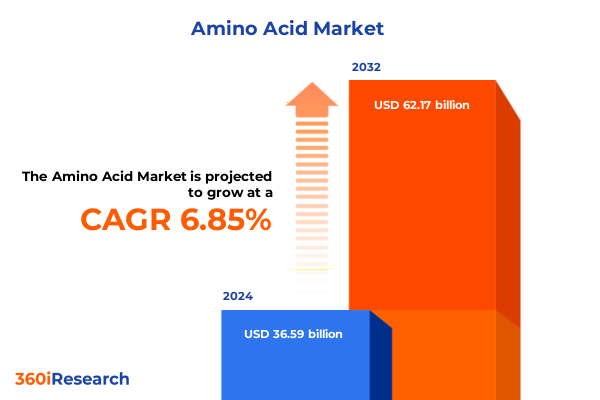

The Amino Acid Market size was estimated at USD 38.95 billion in 2025 and expected to reach USD 41.47 billion in 2026, at a CAGR of 6.90% to reach USD 62.17 billion by 2032.

Setting the Stage for the Dynamic Evolution of the Global Amino Acid Market Amid Shifting Supply Chains and Spiraling Demand Patterns

The global amino acid industry has emerged as an indispensable cornerstone of diverse sectors ranging from animal nutrition and food and beverage formulation to pharmaceuticals and personal care. This dynamic market is driven by accelerating demand for high-quality protein solutions, the surge in consumer health consciousness, and the relentless pursuit of sustainable ingredient sourcing. As population growth and urbanization intensify pressure on food systems, amino acids offer precise nutritional supplementation that enhances feed conversion rates, supports metabolic health, and optimizes functional properties in processed foods.

Against this backdrop, innovations in bioprocessing, fermentation, and synthetic biology are fueling new growth avenues and enabling the development of tailored amino acid profiles. At the same time, regulatory frameworks evolve to address safety, purity, and labeling standards, influencing supply chain configurations and market entry strategies. Moreover, geopolitical tensions and trade policy shifts are reshaping cost structures and sourcing decisions, underlining the criticality of resilient procurement models.

In this environment, stakeholders must navigate a complex interplay of technological advancements, consumer expectations, and external pressures. The subsequent analysis offers a holistic overview of the transformative forces at play, the impacts of recent United States tariff policies, nuanced segmentation facets, regional variances, and actionable recommendations to steer organizations toward sustainable competitive advantage.

Uncovering the Pivotal Technological, Regulatory, and Consumer Behavior Transformations Reshaping the Amino Acid Industry Landscape Today

The amino acid landscape is undergoing transformative shifts propelled by breakthroughs in microbial fermentation, enzyme engineering, and continuous bioprocessing. Cutting-edge synthetic biology platforms are enabling manufacturers to engineer microbial strains with enhanced yield and reduced byproduct formation, thereby driving down production costs and opening new possibilities for specialty amino acid derivatives. Concurrently, the integration of digital monitoring tools and predictive analytics is optimizing upstream processes, reducing cycle times, and bolstering quality control.

In parallel, evolving regulatory environments are compelling producers to adopt greener chemistry principles and transparent sourcing practices. Sustainability criteria now extend beyond carbon footprints to encompass land use, water stewardship, and ethical supply chain management. As a result, an increasing number of companies are forging partnerships with agricultural cooperatives and investing in next-generation feedstocks such as lignocellulosic biomass and waste-derived substrates.

Consumer behavior is likewise catalyzing market change. The growing emphasis on personalized nutrition, plant-based formulations, and clean label declarations is prompting formulators to leverage essential amino acids for flavor enhancement, pH control, and preservation without synthetic additives. This convergence of technological prowess, regulatory modernization, and shifting consumer dynamics underscores a market in flux-one that rewards agility, innovation, and sustainability commitments.

Examining the Far-reaching Consequences of 2025 United States Tariffs on Amino Acid Supply Chains, Pricing Structures, and Import Strategies

In April 2025, a landmark executive order introduced a universal 10 percent tariff on imports from non-exempt countries, while imposing reciprocal duties ranging from 11 to 50 percent on products from 57 nations labeled as engaging in unfair trade practices. When combined with existing Section 301 levies, imports originating from China may be subject to cumulative duties as high as 145 percent, representing the most stringent tariff environment for amino acids since mid-twentieth century trade conflicts.

Despite the sweeping tariff measures, Annex II of the order explicitly shields a defined group of dietary supplement ingredients-including L-lysine, L-glutamine, and other amino acids-from the newly enacted duties. This exemption acknowledges the critical role of these biomolecules in animal feed, human nutrition, and pharmaceutical formulations, thereby ensuring continuity of supply for sectors reliant on precise amino acid functionality.

However, not all amino acids have remained insulated from the tariff wave. Feed-grade threonine, DL-methionine alternatives such as methionine hydroxyl analogs, tryptophan, and valine have encountered elevated cost pressures due to their exclusion from the exemption list. The result has been a reshuffling of procurement strategies, with buyers seeking alternative origins or forward-contract coverage to mitigate volatility.

These policy shifts have translated into real-world pricing effects: importers reported an approximate 5 percent uptick in landed costs for non-exempt amino acids at the start of 2025, driven by both tariff stacking and residual logistical disruptions emanating from earlier supply chain bottlenecks.

Animal nutrition stakeholders, which account for nearly 70 percent of total amino acid demand in the United States, are particularly attuned to these developments. Heightened raw material costs have prompted feed producers to explore yield-optimizing formulations and to negotiate longer-term offtake agreements. Equally, integrators in pharmaceuticals and food-grade segments are reevaluating their supplier portfolios to preserve margin integrity amid an unpredictable trade policy backdrop.

Deconstructing the Multifaceted Segmentation Framework That Illuminates Diverse Pathways of Value Creation Across the Amino Acid Spectrum

Navigating the amino acid market requires an appreciation of its intrinsic segmentation across multiple dimensions, each reflecting distinct value drivers and adoption dynamics. At the foundational level, essential and non-essential amino acids serve differentiated nutritional roles, with the former commanding premium positioning in dietary supplements and therapeutic applications due to their indispensable physiological functions. Advancing up the value chain, blends that combine targeted amino acids, short-chain peptides, and protein hydrolysates unlock tailored functionalities for specific delivery systems and sensory profiles.

Beyond molecule type and derivative format, the provenance of source material-be it animal-based isolates, fermentation-derived specialties, plant extracts, or fully synthetic constructs-shapes cost, purity, and consumer perceptions. Granular, liquid, powder, and tablet presentations further expand the applicability of amino acids, facilitating seamless integration into feed rations, beverage systems, or solid dose forms. Functionality likewise spans flavor enhancement, nutritional fortification, pH modulation, and preservative efficacy.

Applications range from aquaculture feeds and broiler diets to anti-aging serums, hair care formulations, and functional sports nutrition beverages. Within pharmaceuticals, capsule, injectable, and tablet formulations leverage amino acids for active drug delivery and excipient roles. Finally, end-user industries-including agriculture, chemicals, food and beverage, and healthcare-exhibit divergent growth trajectories and regulatory sensitivities, underscoring the imperative for tailored market approaches that align with each sector’s performance metrics and compliance frameworks.

This comprehensive research report categorizes the Amino Acid market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product Derivatives

- Source

- Form

- Function

- Application

- End-User Industry

Navigating the Strategic Regional Dynamics Driving Growth and Competitive Advantage Across Americas, EMEA, and Asia-Pacific Amino Acid Markets

Regional dynamics exert a profound influence on supply, demand, and competitive positioning within the global amino acid industry. In the Americas, entrenched feed and pharmaceutical manufacturing hubs benefit from robust infrastructure, stringent quality norms, and consolidated distribution networks. Investments in greenfield fermentation plants and onshore capacity expansions are aimed at reducing dependency on volatile imports while meeting stringent regulatory thresholds for feed safety and human nutrition.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts and sustainability mandates are reshaping production and sourcing choices. Europe’s evolving chemical registration protocols and EEA-wide environmental directives have accelerated adoption of low-carbon fermentation processes, while emerging markets in the Middle East and North Africa are leveraging amino acid imports to bolster food security and industrial biotechnology initiatives.

In Asia-Pacific, China’s dominance in large-scale fermentation reactors and cost-competitive feed additives continues to exert downward pressure on global pricing. Simultaneously, India’s growing biotech sector is investing in specialty amino acids, and Southeast Asian nations are seeking to attract contract manufacturing partnerships. These regional nuances underscore the need for bespoke market entry strategies and risk mitigation plans that align with local policy landscapes and infrastructure capabilities.

This comprehensive research report examines key regions that drive the evolution of the Amino Acid market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Strategic Maneuvers and Competitive Strengths of Leading Global Players Steering the Amino Acid Market Forward

Leading entities in the amino acid arena are deploying differentiated strategies to secure competitive advantage and capture emerging opportunities. One global frontrunner has expanded its fermentation footprint through strategic joint ventures in Southeast Asia while simultaneously investing in enzyme engineering capabilities to bolster production yields. Another major player has leveraged its integrated feed business to bundle amino acid solutions with broader nutritional portfolios, driving cross-sell synergies and deepening customer relationships.

A diversified agribusiness conglomerate has adopted a dual-sourcing approach, balancing cost advantages of large-scale synthesis with the premium positioning of plant-derived amino acid isolates. Innovation-focused biotech firms are forging alliances with academic and research institutions to pioneer next-generation microbial strains, targeting rare and modified amino acids for pharmaceutical and nutraceutical niches. Meanwhile, established chemical manufacturers are pursuing backward integration from raw materials to finished formulations, enhancing margin capture and ensuring supply continuity.

Across the landscape, environmental, social, and governance metrics are becoming integral to corporate value propositions. Firms at the vanguard are publishing comprehensive life cycle assessments for key amino acid lines, setting emission reduction targets, and sourcing feedstocks from circular economy streams-all in service of resonating with customers who demand verifiable sustainability credentials.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amino Acid market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ajinomoto Co., Inc.

- Amino GmbH

- Archer Daniels Midland Company

- Capot Chemical Co.,Ltd

- Cargill, Incorporated

- CJ CheilJedang Corp.

- Evonik Industries AG

- Fresenius Kabi AG

- Fufeng Group Limited

- Hangzhou Think Chemical Co., Ltd.

- Hangzhou Zhenrui Chemicals Co.,Ltd.

- Iris Biotech GmbH

- Jiangsu Shenhua Pharmaceutical Co., Ltd.

- Kirin Holdings Company, Limited.

- Koninklijke DSM N.V.

- Kyowa Hakko Bio Co., Ltd.

- Luzhou Bio-Chem Technology Limited

- MeiHua Holdings Group Co., Ltd.

- Merck KGaA

- Mitsui & Co., Ltd.

- Nagase & Co., Ltd.

- Phibro Animal Health Corporation

- Sumitomo Chemical Co., Ltd.

- Tocris Bioscience

- Daesang Corporation

Implementing Strategic Roadmaps and Operational Initiatives to Capitalize on Emerging Opportunities and Mitigate Risks in the Amino Acid Sector

To thrive amid evolving market forces, industry leaders must institute robust supply chain diversification strategies, blending regional sourcing hubs with alternative feedstocks to alleviate single-source dependencies. Parallel investments in fermentation optimization and enzyme catalysis can unlock cost efficiencies and enhance product customization capabilities. Entities should also cultivate strategic alliances across the value chain-spanning raw material suppliers, research institutions, and distribution partners-to co-innovate and accelerate time to market for specialty amino acid applications.

Additionally, embedding sustainability and traceability into procurement and production processes will fortify brand differentiation and align with tightening regulatory frameworks. Embracing digital twins and real-time analytics can further streamline operations, enabling proactive risk management and dynamic pricing models that react to tariff fluctuations and logistics disruptions. Finally, a customer-centric go-to-market approach-leveraging solution selling and application expertise-will prove decisive in capturing share in high-value segments such as personalized nutrition, therapeutic formulations, and premium feed additives.

Outlining Rigorous Research Methodology and Analytical Techniques Underpinning the Comprehensive Insights Into the Global Amino Acid Industry

This report’s findings are grounded in a rigorous mixed-method research design encompassing both primary and secondary data collection. Extensive interviews were conducted with C-suite executives, technical directors, and procurement leads across regional operations, capturing qualitative insights on technological trends, regulatory impact, and strategic priorities. Concurrently, an exhaustive review of industry white papers, government policy releases, and trade association reports provided contextual depth and triangulation.

Quantitative analysis was performed using proprietary datasets and third-party subscription databases, allowing for meticulous segmentation by type, derivative, source, form, function, application, and end-user industry. Regional market dynamics were validated through geo-specific trade statistics and localized expert consultations. Benchmarks for pricing trends, capacity expansions, and R&D investment levels were established to ensure robust comparative analysis.

All findings were subjected to multi-level validation, including peer review by independent market analysts and cross-checks against publicly disclosed corporate filings. This structured approach ensures that the insights presented herein are both credible and actionable, providing a solid foundation for strategic decision-making in the amino acid domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amino Acid market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amino Acid Market, by Type

- Amino Acid Market, by Product Derivatives

- Amino Acid Market, by Source

- Amino Acid Market, by Form

- Amino Acid Market, by Function

- Amino Acid Market, by Application

- Amino Acid Market, by End-User Industry

- Amino Acid Market, by Region

- Amino Acid Market, by Group

- Amino Acid Market, by Country

- United States Amino Acid Market

- China Amino Acid Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Synthesizing Core Findings and Strategic Implications That Inform Future Directions and Decision Making Within the Evolving Amino Acid Ecosystem

Through a holistic examination of technological innovations, tariff-induced market shifts, and nuanced segmentation patterns, this analysis has illuminated the critical vectors guiding amino acid market evolution. Regional assessments underscored the strategic importance of localized production and regulatory compliance, while company profiles revealed the diverse strategies employed to capture value across segments.

The synthesis of these insights highlights an industry at the intersection of sustainability imperatives, digital transformation, and dynamic trade environments. Stakeholders equipped with the understanding of these interrelated forces will be positioned to architect resilient supply chains, pioneer differentiated product offerings, and secure enduring competitive advantage.

Unlock Comprehensive Market Intelligence on Amino Acid Trends and Strategies—Connect with Ketan Rohom to Elevate Your Business Outcomes through Our Full Report

To explore the full depth of insights on market dynamics, competitive intelligence, and strategic pathways for amino acid sector leadership, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing, and gain immediate access to the comprehensive research report that will empower your organization to make data-driven decisions and unlock growth potential.

- How big is the Amino Acid Market?

- What is the Amino Acid Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?