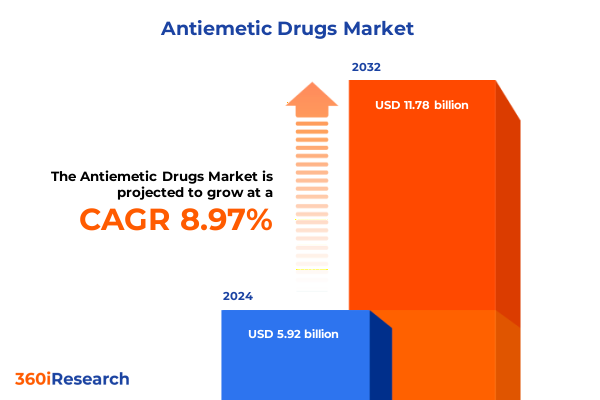

The Antiemetic Drugs Market size was estimated at USD 6.44 billion in 2025 and expected to reach USD 7.01 billion in 2026, at a CAGR of 9.00% to reach USD 11.78 billion by 2032.

Discover the Critical Role of Antiemetic Medications in Alleviating Nausea and Vomiting Across Diverse Clinical Scenarios and Patient Populations

The management of nausea and vomiting has emerged as a cornerstone of patient care across a spectrum of medical disciplines, driving the evolution of antiemetic drug therapies. Historically, the development of these agents focused on symptomatic relief, but ongoing advances have repositioned them as critical adjuncts in oncology, surgical recovery, and radiation treatment pathways. As clinicians increasingly emphasize holistic patient experiences, effective antiemetic regimens not only reduce morbidity associated with emesis but also enhance adherence to primary therapies and shorten hospital stays. Consequently, drug developers and healthcare institutions are prioritizing compounds that offer robust efficacy profiles, favorable safety margins, and convenient administration routes.

In recent years, the antiemetic drug landscape has been shaped by shifting regulatory standards and a growing emphasis on patient-centric outcomes. Regulatory bodies now closely evaluate clinical trial designs, demanding comprehensive evidence of both acute and delayed nausea control, as well as real-world performance metrics. This regulatory rigor, combined with mounting pressure to contain costs, has fostered a competitive environment in which novel entrants must demonstrate clear differentiators to secure formulary positioning. Simultaneously, healthcare providers are integrating digital health tools and patient-reported outcome measures to fine-tune antiemetic protocols and monitor treatment effectiveness in outpatient and home care settings.

Transitioning from traditional blockbuster models, pharmaceutical innovators are exploring combination therapies and new molecular entities aimed at unmet needs in high-risk populations. As these strategies gain traction, stakeholders must stay attuned to emerging safety data, evolving reimbursement frameworks, and the potential for value-based contracting. Ultimately, the introduction of next-generation antiemetic solutions will hinge on multidisciplinary collaboration and the alignment of clinical objectives with commercial imperatives.

Exploring Pivotal Technological and Therapeutic Advances Reshaping the Antiemetic Drug Sphere Through Innovation and Clinical Breakthroughs

The antiemetic drug sector is undergoing a profound transformation driven by breakthroughs in pharmacology and infusion of digital technologies into treatment protocols. The integration of precision medicine approaches has enabled researchers to identify genetic and molecular markers predictive of individual patient responses, fostering the development of targeted therapies with enhanced efficacy and minimized adverse effects. Alongside these advances, the incorporation of smart infusion pumps and real-time symptom tracking platforms is revolutionizing how clinicians administer and adjust antiemetic regimens, ensuring timely intervention and personalized dose optimization.

Emerging drug delivery systems, such as sustained-release formulations and subcutaneous depot injections, are reshaping convenience and adherence paradigms in outpatient settings. In parallel, artificial intelligence–based algorithms are being piloted to predict emesis risk profiles, allowing care teams to preemptively tailor prophylactic treatments. These technological and therapeutic advances are complemented by strategic collaborations between pharmaceutical firms and biotech innovators, which accelerate the translation of novel compounds from bench to bedside. As a result, the industry is witnessing an unprecedented pace of product launches and combination therapies, challenging traditional market leaders to adapt swiftly or risk ceding ground to agile newcomers.

With these shifts, stakeholders are compelled to reimagine research priorities, commercial strategies, and patient engagement models. Forward-thinking organizations are investing in cross-sector partnerships that integrate genomics, machine learning, and advanced clinical trial designs. Ultimately, by embracing this wave of innovation, the antiemetic drug landscape is poised to deliver treatments that not only prevent nausea and vomiting but also contribute to improved quality of life and long-term therapeutic success.

Assessing the Far-Reaching Implications of 2025 United States Trade Tariffs on Antiemetic Drug Supply Chains Costs and Market Dynamics

Beginning in early 2025, the United States implemented a series of revised trade tariffs targeting imported active pharmaceutical ingredients and finished dosage forms, profoundly affecting the cost structure of antiemetic drugs. These measures were introduced amid broader geopolitical tensions, as part of a strategy to bolster domestic manufacturing resilience. Pharmaceutical companies faced increased duties on key excipients and proprietary molecules sourced from global supply hubs, leading to unanticipated cost escalations along the value chain. Consequently, manufacturers initiated comprehensive reviews of procurement strategies, contract terms, and supplier diversification to mitigate exposure to tariff-driven price volatility.

As the ripple effects of these tariffs permeated through commercial operations, stakeholders encountered challenges in maintaining price competitiveness, particularly in hospital pharmacies and retail channels. Some companies accelerated investments in near-shoring initiatives, relocating critical production steps to domestic facilities or to countries exempted from heightened duties. Others explored process intensification and green chemistry approaches to reduce dependence on expensive imported inputs. Over time, these efforts not only offset portions of the tariff burden but also primed organizations for enhanced supply chain agility.

Moving forward, the industry must reconcile the tension between securing cost-effective raw material sourcing and upholding stringent quality standards. Collaborative frameworks between regulators, manufacturers, and logistics providers are vital to streamline customs procedures and prevent disruptions. Moreover, proactive scenario planning and real-time data analytics can equip decision makers to anticipate tariff adjustments and recalibrate pricing models rapidly. In this evolving environment, resilience will depend on the ability to incorporate both strategic foresight and operational flexibility into core business processes.

Uncovering Actionable Segmentation Insights Across Indications Drug Classes Administration Routes End Users and Distribution Channels in the Antiemetic Market

An in-depth analysis of segmentation in the antiemetic drug market reveals nuanced opportunities and challenges across indication, drug class, route of administration, end user, and distribution channel dimensions. When considering indications, therapeutic focus spans chemotherapy-induced nausea and vomiting, post-operative nausea and vomiting, and radiation-induced nausea and vomiting, each presenting distinct clinical pathways and patient risk profiles. In the chemotherapy domain, the timing and severity of emesis necessitate multifaceted prophylactic regimens, whereas the acute but transient nature of post-operative nausea demands agents with rapid onset and minimal sedation. Radiation-associated emesis, often correlated with specific anatomical irradiation sites, calls for sustained antiemetic coverage in both inpatient and outpatient contexts.

Exploring drug classes uncovers heterogeneity in mechanism of action, ranging from corticosteroids that modulate inflammatory mediators to dopamine antagonists that block central emetic pathways, as well as neurokinin 1 receptor antagonists and serotonin 5-HT3 receptor antagonists that target critical neurochemical receptors involved in nausea signaling. Each class offers unique efficacy and safety trade-offs, prompting combination approaches to optimize prophylaxis. Moreover, route of administration considerations-spanning intravenous infusions for rapid control in acute settings and oral formulations for convenient outpatient management-shape prescribing patterns and patient adherence dynamics.

Turning to end users, clinics, home care settings, and hospitals exhibit varying procurement practices and budgetary constraints, influencing formulary decisions and therapeutic protocols. In clinics, streamlined inventory systems and cost pressures drive demand for multiuse vials and unit-dose packaging, while home care environments prioritize ease of administration and patient education. Hospitals, balancing high-volume use with diverse patient acuity, often implement formulary committees to evaluate clinical outcomes and total cost of ownership. Finally, distribution channels, including hospital pharmacy, online pharmacy, and retail pharmacy, each entail distinct regulatory frameworks, customer engagement models, and logistical considerations. Understanding these layered segmentation insights is essential for stakeholders seeking targeted strategies and enduring market success.

This comprehensive research report categorizes the Antiemetic Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Indication

- Drug Class

- Route Of Administration

- End User

- Distribution Channel

Analyzing Regional Variations Impacting Antiemetic Drug Adoption Access and Innovation Trends Across the Americas Europe Middle East Africa and Asia Pacific

Regional dynamics continue to play a decisive role in shaping access to and adoption of antiemetic therapies across global healthcare systems. In the Americas, robust oncology and surgical care infrastructures have catalyzed widespread uptake of advanced combination regimens, supported by favorable reimbursement policies and integrated cancer care pathways. Nonetheless, disparities persist between high-income nations with established healthcare networks and underserved regions where logistical challenges constrain distribution and patient monitoring.

Turning to Europe, Middle East & Africa, variation in national regulatory requirements and pricing negotiations underscores the need for tailored market entry strategies. While major European markets benefit from centralized tendering processes and comprehensive reimbursement frameworks, Middle Eastern countries often leverage public-private partnerships to enhance oncology services. In several African markets, limited cold-chain logistics and fragmented procurement systems necessitate innovative supply models and targeted capacity-building initiatives to ensure reliable drug availability.

In the Asia-Pacific region, rapid growth in cancer incidence and elective surgeries has stimulated demand for antiemetic agents, particularly in emerging markets experiencing healthcare infrastructure expansion. Governmental investments in hospital upgrades and pharmacy modernization have opened avenues for higher-value formulations, yet variable insurer coverage and price sensitivity continue to influence prescribing behaviors. Moreover, cultural considerations around patient care and expectations inform adoption patterns, highlighting the importance of localized education campaigns and clinician training programs. Across these regions, stakeholders must align commercial tactics with regulatory landscapes, infrastructure capabilities, and patient needs to maximize therapeutic impact.

This comprehensive research report examines key regions that drive the evolution of the Antiemetic Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Strategic Moves Competitive Positioning and Collaborative Innovations Among Leading Antiemetic Drug Manufacturers and Industry Stakeholders

Leading pharmaceutical companies have demonstrated strategic agility in navigating the competitive antiemetic landscape through targeted acquisitions, research collaborations, and portfolio expansions. Several major manufacturers have strengthened their pipelines by partnering with biotech firms specializing in novel receptor targets, thereby accelerating the development of first-in-class and best-in-class therapies. Concurrently, established players have pursued horizontal integration strategies, acquiring complementary product lines to offer comprehensive antiemetic solutions and capture cross-segment synergy.

Innovation-driven competitiors have also leveraged digital health platforms to differentiate their offerings, incorporating mobile patient monitoring applications that facilitate real-time symptom reporting and adherence tracking. These value-added services enhance clinician decision making and provide pharmaceutical organizations with rich longitudinal data to refine treatment algorithms and support reimbursement discussions. Moreover, select companies have piloted outcomes-based contracts, aligning pricing with patient-reported outcome measures and demonstrating commitment to value-based care models.

While incumbents compete on therapeutic breadth and service integration, niche players are carving out specialized opportunities by focusing on under-addressed indications and leveraging agility to navigate regulatory pathways rapidly. As a result, the competitive landscape is increasingly defined by collaborations, co-development agreements, and consortium models that balance risk-sharing with shared innovation goals. The convergence of robust pipelines, digital enablement, and strategic partnerships underscores the dynamic nature of corporate competition in the antiemetic sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Antiemetic Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acacia Pharma Limited

- Akorn Operating Company LLC

- Algen Healthcare Ltd.

- Alkem Laboratories Ltd.

- Cipla Limited

- Dr. Reddy's Laboratories Limited

- Fresenius Kabi Pte Ltd.

- Glenmark Pharmaceuticals Limited

- Global Calcium Private Limited

- Helsinn Healthcare S.A.

- Hikma Pharmaceuticals PLC

- Lupin Limited

- Merck KGaA

- Novartis AG

- Pax Healthcare

- Pfizer Inc.

- Sanofi S.A.

- Saphnix Life Sciences

- Scindia Pharma

- Sun Pharmaceutical Industries Limited

- Swastik Life Sciences

- Teva Pharmaceuticals Industries Ltd.

- Torrent Pharmaceuticals Ltd.

- Viatris Inc.

- Weefsel Pharma

Delivering Practical Guidance on Innovation Investment Market Entry Partnerships and Supply Chain Optimization for Antiemetic Drug Industry Leaders

Industry leaders must adopt a multifaceted approach to secure sustainable growth in the evolving antiemetic sphere. First, prioritizing innovation investments in novel molecular entities and combination therapies offers a pathway to differentiate portfolios and address unmet clinical needs. Strategic alliances with academic institutions and biotech startups can accelerate discovery timelines and diversify risk exposure. Additionally, investing in patient-centric digital tools to monitor treatment response and manage adverse events will enhance real-world data capture and fortify value arguments for payers.

Second, organizations should refine their market entry frameworks by tailoring commercial models to regional healthcare ecosystems. This includes designing adaptive pricing strategies that align with local reimbursement standards and leveraging omnichannel engagement techniques to educate prescribers and patients. Third, companies must optimize supply chain resilience through diversified sourcing, near-shoring of critical components, and integration of advanced analytics to predict demand fluctuations. Proactive scenario planning with cross-functional teams will enable rapid response to trade policy shifts and logistical disruptions.

Finally, fostering a culture of continuous learning through cross-disciplinary collaborations will empower leadership to anticipate market inflection points. Regular competitive intelligence reviews, participation in policy forums, and ongoing stakeholder engagement will ensure that strategic decisions remain grounded in emerging evidence. By balancing innovation, operational excellence, and strategic partnerships, industry leaders can navigate complexity and unlock long-term value in the antiemetic drug market.

Elucidating Rigorous Multimodal Research Methods Data Collection Approaches and Analytical Frameworks Underpinning the Antiemetic Drug Market Study

This study employed a rigorous, multimodal research framework that synthesized quantitative and qualitative methodologies to deliver comprehensive insights into the antiemetic drug market. Primary research involved in-depth interviews with key opinion leaders, including oncologists, anesthesiologists, clinical pharmacists, and health economics experts, to validate emerging trends and clinical practice patterns. These discussions were complemented by targeted surveys of hospital procurement managers and home care providers to capture end-user perspectives on formulary decision drivers and distribution challenges.

Secondary research encompassed extensive analysis of peer-reviewed journals, regulatory documents, pipeline disclosures, and trade publications to contextualize industry developments and technological advancements. Data triangulation techniques were applied to reconcile information from diverse sources, ensuring robustness and consistency across thematic areas such as segment performance, regional dynamics, and corporate strategies. Advanced analytical tools, including statistical software and process-mining algorithms, underpinned the evaluation of supply chain resilience and tariff impact modeling, facilitating scenario analyses and sensitivity testing.

Throughout the research process, quality assurance protocols were adhered to, involving editorial reviews, validation workshops with subject matter experts, and cross-functional verification to minimize bias and ensure objectivity. This systematic approach underpins the credibility of findings and positions the report as a trusted resource for decision-makers seeking informed guidance in the antiemetic therapeutics space.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Antiemetic Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Antiemetic Drugs Market, by Indication

- Antiemetic Drugs Market, by Drug Class

- Antiemetic Drugs Market, by Route Of Administration

- Antiemetic Drugs Market, by End User

- Antiemetic Drugs Market, by Distribution Channel

- Antiemetic Drugs Market, by Region

- Antiemetic Drugs Market, by Group

- Antiemetic Drugs Market, by Country

- United States Antiemetic Drugs Market

- China Antiemetic Drugs Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing Critical Insights Future Prospects and Strategic Imperatives in the Antiemetic Drug Domain for Decision Makers and Stakeholders

The antiemetic drug landscape is poised at a pivotal juncture, shaped by technological breakthroughs, shifting trade policies, and dynamic competitive forces. Innovations in pharmacogenomics and digital health are redefining treatment personalization, while revised trade tariffs have underscored the importance of supply chain resilience and cost management. Segmentation insights across indications, drug classes, administration routes, end users, and distribution channels reveal the complexity of market dynamics and highlight targeted opportunities for differentiation.

Regional analyses demonstrate that success hinges on aligning strategies with local healthcare infrastructures, regulatory frameworks, and patient care models. Concurrently, leading companies are forging collaborations and leveraging digital enablement to strengthen their value propositions and gain competitive advantage. Through a combination of strategic investments, adaptive commercial approaches, and proactive scenario planning, industry stakeholders can navigate emerging challenges and harness growth potential.

As decision makers chart their path forward, the critical themes of innovation, operational agility, and patient-centricity must remain at the forefront. By integrating the actionable insights presented in this report, organizations will be better equipped to anticipate market shifts, optimize resource allocation, and deliver enhanced therapeutic outcomes. The path ahead demands both visionary leadership and disciplined execution to shape the future of antiemetic care.

Engaging with Associate Director Ketan Rohom to Acquire Comprehensive Antiemetic Drug Market Research Report and Fuel Informed Strategic Decisions Today

To embark on a journey of unparalleled strategic insight, reach out to Associate Director Ketan Rohom to acquire the complete antiemetic drug market research report. This comprehensive dossier offers a nuanced exploration of therapeutic innovations, tariff implications, segmentation analyses, regional dynamics, and competitive intelligence. Engaging directly with Ketan Rohom will enable your organization to leverage validated data and expert guidance tailored to your unique objectives. His deep understanding of market intricacies and commitment to client success ensures that you will receive personalized recommendations designed to optimize product portfolios, streamline supply chains, and capitalize on emerging opportunities. Secure this essential resource today to empower your teams, refine your strategies, and stay ahead of industry transformation. By connecting with Ketan Rohom, you will gain exclusive access to actionable insights that drive informed decision making and foster sustained growth in the rapidly evolving antiemetic therapeutics sector;

- How big is the Antiemetic Drugs Market?

- What is the Antiemetic Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?