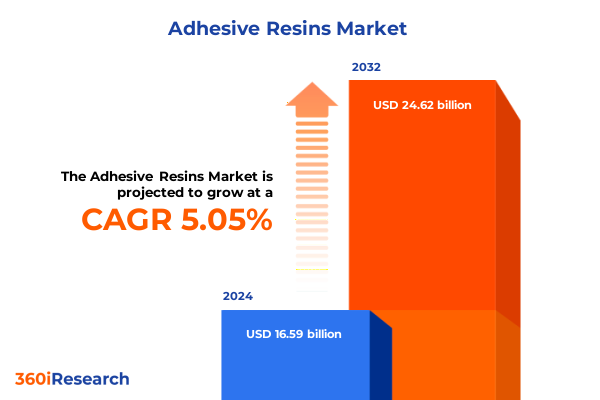

The Adhesive Resins Market size was estimated at USD 17.41 billion in 2025 and expected to reach USD 18.26 billion in 2026, at a CAGR of 5.07% to reach USD 24.62 billion by 2032.

Overview of the Adhesive Resins Market Landscape Highlighting Key Drivers Emerging Opportunities and Strategic Imperatives

Adhesive resins have become integral components across industries ranging from automotive and construction to electronics and packaging, thanks to their ability to bond disparate materials with precision and durability. As manufacturers pursue lighter, stronger, and more sustainable solutions, resin formulations have grown increasingly sophisticated, incorporating advanced chemistries that balance performance, cost, and environmental compliance. In this evolving landscape, understanding the interplay between raw material sources, process technologies, and application requirements is crucial for strategic planning.

Amid rising regulatory demands and shifting consumer preferences, companies face mounting pressure to innovate while managing supply chain complexities. Fluctuations in petrochemical feedstock prices, tightening environmental standards, and the drive toward bio-based alternatives collectively shape the decision matrix for resin producers and end-users. Against this backdrop, this executive summary distills the core drivers, transformative trends, and segmentation insights that will influence market dynamics through 2025.

The following sections will unpack the most significant shifts affecting adhesive resin development, analyze the cumulative impact of new United States tariffs on raw material accessibility and manufacturing costs, and offer deep dives into product, application, and technology segmentation. Decision-makers will also find regional perspectives, leading-company analyses, actionable recommendations, and methodological clarity designed to inform strategic initiatives in this critical materials sector.

Identification of Major Disruptive Trends Redefining Production Formulations and Supply Chain Dynamics in the Adhesive Resins Sector

In recent years, the adhesive resins sector has undergone transformative changes as sustainability imperatives and digitalization reshape product development and supply chain operations. Bio-based chemistries have moved from the lab to commercial scale, driven by regulatory incentives and consumer demand for lower carbon footprints. At the same time, data-driven formulation platforms and advanced analytics enable faster optimization of cure profiles and performance attributes, ushering in a new era of precision engineering in resin manufacturing.

Concurrently, the integration of automation and Industry 4.0 solutions has streamlined production lines, facilitating agile scale-up and reducing batch variability. Remote monitoring and predictive maintenance reduce downtime, while digital twins allow virtual process trials that accelerate time to market. These technological advances coincide with brand owners seeking end-to-end transparency, prompting investment in traceability systems that capture raw material origins and lifecycle impacts.

Furthermore, collaborative innovation models have taken shape as resin producers partner with equipment manufacturers, academic institutions, and specialty chemical suppliers. By co-developing next-generation formulations that balance performance with environmental stewardship, these alliances are setting new industry benchmarks. Collectively, these shifts are redefining how adhesive resins are designed, produced, and delivered, setting the stage for continued evolution.

Analysis of the Multifaceted Impact of New Tariff Structures on Raw Material Accessibility Manufacturing Economics and Competitive Positioning

Effective January 1, 2025, the United States imposed new tariff rates on several key resin precursors and intermediates, including certain acrylic monomers, epichlorohydrin, and specialized polyols. These measures, intended to bolster domestic manufacturing, have had unintended consequences on raw material affordability and availability for adhesive resin producers. As a result, many formulators confronted higher input costs, compelling some to seek alternative sources and to reevaluate supply chain strategies.

The tariff changes have exerted upward pressure on the composite cost structure for epoxy and polyurethane resins in particular, as bisphenol A derivatives, cycloaliphatic epoxies, and aliphatic isocyanates became subject to additional duties. Producers have responded with a mix of tactics: passing incremental costs to OEMs, optimizing feedstock yields through improved reaction efficiencies, or relocating certain processing steps to overseas facilities where duties do not apply. These adaptations underscore the dynamic nature of global supply chains and the need for flexible manufacturing networks.

In contrast, suppliers of silicone-based resins and water-based systems experienced relatively muted impact, given their distinct feedstock profiles and existing domestic capacities. Nevertheless, as producers realign their portfolios, tariff-driven distortions have accelerated consolidation among smaller players unable to absorb cost volatility. Looking ahead, continuous monitoring of trade policy developments and proactive engagement with government initiatives will be essential for maintaining competitive positioning.

Deep Dive into Product Application and Process Technology Segmentation Unveiling Nuanced Demand Patterns and Growth Drivers

A nuanced understanding of market segmentation reveals divergent growth trajectories based on product, application, and technology preferences. From a product type perspective, acrylic resins-including both alkyl and methacrylate variants-continue to secure significant interest due to their fast cure profiles and clarity in coatings and adhesives. Meanwhile, epoxy formulations such as bisphenol A, cycloaliphatic, and novolac types are favored in structural applications requiring high mechanical strength and chemical resistance. Polyurethane resins present further diversity through aliphatic grades ideal for UV-stable coatings and aromatic versions used in footwear and specialty adhesives. Silicon-based resins, albeit a smaller segment, command premium positions where extreme thermal or electrical performance is mandated.

Application segmentation further refines market pathways. In the automotive sector, lightweight composite bonding and electric vehicle battery assembly drive demand for epoxy and polyurethane chemistries. The construction industry’s emphasis on sustainable building materials elevates demand for water-borne and hot-melt resin systems. Electronics applications prioritize solvent-based and UV-curable technologies for fine-pitch bonding and encapsulation. Footwear manufacturers lean toward polyurethane adhesives for their flexibility and resilience, whereas packaging converters increasingly adopt water-based and hot-melt formulations to meet environmental regulations and speed of assembly.

Technology segmentation highlights critical process differentiators. Hot-melt systems offer rapid set times and solvent-free processing, while solvent-based options deliver strong initial tack and broad substrate compatibility. UV-curable resins facilitate instant cure under controlled irradiation, unlocking high-speed production lines. Water-based technologies appeal to low-VOC mandates and simplified clean-up, albeit with nuanced formulation challenges. Together, these segmentation insights illuminate the interplay between performance requirements, regulatory constraints, and processing infrastructures that shape adhesive resin choices.

This comprehensive research report categorizes the Adhesive Resins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Form

- Application

Strategic Evaluation of Regional Market Variations and Performance Factors Driving Adoption Across the Americas EMEA and Asia-Pacific

Regional dynamics within the adhesive resins market reveal distinct growth catalysts and obstacles. In the Americas, well-established petrochemical infrastructures support robust production of epoxy and polyurethane feedstocks, enabling domestic formulators to rapidly adapt to new formulations. However, logistical bottlenecks in North American port capacity and trucking constraints necessitate strategic inventory management and diversified transportation networks. Concurrently, sustainability goals in Canada and the United States are driving uptake of bio-based resin alternatives, prompting regional producers to invest in green chemistries and circular-economy frameworks.

Across Europe, Middle East & Africa, regulatory complexity and geopolitical uncertainties create a mosaic of opportunities and risks. The European Union’s stringent VOC and REACH regulations have accelerated the shift toward water-based and UV-curable systems, elevating technology providers capable of compliance-driven innovation. Meanwhile, Middle Eastern initiatives to expand petrochemical capacities and Africa’s emerging infrastructure projects are fostering pockets of increased demand for construction-grade adhesives. Nonetheless, currency fluctuations and trade barriers can moderate investment timelines and influence sourcing decisions across the EMEA zone.

Asia-Pacific remains a powerhouse for adhesive resin consumption, driven by large-scale manufacturing in China, India, Japan, and Southeast Asian economies. Rapid urbanization and infrastructure build-out support construction adhesives, while a burgeoning electronics export market fuels demand for precision resin technologies. Domestic resin producers in China and South Korea are scaling up capacity for acrylic and solvent-based chemistries, often leveraging lower-cost feedstocks. However, environmental regulations and public scrutiny have begun to introduce production quotas and emissions standards, creating both innovation incentives and compliance costs.

This comprehensive research report examines key regions that drive the evolution of the Adhesive Resins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Comprehensive Examination of Leading Industry Players Innovations Collaborations and Strategic Initiatives Shaping Market Leadership

The adhesive resins landscape is characterized by a mix of global conglomerates and specialized regional suppliers, each leveraging unique strengths to capture market share. Leading multinational companies have invested heavily in research to engineer novel resin chemistries that align with sustainability mandates and performance benchmarks, often forming cross-sector partnerships with automotive OEMs and electronics manufacturers. Strategic acquisitions of niche technology providers have further augmented their portfolios, enabling rapid entry into high-growth segments such as UV-curable and bio-based resins.

Meanwhile, agile mid-tier players focus on application-specific solutions and customer service excellence. By maintaining flexible production lines and localized technical support, these companies can tailor formulations to the precise needs of packaging converters or footwear manufacturers, for instance. Collaboration with academic institutions and contract manufacturers drives incremental innovation, ensuring that specialized grades-such as cycloaliphatic epoxies for marine coatings or aliphatic polyurethanes for outdoor adhesives-remain aligned with emerging use cases.

Smaller, innovative startups have also emerged, capitalizing on digital design tools and micro-reactor technologies to accelerate development cycles. Their strategies often hinge on offering rapid prototyping services, small-batch production runs, and proprietary bio-polymer blends. Although operating on leaner budgets, these disruptors can influence broader market priorities by demonstrating the viability of sustainable alternatives and digital workflow integration. Together, the mosaic of industry participants drives both incremental gains and paradigm shifts in the adhesive resins domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Adhesive Resins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Arkema S.A.

- Ashland Inc.

- Beardow & Adams (Adhesives) Limited

- Cattie Adhesives

- Chang Chun Group

- Chempoint by Univar Solutions Inc.

- Daubert Chemical Company, Inc.

- DuPont de Nemours, Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Exxon Mobil Corporation

- Georgia-Pacific Chemicals LLC

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hexion Inc.

- Huntsman International LLC

- Jowat SE

- Kukdo Chemical Co.,Ltd.

- Lawter Inc.

- Lesaffre & CIE

- MAPEI S.p.A.

- Master Bond, Inc.

- Mitsubishi Chemical Corporation

- Nan Ya Plastics Corporation

- NIPPON SHOKUBAI CO., LTD.

- Panacol-Elosol GmbH

- Polyram Plastic Industries LTD

- Sika AG

- Soudal Holding N.V.

- The Dow Chemical Company

Actionable Strategic Recommendations to Advance Product Development Expand Market Reach and Optimize Supply Chain Resilience

To navigate the evolving adhesive resins landscape, industry leaders should prioritize diversification of feedstock sources and enhancement of supply chain resilience. Developing partnerships with multiple upstream suppliers, including those offering bio-based monomers, will mitigate the impact of future tariff adjustments and petrochemical price volatility. Simultaneously, integrating digital supply chain platforms can provide end-to-end visibility, enabling proactive risk management and real-time inventory optimization.

Accelerating investment in R&D is essential for maintaining competitive differentiation. Companies should allocate resources toward advanced formulation platforms that leverage machine learning to predict performance attributes, thereby reducing bench-scale trial cycles. Collaborative innovation models-such as joint labs with OEMs and academic institutions-can further expedite the co-creation of next-generation resins that meet stringent environmental and performance criteria.

Finally, embedding sustainability as a core tenet of corporate strategy will unlock new market segments and partnership opportunities. By establishing circular-economy frameworks, resin manufacturers can reclaim and recycle end-of-life materials, while offering customers demonstrable carbon-footprint reductions. Altogether, these actionable measures will equip organizations to seize emerging markets, bolster profitability, and contribute to broader ecological objectives.

Robust Research Framework Detailing Methodological Approaches Data Sources and Analytical Techniques Ensuring Comprehensive Insights

This research employs a robust, multi-stage methodological framework combining primary interviews, secondary data analysis, and rigorous validation protocols. Primary research involved in-depth discussions with raw material suppliers, resin formulators, OEM procurement leaders, and industry experts to capture firsthand insights on formulation trends, cost pressures, and application requirements. These qualitative interviews informed the development of detailed questionnaires that were distributed to a broader panel of stakeholders for quantitative validation.

Secondary research encompassed comprehensive reviews of regulatory filings, patent databases, corporate press releases, and trade associations to map technological advancements and strategic initiatives. Data triangulation techniques were applied to reconcile quantitative responses with publicly available financial and operational metrics. Each data point was cross-checked against at least two independent sources to ensure accuracy and consistency.

Analytical tools included segmentation modeling to identify performance differentials across product types, applications, and process technologies, as well as regional demand forecasting based on macroeconomic indicators and industry capacity data. Findings were subjected to peer review by an advisory board of seasoned chemists and supply chain specialists, ensuring that conclusions and recommendations reflect the highest standards of methodological rigor.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Adhesive Resins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Adhesive Resins Market, by Product Type

- Adhesive Resins Market, by Technology

- Adhesive Resins Market, by Form

- Adhesive Resins Market, by Application

- Adhesive Resins Market, by Region

- Adhesive Resins Market, by Group

- Adhesive Resins Market, by Country

- United States Adhesive Resins Market

- China Adhesive Resins Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Consolidated Synopsis of Key Findings Opportunities and Challenges Informing Strategic Decision-Making in the Adhesive Resins Domain

In aggregate, this executive summary has highlighted the critical inflection points shaping the adhesive resins market in the current era. Transformative technological shifts, from bio-based chemistries to digital formulation tools, are redefining product development paradigms, while evolving US tariff policies have introduced fresh complexities in raw material procurement. Segmentation insights underscore the importance of tailoring resin offerings to discrete product types, applications, and process technologies. Regional analyses further reveal how diverse regulatory environments and infrastructure constraints drive differentiated adoption patterns.

Looking forward, organizations that embrace agile, data-driven approaches to innovation and supply chain management will be best positioned to capitalize on emerging growth pockets. Strategic emphasis on sustainability, coupled with collaborative R&D models, will unlock new performance thresholds and customer value propositions. By integrating the actionable recommendations outlined herein, stakeholders can navigate volatility, mitigate risks, and chart a path toward sustained competitive advantage in the adhesive resins landscape.

Engaging Invitation to Connect with Ketan Rohom for Exclusive Access to Comprehensive Adhesive Resins Market Intelligence

We appreciate your interest in gaining the strategic insights and detailed analysis presented in this executive summary. To explore the comprehensive findings, understand the nuanced shifts in formulations, dissect the impact of evolving tariff environments, and access our in-depth segmentation and regional breakdowns, we invite you to engage directly with Ketan Rohom, Associate Director, Sales & Marketing. His expertise in guiding decision-makers through market complexities will ensure you extract maximum value from the full report.

Connecting with Ketan will provide you with tailored guidance on how to leverage these insights for competitive advantage. Whether you seek customized data extracts, focused deep dives into specific formulations, or support in crafting strategic roadmaps, his consultative approach will align the research outcomes with your organization’s objectives. Schedule a conversation today to secure access to the definitive adhesive resins market research report and drive your next wave of growth initiatives.

- How big is the Adhesive Resins Market?

- What is the Adhesive Resins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?