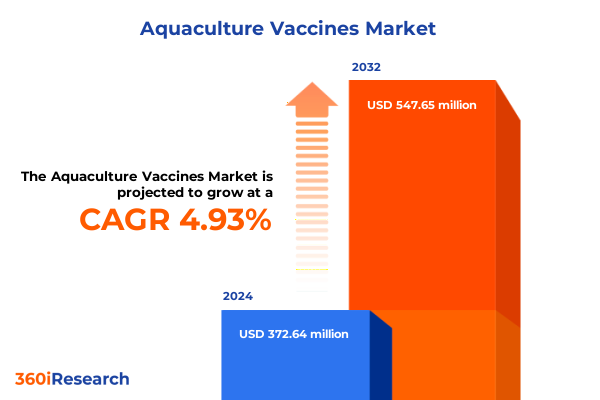

The Aquaculture Vaccines Market size was estimated at USD 390.70 million in 2025 and expected to reach USD 410.74 million in 2026, at a CAGR of 4.94% to reach USD 547.65 million by 2032.

Unveiling the Critical Role of Vaccination in Aquaculture and Its Emergence as a Cornerstone of Resilient and Sustainable Seafood Production

Aquaculture vaccines have emerged as foundational tools for mitigating disease outbreaks and ensuring the health of aquatic species cultivated across the globe. As the industry scales to meet growing protein demands, preventing the proliferation of pathogens in densely stocked systems has become paramount. Vaccination strategies are central to reducing reliance on antibiotics, enhancing animal welfare, and safeguarding trade by enabling compliance with stringent biosecurity regulations. In this context, the evolution of vaccine technologies marks a pivotal shift toward more resilient and efficient production systems.

This executive summary delves into the critical trends, segmentation insights, regional dynamics, and strategic imperatives shaping the aquaculture vaccine landscape. By examining the convergence of scientific breakthroughs, regulatory changes, and market forces, readers will gain a comprehensive understanding of how vaccination solutions are transforming aquatic health management. With a focus on actionable insights, this overview equips industry leaders and decision-makers with the knowledge required to navigate a rapidly evolving environment and capitalize on opportunities for sustainable growth.

Mapping the Paradigm Shifts Transforming Aquaculture Vaccine Development, Distribution, and Adoption in the Face of Evolving Industry Dynamics

The aquaculture vaccine sector is undergoing transformative shifts driven by advances in molecular biology, heightened regulatory scrutiny, and the imperative for cost-effective disease control methods. DNA-based vaccines and subunit formulations are redefining the precision with which pathogens are targeted, delivering enhanced immunogenicity while minimizing adverse effects. Concurrently, the integration of next-generation platforms, including recombinant technologies, is accelerating the development of novel vaccines capable of addressing complex viral and bacterial threats that traditional approaches struggled to contain.

Furthermore, shifting consumer expectations and sustainability commitments have prompted value chain integration, encouraging collaboration among hatcheries, feed manufacturers, and vaccine developers. Digital technologies such as blockchain and IoT-enabled monitoring systems are enhancing traceability, streamlining vaccine administration workflows, and facilitating data-driven decision-making. These paradigm shifts underscore the industry’s evolution toward holistic health management strategies that balance biological efficacy with economic and environmental considerations.

Assessing the Aggregate Consequences of United States 2025 Tariff Adjustments on Aquaculture Vaccine Supply Chains and Global Industry Competitiveness

In 2025, the United States implemented a series of tariff adjustments on imported vaccine components and finished products, reshaping the cost structure and competitive landscape. These measures have increased the landed cost of inactivated and subunit vaccines, compelling manufacturers and distributors to reevaluate supply chain configurations and sourcing strategies. As a result, some producers have accelerated local partnerships to cultivate domestic antigen production capabilities, while others have diversified procurement across tariff-exempt trade agreements to mitigate expense escalation.

The cumulative impact of these tariffs extends beyond cost considerations. Industry stakeholders are navigating altered pricing models, renegotiated distribution contracts, and evolving regulatory requirements that accompany domestically sourced manufacturing processes. In parallel, research and development pipelines are adapting to leverage regional strengths, with several companies exploring collaborations with U.S.-based biotech firms to advance next-generation vaccine platforms. These dynamics collectively underscore the need for agility and strategic foresight in managing tariff-induced complexities.

Dissecting Comprehensive Segmentation Insights to Illuminate Key Drivers and Differentiators Across Vaccine Types, Administration Routes, Species, Pathogens, Applications, and Platforms

The aquaculture vaccine market is shaped by an intricate interplay of product attributes, delivery mechanisms, target species, pathogen profiles, therapeutic objectives, and technological platforms. Vaccine developers must navigate a spectrum of modalities: inactivated preparations offer proven safety profiles for bacterial infections, whereas live attenuated and recombinant constructs deliver robust immune stimulation against both viral and parasitic agents. DNA vaccines and subunit technologies represent the frontier of precision immunization, enabling targeted antigen presentation with reduced risk of reversion.

Route of administration plays a critical role in operational feasibility. Injection methods ensure accurate dosing in high-value species, while immersion techniques-implemented through bath or dip applications-facilitate mass immunization in hatcheries. Oral formulations unlock opportunities for large-scale vaccination in extensive pond systems. At the level of target species, finfish such as carp, catfish, salmon, tilapia, and trout each present unique immunological considerations, whereas shellfish including crab, mussel, oyster, and shrimp drive specialized vaccine development due to their distinct immune architectures.

Beyond species specificity, vaccines are designed to address bacterial, fungal, parasitic, and viral threats, with prophylactic interventions aimed at preventing infection and therapeutic options focused on mitigating disease progression. Conventional platforms continue to dominate, yet next-generation methodologies-encompassing DNA constructs, recombinant antigens, and subunit vaccines-are gaining traction for their enhanced efficacy, scalability, and adaptability to emerging pathogens. Understanding these layered segmentation insights is essential for stakeholders seeking to allocate resources effectively and tailor solutions to nuanced market needs.

This comprehensive research report categorizes the Aquaculture Vaccines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vaccine Type

- Route Of Administration

- Target Species

- Pathogen Type

- Application

- Technology Platform

Illuminating Regional Market Dynamics by Exploring Drivers, Barriers, and Opportunities Across the Americas, EMEA, and Asia Pacific Aquaculture Vaccine Landscapes

Regional variances in regulatory frameworks, production capacities, and disease prevalence drive distinct trajectories for aquaculture vaccine adoption across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, robust R&D ecosystems and favorable biotech policies underpin progress in DNA-based and recombinant vaccine development, enabling rapid commercialization of innovative formulations. However, infrastructural challenges in Latin American hatcheries have prompted tailored immersion solutions to enhance accessibility and reduce labor costs.

Across Europe, the Middle East and Africa, stringent animal health regulations and consolidation among major pharmaceutical players are shaping a landscape that prioritizes high-margin prophylactic products. Collaborative initiatives among government agencies and private sector innovators are accelerating the validation of live attenuated vaccines, particularly in regions facing recurrent viral outbreaks. In contrast, cost pressures in certain EMEA markets have spurred interest in cost-effective inactivated vaccines and modular manufacturing approaches.

Asia Pacific remains the fastest-growing region for aquaculture vaccine uptake, with high-density production systems in China, Southeast Asia, and India driving demand for scalable immersion and oral platforms. Investments in downstream processing, cold-chain logistics, and local antigen production are reducing dependency on imports. Simultaneously, partnerships between regional biotech hubs and multinational corporations are fostering the transfer of next-generation technologies and supporting capacity building across diverse submarkets.

This comprehensive research report examines key regions that drive the evolution of the Aquaculture Vaccines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Company Profiles to Reveal Competitive Strengths, Innovation Trajectories, and Collaborative Endeavors Shaping the Aquaculture Vaccine Sector

Leading stakeholders in the aquaculture vaccine space display a range of strategic postures, from vertically integrated firms leveraging proprietary antigen discovery platforms to specialized biotech start-ups focused on niche pathogen targets. Several established animal health companies have fortified their portfolios through acquisitions of regional vaccine producers, gaining access to preexisting distribution networks and localized expertise in immersion and oral delivery technologies.

Innovative pioneers are distinguishing themselves through collaboration with genomic research centers to accelerate antigen identification, applying bioinformatics tools to predict antigenic epitopes and optimize immunogenicity. Cross-sector partnerships between feed manufacturers and vaccine developers are emerging to integrate adjuvants directly into nutritional solutions, offering holistic health management strategies. Meanwhile, contract research organizations and pilot-scale manufacturing facilities are expanding their service offerings to accommodate the development timelines and regulatory demands of next-generation vaccine candidates.

These strategic profiles highlight the importance of aligning R&D investments with broader market needs. Companies that can demonstrate agility in addressing both routine bacterial threats and novel viral challenges are poised to secure competitive advantages, while those investing in manufacturing scale-up and cold-chain innovations will better serve the demands of high-density aquaculture operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aquaculture Vaccines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anicon Labor GmbH

- Benchmark Holdings plc

- Bio Angle Vacs Sdn Bhd

- Bluestar Adisseo Co

- Ceva Sante Animale

- Elanco Animal Health Incorporated

- Hester Biosciences Limited

- HIPRA S A

- Ictyogroup

- Indian Immunologicals Ltd

- KBNP Inc

- Kyoto Biken Laboratories Inc

- Merck & Co Inc

- Nisseiken Co Ltd

- Novartis Animal Health

- Phibro Animal Health Corporation

- Tecnovax S A

- Vaxxinova International B V

- Veterquimica S A

- Virbac S A

- Zoetis Inc

Translating Industry Intelligence into Actionable Strategies That Empower Leaders to Navigate Challenges, Seize Opportunities, and Drive Sustainable Growth in Aquaculture Vaccines

Industry leaders must adopt multifaceted strategies to navigate the evolving aquaculture vaccine landscape. Prioritizing investments in next-generation platforms such as DNA and recombinant technologies will position organizations to respond rapidly to emergent pathogen strains. Equally important is the development of flexible manufacturing processes capable of toggling between conventional and advanced platforms, thereby mitigating supply chain disruptions and optimizing cost efficiency.

To maximize market penetration, stakeholders should cultivate partnerships with hatchery operators, feed suppliers, and digital platform providers. Integrating vaccination protocols into existing farm management software will streamline dosing schedules and enhance traceability, driving higher adoption rates. Moreover, engaging with regulatory bodies proactively to shape harmonized approval pathways can reduce time to market and enable smoother cross-border distribution.

Finally, a customer-centric approach that emphasizes value-added services-such as field support, monitoring tools, and data analytics-will reinforce brand loyalty and differentiate offerings in a crowded marketplace. Embracing these recommendations will empower decision-makers to translate insights into actionable plans that bolster resilience, foster innovation, and stimulate sustainable growth within the aquaculture vaccine domain.

Detailing Rigorous Research Methodology to Ensure Data Integrity, Analytical Transparency, and Insightful Outcomes Supporting Decision Making in Aquaculture Vaccine Studies

This analysis is underpinned by a multi-pronged research methodology designed to ensure robustness, transparency, and actionable outcomes. Primary data collection included in-depth interviews with industry experts, vaccine developers, regulatory officials, and aquaculture producers across key regions. Insights from these interviews were triangulated with secondary research drawn from peer-reviewed journals, regulatory filings, patent databases, and trade association reports to validate emerging trends and technology adoption patterns.

Quantitative data were subjected to rigorous cleaning and normalization procedures, ensuring consistency across different sources and reducing biases. A structured framework guided the segmentation analysis, examining vaccine types, administration methods, species targets, pathogen classes, applications, and platform technologies. Regional insights were derived through comparative assessments of regulatory landscapes, production infrastructures, and market dynamics, highlighting interdependencies and unique growth catalysts.

Ongoing consultations with subject-matter advisors provided continuity and contextual depth, while iterative peer reviews reinforced the credibility of findings. This methodological approach enables stakeholders to rely confidently on the conclusions and recommendations presented herein, facilitating informed decision-making in the complex aquaculture vaccine ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aquaculture Vaccines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aquaculture Vaccines Market, by Vaccine Type

- Aquaculture Vaccines Market, by Route Of Administration

- Aquaculture Vaccines Market, by Target Species

- Aquaculture Vaccines Market, by Pathogen Type

- Aquaculture Vaccines Market, by Application

- Aquaculture Vaccines Market, by Technology Platform

- Aquaculture Vaccines Market, by Region

- Aquaculture Vaccines Market, by Group

- Aquaculture Vaccines Market, by Country

- United States Aquaculture Vaccines Market

- China Aquaculture Vaccines Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Core Insights to Offer a Cohesive Perspective on Aquaculture Vaccine Market Evolution, Strategic Imperatives, and Future Imperatives for Stakeholders

The convergence of scientific innovation, regulatory realignment, and shifting market demands has positioned aquaculture vaccines at the forefront of sustainable aquatic health management. From inactivated and live attenuated formulations to cutting-edge DNA and subunit technologies, the spectrum of vaccine modalities addresses a broad array of pathogen challenges. Immersion, injection, and oral administration strategies further enable adaptation to diverse production systems and species-specific requirements.

Tariff-induced shifts in supply chains underscore the necessity for strategic agility, driving localization of antigen production and the reevaluation of distribution frameworks. Regional nuances-from structured biotech ecosystems in the Americas to high-density aquaculture hubs in Asia Pacific-demand tailored approaches that align technological capabilities with regulatory and infrastructural realities. Competitive landscapes are being reshaped by collaborations, acquisitions, and cross-sector partnerships that emphasize integrated health management solutions.

Armed with these insights, decision-makers can craft strategies that balance innovation with operational excellence, optimize resource allocation across key segments, and proactively engage with stakeholders to foster regulatory alignment. The aquaculture vaccine arena is poised for continued evolution, and the findings presented here offer a coherent perspective to guide future actions and investments.

Engage with Ketan Rohom to Unlock In-Depth Aquaculture Vaccine Market Intelligence and Propel Strategic Decisions with Tailored Research Insights

To explore the full breadth of strategic insights, competitive intelligence, and detailed analyses that will inform your next moves in the aquaculture vaccine landscape, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan’s expertise in translating complex research findings into actionable business strategies will ensure you have the intelligence needed to outpace competitors and capitalize on emerging opportunities. Engage directly with Ketan to customize your market research package, request deeper dives into specific segments, or schedule a personalized briefing that aligns with your organizational objectives. Leverage this opportunity to secure comprehensive knowledge, accelerate decision-making processes, and drive growth through informed investments. Connect with Ketan today to take the decisive step toward strengthening your foothold in the dynamic aquaculture vaccine market and unlocking high-impact insights tailored to your strategic goals.

- How big is the Aquaculture Vaccines Market?

- What is the Aquaculture Vaccines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?