revolutionizing histopathological assessment by streamlining slide interpretation and reducing manual error.

However, successful integration of these capabilities hinges on overcoming critical challenges such as data interoperability, regulatory validation, and clinician acceptance. Standardizing data formats across imaging, molecular assays, and electronic health records remains a pressing concern, as does the need for robust clinical validation to establish trust among healthcare providers. Moreover, addressing ethical considerations around algorithmic bias and maintaining patient privacy are paramount. Despite these hurdles, the convergence of large-scale healthcare datasets and advances in AI research is creating unprecedented opportunities to shift the paradigm of cancer diagnostics toward earlier, more personalized interventions.

Unprecedented Advancements in Cancer Diagnostics Enabled by AI Across Imaging, Genomics, Digital Pathology, Predictive Analytics, and Treatment Planning

Across the cancer diagnostics ecosystem, transformative shifts are occurring as AI-driven solutions demonstrate the capacity to elevate both diagnostic accuracy and operational efficiency. In medical imaging, convolutional neural networks are being trained on vast repositories of radiographic data to detect lesions that may elude human observers, while generative models are augmenting image quality for low-dose CT scans. Concurrently, genomic profiling tools are leveraging unsupervised learning to uncover hidden genomic signatures associated with specific cancer subtypes, enabling more targeted treatment strategies.

Pathology is experiencing its own renaissance as image analysis algorithms automate the annotation of histological slides, quantify biomarker expression, and flag atypical cellular structures for pathologist review. This acceleration of digital pathology workflows is complemented by advanced predictive analytics platforms that integrate multimodal data-imaging, genomics, clinical history-to forecast treatment response and estimate disease progression risk. Moreover, treatment planning applications are harnessing optimization algorithms to tailor radiotherapy trajectories and surgical approaches, minimizing damage to healthy tissues. As a result, the cumulative effect of these innovations is reshaping clinical pathways, reducing diagnostic delays, and fostering a more proactive, patient-centric approach to cancer care.

Evaluating the Compound Consequences of 2025 United States Tariff Measures on AI-Enabled Cancer Diagnostic Technologies and Supply Chain Resilience

The imposition of new United States tariffs on select hardware components, processors, and associated subsystems in early 2025 has introduced a layer of complexity to the deployment of AI-driven cancer diagnostic solutions. These trade measures have increased import costs for advanced imaging detectors, high-performance graphics processing units, and specialized laboratory instrumentation, leading to pressure on pricing models for diagnostic imaging and genomic profiling platforms. As a consequence, healthcare providers and diagnostic laboratories are exploring alternative sourcing strategies, including regional manufacturing partnerships and nearshoring, to mitigate supply chain disruptions.

In parallel, software providers and service integrators are adapting by offering modular deployment options that reduce upfront capital expenditure, such as cloud-native AI services and outcome-based pricing models. Nevertheless, the additional cost burdens have prompted some institutions to delay large-scale upgrades of imaging suites and pathology laboratories, thereby decelerating adoption rates in price-sensitive segments. Moreover, uncertainties around the long-term trajectory of tariff policies have underscored the need for flexible procurement frameworks and collaborative agreements between vendors, payers, and regulatory bodies to ensure continuity of AI innovation in cancer diagnostics.

Comprehensive Multidimensional Segmentation Analysis Revealing the Diverse Applications Components End Users Cancer Types and Technologies in AI-Powered Oncology Diagnostics

Delving into application-based segmentation, the diagnostic imaging domain encompasses CT, MRI, PET, and ultrasound modalities, each increasingly enhanced by AI algorithms that improve lesion detection, quantification, and triage prioritization. Within genomic profiling, DNA sequencing workflows are streamlined by machine learning–driven variant calling, epigenetic analysis harnesses deep neural networks to decode methylation patterns, and RNA sequencing benefits from clustering algorithms that reveal transcriptional heterogeneity. Pathology segmentation spans digital slide scanning automated by image classification networks, and traditional histopathology augmented by AI-assisted scoring of immunohistochemical markers. Predictive analytics subdivides into outcome prediction tools that forecast survival probabilities and risk assessment platforms that identify high-risk patient cohorts, while treatment planning extends to radiotherapy optimization and surgical strategy simulations.

From a component perspective, hardware remains critical as GPUs, specialized processors, and imaging sensors underpin algorithm performance, whereas services are bifurcated into managed offerings that handle end-to-end AI solution upkeep and professional engagements focused on custom implementation and training. Software architectures split between cloud-based deployments favoring scalability and on-premises installations valued for data security. End users range from diagnostic laboratories that rely on high-throughput screening, hospitals and clinics integrating AI at points of care, pharmaceutical companies leveraging real-world evidence for drug development, to research institutes exploring novel algorithmic approaches. In cancer-specific segmentation, applications span breast, colorectal, lung, and prostate cancer, reflecting areas of high incidence and research intensity. Technological segmentation underscores the differentiation between deep learning frameworks for image analysis, machine learning models for predictive risk scoring, and natural language processing systems that extract clinically relevant insights from unstructured data.

This comprehensive research report categorizes the AI in Cancer Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Component

- End User

- Cancer Type

- Technology

Distinct Regional Dynamics Fueling the Expansion of AI-Driven Cancer Diagnostics Across the Americas EMEA and Asia Pacific Healthcare Ecosystems

The Americas region leads in the adoption of AI-powered cancer diagnostics, supported by substantial healthcare infrastructure investments, advanced clinical trial pipelines, and regulatory frameworks that incentivize innovation. United States institutions are pioneering AI integrations within radiology and pathology departments, benefiting from reimbursement pathways and research funding that accelerate commercial deployment. Meanwhile, Latin American markets are gradually embracing telepathology and cloud-based analytics to overcome the challenges of specialist shortages and expand access to diagnostic expertise.

In the Europe, Middle East & Africa cluster, collaborative research consortia are harmonizing data-sharing protocols to fuel algorithm development across international cohorts. European regulatory entities have introduced clear guidance on AI validation requirements, fostering a more predictable commercialization pathway. Middle Eastern cancer centers are increasingly investing in genomics facilities, while select African nations are piloting AI-driven ultrasound screening programs to address high disease burdens with lower-cost imaging modalities. Across this region, concerted efforts toward interoperability and standardized evaluation metrics are facilitating cross-border technology adoption.

The Asia-Pacific region is experiencing rapid growth driven by rising cancer incidence rates, expanding healthcare infrastructure, and government initiatives supporting AI research. Countries such as China, Japan, and South Korea are deploying national AI strategies that encompass oncology diagnostics, while Southeast Asian markets are leveraging public–private partnerships to implement cloud-based platforms and mobile imaging solutions. The convergence of manufacturing capabilities, high-volume data generation, and cost-sensitive market dynamics is shaping a unique innovation ecosystem that promises to accelerate AI adoption in cancer detection and care.

This comprehensive research report examines key regions that drive the evolution of the AI in Cancer Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Competitive Landscape Spotlighting Technology Innovators Clinical Partners and Emerging Entrants Transforming AI-Driven Cancer Diagnostics

Within the AI for cancer diagnostics landscape, a handful of strategic players are defining the competitive arena through their technological prowess, clinical partnerships, and regulatory milestones. One category of leaders leverages proprietary deep learning frameworks to deliver imaging analysis solutions integrated directly with modality vendors, thereby ensuring seamless workflow adoption. Another cohort specializes in genomic data interpretation, applying advanced machine learning to both somatic and germline sequencing outputs and collaborating with pharmaceutical companies to inform precision oncology trials.

Innovators in digital pathology are securing regulatory clearances for AI-assisted slide interpretation, reducing pathologist workload and opening new avenues for remote diagnostics. Concurrently, software platform providers are assembling AI modules into unified clinical decision support suites that bridge imaging, pathology, molecular, and EHR data. Hyperscale cloud providers contribute by offering scalable compute infrastructure and certified environments for sensitive healthcare workloads. In parallel, emerging startups explore niche applications-such as ultrasound-based screening in resource-constrained settings and natural language processing tools that mine unstructured clinical notes-thereby broadening the scope of AI integration and addressing underserved segments of the oncology diagnostics market.

This comprehensive research report delivers an in-depth overview of the principal market players in the AI in Cancer Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories Inc

- Aidoc Medical

- Aiforia Technologies

- Azra AI

- C the Signs

- ConcertAI LLC

- Enlitic Inc

- F. Hoffmann-La Roche Ltd

- Flatiron Health Inc

- Foresight Diagnostics

- GE HealthCare

- GRAIL Inc

- Ibex Medical Analytics

- IBM Corporation

- Intuitive Surgical Inc

- Kheiron Medical Technologies Limited

- Koninklijke Philips N.V.

- Lunit Inc

- Medial EarlySign

- Medtronic Plc

- Microsoft Corporation

- NVIDIA Corporation

- Paige AI Inc

- PathAI Inc

- Qure.ai Technologies Private Limited

- Siemens Healthineers AG

- SkinVision

- Tempus AI Inc

- Viz.ai Inc

- Zebra Medical Vision

Actionable Strategic Imperatives for Healthcare Leaders to Enhance Adoption Foster Collaboration and Navigate Regulatory Requirements in AI-Enabled Oncology Diagnostics

Industry leaders seeking to capitalize on AI’s potential in oncology diagnostics should prioritize the establishment of interoperable data pipelines to facilitate seamless exchange between imaging systems, molecular laboratories, and electronic health records. Additionally, forging strategic alliances with specialized AI developers enables rapid prototyping and validation of novel algorithms within clinical environments. Leaders must also engage proactively with regulatory authorities to shape guidelines around algorithm transparency, performance benchmarks, and post-market surveillance.

Moreover, an emphasis on clinician education and change management is necessary to foster user confidence and drive adoption. Implementing pilot programs that demonstrate tangible improvements in diagnostic accuracy and workflow efficiency can build institutional buy-in. From a technology standpoint, organizations should consider hybrid deployment models that balance the scalability of cloud solutions with the security advantages of on-premises installations. Finally, committing to continuous outcome monitoring and real-world performance assessment ensures that AI tools remain aligned with evolving clinical standards and patient safety imperatives.

Rigorous Mixed Methodology Integrating Primary Expert Interviews Secondary Literature Review and Expert Validation to Ensure Comprehensive Insights

This analysis is grounded in a rigorous research methodology that combines qualitative and quantitative approaches to yield robust insights. Primary research involved in-depth interviews with oncologists, radiologists, pathologists, laboratory directors, and health system executives to capture firsthand perspectives on AI integration challenges and value drivers. These conversations were complemented by consultations with AI solution architects, software engineers, and data scientists to understand technological enablers and implementation best practices.

Secondary research entailed a thorough review of peer-reviewed journals, clinical trial registries, regulatory submissions, patent filings, and public funding announcements to map the evolution of AI applications in cancer diagnostics. Data from healthcare analytics platforms and institutional reports provided context on adoption rates and partnership trends. Following data collection, findings underwent expert panel validation sessions, where key opinion leaders assessed the relevance and accuracy of thematic conclusions. The resulting insights were synthesized through thematic analysis, ensuring that recommendations are grounded in empirical evidence and reflective of current industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our AI in Cancer Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- AI in Cancer Diagnostics Market, by Application

- AI in Cancer Diagnostics Market, by Component

- AI in Cancer Diagnostics Market, by End User

- AI in Cancer Diagnostics Market, by Cancer Type

- AI in Cancer Diagnostics Market, by Technology

- AI in Cancer Diagnostics Market, by Region

- AI in Cancer Diagnostics Market, by Group

- AI in Cancer Diagnostics Market, by Country

- United States AI in Cancer Diagnostics Market

- China AI in Cancer Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Conclusive Synthesis of Strategic Drivers Technological Breakthroughs and Collaborative Pathways Shaping the Future of AI in Cancer Diagnostics

Artificial intelligence is redefining the contours of oncology diagnostics by delivering enhanced accuracy, accelerating workflows, and enabling more personalized care pathways. Through the fusion of advanced imaging analysis, genomic profiling, pathology automation, and predictive modeling, AI-powered tools are unlocking deeper insights into tumor biology and patient risk profiles. The integration of these capabilities across clinical settings is contingent upon addressing data interoperability, regulatory clarity, and stakeholder collaboration.

Looking ahead, success will be determined by organizations that can harmonize technological innovation with robust validation frameworks and clinician engagement strategies. By investing in scalable infrastructure and forging strategic partnerships, healthcare providers and technology vendors can navigate the complexities introduced by geopolitical shifts and regulatory evolutions. Ultimately, the confluence of data-driven decision making and AI-enabled diagnostics holds the promise of transforming cancer care, enabling earlier detection, tailored interventions, and improved patient outcomes on a global scale.

Engage Directly with the Associate Director to Secure Tailored Strategic Insights from the Definitive AI in Cancer Diagnostics Research Report

For executives eager to harness the power of artificial intelligence in oncology diagnostics, securing comprehensive, data-driven insights is essential. Reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, to discuss a customized package that addresses your organization’s unique strategic objectives. With deep expertise in AI-driven cancer detection and treatment planning, Ketan can provide a tailored walk-through of the research methodology, key trends, and actionable recommendations. Whether you aim to optimize clinical workflows, evaluate partnership opportunities, or benchmark your AI initiatives against industry peers, this market research report delivers the detailed analysis and competitive intelligence required to drive informed decisions. Contact Ketan today to unlock a special advisory session, access proprietary datasets, and elevate your strategic planning with a definitive guide to the future of AI in cancer diagnostics.

- How big is the AI in Cancer Diagnostics Market?

- What is the AI in Cancer Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?