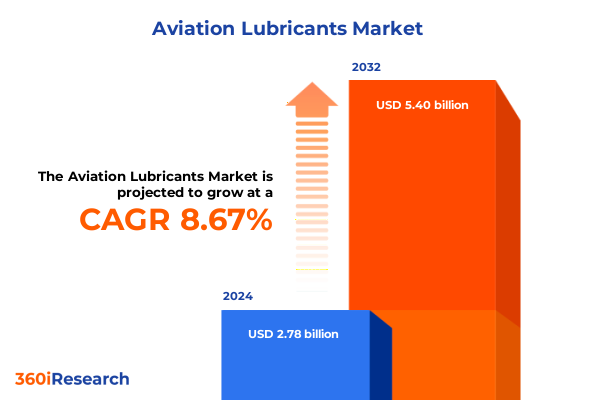

The Aviation Lubricants Market size was estimated at USD 3.02 billion in 2025 and expected to reach USD 3.28 billion in 2026, at a CAGR of 8.68% to reach USD 5.40 billion by 2032.

Discover the Critical Role of Tailored Aviation Lubricants in Enhancing Aircraft Performance and Operational Efficiency Across Diverse Flight Operations

Aviation lubricants serve as the lifeblood of aircraft reliability, safeguarding engines, hydraulic systems, turbines, and auxiliary components against friction, wear, corrosion, and thermal stress. These specialized formulations are engineered to endure extreme temperature fluctuations, high rotational speeds, and varied load conditions that define flight operations. As fleets expand and maintenance intervals tighten, the role of high-performance lubricants has become even more critical to ensure uninterrupted air travel and minimize unplanned downtime.

Transitioning from conventional oils to next-generation synthetic blends has redefined maintenance frameworks, enabling extended drain intervals and reducing the total cost of ownership. Leading operators now demand tailor-made solutions that not only meet rigorous military and civil specifications but also align with environmental objectives. Consequently, innovation in base oil chemistry and additive packages is driving a shift toward products that deliver superior oxidative stability and enhanced film strength under the most demanding flight profiles.

This executive summary introduces the key dimensions of the aviation lubricants domain, highlighting product innovations, regulatory pressures, and strategic market dynamics. It outlines the transformative shifts reshaping performance expectations, examines the ramifications of recent policy developments, and presents actionable insights for stakeholders aiming to capitalize on emerging opportunities. By synthesizing these factors, this section sets the stage for an in-depth exploration of how lubrication strategies will underpin operational excellence across the industry’s future horizon.

Explore the Revolutionary Technological Advances and Sustainability Initiatives Reshaping the Aviation Lubricants Landscape and Driving Industry Transformation

Technological advances in additive chemistry and base oil formulations are rewriting the rules for aviation grease, oil, and synthetic blends. Emerging bio-based lubricants and high-viscosity synthetic esters are delivering unprecedented thermal resilience, while nanotechnology-infused additives enhance load-bearing capacity without compromising fluidity. In parallel, digital platforms powered by sensors and machine learning algorithms are enabling real-time lubrication condition monitoring, allowing maintenance teams to shift from preventive to predictive practices with pinpoint accuracy.

Sustainability initiatives are simultaneously gaining momentum as regulatory bodies tighten emissions targets and pressure mount to reduce carbon footprints. Manufacturers are testing renewable feedstocks and closed-loop recycling processes to reduce waste and lifecycle environmental impact. These green lubricants, certified under rigorous eco-labeling regimes, not only demonstrate comparable performance to petroleum-based oils but also open pathways for circular economy models in maintenance protocols.

Furthermore, the integration of advanced diagnostics through digital twins is facilitating virtual performance simulations, enhancing R&D cycles and accelerating time-to-market for next-gen formulations. Cross-industry collaborations among lubricant suppliers, airframers, and engine OEMs are fostering co-development programs that align formulation properties with specific powerplant architectures. As a result, the traditional boundaries between product development and fleet operators are dissolving, creating a more collaborative innovation ecosystem.

In essence, these transformative forces are converging to create a lubricants landscape defined by smarter monitoring, greener chemistries, and accelerated product cycles, thereby empowering airlines and defense operators to achieve higher reliability, lower operating expenditures, and stronger environmental stewardship.

Assess the Extensive Consequences of the 2025 United States Tariffs on Aviation Lubricant Supply Chains Cost Structures and Competitive Dynamics Across Markets

In early 2025, the United States imposed new tariffs on key raw materials and finished aviation lubricants, fundamentally altering global supply chain dynamics. These import duties have increased procurement costs for international suppliers, forcing many to reassess pricing structures and contract terms. As a result, aviation operators dependent on cross-border sourcing experienced a notable shift in lubricant availability, prompting a recalibration of maintenance budgets and supplier portfolios.

Domestically, the tariff environment has created opportunities for local producers to capture incremental demand by leveraging existing manufacturing capacities and supply chain proximity. However, higher input costs for specialized additive packages have also compressed margins, driving suppliers to optimize blend ratios and explore alternative, lower-cost feedstocks. Consequently, operators must balance cost containment with performance requirements, often engaging in consortium purchasing or strategic alliances to mitigate cost volatility.

The ripple effects extend beyond pricing to impact inventory management and lead times. Extended lead times have emerged as a critical concern, necessitating more robust safety stock policies and contingency planning. Some operators have responded by diversifying their procurement strategies, combining domestic production with regional sourcing hubs to maintain continuity of supply.

Looking ahead, industry participants will need to monitor policymaker actions closely, as potential tariff adjustments or exemptions could alter competitive landscapes once more. This section underscores the urgency for agile sourcing frameworks and collaborative negotiation approaches, enabling stakeholders to navigate an evolving tariff regime while safeguarding operational reliability.

Unveil the Market Segmentation Dimensions Highlighting Product Types Application Areas Base Oil Varieties Aircraft Categories and Distribution Channels

Aviation lubricants are segmented across multiple dimensions to align with performance criteria, regulatory mandates, and end-user requirements. Product type analysis encompasses compressor oil, grease formulations, hydraulic oil variants, and turbine engine oils. Within grease, calcium-based, lithium-based, and polyurea chemistries cater to specific bearing and airframe interfaces, while hydraulic oil options span military-grade MILPRF5606 to fire-resistant Skydrol. Turbine engine lubricants are characterized by exacting standards such as Def Stan 91-102 and MILPRF23699, each tailored to meet distinct thermal and oxidative stability benchmarks.

Application-based segmentation highlights the diverse roles lubricants play within airframe structures, bearing assemblies, engine systems, hydraulic circuits, and landing gear mechanisms. Each application demands unique viscosity profiles and additive packages to withstand differing mechanical stresses and environmental exposures. Meanwhile, base oil type serves as a foundational filter, with mineral options divided into Group I, Group II, and Group III stocks; semi-synthetic blends offering intermediate performance; and full synthetics like esters, PAG, and PAO pushing the boundaries of high-temperature resilience and low-temperature fluidity.

Aircraft type segmentation differentiates between business jets, commercial airliners, general aviation craft, helicopters, and military platforms, reflecting varying flight cycles, duty intensities, and maintenance regimes. Sales channel segmentation further distinguishes aftermarket supply chains from original equipment manufacturer agreements, illuminating how procurement strategies and service contracts shape lubricant selection and lifecycle management.

By integrating these segmentation lenses, stakeholders can pinpoint niche opportunities, tailor product portfolios to evolving needs, and optimize value propositions for each distinct customer cohort.

This comprehensive research report categorizes the Aviation Lubricants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- Base Oil Type

- Aircraft Type

- Sales Channel

Reveal the Strategic Regional Dynamics and Growth Drivers Shaping Aviation Lubricant Demand Across the Americas Europe Middle East Africa and Asia-Pacific

In the Americas, robust airline networks and a focus on fleet renewal programs are driving demand for lubricants that balance performance, regulatory compliance, and cost efficiency. Operators in the United States and Canada increasingly prioritize synthetic blends and advanced grease formulations to support longer flight cycles and reduce maintenance intervals. Meanwhile, in Latin America, infrastructure expansion and low-cost carrier growth are catalyzing opportunities for suppliers to introduce modular lubrication management services and integrated digital maintenance platforms.

Europe, the Middle East, and Africa (EMEA) present a mosaic of regulatory frameworks and climatic challenges. Stricter emissions and waste disposal regulations in Europe are accelerating adoption of eco-certified lubricants, while Gulf region hubs emphasize 24/7 operational readiness under extreme temperatures. Across Africa, growing general aviation and military modernization projects are generating tailored demand for robust hydraulic and turbine oils that can tolerate variable supply chain reliability and rugged operating environments.

Asia-Pacific stands out as the fastest-evolving region, with emerging economies bolstering domestic air travel and defense modernization. Rapid commercial aircraft deliveries in China and India are creating sustained lubricant uptake, complemented by the proliferation of regional aftersales networks. In addition, government initiatives to enhance manufacturing self-sufficiency are encouraging joint ventures between lubricant producers and local oil refiners, facilitating technology transfer and base oil diversification.

These regional dynamics underscore the importance of localized value propositions, regulatory foresight, and agile distribution partnerships to secure competitive positioning across diverse market landscapes.

This comprehensive research report examines key regions that drive the evolution of the Aviation Lubricants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examine the Pioneering Innovations Collaborations and Competitive Strategies Employed by Leading Aviation Lubricant Manufacturers to Secure Market Leadership

Leading aviation lubricant manufacturers are intensifying R&D investments to develop next-generation formulations that satisfy both performance and environmental objectives. Collaborative programs with engine OEMs and airframers are producing co-branded solutions that are bench-tested to optimize specific powerplant architectures, resulting in streamlined certification processes and accelerated adoption cycles. In parallel, strategic partnerships with additive specialists are enabling breakthrough chemistries that extend drain intervals and reduce thermal degradation by harnessing novel dispersants and anti-wear agents.

Mergers and acquisitions have emerged as a key strategy for market consolidation and capability expansion. Several top suppliers have integrated specialty base oil providers and analytics firms to enhance their vertical integration and digital service offerings. By combining formulation expertise with data-driven condition monitoring platforms, these companies are transitioning from pure product suppliers to comprehensive lubrication management solution providers.

Competitive dynamics are further shaped by the entrance of regional players aiming to capture niche segments, such as eco-friendly greases or ultra-high-temperature turbine oils. These emerging competitors leverage localized production footprints and agile customer service models to challenge established multinationals, prompting the latter to refine their value propositions through enhanced technical support and global logistics networks.

Overall, the landscape of aviation lubricant providers is evolving from commodity-style sales toward integrated service partnerships, underscoring the necessity for continuous innovation, supply chain optimization, and customer-centric engagement to maintain leadership in this competitive domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aviation Lubricants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BP p.l.c.

- Chevron Corporation

- China Petroleum & Chemical Corporation

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- Idemitsu Kosan Co., Ltd.

- PetroChina Company Limited

- Phillips 66 Company

- Shell plc

- TotalEnergies SE

Deliver Actionable Strategies for Industry Leaders to Enhance Operational Resilience Sustainability and Competitive Positioning in Aviation Lubricants

Industry leaders must prioritize the integration of predictive lubrication management systems to transition from reactive maintenance to data-driven decision-making. Implementing real-time condition monitoring sensors and leveraging machine learning analytics will enable maintenance teams to preemptively address lubrication anomalies, reducing unscheduled downtime and extending component life.

In addition, forging strategic alliances with sustainable feedstock suppliers and additive developers will be critical to ensuring access to next-generation eco-certified lubricants. By co-investing in circular economy initiatives and closed-loop recycling programs, manufacturers can mitigate regulatory risks and support end-of-pipeline waste reduction objectives.

To navigate the evolving tariff landscape, companies should develop agile procurement frameworks that combine domestic production capacities with diversified regional sourcing. This will require close collaboration with policymakers and trade associations to advocate for balanced duty structures, while fostering consortium purchasing models to optimize negotiating leverage.

By aligning these strategies with a comprehensive understanding of customer-specific use cases and maintenance philosophies, industry leaders can bolster operational resilience, drive sustainable growth, and maintain a competitive edge in a dynamic aviation lubricants market.

Outline the Rigorous Methodological Framework and Analytical Approaches Employed to Ensure Comprehensive and Credible Insights in Aviation Lubricants Research

This research employed a rigorous, multi-stage methodology to ensure robust and reliable insights. Primary research included in-depth consultations with lubricant formulators, maintenance engineers, and procurement specialists across major airline and defense operators. These interviews provided firsthand perspectives on performance expectations, supply chain challenges, and cost optimization strategies.

Secondary research involved the systematic review of regulatory publications, OEM technical specifications, industry whitepapers, and academic journals to validate product performance attributes and sustainability credentials. Data triangulation was achieved by cross-referencing proprietary maintenance logs, tariff filings, and supplier financial disclosures to develop a nuanced understanding of market drivers and constraints.

Quantitative analysis incorporated segmentation modeling across product types, applications, base oil categories, aircraft classes, and sales channels to delineate demand pockets and growth corridors. Scenario planning techniques were applied to assess the impact of policy shifts, such as the 2025 tariff changes, under varying market conditions.

Finally, all findings underwent expert validation through peer reviews and an advisory board comprising industry veterans and technical specialists. This layered analytical approach ensured that the report’s insights are both comprehensive and grounded in the latest technological, regulatory, and market developments.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aviation Lubricants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aviation Lubricants Market, by Product Type

- Aviation Lubricants Market, by Application

- Aviation Lubricants Market, by Base Oil Type

- Aviation Lubricants Market, by Aircraft Type

- Aviation Lubricants Market, by Sales Channel

- Aviation Lubricants Market, by Region

- Aviation Lubricants Market, by Group

- Aviation Lubricants Market, by Country

- United States Aviation Lubricants Market

- China Aviation Lubricants Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesize the Core Findings and Strategic Imperatives Shaping the Future of Aviation Lubricants Amidst Technological Regulatory and Market Evolutions

The analysis reveals that continuous innovation in additive technology and base oil chemistry is central to addressing the dual imperatives of performance enhancement and environmental compliance. Synthetic esters and advanced dispersant systems are driving better thermal stability and load-bearing capacity, while bio-based formulations are gaining traction under stringent emission and waste directives.

Moreover, the introduction of US tariffs in 2025 has catalyzed realignment in supply chain architectures, compelling operators and suppliers to pursue agile sourcing models and strategic production alliances. These tariff-induced shifts underscore the importance of adaptable procurement strategies and consortium negotiations to mitigate cost pressures while ensuring uninterrupted supply.

Segmentation insights indicate that growth opportunities are most pronounced in high-duty applications such as turbine engine oils meeting MILPRF23699 standards and in regions with intensive flight operations like Asia-Pacific. Regional dynamics, evolving competitive strategies, and collaborative R&D partnerships collectively suggest that the future aviation lubricants market will be characterized by integrated service offerings rather than commodity exchanges.

In conclusion, stakeholders who align their product development, supply chain, and sustainability initiatives with these strategic imperatives will be best positioned to capture value and drive operational excellence in the ever-evolving aviation lubrication landscape.

Engage with Ketan Rohom Associate Director Sales Marketing to Access the Comprehensive Aviation Lubricants Market Research Report and Propel Strategic Growth

Engaging with Ketan Rohom, Associate Director of Sales & Marketing, is your gateway to unlocking unparalleled insights into the aviation lubricants landscape. By initiating a dialogue, stakeholders can explore customized research deliverables that address specific operational challenges and strategic growth objectives. Through a collaborative consultation, decision-makers will gain clarity on leveraging advanced lubricant technologies to optimize fleet performance and minimize lifecycle costs.

Act now to secure access to the comprehensive market research report and empower your organization with data-driven strategies. Connect directly with Ketan Rohom to arrange a briefing, discuss tailored analysis packages, and establish a roadmap for maximizing the value of your investment. This proactive step will position your team at the forefront of innovation in aviation lubrication and accelerate informed decision-making for sustainable competitive advantage.

- How big is the Aviation Lubricants Market?

- What is the Aviation Lubricants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?