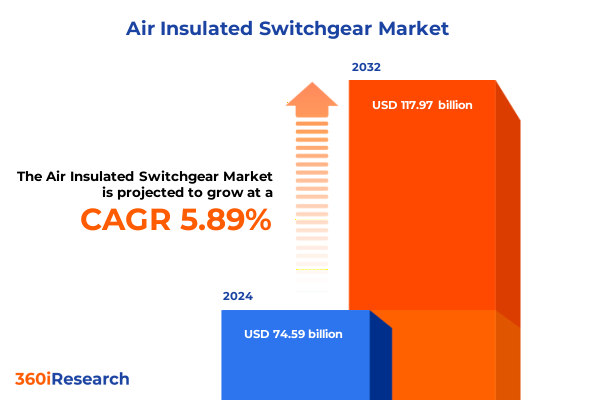

The Air Insulated Switchgear Market size was estimated at USD 78.78 billion in 2025 and expected to reach USD 83.21 billion in 2026, at a CAGR of 5.93% to reach USD 117.97 billion by 2032.

Harnessing the Power of Air Insulated Switchgear to Drive Grid Resilience and Sustainable Energy Transitions Across Evolving Infrastructure Landscapes

Air insulated switchgear serves as the backbone of modern electrical networks, ensuring reliable power distribution across industrial, commercial, and utility applications. Rooted in proven engineering principles, these systems provide consistent performance under diverse environmental and load conditions, making them indispensable to grid operators and infrastructure developers. As power demands intensify and electrification initiatives expand globally, the robustness and adaptability of air insulated switchgear become ever more critical.

In today’s energy transition landscape, stakeholders require equipment that not only meets established safety standards but also integrates seamlessly with digital monitoring and control frameworks. Consequently, manufacturers have responded by enhancing device modularity and enabling real-time diagnostics. Such advancements increase operational efficiency, simplify maintenance cycles, and mitigate the risk of unplanned outages. Looking ahead, air insulated switchgear stands poised to support emerging trends such as distributed generation, microgrids, and intelligent asset management, reinforcing its stature at the core of resilient power architectures.

Rapid Technological Advancements and Decarbonization Efforts Are Reshaping Air Insulated Switchgear for Smarter, Greener, and More Connected Power Systems

The air insulated switchgear market has undergone a series of transformative shifts as digital technology and sustainability imperatives converge to redefine industry expectations. Foremost among these changes is the integration of advanced sensor networks and remote monitoring capabilities, which allow for predictive maintenance and reduce downtime through condition-based servicing. Additionally, the drive to eliminate sulfur hexafluoride (SF6) due to its high global warming potential has accelerated the development of SF6-free solutions, including vacuum interrupters and alternative gas mixtures, thereby aligning equipment design with corporate environmental goals.

Moreover, the adoption of modular and compact switchgear architectures has streamlined installation processes and facilitated faster deployment in space-constrained urban substations. These modular systems also support plug-and-play upgrades, enabling utilities and end users to scale capacity without the need for extensive civil works. Finally, the proliferation of renewable energy sources, coupled with heightened regulatory scrutiny on carbon emissions, has prompted equipment suppliers to invest heavily in research and development, ensuring that air insulated switchgear remains both technologically relevant and environmentally responsible.

Analysis of Layered Section 232 and Section 301 Tariff Measures Unveils Complex Cost Pressures on Air Insulated Switchgear Supply Chains

The cumulative impact of U.S. tariff measures in 2025 has introduced multifaceted cost pressures for producers and end users of air insulated switchgear components. On March 12, 2025, the reinstatement and expansion of Section 232 tariffs imposed a 25 percent duty on imported steel and aluminum, including derivative products, to bolster domestic manufacturing of critical infrastructure materials. These measures eliminated all general approved exclusions, effectively broadening the tariff base and compelling manufacturers to reassess sourcing strategies for busbars, circuit breakers, current transformers, and related metallic components.

In parallel, the United States Trade Representative’s conclusion of the four-year review under Section 301 saw significant tariff hikes on technology-linked imports, raising duties on semiconductors and certain electrical machinery to 50 percent as of January 1, 2025. While the USTR extended exclusions for select solar manufacturing equipment until May 31, 2025, most electrical switchgear parts no longer benefit from exemptions, creating further inflationary pressures across indoor and outdoor switchgear segments. Consequently, suppliers and project developers must navigate an intricate tariff environment that directly affects production costs and delivery timelines across both SF6-free and vacuum interrupter-based switchgear offerings.

In-Depth Examination of Component, Product Type, Technology, Voltage, Power, Insulation, Installation, End User, and Application Segmentation Reveals Market Opportunities

A comprehensive segmentation lens reveals how the air insulated switchgear market dissects into distinct verticals, each exhibiting unique performance drivers and customer requirements. Examining product components uncovers differentiated growth among busbars that facilitate power distribution, circuit breakers critical for system safety, current transformers that measure alternating currents, disconnectors that enable secure isolation of electrical circuits, and relay panels that orchestrate protective schemes.

From a product type perspective, indoor switchgear units dominate compact installations within commercial buildings and industrial plants, while outdoor switchgear thrives in harsh environments such as substations and renewable energy sites. Technology segmentation further distinguishes traditional gas insulated options from emerging SF6-free solutions and vacuum interrupter systems designed to meet stringent environmental mandates. Voltage level categorizations across high, medium, and low voltage applications address diverse network requirements, whereas power rating divisions-from up to 15 kV through 15–30 kV to above 30 kV-align equipment capabilities with specific load demands.

Insights into insulation types underscore the predominance of air insulation for simplicity and cost-effectiveness, while gas insulation and hybrid approaches-mixing air with gas or air with vacuum-cater to niche performance or space-constrained needs. Installation segmentation highlights the juxtaposition of new infrastructure projects and retrofit initiatives that extend asset lifecycles. End user analysis spans commercial buildings, including educational institutions, office spaces, and shopping centers; industrial applications across manufacturing, metal processing, and mining operations; renewable energy facilities such as hydroelectric plants, solar power arrays, and wind energy sites; and utilities, both private and public. Finally, application segmentation spans infrastructure planning, primary and secondary power distribution, and substations differentiated into distribution and transmission nodes, illustrating tailored use cases that guide product development and deployment strategies.

This comprehensive research report categorizes the Air Insulated Switchgear market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Components

- Product Type

- Technology

- Voltage Level

- Power Rating

- Insulation Type

- Installation

- End Users

- Application

Regional Dynamics Across Americas, Europe Middle East Africa, and Asia-Pacific Highlight Divergent Growth Drivers and Investment Priorities in Air Insulated Switchgear

Regional market dynamics for air insulated switchgear reflect divergent growth trajectories driven by infrastructure maturity, regulatory frameworks, and decarbonization priorities. In the Americas, legacy grid modernization initiatives and utility capital expenditure on resilience post-extreme weather events underpin sustained demand, particularly in the United States and Brazil, where cross-border interconnection projects and distributed energy integration prevail.

Meanwhile, Europe, the Middle East, and Africa present a mosaic of opportunities shaped by stringent emissions targets, progressive smart grid mandates, and large-scale renewable roll-outs. Western European nations focus on retrofitting aging substations with digitalized switchgear, whereas Middle Eastern markets leverage abundant capital to build new power networks for urban expansions. In Africa, electrification programs aimed at closing access gaps fuel investments in compact, modular switchgear solutions.

Asia-Pacific stands out for its rapid infrastructure expansion and policy-driven renewable targets, with China leading in high-voltage installation projects and India pursuing rural electrification and industrial corridor developments. Southeast Asian nations, supported by multilateral financing, deploy medium-voltage switchgear for emerging industrial zones, while Australia emphasizes grid stability to accommodate a growing share of variable renewable generation.

This comprehensive research report examines key regions that drive the evolution of the Air Insulated Switchgear market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive Intelligence Reveals Leading Air Insulated Switchgear Manufacturers’ Strategies, Partnerships, and Innovation Pathways in a Dynamic Market Environment

Leading players in the air insulated switchgear arena deploy multifaceted strategies to differentiate their offerings and extend market reach. Legacy manufacturers invest heavily in research and development to integrate digital control platforms and predictive analytics, enhancing product intelligence and facilitating remote asset management. Within this competitive landscape, alliances and joint ventures enable technology sharing and local content development, particularly in regions subject to localization regulations.

Moreover, top-tier companies pursue strategic acquisitions to rapidly augment capabilities in SF6 alternatives and modular switchgear, thereby accelerating time-to-market for environmentally compliant solutions. Capitalizing on supply chain integration, these firms establish regional manufacturing hubs to mitigate tariff impacts and optimize logistics. Concurrently, a strong focus on after-sales services, including training, maintenance contracts, and lifecycle management, reinforces customer engagement and supports long-term revenue streams amidst intensifying price competition.

This comprehensive research report delivers an in-depth overview of the principal market players in the Air Insulated Switchgear market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Alfanar Group

- CG Power & Industrial Solutions Ltd. by Murugappa Group

- Chint Group

- Eaton Corporation PLC

- EFACEC Power Solutions SGPS, S.A.

- EPE Power Switchgear Sdn. Bhd.

- General Electric Company

- Hitachi, Ltd.

- Larsen & Toubro Ltd.

- Lucy Group Ltd

- Matelec SAL

- Mitsubishi Electric Corporation

- Nissin Electric Co., Ltd. by Sumitomo Electric Industries, Ltd.

- Ormazabal by VELATIA, S.L.

- RITTER Starkstromtechnik GmbH & Co. KG

- S&C Electric Company

- Schneider ELectric SE

- Siemens AG

- SOJO Electric Co., Ltd.

- SwitchGear Company NV

- Tavrida Electric AG

- TEPCO Group

- Toshiba Corporation

- Wenzhou Unisun Electric Co., Ltd.

Strategic Recommendations Empower Industry Leaders to Enhance Resilience, Elevate Efficiency, and Capitalize on Emerging Trends in Air Insulated Switchgear

Industry leaders should embark on a holistic supply chain diversification initiative to reduce dependency on single-source suppliers and buffer against ongoing tariff volatility. By establishing alternative procurement channels for critical raw materials and components, organizations can alleviate cost fluctuations and maintain production continuity. In addition, investing in advanced digital retrofit kits for existing switchgear assets can prolong equipment lifecycles and defer capital outlays for greenfield projects.

Crucially, stakeholder collaboration with government agencies and industry consortia can influence policy development and secure tariff exclusions or relief measures for strategic infrastructure categories. Similarly, forging partnerships with technology innovators specializing in SF6-free interrupters and compact modular designs will position companies at the forefront of sustainability compliance and space-constrained deployment requirements. Finally, cultivating technical expertise through targeted workforce training and certification programs ensures that operational teams can effectively leverage emerging digital diagnostics and predictive maintenance tools, driving both safety and efficiency improvements.

Comprehensive Research Methodology Integrates Primary Interviews, Secondary Data Analysis, and Rigorous Validation to Ensure Robust Air Insulated Switchgear Insights

The research methodology underpinning this analysis combines rigorous primary and secondary data collection to deliver robust, actionable insights. Primary engagements included structured interviews with power utilities, equipment manufacturers, and end users across multiple geographies, yielding firsthand perspectives on technology adoption barriers and performance priorities. These qualitative findings were systematically supplemented with quantitative data derived from regulatory filings, trade databases, and publicly available import-export statistics, ensuring comprehensive market coverage.

Secondary research integrated a review of industry white papers, academic journals, and technical standards to contextualize emerging trends in digitalization and SF6 alternatives. Tariff schedules and U.S. Trade Representative announcements were analyzed in detail to quantify the implications of Section 232 and Section 301 measures. All data points underwent a multi-level validation process, incorporating cross-referencing, data triangulation, and peer review by an advisory panel of energy sector specialists to guarantee analytical accuracy and strategic relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Air Insulated Switchgear market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Air Insulated Switchgear Market, by Components

- Air Insulated Switchgear Market, by Product Type

- Air Insulated Switchgear Market, by Technology

- Air Insulated Switchgear Market, by Voltage Level

- Air Insulated Switchgear Market, by Power Rating

- Air Insulated Switchgear Market, by Insulation Type

- Air Insulated Switchgear Market, by Installation

- Air Insulated Switchgear Market, by End Users

- Air Insulated Switchgear Market, by Application

- Air Insulated Switchgear Market, by Region

- Air Insulated Switchgear Market, by Group

- Air Insulated Switchgear Market, by Country

- United States Air Insulated Switchgear Market

- China Air Insulated Switchgear Market

- Competitive Landscape

- List of Figures [Total: 21]

- List of Tables [Total: 2703 ]

Synthesis of Air Insulated Switchgear Market Dynamics Reinforces the Imperative for Innovation, Collaboration, and Strategic Adaptation to Future Challenges

The collective examination of market dynamics, tariff impacts, segmentation nuances, regional drivers, and competitive tactics underscores the critical need for agility and foresight among stakeholders in the air insulated switchgear domain. As supply chains recalibrate in response to trade policy shifts, manufacturers and end users alike must prioritize adaptive sourcing strategies and digital enablement to sustain operational continuity.

Furthermore, the convergence of environmental mandates and customer demand for predictive diagnostics positions SF6-free and vacuum-based interrupter technologies at the forefront of future growth. Regional infrastructure aspirations will continue to shape deployment patterns, requiring tailored product portfolios and localized service models. Ultimately, success in this evolving landscape hinges on the ability to harmonize innovation with pragmatic business practices, fostering resilient partnerships and unlocking new revenue channels amid the transformation of global power networks.

Engage with Ketan Rohom to Secure Expert Air Insulated Switchgear Market Intelligence and Drive Informed Strategic Decisions Today to Gain the Competitive Edge

Engaging with Ketan Rohom offers a strategic path to unlock comprehensive market intelligence on air insulated switchgear and translate data-driven insights into tangible business outcomes. By collaborating directly, organizations gain tailored analysis addressing specific operational challenges, from navigating evolving tariff landscapes to optimizing regional deployment strategies. Through a bespoke consultation, leaders can harness forward-looking trends, segmented market deep dives, and competitive benchmarking to sculpt resilient supply chains and fortify their market position. With this partnership, decision-makers will be empowered to move beyond generic trends and implement actionable roadmaps that align with their unique growth objectives. Reach out now to initiate a dynamic dialogue that accelerates your strategic planning and cements your competitive edge in a rapidly evolving infrastructure environment.

- How big is the Air Insulated Switchgear Market?

- What is the Air Insulated Switchgear Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?