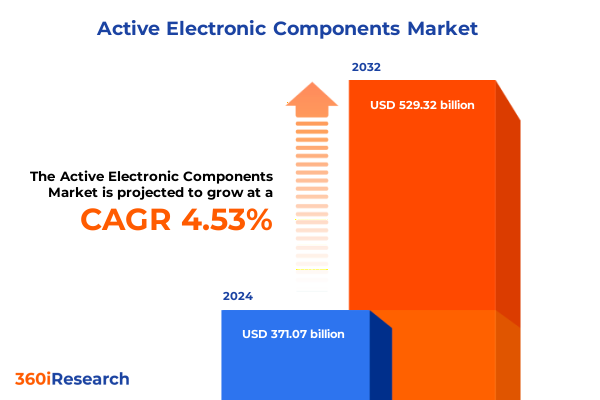

The Active Electronic Components Market size was estimated at USD 387.63 billion in 2025 and expected to reach USD 406.93 billion in 2026, at a CAGR of 4.55% to reach USD 529.32 billion by 2032.

Exploring the Core Role of Active Electronic Components in Powering Modern Electronics and Driving Next-Generation Innovations

Active electronic components serve as the cornerstone of modern electronic systems, enabling everything from power management in renewable energy applications to data processing in sophisticated artificial intelligence platforms. These components, which include discrete semiconductors, integrated circuits, optoelectronic devices, and sensors, are critical for translating raw electrical signals into meaningful information and performance enhancements. In 2024, global semiconductor industry sales reached an all-time high of $630.5 billion, driven by robust demand across emerging technologies. Projections from the World Semiconductor Trade Statistics anticipate sales climbing to $701 billion in 2025, underscoring the pivotal role that active components play in powering innovation across industries.

As digital transformation accelerates, active electronic components are positioned at the heart of next-generation solutions. The proliferation of connected devices is one clear indicator of this trend, with the number of Internet of Things endpoints forecast to exceed 25 billion by 2025. This surge is fueling unprecedented demand for advanced sensor technologies, power-efficient converter designs, and miniaturized circuits that can operate reliably under varying environmental conditions.

How Digitalization, AI, IoT and Power Electronics Are Revolutionizing the Active Components Landscape for Unprecedented Applications

The active components landscape is undergoing a profound transformation propelled by digitalization and the rapid rise of artificial intelligence. Generative AI and high-performance computing applications are redefining chip architectures, driving a surge in demand for specialized processors, memory modules, and power management units. Industry analyses indicate that AI-optimized chips-comprising CPUs, GPUs, data-center communication devices, and associated memory and power components-will represent a substantial portion of total semiconductor revenues in 2025. These high-value chips are reshaping investment priorities, with leading players accelerating research in neuromorphic designs and advanced packaging techniques to meet performance and energy-efficiency objectives.

In parallel, the Internet of Things continues to expand the envelope of active component requirements, driving innovation in sensor miniaturization and power electronics. By 2025, IoT-related semiconductor and sensor markets are projected to more than quadruple compared to 2015 levels, reflecting a compound annual growth rate exceeding 15%. Developments in wide-bandgap semiconductor devices, such as gallium nitride and silicon carbide, are poised to cut power conversion losses in electric vehicles and renewable energy systems by up to 50%. These advances underscore the convergence of component innovation and system-level performance targets across diverse application domains.

Assessing the Multi-Dimensional Impact of 2025 United States Tariffs on Active Electronic Component Supply Chains and Cost Structures

In April 2025, a sweeping set of “reciprocal” U.S. tariffs-34% on goods from China, 32% on Taiwan, 25% on South Korea, and a baseline 10% on all imports-sent immediate shockwaves through semiconductor and electronic component supply chains. Although semiconductor chips were initially exempt from targeted duties, industry stakeholders now anticipate the extension of tariffs to high-value chip categories. This policy shift comes on the heels of a 19% jump in global semiconductor sales to $627 billion in 2024, a growth fueled primarily by AI accelerators and data-center expansion. The imposition of tariffs threatens to raise costs for chipmakers and OEMs alike, prompting stock prices to retreat and strategic supply-chain adjustments in real time.

While the policy objective centers on reshoring domestic capacity, blanket tariffs risk unintended consequences for U.S. firms that rely on intricate global manufacturing networks. With the United States accounting for only 13% of worldwide fabrication capacity, sudden cost increases could ripple across industries, from consumer electronics to medical devices. As a result, many companies are beginning to explore alternative sourcing strategies, invest in local assembly and packaging capabilities, and engage in public-private partnerships to mitigate supply-chain disruptions without undermining innovation incentives.

Unveiling Comprehensive Segmentation Insights Across Product Types, Applications, Materials, and Mounting Methods to Guide Strategic Decisions

A deep dive into product-type segmentation reveals that discrete semiconductors are at the forefront of power and signal management applications, with MOSFETs, IGBTs, and BJTs leading demand in electric vehicle inverters and industrial motor controls. Simultaneously, analog and power-management integrated circuits-encompassing DC/DC converters, low dropout regulators, and specialized power-management ICs-are gaining traction in energy-sensitive consumer devices. Optical components such as infrared and visible LEDs play critical roles in sensing and communication, while a new wave of photodiodes and optical sensors enables high-speed data links and environmental monitoring. These dynamics highlight the need for strategic alignment across multiple product hierarchies to capture emerging opportunities in performance-driven markets.

Beyond product types, application segmentation underscores differentiated growth vectors. Advanced driver assistance systems and infotainment platforms in automotive electronics demand robust, high-reliability semiconductors, while consumer devices like smartphones, tablets, and wearables prioritize miniaturized, low-power components with advanced packaging. Material innovations-from gallium nitride and silicon carbide for high-voltage switching to organic semiconductors for flexible electronics-are reshaping design paradigms. Meanwhile, surface-mount mounting methods, especially Ball Grid Array and chip-scale packaging formats, facilitate denser integration and shorter signal paths. These converging forces emphasize the importance of a granular, cross-segment perspective for effective product planning and portfolio management.

This comprehensive research report categorizes the Active Electronic Components market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Material

- Mounting Type

Analyzing Regional Dynamics in the Americas, Europe Middle East & Africa, and Asia-Pacific to Unlock Growth Opportunities and Challenges

In the Americas, robust government incentives and private-sector investments are reinforcing the region’s leadership in semiconductor research, design, and advanced packaging. Major U.S. initiatives have catalyzed over half-a-trillion dollars in private commitments, spanning fabrication, R&D centers, and workforce development programs. This momentum is complemented by growing regional demand for next-generation automotive and industrial electronics, supported by reshoring efforts and trade policies that aim to strengthen domestic manufacturing ecosystems.

Across Europe, the Middle East, and Africa, strategic partnerships and regulatory frameworks are shaping a resilient semiconductor landscape. The EU’s CHIPS Act and localized funding schemes are accelerating local production capabilities, while industry alliances focus on supply-chain transparency and sustainability. In the Asia-Pacific region, production capacity remains unparalleled, led by leading foundries in Taiwan, South Korea, and China. These countries are expanding their technological edge through state-backed incentives, reinforcing a competitive triad that will influence global component availability, pricing, and innovation trajectories in the coming decade.

This comprehensive research report examines key regions that drive the evolution of the Active Electronic Components market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Competitive Landscape of Active Electronic Components

Taiwan Semiconductor Manufacturing Company (TSMC) is driving transformational capacity expansion in the United States with a planned increase of $100 billion on top of its existing $65 billion investment, bringing the total to $165 billion. This multi-billion-dollar commitment supports three new fabrication plants, two advanced packaging facilities, and an R&D center, making it the largest single foreign direct investment in U.S. history. The initiative underscores TSMC’s intent to anchor critical AI and high-performance computing supply chains domestically, while meeting surging demand from leading-edge technology innovators.

Meanwhile, Intel is securing up to $7.86 billion in direct funding under the CHIPS and Science Act to advance manufacturing and packaging projects across Arizona, New Mexico, Ohio, and Oregon. Complementing this support, Intel’s strategic roadmap includes decisions on a new “fab city” hub, projected to cost between $60 billion and $120 billion over the next decade. These initiatives illustrate a collaborative ecosystem where government incentives and corporate capital converge to establish a more resilient, future-ready semiconductor infrastructure in the United States.

This comprehensive research report delivers an in-depth overview of the principal market players in the Active Electronic Components market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Micro Devices Inc

- Analog Devices Inc

- ASML Holding N.V.

- Broadcom Inc

- Infineon Technologies AG

- Intel Corporation

- Kemet Corporation

- Kyocera Corporation

- Marvell Technology Inc

- MediaTek Inc

- Microchip Technology Inc

- Micron Technology Inc

- Monolithic Power Systems Inc

- Murata Manufacturing Co Ltd

- NVIDIA Corporation

- NXP Semiconductors N.V.

- ON Semiconductor Corporation

- Panasonic Corporation

- Qualcomm Inc

- Renesas Electronics Corporation

- Samsung Electronics Co Ltd

- SK Hynix Inc

- STMicroelectronics N.V.

- Taiwan Semiconductor Manufacturing Company Limited

- Texas Instruments Incorporated

- Toshiba Corporation

- Vishay Intertechnology Inc

Implementing Actionable Strategies for Industry Leaders to Navigate Disruptions, Foster Innovation, and Secure Competitive Advantages

Industry leaders must diversify sourcing strategies to mitigate the risks posed by concentrated manufacturing dependencies and evolving trade policies. Embracing a multi-sourcing approach that spans established and emerging production hubs can enhance supply-chain resilience. Collaborative R&D partnerships, particularly in advanced materials and wide-bandgap semiconductors, will be critical to meeting stringent performance and efficiency targets. Furthermore, integrating sustainable manufacturing practices and circular-economy principles can reduce environmental footprints and align corporate strategies with evolving regulatory and customer expectations.

To sustain long-term competitiveness, organizations should accelerate digital transformation initiatives across the value chain. Advanced analytics platforms can drive real-time visibility into inventory, quality metrics, and manufacturing yields, enabling proactive decision-making. Investing in workforce development-through targeted upskilling programs and academia-industry collaborations-will address skill gaps in advanced packaging, design for reliability, and system integration. By prioritizing agile innovation processes and fostering cross-functional integration, industry leaders can seize market opportunities and navigate disruptions with confidence.

Detailing a Robust Research Methodology Combining Primary Insights, Secondary Data Analysis, and Triangulation for Credible Findings

Our research approach integrates rigorous secondary data collection with targeted primary validation, ensuring a holistic view of active electronic component markets. Secondary research sources include industry association reports, government and regulatory data, corporate financial disclosures, and proprietary trade analyses. This foundational insight is enriched through direct engagement with key stakeholders-ranging from R&D leaders and supply-chain executives to end-user decision-makers-to validate assumptions and uncover emerging trends. By cross-referencing and contextualizing diverse data sets, we establish a robust framework for credible, actionable findings.

To enhance the reliability of our conclusions, we employ methodological triangulation, combining qualitative interviews, quantitative surveys, and analytical modeling. Best practices in triangulation-such as transparent documentation of data sources, standardized collection protocols, and iterative cross-validation-ensure that our insights withstand rigorous scrutiny. This mixed-methods strategy minimizes bias, enhances data integrity, and provides a comprehensive perspective on market dynamics, supplier landscapes, and technology adoption patterns.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Active Electronic Components market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Active Electronic Components Market, by Product Type

- Active Electronic Components Market, by Application

- Active Electronic Components Market, by Material

- Active Electronic Components Market, by Mounting Type

- Active Electronic Components Market, by Region

- Active Electronic Components Market, by Group

- Active Electronic Components Market, by Country

- United States Active Electronic Components Market

- China Active Electronic Components Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Consolidating Core Findings and Forward-Looking Perspectives to Illuminate the Future Trajectory of Active Electronic Components

The active electronic components market stands at a pivotal inflection point driven by emerging applications, materials innovation, and evolving trade policies. Robust growth in AI-optimized chips, the proliferation of IoT devices, and the transition toward electric and autonomous vehicles are reshaping demand. At the same time, geopolitical dynamics and tariff uncertainties underscore the need for strategic agility. As companies recalibrate supply chains and invest in advanced manufacturing capabilities, the ability to align product portfolios with high-value segments-such as power management ICs and wide-bandgap semiconductors-will determine market leadership.

Looking forward, organizations that leverage data-driven decision frameworks and foster collaborative innovation ecosystems will unlock sustainable competitive advantages. By adopting a granular segmentation approach, prioritizing regional diversification, and investing in workforce capabilities, industry participants can navigate complexity and capitalize on growth vectors. The integration of advanced analytics, strategic partnerships, and resilient operational models will illuminate the path toward lasting success in the dynamic active electronic components landscape.

Connect with Ketan Rohom to Secure Exclusive Access to the Comprehensive Active Electronic Components Market Research Report

To gain a comprehensive understanding of the active electronic components market and unlock tailored strategic insights that align with your organizational priorities, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing. Ketan brings extensive expertise in translating complex market data into actionable business strategies and will guide you through the exclusive offerings of this market research report. Secure your access today to benefit from in-depth analysis, customized executive briefings, and direct support for driving growth in the evolving landscape of active electronic components.

- How big is the Active Electronic Components Market?

- What is the Active Electronic Components Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?