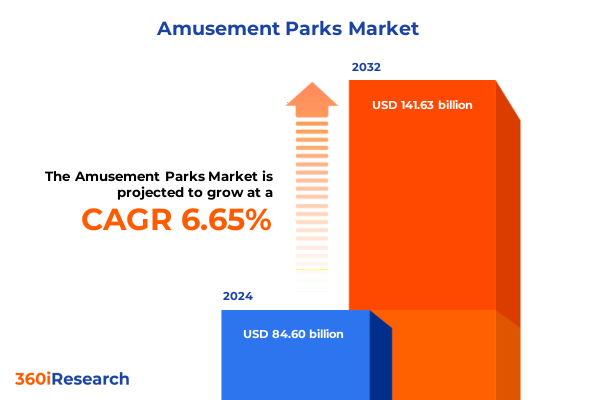

The Amusement Parks Market size was estimated at USD 89.93 billion in 2025 and expected to reach USD 95.74 billion in 2026, at a CAGR of 6.70% to reach USD 141.63 billion by 2032.

Illuminating the Current Amusement Parks Industry at the Intersection of Consumer Demand, Economic Pressure and Technological Advancement

The amusement parks sector has entered a pivotal era defined by accelerating consumer demands and rapidly evolving market forces. In recent years, operators have been navigating the aftermath of global health crises, rising input costs and shifting demographics to reimagine the guest experience. Parks are no longer solely judged by the scale of their roller coasters or the breadth of their attractions; rather, success hinges on seamless integration of technology, immersive storytelling and operational resilience. As families seek richer, more personalized experiences and younger generations prioritize authenticity and sustainability, industry leaders are compelled to adapt to a higher bar of guest expectations.

Simultaneously, macroeconomic pressures, including higher interest rates, inflation and geopolitical tensions, are reshaping capital investment cycles. The interplay between cost pressures and the imperative for innovation underscores the challenge for park operators: how to deliver next-generation experiences while preserving affordability and operational stability. In this context, the landscape of amusement parks is being redrawn, with key players reorienting strategies around targeted expansions, diversified revenue streams and deeper engagement with local and regional markets. By understanding these converging trends, stakeholders can position themselves to lead in an industry that balances the magic of nostalgia with the rigor of modern business imperatives.

Exploring the Technological, Sustainability and Revenue Model Revolutions Reshaping Modern Amusement Parks Experiences

The amusement parks landscape is experiencing transformative shifts that extend far beyond the addition of new rides. Immersive technologies are now central to drawing crowds and differentiating brands, with artificial intelligence and augmented reality enabling hyper-personalized itineraries and dynamic queue management. Industry giants are forging partnerships with leading tech firms to develop next-generation experiences that blur the boundaries between digital and physical realms. At the same time, sustainability has moved from a buzzword to a core operational mandate, as parks deploy energy-efficient infrastructure, waste reduction programs and green building practices to meet both regulatory requirements and guest expectations.

Concurrently, the adoption of advanced analytics and generative AI is reshaping revenue optimization models. Operators are leveraging real-time data to implement dynamic pricing strategies that adjust to demand, weather and achieving targeted attendance thresholds. These strategies allow for more flexible ticketing options, including tiered access passes, subscription-style season memberships and micro-experiences tailored to high-value segments. Furthermore, supply chain resilience has become critical as fluctuating tariffs and global disruptions highlight the need for diversified sourcing, strategic stockpiling and localized production of ride components, merchandise and consumables. Taken together, these developments signify a fundamental reimagining of how parks engage guests, allocate capital and future-proof their operations

Analyzing How Recent Multitiered U.S. Tariffs on Steel, Aluminum and Imports Are Elevating Costs and Disrupting Park Operations

In 2025, the United States has imposed a broad spectrum of tariffs that are creating headwinds for amusement park operators and suppliers alike. Steel and aluminum inputs, critical for the construction and maintenance of rides, now attract up to 50% duties, while a 30% levy on Chinese goods and a 10% universal reciprocal tariff on imports have driven up costs across the board. These measures, intended to support domestic manufacturing, have led to a “whipsaw effect” as operators rush to secure components ahead of tariff hikes and pause orders when exemptions are granted or modified.

For smaller and regional parks, the tariff environment has disrupted delivery schedules and inflated the cost of game prizes, ride parts and concession equipment. Some operators have absorbed these costs to protect affordability, while others have been forced to delay or curtail planned capital projects. Leading equipment manufacturers report that up to a quarter of profit margins on imported roller coaster components and water park attractions have eroded due to steel and aluminum duties. In turn, these added expenses have reverberated through supply chains, compelling parks to explore second-tier suppliers in Vietnam, India and Mexico and to evaluate localized assembly operations to mitigate further exposure to U.S. tariffs.

On the consumer side, inflationary pressures linked to tariff-induced cost increases have contributed to a notable rise in average ticket prices and in-park spending, fueling broader concerns about affordability. The Consumer Price Index rose by 2.7% in June 2025 year-over-year, with toys up 1.4% and nonalcoholic beverages up 4.4%, reflecting the tariffs’ pass-through impacts on related sectors. As economic headwinds persist, parks must balance the need to offset higher input costs with the imperative to maintain accessible price points for families and drive visitation amid tightening household budgets.

Uncovering Comprehensive Segmentation Dynamics Spanning Park Types, Revenue Streams, Ticket Systems, Demographics and Distribution Channels

Across the amusement parks ecosystem, nuanced segmentation reveals critical strategic levers that operators are leveraging to tailor offerings and drive profitability. In understanding guest preferences by park type, leading companies differentiate their chain amusement parks from independent operators, while theme parks invest heavily in branded intellectual property such as Disney and Universal lands. Water parks strike a balance between chain-led experiences and boutique, independent facilities, and wildlife parks segment into biodiverse reserves, safari attractions and zoological sanctuaries that target conservation-minded visitors.

Revenue streams are equally diversified, with food and beverage outlets ranging from full-service restaurants to quick-serve snack kiosks, while merchandise categories span branded apparel to collectible souvenirs and toys. Sponsorship and advertising, whether digital activations on mobile apps or on-site banner placements, have emerged as significant revenue drivers alongside traditional ticketing, which now includes tiered admission options from single-day passes to expedited fast-track access. Ticket types themselves span single-day, group and express offerings, while season passes underpin loyalty programs that seek to boost repeat visitation and ancillary spend.

Facility considerations-indoor versus outdoor-shape investment priorities around climate control, lighting and guest comfort, while demographic segmentation by age underscores the need for differentiated attractions that appeal to adults, children, seniors and teenagers. Finally, booking channels from online platforms, mobile apps and third-party aggregators to offline channels such as on-site box offices and travel agents highlight the importance of omnichannel distribution in capturing demand. Together, these interlocking segmentation dimensions empower industry participants to craft tailored value propositions that meet evolving guest expectations while optimizing operational efficiency and revenue capture

This comprehensive research report categorizes the Amusement Parks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Park Type

- Revenue Stream

- Visitor Type

- Facility Type

- Age Group

- Booking Channel

Examining Regional Growth Drivers and Market Variations Across the Americas, EMEA and Asia-Pacific Attraction Segments

Regional dynamics continue to shape the strategic priorities and growth trajectories of amusement park operators around the globe. In the Americas, parks are capitalizing on strong domestic tourism and the pent-up demand for travel, as the U.S. Travel Association forecasts nearly two billion national trips in 2025. While major destination resorts in Florida and California focus on post-pandemic expansion and premium offerings, regional and independent parks are finding traction by emphasizing local culture, value pricing and community partnerships.

Europe, the Middle East and Africa (EMEA) present a mosaic of mature and emerging markets, where ongoing investment in integrated resort models has elevated guest expectations. The recent addition of Warner Bros. World Abu Dhabi underscores the Middle East’s ambition to become a major attractions hub, while longstanding parks in Western Europe continue to drive attendance through historic brand equity, seasonal events and a strong focus on sustainability. Further, parks in Eastern Europe are benefiting from targeted infrastructure improvements and regional tourism growth.

Asia-Pacific has seen the most dramatic rebound, with parks in China experiencing year-over-year gains of up to 78% as operating restrictions lifted. Beyond China, markets like Japan, South Korea and emerging Southeast Asian destinations are investing in new IP-driven attractions, with regional operators partnering with global brands to deliver hybrid entertainment complexes. While headwinds such as exchange rate volatility and regulatory considerations remain, the Asia-Pacific region is expected to sustain above-average growth as cross-border travel resumes and middle-class spending power strengthens.

This comprehensive research report examines key regions that drive the evolution of the Amusement Parks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting How Disney, Universal, Six Flags and New Market Entrants Are Shaping Competitive Dynamics Through Investment, Innovation and Alliances

Leading companies in the amusement parks industry continue to push the envelope in terms of scale, innovation and operational excellence. The Walt Disney Company, with its multi-billion dollar investments in global expansions including a new park in Abu Dhabi and enhancements at existing resorts, is doubling down on IP-driven experiences and high-per-capita revenue initiatives. Universal Parks & Resorts, under Comcast, is poised to open Epic Universe in Orlando-a landmark project designed to diversify its guest profile and extend average length of stay through immersive lands and premium accommodations.

Regional operators are adopting differentiated strategies. Six Flags, now the largest regional chain following its merger with Cedar Fair, has unveiled a bold $1 billion capital investment plan for 2025 featuring record-shattering coasters, enhanced seasonal events and an expanded all-park membership offering that bolsters loyalty and recurring revenue. SeaWorld Entertainment focuses on attraction innovation and marine conservation storytelling, while Cedar Fair aligns its park portfolio through selective asset divestitures and targeted reinvestment in high-growth markets.

Additionally, emerging global players such as Chimelong Group in China are redefining scale outside of the traditional Disney-Universal duopoly, drawing over 12 million annual visitors to their flagship Ocean Kingdom and pursuing integrated resort models with hotels, water parks and cultural attractions. Across the sector, technology partnerships, M&A activity and franchise collaborations are shaping a competitive landscape where scale, differentiation and guest loyalty are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Amusement Parks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ASPRO PARKS, S.L.

- Coast Entertainment Holdings Limited

- Comcast Corporation

- Compagnie des Alpes

- Dubai Holding Corporate LLC

- Europa-Park GmbH & Co Mack KG

- Fantawild Holdings Inc.

- Fuji Kyuko Co., Ltd.

- Haichang Ocean Park Holdings Ltd.

- Herschend Family Entertainment Corporation

- Hershey Entertainment & Resorts Company

- Imagicaaworld Entertainment Limited

- Knoebels Amusement Resort

- Lotte Corporation

- Merlin Entertainments Limited

- Oriental Land Co.,Ltd.

- Parques Reunidos Servicios Centrales, S.A.

- PORT AVENTURA ENTERTAINMENT, S.A.U.

- Six Flags Entertainment Corporation

- The Hettema Group

- The Walt Disney Company

- Toverland B.V.

- United Parks & Resorts Inc.

- Village Roadshow Limited

- Wonderla Holidays Ltd.

Driving Future Growth Through Technology Adoption, Supply Chain Resilience, Segmented Offerings and Sustainability Leadership

Industry leaders should intensify investment in advanced technologies such as artificial intelligence, machine learning and immersive reality to drive guest personalization and operational efficiency. By adopting AI-driven crowd analytics and dynamic pricing, parks can optimize throughput and maximize revenue per guest while minimizing perceived wait times. Partnerships with technology vendors and in-house innovation labs will accelerate the development of bespoke digital features that differentiate the guest journey.

To mitigate input-cost volatility and tariff risks, operators should develop diversified supply chains that blend strategic inventory management, local assembly capabilities and alternative manufacturing hubs. Long-term agreements with key suppliers, co-investment in domestic production facilities and collaborative procurement consortia can secure critical ride components and merchandise at stable costs.

Leveraging segmentation insights, parks should refine their product mix and marketing strategies to align offerings with specific guest cohorts, from high-value season pass holders seeking VIP experiences to family-oriented visitors prioritizing affordability and repeat visits. Omnichannel distribution strategies, including third-party integrations, direct-to-consumer platforms and on-site sales, must be optimized to capture evolving booking preferences.

Finally, sustainability should serve as both an operational imperative and a brand differentiator. By investing in renewable energy, waste-minimization programs and green building certifications, parks can meet regulatory standards, appeal to eco-conscious guests and potentially unlock incentives through public-private partnerships. Embedding environmental, social and governance (ESG) criteria into capital planning will strengthen corporate resilience and long-term stakeholder value.

Detailing the Comprehensive Research Approach That Blends Market Data, Executive Interviews and Visitor Surveys for Robust Insights

This research integrates a robust combination of secondary and primary methodologies to capture a holistic view of the amusement parks industry. Secondary research comprised an extensive review of industry publications, annual TEA/AECOM attendance reports, company financial statements and reputable news sources covering park investments, tariff developments and consumer trends. The analysis also leveraged trade association insights from IAAPA and technology consultancies.

Primary research involved structured interviews with park executives, equipment manufacturers and regional tourism boards to validate secondary findings and glean forward-looking perspectives. In addition, survey data from on-site visitors provided nuanced understanding of spending behavior, segment preferences and satisfaction drivers. Data triangulation ensured the reliability of key themes and helped identify emerging inflection points across different regions and business models.

Quantitative data was analyzed using descriptive statistics and trend-forecast modeling, while qualitative insights were coded thematically to surface strategic imperatives. Rigorous data validation was conducted through cross-referencing multiple sources and expert peer review. This combined methodology underpins the actionable recommendations and market insights presented in this comprehensive report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Amusement Parks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Amusement Parks Market, by Park Type

- Amusement Parks Market, by Revenue Stream

- Amusement Parks Market, by Visitor Type

- Amusement Parks Market, by Facility Type

- Amusement Parks Market, by Age Group

- Amusement Parks Market, by Booking Channel

- Amusement Parks Market, by Region

- Amusement Parks Market, by Group

- Amusement Parks Market, by Country

- United States Amusement Parks Market

- China Amusement Parks Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Synthesizing Key Findings and Strategic Imperatives to Navigate the Evolving Amusement Parks Landscape in a Dynamic Economic and Technological Environment

The amusement parks industry stands at an inflection point where technological innovation, consumer expectations and macroeconomic forces converge to redefine success. Parks that embrace digital transformation, invest in immersive experiences and proactively address cost pressures will be best positioned to capture both traditional leisure visitors and new high-value segments. Regional diversification and agility in adapting to regulatory and tariff changes will be essential as operators optimize capital allocation across mature and emerging markets.

At the same time, a robust focus on sustainability and ESG credentials will not only meet growing stakeholder demands but also deliver tangible operational efficiencies and brand value. Strategic segmentation and omnichannel distribution will continue to shape how parks design their offerings and engage guests across the visit lifecycle. By integrating these strategic levers into long-term planning, industry leaders can navigate the evolving landscape and unlock sustained growth.

Ultimately, the parks that succeed will combine the enchantment of compelling storytelling with the rigor of data-driven decision making. Those that can seamlessly orchestrate guest journeys, maintain financial discipline and anticipate market shifts will define the next frontier of amusement parks success in this dynamic era.

Harness the Full Potential of Industry Insights by Connecting with Ketan Rohom to Acquire the Comprehensive Amusement Parks Market Research Report

Interested in deepening your understanding of the evolving amusement parks landscape and securing a competitive advantage? Reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to explore how this comprehensive market research report can inform your strategic decisions. Ketan brings a wealth of expertise in amusement parks market dynamics and can guide you through the report’s actionable insights. Contact Ketan to schedule a personalized walkthrough, learn about flexible licensing options, and discover how your organization can capitalize on the latest industry trends and shift from analysis to action effectively

- How big is the Amusement Parks Market?

- What is the Amusement Parks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?