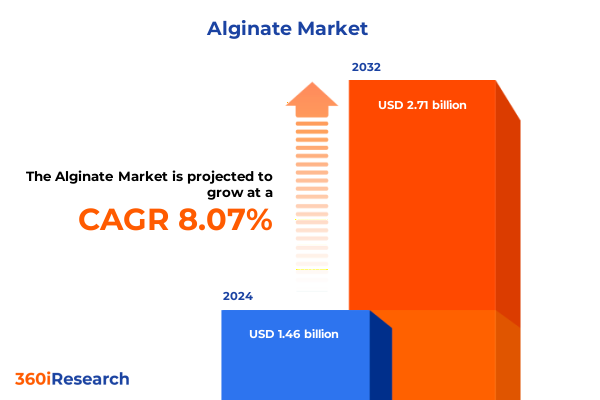

The Alginate Market size was estimated at USD 1.58 billion in 2025 and expected to reach USD 1.71 billion in 2026, at a CAGR of 9.15% to reach USD 2.91 billion by 2032.

Exploring the Multifaceted Role of Alginate as a Critical Biopolymer Transforming Industrial Processes and Innovative Consumer Solutions

Alginate, a naturally derived polymer extracted from brown seaweed, has emerged as a pivotal material across diverse industrial and consumer sectors. Its molecular structure, characterized by long chains of mannuronic and guluronic acids, imparts a unique combination of rheological and gelling properties that synthetic counterparts often cannot replicate. As end users increasingly favor sustainable and bio-based ingredients, alginate stands out for its renewable origins and biodegradability. This shift towards environmentally responsible materials has elevated alginate from a niche additive to a strategic resource for manufacturers aiming to meet stringent ecological standards.

Moreover, the versatility of alginate facilitates seamless adaptation across multiple processing environments. In food formulations, it functions as a stabilizer that enhances textural quality; in pharmaceutical settings, it underpins advanced drug delivery systems; and in construction applications, it contributes to high-performance coatings and sealants. Consequently, cross-industry collaboration has intensified, driving innovation in extraction technologies and downstream processing. With stakeholders placing greater emphasis on supply chain transparency and regulatory compliance, alginate is poised to capture an ever-expanding role in future product development initiatives.

Analyzing Sustainable Extraction Innovations and Biotechnological Advances That Are Redefining the Competitive Dynamics of the Alginate Market

The landscape for alginate is undergoing significant transformation as sustainability and technological breakthroughs converge. Environmental concerns have spurred investment in ecofriendly extraction practices that reduce chemical usage and lower energy consumption. Enzyme-assisted extraction methodologies, for example, harness biologically derived catalysts to gently release alginate from seaweed cell walls, enhancing yield while preserving polymer integrity. Consequently, producers can respond to growing demands for “clean label” ingredients without compromising cost efficiency.

Furthermore, advances in biotechnology are unlocking novel production pathways. Researchers are engineering microbial strains to biosynthesize alginate analogues, offering the potential for year-round manufacturing independent of seaweed harvest cycles. This biotechnological pivot not only stabilizes supply but also enables customization of polymer chain lengths for tailored viscosity and gelling behaviors. Digital process monitoring, powered by real-time analytics and machine learning, complements these innovations by ensuring consistent quality and streamlining scale-up operations.

In parallel, regulatory frameworks are evolving to reflect heightened safety and sustainability criteria. New guidelines from international agencies increasingly emphasize traceability, permissible additive levels, and environmental impact assessments. As a result, companies that proactively align their processes with emerging standards gain a competitive advantage, positioning themselves as reliable partners in the global value chain.

Uncovering How Recent U.S. Tariff Adjustments on Alginate Imports Are Reshaping Supply Chains, Cost Structures, and Strategic Sourcing Dynamics

Recent adjustments to United States import duties on alginate have created a cascade of strategic recalibrations across the supply chain. With tariff rates elevated in early 2025, cost pressures have prompted companies to revisit sourcing strategies and explore alternative procurement models. Domestic processors are accelerating expansion plans to capitalize on these shifts, while import-reliant formulators seek to diversify supplier portfolios beyond traditional sourcing regions.

In this context, supply chain resilience has become paramount. Organizations are implementing dual-sourcing approaches, combining regional suppliers with vertically integrated partners to stabilize lead times and mitigate geopolitical risks. Logistics providers, adapting to fluctuating demand patterns, offer more flexible delivery schedules and consolidated shipping options to help offset additional tariff burdens. These adaptations are reshaping relationships between raw material producers, intermediaries, and end users, driving closer collaboration and transparency.

Consequently, strategic sourcing now encompasses not only price considerations but also regional risk assessments and sustainability credentials. Some firms are investing in in-house extraction facilities or forging joint ventures with seaweed farmers to secure feedstock at its origin. Others are reallocating research and development efforts toward synthetic biology platforms, seeking to insulate operations from trade policy volatility. As the regulatory landscape continues to evolve, companies that integrate tariff impact analysis into decision-making processes will be better positioned to navigate cost fluctuations and maintain competitive agility.

Delving into Formulation Types, Functional Roles, Application Domains, and Quality Grades to Reveal Critical Segmentation Insights for Alginate Demand

Examining the market through a formulation lens reveals how each form of alginate responds to specific performance demands. Ammonium alginate delivers enhanced solubility in diverse pH environments, supporting film forming in advanced coatings. Calcium alginate, by contrast, yields robust gel networks prized in wound dressing and encapsulation processes, while potassium alginate contributes to smoother textures in bakery and confectionery items. Sodium alginate remains the most ubiquitous, balancing cost-efficient thickening with reliable stabilizing properties across food, pharmaceutical, and cosmetic formulations.

Shifting to functional roles underscores the adaptive capacity of alginate as an encapsulating agent that protects sensitive actives from degradation, as a film former that creates moisture barriers, and as a gelling agent that sets high-viscosity systems. Its stabilizing function ensures uniform dispersion of particulate ingredients, whereas its thickening behavior augments mouthfeel and process control. These functional characteristics drive formulation choices in industries seeking optimal consistency and shelf life.

Exploring applications highlights the polymer’s broad adoption across construction - where it enhances coatings and sealants and adhesives - and in food and beverage, from bakery products to beverages, confectionery, and dairy offerings. Pharmaceutical and cosmetic use cases range from sophisticated drug delivery matrices to wound care products that benefit from controlled release. Meanwhile, textile and printing segments leverage alginate in printing inks and finishing processes that demand precise rheological control and environmental compliance.

Finally, assessing quality grades clarifies how food grade, industrial grade, and pharmaceutical grade variants align with regulatory requirements and purity standards. Food-grade alginate must meet stringent contamination thresholds and sensory criteria, while industrial grade tolerates broader molecular weight distributions and is optimized for high-volume applications. Pharmaceutical grade undergoes rigorous sterilization and validation protocols, ensuring biocompatibility for medical device integration.

This comprehensive research report categorizes the Alginate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Functionality

- Grade

- Application

Mapping Regional Drivers and Challenges Across the Americas, Europe Middle East Africa, and Asia Pacific to Illuminate Alginate Growth Opportunities

The Americas region exhibits a mature value chain underpinned by established seaweed processing hubs along the Pacific coastline and Gulf of Mexico. End users in food and beverage benefit from proximity to reliable sodium alginate sources, while pharmaceutical innovators collaborate with domestic producers to develop advanced wound management technologies. However, tariff fluctuations have intensified interest in nearshoring and have spurred investments in localized extraction and purification assets.

In Europe, Middle East, and Africa, stringent environmental regulations in the European Union are accelerating the adoption of ecofriendly alginate grades, prompting manufacturers to pursue certifications and eco-labeling initiatives. The Middle East has emerged as a strategic aggregation point for imports destined for African markets, leveraging free trade agreements to optimize cost structures. Across North Africa, nascent seaweed farming projects are demonstrating potential to supply regional demand and to provide socioeconomic benefits in coastal communities.

Asia-Pacific continues to dominate raw material availability, thanks to extensive brown seaweed harvesting along the coastlines of China, Indonesia, and the Philippines. This region’s robust manufacturing infrastructure supports a wide array of application developments in construction materials, textile treatments, and biodegradable packaging solutions. Domestic policy incentives, particularly in Southeast Asia, are encouraging investments in value-added processing, enabling regional producers to capture a greater share of downstream markets and to compete on the basis of integrated supply chains and faster time to market.

This comprehensive research report examines key regions that drive the evolution of the Alginate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Strategic Collaborations That Are Shaping Innovation, Competitive Positioning, and Market Leadership in the Alginate Sector

Leading companies in the alginate sector are leveraging strategic acquisitions to enhance their feedstock security and to expand capacity for high-purity grades. Vertical integration strategies have seen processors acquire seaweed farming cooperatives or invest directly in coastal cultivation projects to secure end-to-end traceability. Concurrently, market incumbents are forging partnerships with biotechnology enterprises to co-develop next-generation alginate derivatives tailored for specialized applications.

In parallel, collaborative ventures with academic institutions and technology startups are fostering a robust pipeline of intellectual property around novel extraction and purification methods. These alliances enable companies to accelerate time to market for specialty formulations and to differentiate their offerings through proprietary performance attributes. Some organizations have introduced digital platforms that provide customers with formulation support, predictive viscosity models, and real-time quality tracking, enhancing transparency and strengthening customer loyalty.

Meanwhile, emerging regional players are capitalizing on localized raw material access and favorable regulatory environments to challenge established firms. These new entrants are advancing agile production models and lean manufacturing practices, enabling rapid scale-up of customized alginate grades. As competition intensifies, consolidation activity is anticipated to continue, with successful entities focusing on innovation leadership, operational excellence, and distinctive application expertise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Alginate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Algaia S.A.S.

- Alginor ASA

- Ashland Global Holdings Inc.

- Cargill, Incorporated

- Compañía Española de Algas Marinas

- CP Kelco

- DuPont de Nemours, Inc.

- FMC Corporation

- Gelymar S.A.

- Ingredion Incorporated

- J. Rettenmaier & Söhne

- KIMICA Corporation

- Marine Hydrocolloids

- Qingdao Bright Moon Seaweed Group

- Shandong Jiejing Group Corporation

Strategic Imperatives and Pragmatic Roadmaps for Industry Stakeholders to Capitalize on Emerging Trends and Strengthen Market Position in Alginate

Industry leaders should prioritize the development and scaling of sustainable extraction processes that minimize environmental impact while reducing production costs. By integrating green chemistry principles and partnering with enzymology specialists, companies can achieve higher yields and produce alginate variants with consistent molecular characteristics. Simultaneously, establishing strategic alliances with seaweed cultivators and biotechnology innovators will ensure a resilient supply base and facilitate access to bespoke polymer solutions.

To differentiate product portfolios, organizations must focus on specialty grades and custom formulations aligned with core functionality categories. Investing in research and development to optimize encapsulation performance, film-forming strength, and gelling precision will open new revenue streams in pharmaceuticals, advanced materials, and clean packaging solutions. Additionally, tailoring offerings to region-specific application needs-such as high-temperature stability for construction in hot climates or ultra-pure grades for medical use-will enhance competitive positioning.

Mitigating trade dynamics in the Americas requires nearshore production capabilities or collaborative ventures with domestic processors to reduce tariff exposure and logistics lead times. In EMEA, firms should pursue eco-certifications and align with circular economy frameworks to capitalize on regulatory incentives and consumer demand for sustainable products. In Asia-Pacific, leveraging government support for value-added processing can foster deeper integration into end-use markets worldwide.

Finally, embracing digital transformation across manufacturing and quality control processes will strengthen operational resilience. Implementing data analytics platforms for predictive maintenance, supply chain monitoring, and batch-to-batch consistency ensures cost efficiencies and enhances traceability, positioning companies to respond swiftly to emerging market opportunities.

Outlining a Rigorous Approach Combining Primary Interviews, Secondary Analysis, and Data Triangulation to Ensure Robust Insights into the Alginate Industry

This research draws on a combination of primary and secondary methodologies to ensure comprehensive and robust insights into the alginate landscape. Primary data was gathered through structured interviews with senior executives, supply chain managers, and R&D directors across leading processing facilities. These conversations provided firsthand perspectives on extraction innovations, tariff impact strategies, and emerging end-use requirements.

Secondary analysis encompassed an extensive review of regulatory documents, trade statistics, and patent filings, complemented by consultations with industry trade associations. Patent analysis illuminated the trajectory of technological advancements in biotechnological production and sustainable processing. Concurrently, trade data review highlighted shifting import and export patterns in response to changing tariffs and regional production developments.

Data triangulation was achieved by cross-verifying insights from supplier surveys, government publications, and environmental impact assessments. This multi-source approach minimized bias and enhanced the validity of qualitative interpretations. Rigorous quality checks, including peer reviews and validation workshops with industry experts, further strengthened the accuracy of findings. The result is a nuanced understanding of market dynamics, segmented by form, functionality, application, and grade, and contextualized within regional and regulatory frameworks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Alginate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Alginate Market, by Form

- Alginate Market, by Functionality

- Alginate Market, by Grade

- Alginate Market, by Application

- Alginate Market, by Region

- Alginate Market, by Group

- Alginate Market, by Country

- United States Alginate Market

- China Alginate Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings on Alginate Dynamics to Highlight Strategic Imperatives and Future Directions for Stakeholders and Decision Makers

In summary, alginate has transitioned from a niche additive to a cornerstone biopolymer valued for its multifunctionality, renewability, and performance advantages. Sustainability imperatives and technological breakthroughs in extraction and biotechnology are driving unprecedented innovation, reshaping value chains, and fostering new application frontiers. Simultaneously, tariff adjustments in the United States have catalyzed strategic recalibrations in sourcing and supply chain design, underscoring the importance of geopolitical awareness in procurement decisions.

Segmentation analysis highlights how form, functionality, application, and grade considerations underpin tailored strategies that address diverse end-use requirements. Regional insights reveal unique drivers and challenges, from the mature supply networks in the Americas to environmental regulations in Europe, Middle East, and Africa, and raw material abundance in Asia-Pacific. Competitive dynamics are evolving as established leaders integrate vertically and as emerging players leverage localized advantages to capture market share.

Looking ahead, stakeholders must embrace sustainable practices, invest in specialized product development, and maintain agile sourcing frameworks to navigate shifting trade landscapes. Digitalization and advanced analytics will play pivotal roles in optimizing operations and enhancing quality assurance. By aligning strategic objectives with evolving regulatory and consumer expectations, companies can unlock new avenues for growth and solidify their leadership positions in the global alginate ecosystem.

Engage with Associate Director Ketan Rohom to Secure Comprehensive Alginate Market Insights and Drive Informed Decision Making for Strategic Growth

For decision makers seeking to harness the full spectrum of market intelligence on alginate’s evolving dynamics, a tailored consultation offers unparalleled strategic advantage. Engaging with Associate Director Ketan Rohom provides direct access to the comprehensive research report, proprietary data analyses, and interpretive guidance designed to inform product development, sourcing strategies, and competitive positioning. By collaborating on customized deliverables-including deep dives into functionality segmentation, regional outlooks, and tariff impact scenarios-industry leaders can accelerate their innovation pipelines and mitigate supply chain risks.

This partnership opportunity extends beyond the mere acquisition of static data; it guarantees ongoing expert support to translate complex insights into actionable roadmaps. Whether refining a sustainability narrative for end users or optimizing formulation platforms across key applications, the on-demand expertise of Ketan Rohom ensures that organizations remain ahead of emerging trends and regulatory shifts. Reach out to secure your strategic edge, unlock hidden opportunities within form, application, and grade segments, and chart a confident course for growth and differentiation in the global alginate market.

- How big is the Alginate Market?

- What is the Alginate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?