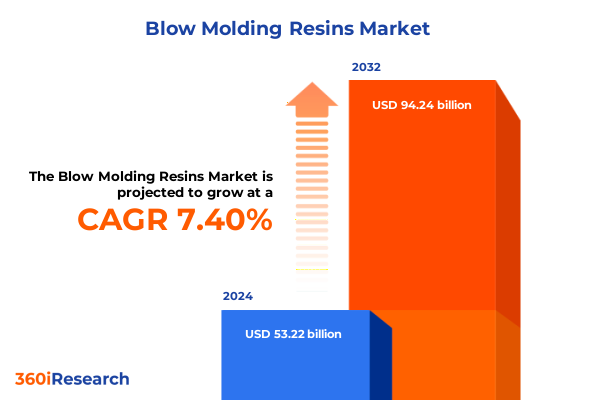

The Blow Molding Resins Market size was estimated at USD 56.42 billion in 2025 and expected to reach USD 59.82 billion in 2026, at a CAGR of 7.60% to reach USD 94.24 billion by 2032.

Exploring how raw material developments regulatory frameworks technological progress and sustainability demands are reshaping the blow molding resins industry

The blow molding resins sector stands at the convergence of material science, regulatory evolution, and shifting consumer expectations. As global demand for lightweight, durable, and recyclable packaging solutions intensifies, producers of High Density Polyethylene, Low Density Polyethylene, Polyethylene Terephthalate, Polypropylene, and Polyvinyl Chloride are racing to refine their offerings and align with sustainability mandates while preserving cost efficiencies. This introductory section explores how the interplay between raw material supply, policy frameworks, and emerging technologies has established a new paradigm within which manufacturers, converters, and brand owners must operate.

Raw material feedstocks such as naphtha, ethane, and recycled post-consumer polymers underpin current production models, yet each presents unique challenges and opportunities. Regulatory drivers, including food contact compliance under the US FDA and extended producer responsibility schemes in Europe, are exerting pressure on resin producers to enhance traceability and material purity. Concurrently, technological advancements in catalyst design, process controls, and additive chemistries are enabling next-generation resins that offer improved mechanical performance and reduced carbon footprints. Sustainability imperatives-ranging from consumer demand for recycled content to corporate net-zero commitments-are further accelerating this transformation. Through this lens, stakeholders must navigate an increasingly dynamic environment where strategic agility and a clear understanding of market forces are essential for long-term success.

Examining key innovations disruptions and breakthroughs that are transforming production efficiencies and competitive dynamics in blow molding resins

Recent years have ushered in a wave of innovations and disruptions that are redefining the competitive landscape of blow molding resins. Advanced catalyst technologies now allow for more precise polymerization, resulting in resins with tailored molecular weight distributions and enhanced barrier properties. These breakthroughs are driving new material grades capable of replacing mixed‐material solutions, thus simplifying recycling streams and reducing environmental impact. At the same time, the integration of digital twins, machine learning, and predictive maintenance into extrusion and injection blow molding operations is elevating throughput and reducing downtime, creating unprecedented production efficiencies.

The pursuit of circularity has also catalyzed disruptive models such as chemical recycling and depolymerization, which promise to convert post-consumer PET back into virgin-equivalent monomers. Several pilot projects in North America and Europe have demonstrated the technical viability of such processes, signaling a shift toward closed-loop supply chains. Alongside these technological shifts, strategic partnerships and joint ventures among resin producers, recyclers, and brand owners are proliferating, enabling shared investment in scale-up efforts and risk mitigation. As a result, companies that embrace these transformative developments will be best positioned to secure feedstock reliability, satisfy evolving regulations, and deliver high-performance resins that meet tomorrow’s market demands.

Assessing how 2025 United States tariff measures compound to influence raw material costs supply chains and market competitiveness in blow molding resins

In 2025, the United States implemented a series of tariff adjustments affecting a range of petrochemical imports, with the intention of bolstering domestic production and protecting strategic industries. These measures have compounded to influence raw material costs, forcing resin producers to reevaluate sourcing strategies and supply chain configurations. Suppliers reliant on imported polyethylene or PVC have confronted increased landed costs, prompting many to pivot toward locally produced feedstocks derived from shale gas or domestic naphtha crackers.

Supply chain fragmentation has emerged as a critical consequence of tariff escalation. Converters and blow molding machine operators are adapting by entering into longer-term contracts with domestic resin suppliers or diversifying import origins to regions not subject to heightened duties. While these adjustments mitigate immediate cost pressures, they also introduce new complexities in logistics and inventory management. The tariff environment has further sharpened competitive positioning: producers with integrated upstream assets have gained an advantage, while those dependent on third-party suppliers face margin compression. As the industry continues to absorb these changes, resilience will hinge on the ability to balance secure feedstock access with operational flexibility and strategic procurement practices.

Deriving nuanced insights across resin types applications end use industries and processes to reveal strategic imperatives for blow molding resin markets

A segmentation-based analysis reveals nuanced drivers and strategic imperatives across five critical dimensions. Based on resin type, the market is studied across High Density Polyethylene, Low Density Polyethylene, Polyethylene Terephthalate, Polypropylene, and Polyvinyl Chloride, each exhibiting distinct performance profiles and end-use suitability. High Density Polyethylene continues to command attention for its rigidity and chemical resistance in industrial containers, while Polyethylene Terephthalate has solidified its position in premium beverage packaging due to its clarity and barrier properties.

Applications span bottles, containers, drums and carboys, and jars and canisters, underscoring the breadth of functional requirements across sectors. Bottle applications remain the most visible to consumers but require stringent control over material consistency and downstream processing. Containers for household chemicals and personal care products demand customized resin grades that balance robustness with aesthetic appeal. Large drums and carboys call for resins with enhanced impact strength, whereas jars and canisters favor grades optimized for barrier performance and lightweight design.

End use industries include automotive, consumer goods, healthcare, industrial, and packaging, each with unique regulatory, performance, and cost constraints. Automotive components rely on high-temperature resistant polypropylene for fluid systems and fuel tanks, while healthcare applications demand sterilizable resins that meet strict biocompatibility standards. The industrial segment values durability and chemical resistance, particularly in sectors such as oil and gas, whereas consumer goods emphasize design flexibility and recyclability. Packaging, the largest user of blow molding resins, increasingly prioritizes materials that facilitate lightweighting and circularity.

Process segmentation comprises extrusion blow molding, injection blow molding, and stretch blow molding, reflecting divergent production rates and design complexities. Extrusion blow molding dominates for large containers due to its cost efficiency, injection blow molding delivers tight dimensional tolerances for small-mouth bottles, and stretch blow molding ensures molecular orientation in high-clarity PET bottles. Each process innovation requires tailored resin formulations and equipment investments.

On the basis of company, the market is studied across ChevronPhillips Chemical, DowDuPont, INEOS, LyondellBasell, and SABIC, highlighting the importance of integrated operations, research collaboration, and geographic reach. ChevronPhillips Chemical’s ethylene integration has driven cost advantages in polyethylene grades. DowDuPont’s diversified portfolio spans high-performance polymers for automotive. INEOS leverages flexible feedstock sourcing to navigate feedstock volatility. LyondellBasell’s leadership in catalyst technology supports premium product development, and SABIC’s global distribution network underpins its capacity to serve emerging markets quickly.

This comprehensive research report categorizes the Blow Molding Resins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Process

- Company

- Application

- End Use Industry

Uncovering distinct regional dynamics across the Americas Europe Middle East & Africa and Asia Pacific shaping blow molding resin markets

The Americas region exhibits robust demand, driven by a combination of established infrastructure, advanced recycling initiatives, and the abundance of shale gas–derived feedstocks. The United States, in particular, remains the largest consumer of blow molding resins, where policy incentives for recyclate content and chemical recycling are fostering new business models. Canada’s proximity to these feedstock sources and its growing emphasis on sustainability further reinforce North America’s competitive edge, while Latin America presents pockets of growth in personal care and food packaging but remains challenged by variable regulatory enforcement.

Europe Middle East & Africa (EMEA) reflects a blend of market maturity and emerging opportunity zones. Western Europe is characterized by stringent regulations on single-use plastics and mandates for recycled content, pushing resin producers and converters toward innovative waste-to-resource solutions. Middle East petrochemical hubs continue to expand resin production capacity, leveraging low-cost ethane feed from adjacent gas fields to compete on global export markets. In Africa, infrastructure constraints and fragmented supply chains limit large-scale adoption, yet rising consumer penetration and incremental investment in recycling plants suggest potential for future expansion.

Asia Pacific remains the fastest evolving region, with China leading both consumption and regulatory rigor. The country’s initiatives to curb plastic waste and improve recycling infrastructure have accelerated adoption of high-quality PET and HDPE grades suitable for closed-loop systems. India’s packaging market is diversifying, with beverage and personal care segments spurring demand for specialty resins. Southeast Asian economies are gradually upgrading their manufacturing bases, focusing on sustainable packaging and regional trade partnerships to secure stable resin imports. Across Asia Pacific, the interplay of government support, consumer awareness, and capacity additions is shaping one of the most dynamic resin markets globally.

This comprehensive research report examines key regions that drive the evolution of the Blow Molding Resins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting strategic positioning innovation capabilities among leading players shaping competitiveness in the global blow molding resins landscape

In evaluating leading market participants, several strategic themes emerge. ChevronPhillips Chemical leverages integrated ethylene production capacity to deliver cost-competitive polyethylene grades while investing in mechanical recycling partnerships to close the loop on waste streams. Its approach to feedstock optimization and scale economics enables responsiveness to both domestic and export markets.

DowDuPont capitalizes on its diversified materials portfolio, coupling high-performance resins for automotive and healthcare with digital services that support predictive maintenance and supply chain visibility. Ongoing collaborations with tier-one OEMs highlight its emphasis on customized solutions and co-development of next-generation polymers.

INEOS’s strategy centers on feedstock flexibility and low-carbon initiatives, exemplified by its investment in pyrolysis projects that convert mixed plastic waste into pyrolysis oil. This model not only addresses environmental mandates but also secures alternative feedstocks that can offset traditional naphtha or ethane availability.

LyondellBasell distinguishes itself through proprietary catalyst technologies and process intensification, enabling the production of high-performance polypropylene and polyethylene. Its licensing of advanced technologies to third parties augments revenue while reinforcing its leadership in polymer chemistry.

SABIC’s global footprint and strong downstream partnerships allow it to serve emerging markets swiftly. The company’s focus on renewable-based feedstocks and certified circular polymers positions it favorably with major brand owners seeking sustainable supply chains. Across these players, integrated operations, R&D investment, and sustainability commitments define competitive differentiation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Blow Molding Resins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGC Group

- Arkema S.A.

- BASF SE

- Blow Molded Products

- Braskem S.A.

- Chevron Phillips Chemical Company LLC

- Eastman Chemical Company

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Haldia Petrochemicals Limited

- INEOS AG

- LANXESS AG

- LG Chem

- LyondellBasell Industries Holdings B.V.

- Microdyne Plastics Inc.

- Mitsui Chemicals, Inc.

- Nexeo Plastics, LLC.

- Reliance Industries Limited

- SABIC

- Solvay S.A.

- The Chemours Company

- The Dow Chemical Company

- TotalEnergies SE

- Univation Technologies, LLC.

- Westlake Corporation

Offering targeted strategic actions and innovation pathways to enable industry leaders to capitalize on growth opportunities in blow molding resins

Industry leaders should pursue several targeted strategies to navigate the evolving environment. First, diversification of feedstock sources-incorporating mechanical and chemical recycling streams alongside traditional naphtha or ethane-will reduce exposure to tariff fluctuations and crude oil price volatility. Cultivating partnerships with waste management companies and recyclers can secure a steady supply of post-consumer polymers essential for circularity goals.

Second, investment in digital process controls and predictive analytics will enhance operational uptime and enable rapid adaptations to shifting production schedules. By integrating machine learning into extrusion and injection blow molding lines, manufacturers can optimize material usage, minimize rejects, and accelerate time-to-market for new resin grades.

Third, engaging proactively with regulatory bodies and industry consortia will ensure alignment with emerging requirements for recycled content, product labeling, and environmental reporting. Early involvement in pilot programs for chemical recycling and bioplastic integration can provide a competitive advantage as regulations tighten.

Finally, focusing on high‐value specialty resins-particularly those engineered for automotive fuel systems, medical devices, or premium packaging-can unlock margins that offset commodity segment pressures. Tailored product development, combined with co-innovation agreements with key end-use customers, will be essential in capturing growth where performance and sustainability converge.

Detailing the rigorous data collection techniques analytical frameworks and expert interviews underpinning the assessment of the blow molding resins market

The research underpinning this analysis was conducted through a combination of primary and secondary methodologies. Primary research involved in-depth interviews with senior executives and technical experts from resin producers, converters, machinery suppliers, and brand owners, ensuring a comprehensive perspective on market dynamics and strategic priorities. Secondary research encompassed a review of company publications, industry journals, regulatory filings, and trade association data to validate interview insights and track emerging trends.

Analytical frameworks, including SWOT analysis, Porter’s Five Forces, and scenario planning, were applied to assess competitive positioning, barriers to entry, and potential disruption pathways. Data triangulation methods were employed to reconcile information from multiple sources, while qualitative observations were corroborated through validation workshops with academic and industry specialists. This rigorous approach ensures that the findings and recommendations presented herein reflect both empirical evidence and forward-looking perspectives critical for strategic decision-making in the blow molding resins domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Blow Molding Resins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Blow Molding Resins Market, by Resin Type

- Blow Molding Resins Market, by Process

- Blow Molding Resins Market, by Company

- Blow Molding Resins Market, by Application

- Blow Molding Resins Market, by End Use Industry

- Blow Molding Resins Market, by Region

- Blow Molding Resins Market, by Group

- Blow Molding Resins Market, by Country

- United States Blow Molding Resins Market

- China Blow Molding Resins Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesis of major findings and strategic imperatives reflecting industry resilience and the path forward for stakeholders in blow molding resins

Our examination of the blow molding resins market highlights the convergence of raw material innovation, technological disruption, and sustainability imperatives that collectively define the current era. The resilience offered by feedstock integration and tariff adaptation strategies complements the growth facilitated through advanced polymer grades and digitalized production processes. Regional dynamics-from North America’s shale gas advantage to Asia Pacific’s regulatory-driven quality upgrades-underscore the importance of market‐specific strategies.

Leading companies are differentiating through integrated operations, catalyst development, and circular economy investments, establishing benchmarks for cost efficiency and environmental stewardship. To maintain momentum, stakeholders must implement targeted actions that align feedstock diversification, process digitization, and specialty resin innovation with evolving regulatory landscapes. This strategic synthesis of insights and imperatives offers a clear roadmap for navigating the complexities of the blow molding resins industry, ensuring that organizations remain agile, competitive, and sustainable as market conditions continue to evolve.

Connect with Ketan Rohom Associate Director Sales & Marketing to acquire comprehensive insights and propel your strategic initiatives in blow molding resins

To gain a deeper understanding of the complex trends, competitive dynamics, and strategic imperatives within the blow molding resins market, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan will grant you access to comprehensive insights tailored to your organization’s needs, spanning raw material developments, process innovations, and sustainability strategies. Whether you seek detailed analyses of resin type performance, guidance on navigating tariff impacts, or recommendations for optimizing regional supply chains, Ketan can guide you toward the precise data and expertise required to inform your next strategic move. Reach out today to secure the market intelligence that will propel your initiatives, strengthen your competitive positioning, and ensure you capitalize on emerging growth opportunities in the blow molding resins landscape.

- How big is the Blow Molding Resins Market?

- What is the Blow Molding Resins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?