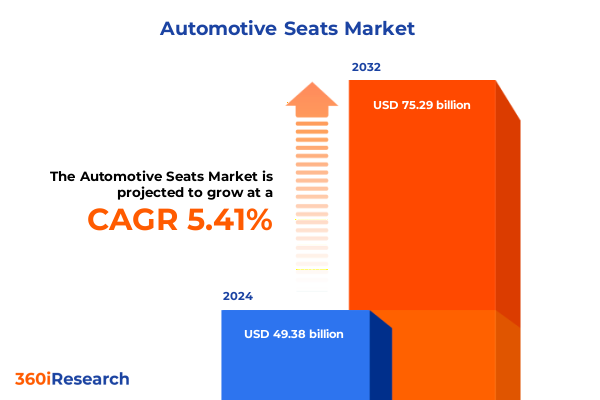

The Automotive Seats Market size was estimated at USD 51.85 billion in 2025 and expected to reach USD 54.55 billion in 2026, at a CAGR of 5.47% to reach USD 75.29 billion by 2032.

Pioneering Comfort and Safety in Modern Vehicle Interiors with Innovative Ergonomic and Adaptive Advanced Seating Solutions Shaping the Automotive Landscape

The evolution of automotive seating has transcended its traditional function of passenger support to become a focal point for innovation, safety, and comfort. As vehicle cabins transform into sophisticated living spaces, seats now integrate advanced ergonomics, sensor technologies, and adaptive materials to cater to an increasingly discerning consumer base. This shift underscores the pivotal role that seating manufacturers play in defining user experience and meeting stringent international safety and emissions regulations.

In recent years, the interplay between consumer expectations and regulatory demands has accelerated development in seating systems. From customizable lumbar support to integrated heating and ventilation, automakers and suppliers are collaborating on holistic solutions that enhance comfort while improving occupant wellbeing and driving posture. Concurrently, global initiatives aimed at reducing vehicular weight have spurred adoption of lightweight alloys, high-density foams, and sustainable textiles that do not compromise durability or crashworthiness.

Against this backdrop, the present executive summary offers a detailed exploration of the trends reshaping the seating landscape, evaluates the cumulative impact of new trade measures in the United States, and provides a nuanced segmentation analysis by seat type, component, material, technology, vehicle application, and end-user channel. Furthermore, the regional dynamics in the Americas, EMEA, and Asia-Pacific are examined alongside profiles of leading industry players, strategic recommendations, and a transparent research methodology designed to inform strategic decision making.

Navigating the Driving Forces Behind Electrification, Connectivity, Sustainability, and Occupant Wellbeing Redefining Automotive Seating Paradigms

The automotive seating domain is undergoing transformative shifts driven by the convergence of electrification mandates, digital connectivity trends, and heightened consumer health consciousness. Electrification is redefining material selection and structural design as seating assemblies must balance lightweight construction with crash protection in battery-powered platforms. In tandem, the growing integration of connectivity features such as embedded sensors, biometric modules, and in-seat climate control is elevating seat systems from passive support components to active nodes in the vehicle’s digital ecosystem.

Sustainability has emerged as another critical vector for disruption, with reciclable and bio-based materials rapidly gaining traction. Manufacturers are investing in closed-loop supply chains and partnering with textile innovators to replace traditional polyurethane foams and vinyl coverings with eco-friendly alternatives. This not only aligns with carbon reduction goals but also resonates with environmentally conscious consumers seeking greener mobility solutions.

Moreover, occupant wellbeing is at the forefront, prompting the integration of adaptive mechanisms that respond to real-time posture analysis and fatigue detection. These smart seating concepts use machine learning algorithms to adjust cushion firmness, lumbar support, and headrest orientation, tailoring comfort profiles to individual passengers. Collectively, these shifts signal a new era in which seats become multifunctional, intelligent, and deeply integrated into vehicle design, enhancing both the driving experience and safety standards.

Assessing the Ripple Effects of 2025 United States Tariff Measures on Supply Chains, Costs, and Innovation in Automotive Seating

In 2025, the United States implemented a series of tariff measures targeting imported automotive seat components and raw materials, prompting far-reaching effects across the supply chain. Manufacturers reliant on overseas production for seat frames, specialized foams, and electronic modules have encountered elevated input costs, compelling them to reassess sourcing strategies and renegotiate supplier agreements. As a result, some OEMs have accelerated plans to localize critical component fabrication to mitigate exposure to trade fluctuations.

This realignment has led to strategic partnerships between Tier-one suppliers and regional fabricators, establishing new capacity in parts of the Midwest and Southern United States. While these initiatives have reduced long-haul logistics expenses and improved lead-time predictability, they have also required substantial capital outlay and process optimization to ensure consistency with global quality standards. Furthermore, the tariffs have spurred innovation in material development, as R&D teams prioritize formulations and alloys that can be produced domestically under more favorable tariff classifications.

Looking ahead, stakeholders are closely monitoring trade negotiations and potential exemptions for electric vehicle production zones, which could alleviate some cost pressures. Meanwhile, companies are diversifying their supply bases beyond traditional hubs such as China and Mexico, exploring emerging markets in Southeast Asia and Eastern Europe. The cumulative impact of these tariff measures thus extends beyond immediate cost inflation, shaping strategic decisions around regional manufacturing footprints, value chain resilience, and long-term competitive positioning.

In-Depth Examination of Seat Type Variations, Component Specializations, Material Innovations, Technological Divergence, Vehicle Suitability, and User Dynamics

A granular view of the automotive seating landscape reveals distinct dynamics across six core segmentation dimensions. In terms of seat type, conventional bench seats continue to dominate heavy-load commercial applications, while ergonomic bucket seats have become the preferred choice for high-end passenger cars and sports models; folding seats-both convertible and removable variants-are particularly valued in SUVs and multipurpose vehicles, and split-bench configurations offer flexibility for mixed passenger-cargo layouts.

Component segmentation shows that headrests remain critical for compliance with evolving safety standards, and advanced seat covering materials-ranging from stain-resistant textiles to antimicrobial coatings-are driving differentiation. Meanwhile, innovation in seat frame and structure design seeks to optimize load paths during crashes, and the refinement of seat recliner mechanisms and seat tracks enhances ease of adjustment and memory functionality.

Material type analysis highlights the persistent use of durable fabrics and high-resilience foams complemented by strategic incorporation of metal alloys for structural elements and engineered plastics for weight reduction. On the technology front, powered seating systems-with multi-axis adjustment motors-are gaining traction alongside ventilated seats that leverage microperforation and active ventilation modules, while standard manual designs remain prevalent in entry-level segments.

Vehicle type considerations underscore that the commercial vehicle sector-including buses, heavy trucks, and light commercial vehicles-prioritizes durability and ergonomic support for long-distance driving, whereas electric cars and luxury vehicles increasingly integrate bespoke seating experiences. Passenger cars and sports cars, conversely, balance cost-effective seating solutions with performance-oriented bolstering. Finally, the end-user perspective differentiates between OEM production volumes and aftermarket customization channels, each with unique requirements for inventory management, regulatory compliance, and branding opportunities.

This comprehensive research report categorizes the Automotive Seats market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Seat Type

- Component

- Material Type

- Technology

- Vehicle Type

- End-User

Comparative Analysis of Regional Market Dynamics Shaping Automotive Seat Demand across the Americas, EMEA, and Asia-Pacific Zones

Distinct regional markets exhibit unique automotive seating trends shaped by regulatory frameworks, consumer preferences, and industrial ecosystems. In the Americas, growth in near-shoring initiatives and incentives for electric vehicle manufacturing have encouraged seat producers to establish facilities in the United States, Mexico, and Canada. This localized approach not only reduces vulnerability to cross-border trade shifts but also facilitates rapid adaptation to evolving safety regulations enacted by U.S. federal agencies.

In Europe, Middle East and Africa, stringent occupant protection standards and ambitious carbon neutrality targets have driven demand for seats with advanced crash-energy management features and eco-friendly materials. European manufacturers are often at the forefront of labeling initiatives that track recyclable content, while Middle Eastern markets are focused on luxury seating packages that deliver premium comfort in high-end SUVs and luxury sedans. African demand, though modest in volume, is characterized by rugged designs capable of withstanding challenging road conditions.

The Asia-Pacific region remains the world’s largest manufacturing hub for seating systems and leverages economies of scale to supply global OEMs. Rapid electrification in China, India, and Southeast Asia is fueling interest in smart seating modules, and local suppliers are collaborating with technology firms to integrate features such as in-seat biometric monitoring. Moreover, cost-competitive production in this region continues to attract investment, while domestic consumer markets increasingly adopt ventilated and heated seats as standard offerings.

This comprehensive research report examines key regions that drive the evolution of the Automotive Seats market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Tier-One Automotive Seating Manufacturers Driving Innovation, Collaborations, and Strategic Investments in the Evolving Market

Leading Tier-one seating suppliers are executing multifaceted strategies to maintain technological leadership and expand geographical footprints. Lear Corporation has intensified its focus on adaptive seating platforms by investing in modular seat architectures that accommodate rapid design cycles for electric and autonomous vehicles. Concurrently, Adient has formed alliances with eco-textile innovators to enhance the sustainability profile of seat coverings and launched pilot programs for in-seat air purification systems.

Faurecia has pursued vertical integration by acquiring specialized foam producers to secure proprietary formulations, while its joint venture in Asia-Pacific has expanded production capacity for ventilated seating modules. Magna International has augmented its portfolio through strategic collaborations with semiconductor firms, embedding advanced sensors and haptic feedback mechanisms into luxury seat offerings. Meanwhile, Toyota Boshoku continues to fortify its OEM partnerships, delivering bespoke seating solutions for premium marque projects and leveraging Japan’s manufacturing precision to optimize structural designs.

These leading players are also exploring aftermarket channels, offering branded accessory kits and retrofit modules that enhance comfort and safety for existing vehicle owners. Their collective investments in R&D, coupled with targeted mergers and acquisitions, signal a competitive environment in which innovation cycles are accelerating and collaboration across the automotive and technology sectors is paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Automotive Seats market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adient PLC

- Bharat Seats Limited

- Brose Fahrzeugteile SE & Co. KG

- C.I.E.B. Kahovec, spol. s r. o

- Camaco, LLC

- Daewon Kang Up Co., Ltd.

- EWON Comfortech Co., Ltd.

- Faurecia Group

- Franz Kiel GmbH

- Freedman Seating Company

- Gentherm Inc.

- GRL A.Ş.

- Guelph Manufacturing Group

- KARL MAYER Holding GmbH & Co. KG

- Lear Corporation

- Magna International Inc.

- NHK Spring Co., Ltd.

- Phoenix Seating Limited

- Summit Group Company

- TACHI-S ENGINEERING U.S.A. INC.

- Tata AutoComp Systems Ltd.

- Toyota Boshoku Corporation

- TS Tech Co., Ltd.

- TUNATEK OTOMOTİV LTD.

- VOGELSITZE GmbH

Strategic Imperatives for Automotive Seating Innovators to Capitalize on Emerging Materials, Technologies, and Geopolitical Shifts for Sustainable Growth

Industry leaders seeking to capitalize on these dynamic trends should prioritize a dual focus on material innovation and digital integration. By partnering with advanced polymer and textile developers, seating OEMs can introduce eco-friendly materials that meet both weight reduction goals and consumer demand for sustainability. Simultaneously, embedding modular electronic architectures that accommodate future upgrades-such as advanced biometric sensors-will ensure adaptability in a rapidly evolving mobility ecosystem.

To mitigate the risks posed by fluctuating trade policies, companies are advised to diversify their supplier base across multiple regions and invest in regional assembly hubs in strategic markets. Strengthening relationships with local fabricators and forging joint ventures can reduce lead times, lower logistics costs, and build resilience against tariff-induced price volatility. Additionally, leveraging data analytics on end-user usage patterns will enable predictive maintenance offerings and aftermarket service models that generate recurring revenue streams.

Finally, forging alliances with vehicle OEMs and technology partners to co-develop seating platforms for emerging segments-particularly electric and autonomous vehicles-will be instrumental in capturing early adoption markets. By aligning R&D roadmaps with electrification milestones and regulatory benchmarks, seating suppliers can position themselves as indispensable collaborators in the next generation of mobility solutions.

Comprehensive Research Framework Combining Primary Interviews, Secondary Literature Review, and Rigorous Data Validation for Market Intelligence

This research is grounded in a rigorous methodology that integrates both primary and secondary data sources. Primary insights were obtained through structured interviews with seating division executives, OEM product planners, material science experts, and aftermarket channel managers. These qualitative engagements provided firsthand perspectives on strategic priorities, pain points in supply chains, and anticipated technology roadmaps.

Complementing this, secondary research encompassed a comprehensive review of regulatory filings, industry association reports, patent databases, and trade statistics. In particular, government publications on safety standards and tariff schedules were analyzed to ensure accurate contextualization of policy impacts. Financial disclosures from leading seating suppliers and OEM annual reports were examined to validate investment trends and strategic acquisitions.

Data triangulation techniques were employed to reconcile discrepancies across sources, and all information was subjected to a multi-stage review process involving subject-matter experts and cross-functional analysts. This approach ensures that the findings presented are both robust and actionable, offering stakeholders a dependable foundation for informed decision-making in the automotive seating arena.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Automotive Seats market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Automotive Seats Market, by Seat Type

- Automotive Seats Market, by Component

- Automotive Seats Market, by Material Type

- Automotive Seats Market, by Technology

- Automotive Seats Market, by Vehicle Type

- Automotive Seats Market, by End-User

- Automotive Seats Market, by Region

- Automotive Seats Market, by Group

- Automotive Seats Market, by Country

- United States Automotive Seats Market

- China Automotive Seats Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Concluding Perspectives on the Future of Automotive Seating Highlighting Convergence of Comfort, Technology, and Regulation in a Competitive Global Environment

The automotive seating industry stands at the threshold of profound transformation, driven by intertwining forces of electrification, digital integration, sustainability mandates, and evolving passenger expectations. As tariff landscapes fluctuate, companies are compelled to adapt supply networks, rethink material strategies, and bolster regional production capabilities to maintain competitiveness.

Segmentation analysis underscores the importance of tailoring seat designs across a spectrum of applications-from heavy-duty commercial vehicles that demand rugged support to luxury electric cars that require bespoke comfort solutions. Regional insights reveal distinct market imperatives, with the Americas emphasizing near-shoring, EMEA prioritizing regulatory compliance and material recyclability, and Asia-Pacific leveraging manufacturing scale to pioneer smart seating features.

Against this backdrop, industry leaders who invest in advanced materials, digital architectures, and strategic partnerships will gain the agility to navigate geopolitical shifts and drive sustainable growth. By embracing an integrated approach that unites R&D, supply chain diversification, and collaborative innovation, stakeholders can chart a path toward seating systems that enhance safety, comfort, and connectivity for the vehicles of tomorrow.

Unlock Comprehensive Insights and Drive Confidence in Strategic Decisions by Accessing the Full Automotive Seating Market Intelligence Report Today

To gain unparalleled clarity into the forces shaping tomorrow’s automotive seating market and secure a competitive edge, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engage in a personalized consultation to discuss your organization’s specific intelligence needs and acquire the comprehensive market research report that will empower your strategic planning for the coming years. With in-depth analysis covering every transformative trend, regional dynamic, and competitive strategy outlined, this report is essential for executives and decision-makers committed to driving innovation in automotive seating.

Contact Ketan Rohom today to unlock full access to the report and equip your team with actionable insights that translate into growth, resilience, and market leadership. Your roadmap to smarter investments and sustainable advancement in the automotive seating sector begins with this critical research resource.

- How big is the Automotive Seats Market?

- What is the Automotive Seats Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?