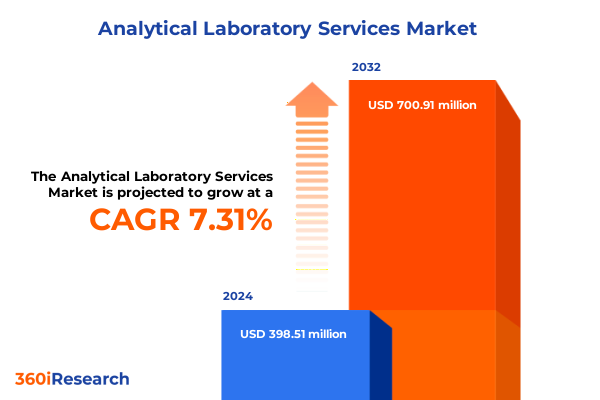

The Analytical Laboratory Services Market size was estimated at USD 422.36 million in 2025 and expected to reach USD 449.47 million in 2026, at a CAGR of 7.50% to reach USD 700.91 million by 2032.

Charting the Trajectory of the Analytical Laboratory Services Sector Through Cutting-Edge Techniques and Emerging Market Dynamics

The analytical laboratory services sector is experiencing a profound transformation as laboratories around the globe adopt innovative methodologies and integrate advanced technologies. Heightened demand for precise, high-throughput analysis has driven investments in next-generation instruments and automation solutions. Concurrently, regulatory scrutiny and quality standards are becoming more stringent, prompting service providers to enhance their compliance frameworks and data management practices. Against this backdrop, laboratories are compelled to refine their operational models, balancing efficiency with the uncompromising accuracy that clients expect.

Moreover, strategic collaborations between instrument manufacturers, software developers, and service providers are redefining the value chain. These partnerships facilitate the development of end-to-end solutions that streamline sample processing, data acquisition, and reporting workflows. As a result, the sector is shifting from a transactional, ad hoc service model toward a collaborative, value-added ecosystem. Clients now seek holistic analytical solutions that address complex challenges, from molecular characterization to environmental monitoring, in a single, integrated engagement. This evolution underscores the importance of agility, innovation, and a client-centric approach as fundamental drivers of competitive advantage in the laboratory services industry.

Illuminating Transformative Shifts That Are Redefining Analytical Capabilities and Operational Paradigms in Modern Laboratory Environments

Recent years have witnessed seismic shifts across the analytical laboratory services landscape, driven by technological breakthroughs and evolving customer expectations. High-resolution mass spectrometry and advanced spectroscopy platforms now enable detection limits that were previously unattainable, opening new avenues for research and quality assurance. These enhancements not only boost sensitivity and throughput but also catalyze the development of novel analytical applications in areas such as metabolomics, nanomaterials analysis, and forensic science.

Simultaneously, digital transformation has permeated every facet of laboratory operations. Cloud-based data management systems, coupled with machine learning algorithms, are facilitating real-time analytics and predictive maintenance. As a result, laboratories can preempt instrument failures, optimize scheduling, and ensure data integrity across geographically dispersed sites. Additionally, the convergence of automated sample handling with robotics is streamlining workflows, reducing manual intervention, and mitigating human error. Together, these advances are reshaping the value proposition of laboratory services, shifting the focus from basic data generation to actionable insights that drive research, compliance, and innovation.

Evaluating the Cumulative Impact of 2025 United States Tariff Measures on Supply Chains, Cost Structures, and Analytical Service Delivery Models

In 2025, the United States implemented a series of tariff measures targeting critical laboratory supplies, reagents, and instrumentation components imported from several key trading partners. These tariff adjustments have reverberated across supply chains, leading to extended lead times and increased procurement costs. Laboratories reliant on specialized chromatography columns, high-purity solvents, and mass spectrometry accessories have faced inventory shortages and disrupted project timelines, compelling many to explore alternative sourcing strategies.

The cumulative effect of these tariffs has also driven a reappraisal of operational budgets, as cost pressures intensify. Service providers are reassessing pricing models, negotiating new vendor agreements, and prioritizing investments that promise rapid return on investment. At the same time, there is a growing inclination toward localized manufacturing and regional distribution hubs to mitigate exposure to import duties and logistical bottlenecks. This strategic realignment is fostering resilience in the face of regulatory shifts, while also encouraging innovation in supply chain design and procurement practices.

Unveiling Key Segmentation Insights Across Techniques, Samples, Services, and End-User Domains Driving Analytical Laboratory Evolution

A nuanced understanding of market segmentation reveals the multifaceted nature of analytical laboratory services. When dissected by technique, the market spans chromatography, which excels in separating complex mixtures; mass spectrometry, prized for its molecular specificity; microscopy, essential for morphological assessments; and spectroscopy, relied upon for rapid compositional analysis. Each technique offers distinct advantages, from the unparalleled sensitivity of mass spectrometry to the high-resolution imaging capabilities of advanced microscopy platforms.

Considering the diversity of sample types further enriches these insights. Analytical workflows are tailored to the physical state of the sample-gas phase analysis demands specialized inlet systems and detectors, liquid samples require careful preparation to prevent matrix effects, while solid samples often necessitate digestion or extraction steps to liberate analytes. Service providers design protocols that optimize recovery and ensure reproducibility across these varying matrices.

Examining service types provides additional clarity. Biological analysis encompasses immunoassays for protein detection, microbiological testing to ensure sterility, and molecular biology assays for genomic profiling. Chemical analysis offers expertise in heritage techniques such as chromatography and elemental analysis alongside modern mass spectrometry and spectroscopic applications. Environmental testing covers air, soil, and water quality assessments with dedicated methodologies. Material testing evaluates the mechanical and thermal properties of substrates through hardness, mechanical, and thermal analysis. Physical testing delves into particle size distribution, rheology, and surface profiling to characterize material behavior.

Finally, end-user industries illustrate the breadth of demand. The automotive sector relies on material and chemical testing to validate component durability; environmental agencies commission air and water testing to uphold public health standards; the food and beverage industry depends on microbiological and chemical assays to maintain safety; petrochemical firms utilize spectroscopy and elemental analysis for quality control; and pharmaceutical companies require rigorous biological and chemical testing to support drug development and regulatory compliance.

This comprehensive research report categorizes the Analytical Laboratory Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technique

- Sample Type

- Service Type

- End-User Industry

Exploring Critical Regional Insights to Understand How the Americas, EMEA, and Asia-Pacific Markets Are Shaping Laboratory Service Strategies

Regional dynamics exert a profound influence on the strategic direction of the analytical laboratory services market. In the Americas, mature regulatory ecosystems and robust pharmaceutical and petrochemical sectors underpin strong demand for advanced analytical capabilities. Laboratories in North America, in particular, are at the forefront of technique validation and automation, driven by stringent compliance mandates and a focus on innovation.

Turning to Europe, the Middle East, and Africa, disparate market conditions present both challenges and opportunities. Western Europe features highly consolidated service networks and rigorous environmental regulations, prompting laboratories to continuously elevate their technical proficiencies. Meanwhile, emerging markets in the Middle East and Africa are characterized by rapid infrastructure development and increasing investments in environmental monitoring, creating fertile ground for service expansion and localized partnerships.

In the Asia-Pacific region, burgeoning pharmaceutical manufacturing hubs and growing research institutions fuel demand for comprehensive analytical support. Countries such as China, Japan, and Australia are investing heavily in next-generation sequencing, high-resolution mass spectrometry, and spectroscopy platforms. Additionally, regional trade agreements and evolving import regulations shape supply chain strategies, encouraging service providers to establish in-country facilities to ensure uninterrupted access to critical testing services.

This comprehensive research report examines key regions that drive the evolution of the Analytical Laboratory Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements and Competitive Dynamics Among Leading Analytical Laboratory Service Providers in 2025

Leading players in the analytical laboratory services realm are employing an array of strategic maneuvers to distinguish their offerings. Alliances with instrument manufacturers and software innovators are enabling comprehensive, turnkey solutions that address end-to-end client needs. Furthermore, a focus on expanding service portfolios through targeted acquisitions is helping some organizations consolidate niche capabilities, particularly in high-growth areas such as metabolomics and nanomaterials analysis.

Investment in digital infrastructure remains a top priority. Companies are deploying advanced laboratory information management systems that integrate with artificial intelligence engines, facilitating rapid data interpretation and predictive analytics. This digital emphasis enhances throughput, bolsters data integrity, and supports compliance reporting. At the same time, specialized centers of excellence are emerging, dedicated to cutting-edge applications and bespoke method development, which serve as hubs for high-value scientific collaboration.

Sustainability initiatives are also gaining traction among market leaders. In response to client demand for environmentally responsible practices, providers are optimizing solvent recycling programs, transitioning to energy-efficient instrumentation, and pursuing certifications that attest to their ecological stewardship. These initiatives not only reduce operational costs but also reinforce brand reputations in increasingly conscientious markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Analytical Laboratory Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ALS Limited

- Bureau Veritas S.A.

- Charles River Laboratories International, Inc.

- Eurofins Scientific SE

- Intertek Group plc

- Laboratory Corporation of America Holdings

- Mérieux NutriSciences

- SGS S.A.

- TÜV Rheinland AG

- TÜV SÜD AG

Actionable Recommendations for Industry Leaders to Navigate Disruption, Optimize Service Portfolios, and Accelerate Growth in Laboratory Services

To navigate the complex landscape of analytical laboratory services in 2025, industry leaders must adopt a multifaceted strategic approach. First, cultivating flexible supply chains through diversified vendor partnerships and localized distribution centers will mitigate exposure to tariff volatility and logistical disruptions. By proactively securing alternative sources for critical consumables and instrumentation components, organizations can sustain service continuity.

Second, investing in digital transformation is essential. Implementing cloud-native data platforms that integrate machine learning for predictive analytics can unlock operational efficiencies and enhance decision-making. Moreover, establishing collaborative digital ecosystems with clients and instrument partners will foster innovation and accelerate method development cycles.

Third, focusing on differentiated service offerings will drive competitive advantage. This involves building centers of excellence for high-value applications such as molecular diagnostics and advanced materials characterization, as well as developing integrated service packages that combine analytical methods to solve complex challenges. Concurrently, embedding sustainability metrics into service portfolios will resonate with clients prioritizing environmental responsibility.

Finally, strengthening talent acquisition and retention strategies is paramount. As demand for specialized expertise intensifies, organizations should cultivate in-house training programs, forge academic partnerships, and offer clear career pathways to attract top scientific talent. This investment in human capital will underpin long-term growth and innovation.

Detailing Rigorous Research Methodology Incorporating Primary and Secondary Sources to Validate Insights and Ensure Analytical Precision

A rigorous research methodology underpins the insights presented in this report, combining both primary and secondary research to ensure comprehensive coverage. Primary research involved in-depth interviews with senior executives, technical directors, and key opinion leaders across leading laboratories and end-user industries. These discussions provided qualitative perspectives on market dynamics, technology adoption, and regulatory challenges.

Secondary research encompassed an extensive review of technical journals, regulatory publications, and white papers, as well as analysis of patent filings and published method development protocols. This multi-source approach facilitated triangulation of data, ensuring the robustness and reliability of the findings. Data validation processes included cross-referencing proprietary performance metrics from instrument vendors with client feedback and industry benchmarks.

In addition, regional market assessments were informed by trade data and import/export analyses to capture the impact of tariffs and regulatory shifts. Segmentation insights were derived through comparative analysis of service portfolios and client use cases, calibrated against regional demand drivers. The iterative research cycle, incorporating stakeholder feedback at multiple stages, further refined the strategic recommendations and ensured alignment with current and emerging market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Analytical Laboratory Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Analytical Laboratory Services Market, by Technique

- Analytical Laboratory Services Market, by Sample Type

- Analytical Laboratory Services Market, by Service Type

- Analytical Laboratory Services Market, by End-User Industry

- Analytical Laboratory Services Market, by Region

- Analytical Laboratory Services Market, by Group

- Analytical Laboratory Services Market, by Country

- United States Analytical Laboratory Services Market

- China Analytical Laboratory Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesis of Critical Findings and Strategic Reflections to Guide Stakeholders Through the Complex Analytical Laboratory Services Landscape

The analytical laboratory services landscape is at a pivotal juncture, shaped by technological advancement, regulatory evolution, and shifting economic conditions. The convergence of high-resolution instrumentation, digital transformation, and strategic supply chain realignment has redefined the criteria for competitive success. Organizations that embrace a holistic view-integrating advanced methods, robust digital platforms, and agile procurement practices-will be best positioned to capture emerging opportunities and mitigate risks.

Moreover, the growing emphasis on sustainability and collaborative partnerships underscores the importance of aligning service offerings with broader industry and societal objectives. By fostering ecosystems that bring together clients, instrument manufacturers, and software innovators, service providers can co-create solutions that address complex analytical challenges more efficiently.

Ultimately, the ability to anticipate market shifts, adapt business models, and maintain a relentless focus on quality and innovation will distinguish industry leaders from followers. As the market continues to evolve, the strategic imperatives outlined in this report will serve as guiding principles for stakeholders seeking to navigate uncertainty and achieve long-term growth and resilience.

Engage with Ketan Rohom Today to Secure Your Comprehensive Market Research Report and Gain a Competitive Edge in Analytical Laboratory Services

To gain unparalleled visibility into the drivers shaping the analytical laboratory services market and position your organization for sustained success, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engaging with him offers a streamlined path to acquiring the latest market research report, tailored to deliver actionable insights and strategic guidance. By contacting Ketan, decision-makers unlock personalized support, ensuring the data aligns precisely with organizational objectives and future growth initiatives. His expertise in distilling complex data into clear strategies will empower your team to mitigate risks, capture emerging opportunities, and refine service offerings with confidence.

Act now to secure the comprehensive analysis that industry leaders rely on for decision-making. This report encapsulates critical findings on evolving market trends, regulatory impacts, and technological advancements, equipping stakeholders to navigate uncertainty with clarity. Collaborating with Ketan Rohom guarantees priority access to updated intelligence, ongoing advisory support, and customized consultancy to translate research findings into impactful action. Reach out today to purchase the report and embark on a data-driven journey toward competitive differentiation and market leadership.

- How big is the Analytical Laboratory Services Market?

- What is the Analytical Laboratory Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?